The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

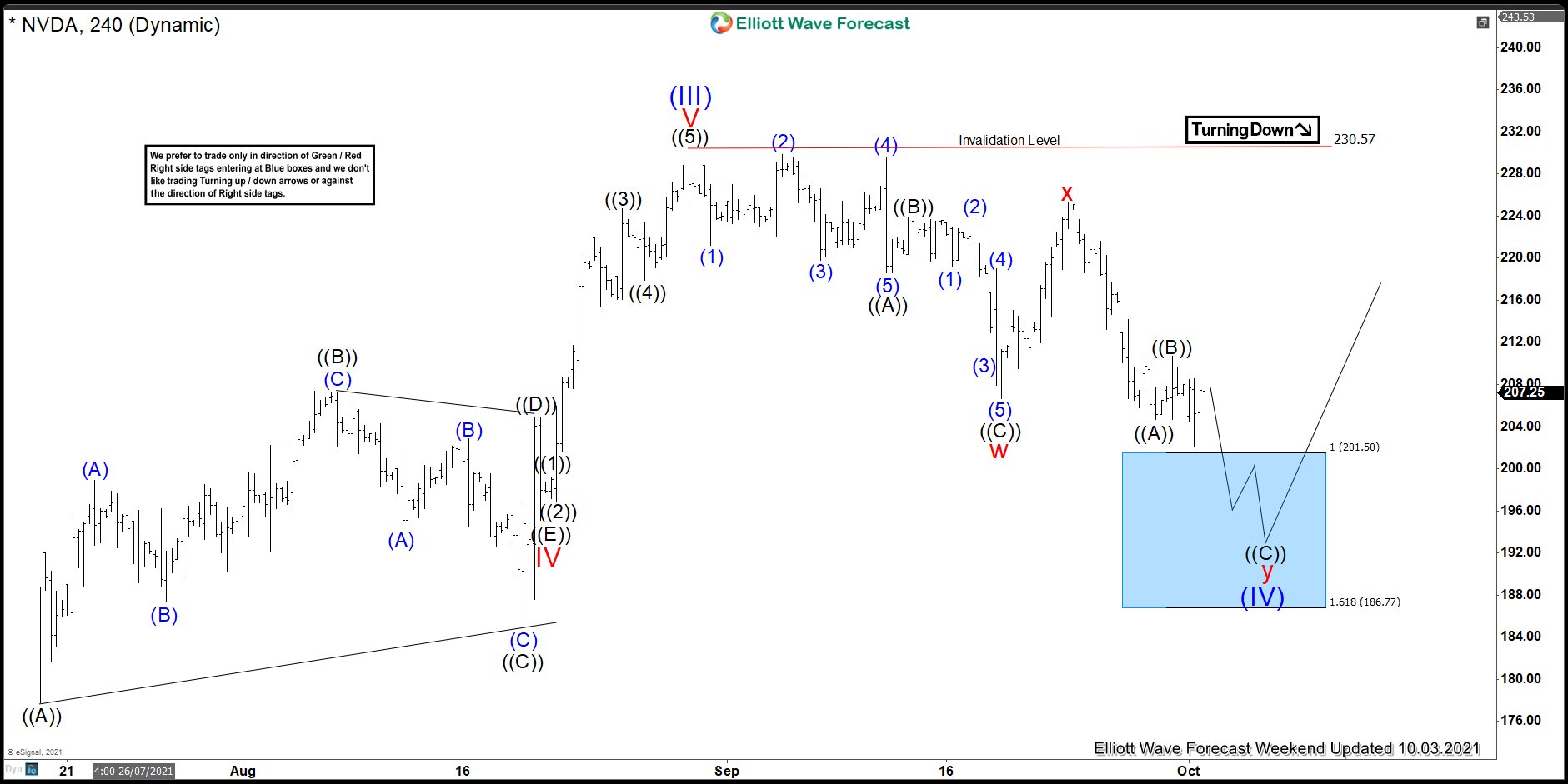

NVDA Made New All-Time Highs From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of NVDA 4hr charts. In which, the stock made new all-time highs from the blue box area.

-

Elliott Wave View: FTSE Extending in Wave 5

Read MoreFTSE rally from September 20 low is in progress as an impulse. This article and video look at the Elliott Wave path of the Index.

-

MicroStrategy ($MSTR) Continues to move higher

Read MoreThe last time I charted this name was back in the summer of 2021 (article can be viewed here). At the time, the price of the stock was 646.00. I was looking for some continuation higher against the low set in May 2021. Firstly, in short summary, MSTR is a large holder of bitcoin, essentially […]

-

Elliott Wave View: Dollar Index (DXY) Continues To Be Supported

Read MoreDollar Index (DXY) rally from October 28, 2021 low is unfolding as an impulse looking for more upside. This article and video look at the Elliott Wave path.