The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

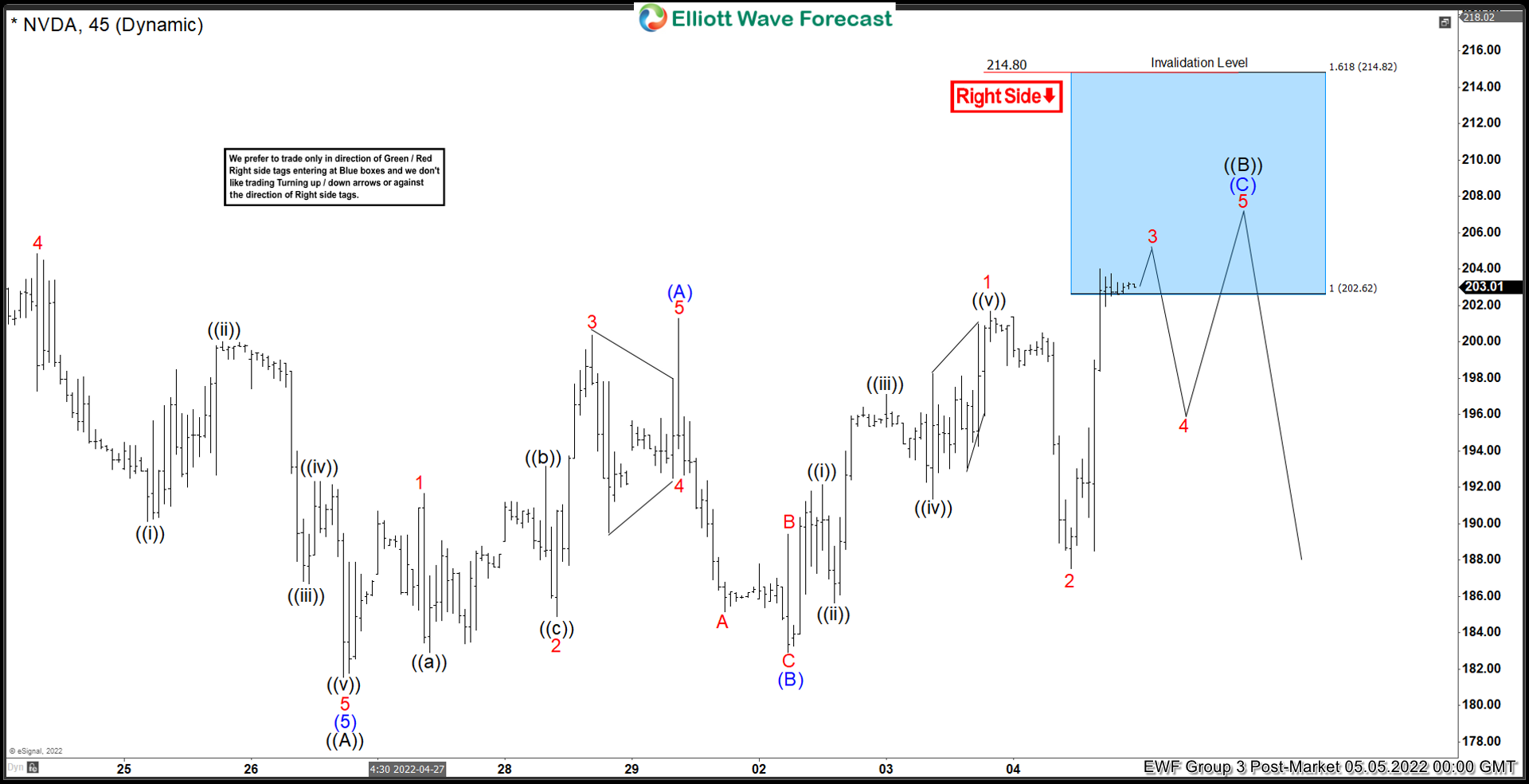

NVDA Elliott Wave View: Selling The Extreme Blue Box Area

Read MoreIn this blog, we take a look at the past performance of NVDA charts. In which, the stock provided a selling opportunity in the blue box area.

-

Elliott Wave View: USDCAD Buyers in Control

Read MoreRally from 4.21.2022 low in USDCAD takes the form of an impulse. This article and video look at the Elliott Wave path for the pair.

-

NZDUSD Selling The Rallies At The Blue Box Area

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of NZDUSD forex pair. As our members know, the pair shows bearish sequences in the cycle from the February 2021 peak. The pair has made 3 waves bounce recently, that has reached our selling zone and gave us good trading […]

-

Best Industrial Stocks for 2024

Read MoreIndustrial stocks are one of the longest-lived sectors in the United States and around the world. The industrial sector is the backbone of the economy. This sector has been growing and expanding for many centuries now. And still, there is room for growth and opportunities. Stock trading advisory websites help investors make the right financial decisions. Investing […]