The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Platinum (PL) Searching for Bottom

Read MorePlatinum (PL) continues to trade sideways and the metal is in the process of forming an important low before the next major bullish cycle starts. The Federal Reserve has aggressively hiked rates multiple times, creating a sideways to lower movement in the commodity sectors. There’s however no doubt that the longer term outlook of commodities […]

-

Is A New Bullish Cycle Starting in DOGEUSD From June Low?

Read MoreDOGEUSD promotes the currency as the “fun and friendly Internet currency”. Software engineers Billy Markus and Jackson Palmer launched the satirical cryptocurrency to make fun of Bitcoin and the many other cryptocurrencies boasting grand plans to take over the world. Dogecoin had established a dedicated blog and forum, and its market value has reached US$8 million, once jumping […]

-

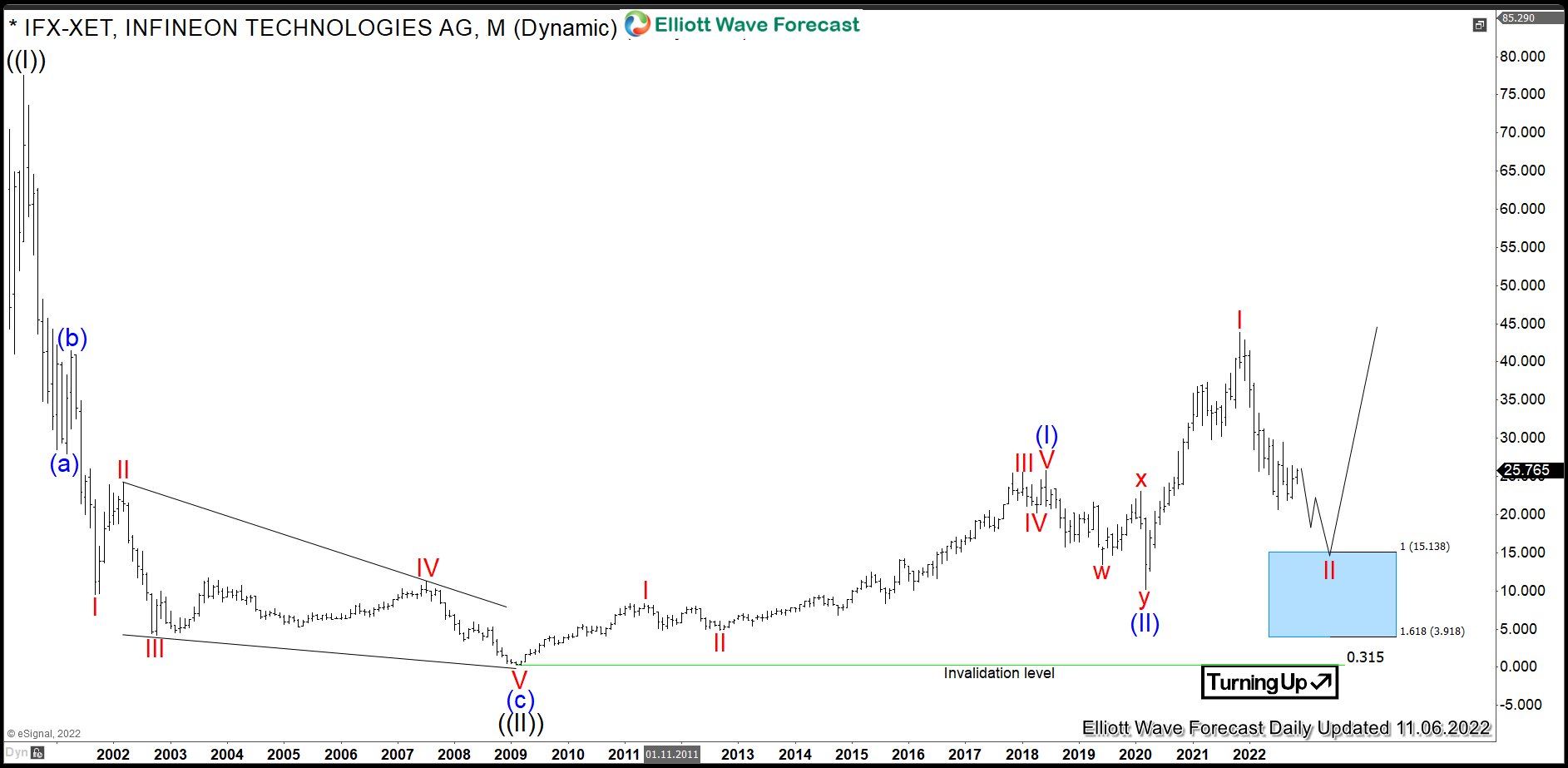

$IFX: Infineon Technologies Provides an Opportunity in a Pullback

Read MoreInfineon Technologies AG is a German semiconductor manufacturing corporation. It has been founded 1999 as a spin-off from Siemens AG and the headquarteres of the company are in Neubiberg, Germany. Today, Infineon belongs to the DAX index and one can trade it under the ticker $IFX at Frankfurt Stock Exchange. The company is the world leader in automotive […]

-

Nike Inc. ($NKE) Perfect Reaction Lower from Blue Box Area.

Read MoreGood day Traders and Investors. In today’s article, we will look at the past performance of 4 Hour Elliottwave chart of Nike Inc. ($NKE). The decline from 08.16.2022 high unfolded as 5 swings which created a bearish sequence in the 4H timeframe. Therefore, we knew that the structure in $NKE is incomplete to the downside […]