The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

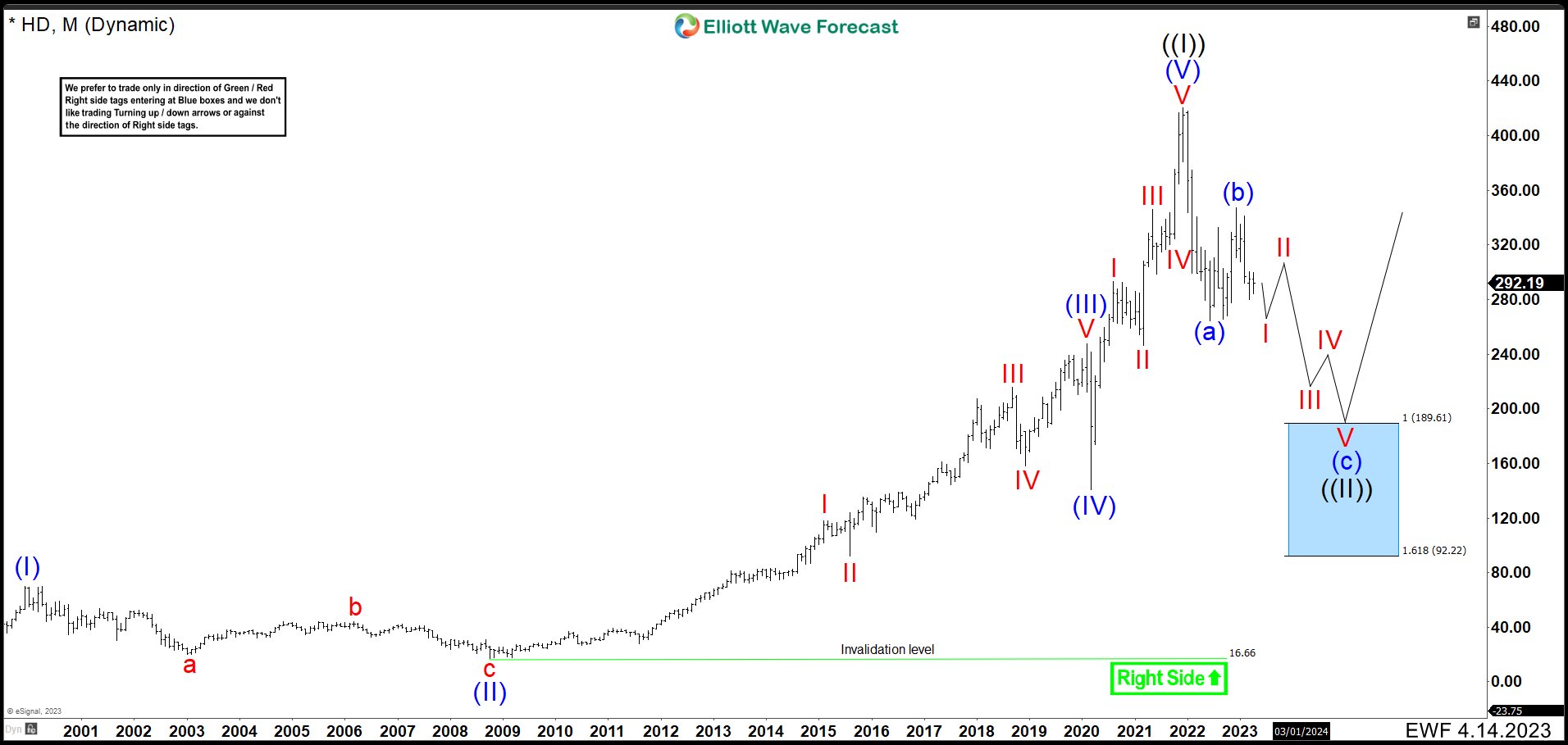

Home Depot (HD) Is Correcting The Cycle Since The Company’s Inception

Read MoreHome Depot (HD), is an American multinational home improvement retail corporation that sells tools, construction products, appliances, and services, including fuel and transportation rentals. Home Depot is the largest home improvement retailer in the United States. The shares of the Home Depot HD company have entered a very interesting stage. After reaching all-time highs in […]

-

10 Best Cyclical Stocks for Inflation

Read MoreWhat are Cyclical Stocks? Cyclical stocks are securities that are heavily affected by the economic cycles of the overall economy. These securities rise and fall in line with the general economic cycle and are affected by macroeconomic changes in the overall economy. These stocks usually belong to companies producing discretionary products like luxury clothing, furniture, […]

-

BTCUSD Elliott Wave: Forecasting The Rally From Intraday Equal Legs Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of Bitcoin BTCUSD . As our members know, BTCUSD is showing impulsive bullish structure in the cycle 15431 low. We have been calling for the rally in the cryptocurrency after 3 waves pull back. Our team […]

-

Elliott Wave Sequence Suggests GBPUSD Favors Higher & Remain Supported

Read MoreGBPUSD ended 5 wave impulse Elliott Wave sequence as wave 1 of (C) at 1.2525 high on 4/04/2023 started from 3/08/2023 low. It already confirmed higher high sequence against September-2022 low, calling for further upside to continue in wave (C). It placed ((i)) of 1 at 1.2204 high & ((ii)) at 1.2009 low. ((ii)) was […]