The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: S&P 500 ETF (SPY) Should Stay Supported to Higher

Read MoreS&P 500 ETF (SPY) is looking to rally as a diagonal from 10.13.2022 low and dips should find support in 3, 7, 11 swing for further upside.

-

Cardano Reacting Higher From The Equal Legs Area

Read MoreIn this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of the Cardano ticker symbol: $ADAUSD. The rally from the 10 March 2023 low showed a higher high sequence & provided a short-term extreme trading opportunity. In this case, the pullback managed to reach the equal legs area […]

-

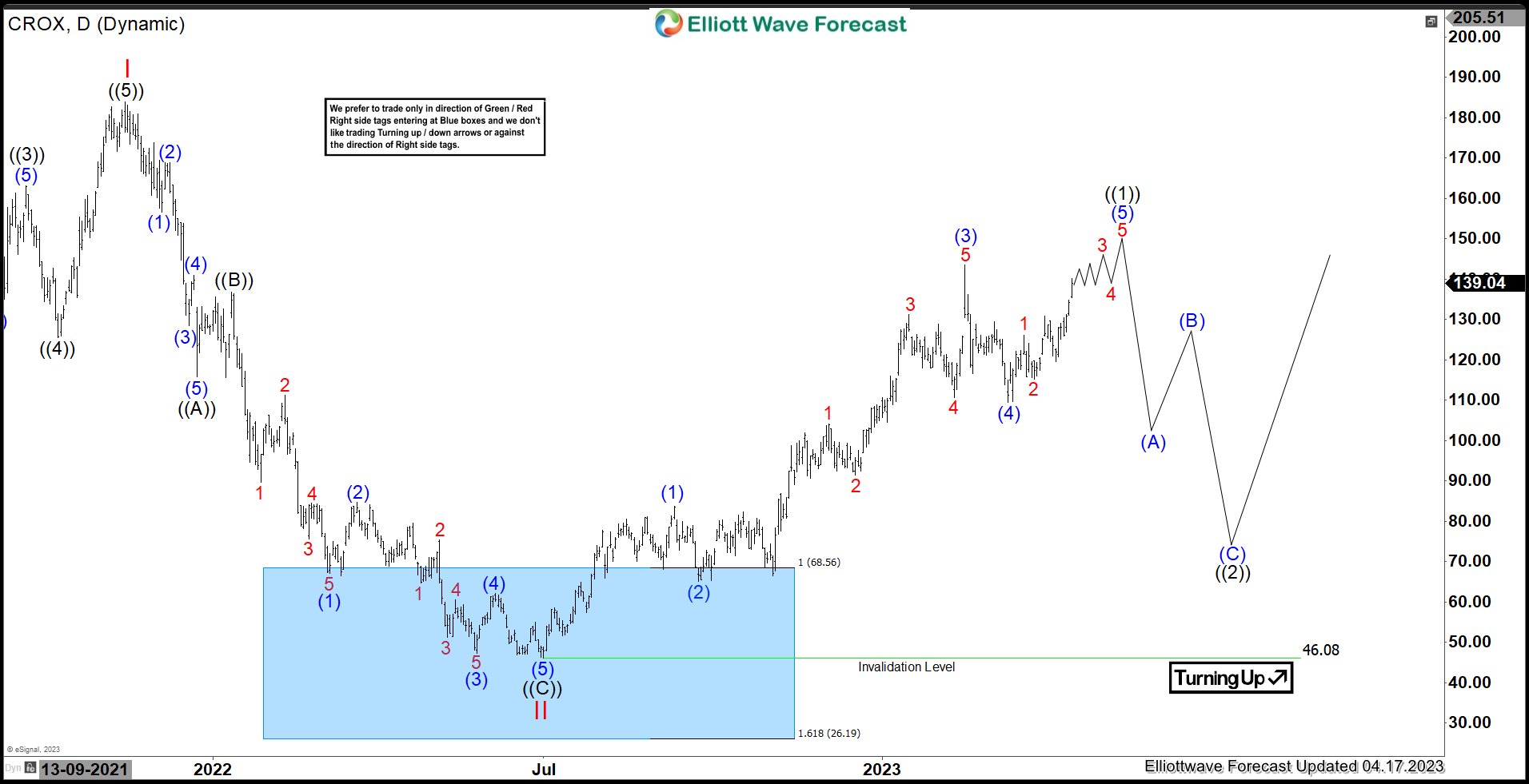

CROX Reacted Higher From Blue Box Area & Favors Upside

Read MoreCrocs Inc., (CROX) designs, manufactures, markets & distributes casual lifestyle footwear & accessories for men, women & children worldwide. The company sells its products in approximately 85 countries through wholesalers, retail stores, e-commerce sites & third-party marketplaces. It is based in Colorado, US, comes under Consumer Cyclical sector & trades as “CROX” ticker at Nasdaq. […]

-

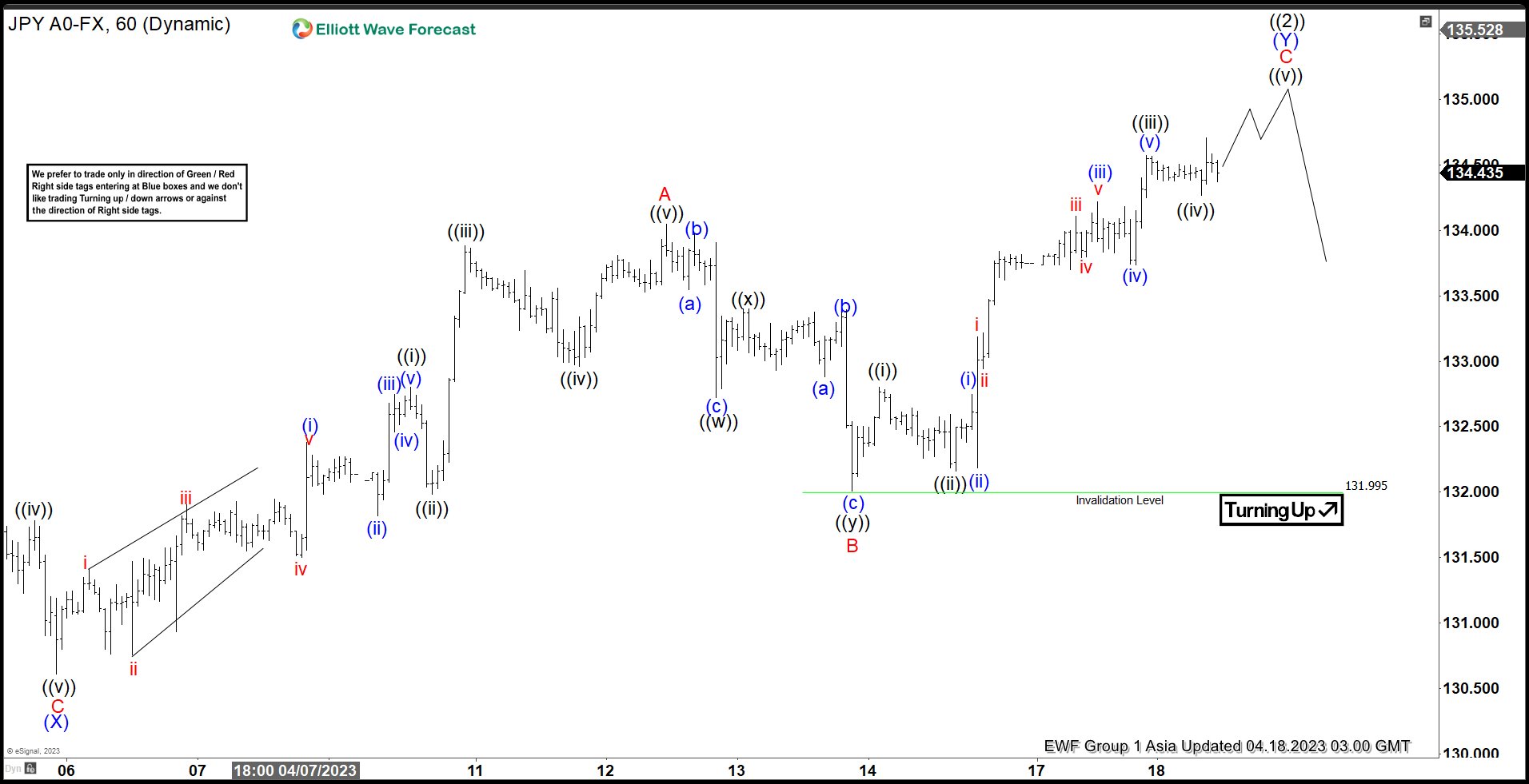

Elliott Wave Suggests USDJPY May See Sellers Soon

Read MoreUSDJPY cycle from 3.23.2023 low is close to completion and pair can see sellers soon. This article and video look at the Elliott Wave path.