The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

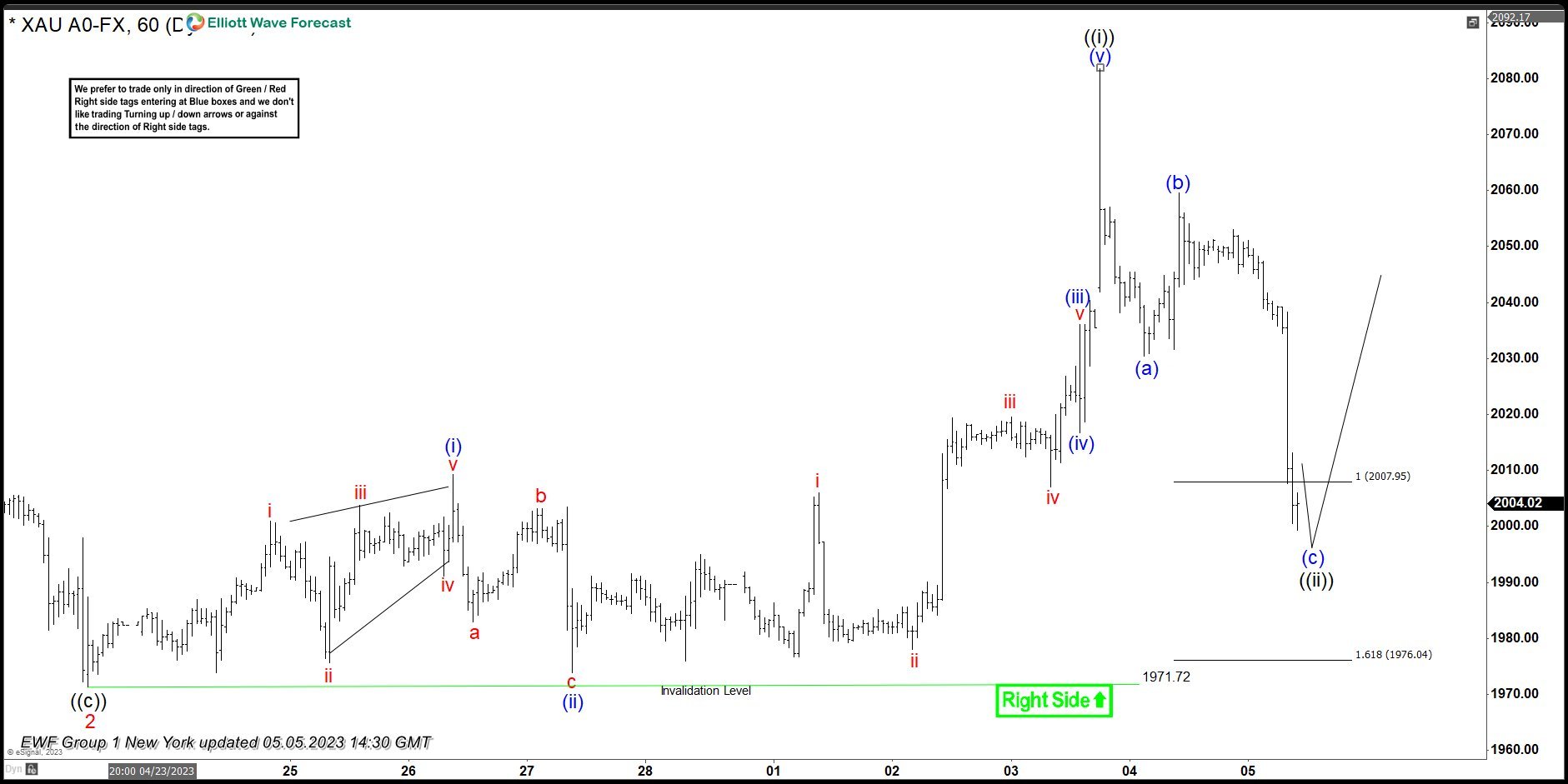

GOLD ( XAUUSD) Found Buyers After 3 Waves Pull Back

Read MoreIn this article we’re going to take a quick look at the Elliott Wave charts of GOLD, published in members area of the website. As our members know, we are favoring the long side in the commodity. GOLD is showing bullish sequences in the cycle from the 1614.3 low. We recommended members to avoid selling […]

-

Brent Crude (BZ) Still Looking for Bottoming Sign

Read MoreBrent Crude (BZ) is the leading global price benchmark for Atlantic basin crude oils. It is used to set the price of two-thirds of the world’s internationally traded crude oil supplies. It is one of the two main benchmark prices for purchases of oil worldwide, the other being West Texas Intermediate (WTI). Brent Crude formed significant low on 4.20.2020 […]

-

Elliott Wave Impulse Decline in Exxon Mobil ($XOM) Suggests Further Downside

Read MoreExxon Mobil (XOM) shows impulsive decline from 4.28.2022 peak suggesting further downside. This article and video look at the Elliott Wave path.

-

$USDSEK and $USDMXN Holding the $USDX

Read MoreThe $USDX peaked back on 09.29.2022. Since then, the Index has been dropping. The Index is at risk of ending the cycle since the lows back in 2008. This means a huge selling could be happening now. We explained the idea in this article, published on 09.21.2022. We knew the $USDX was about to enter […]