The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Platinum’s Correction in the Form of Expanded Flat

Read MorePlatinum (PL) is still correcting cycle from 9.1.2022 low and the correction is likely in the form of expanded flat. In this article, we will update the longer term Elliott Wave outlook for Platinum. We also present an alternate view if the pivot at September 2022 low (803) fails, which suggests a bigger correction against […]

-

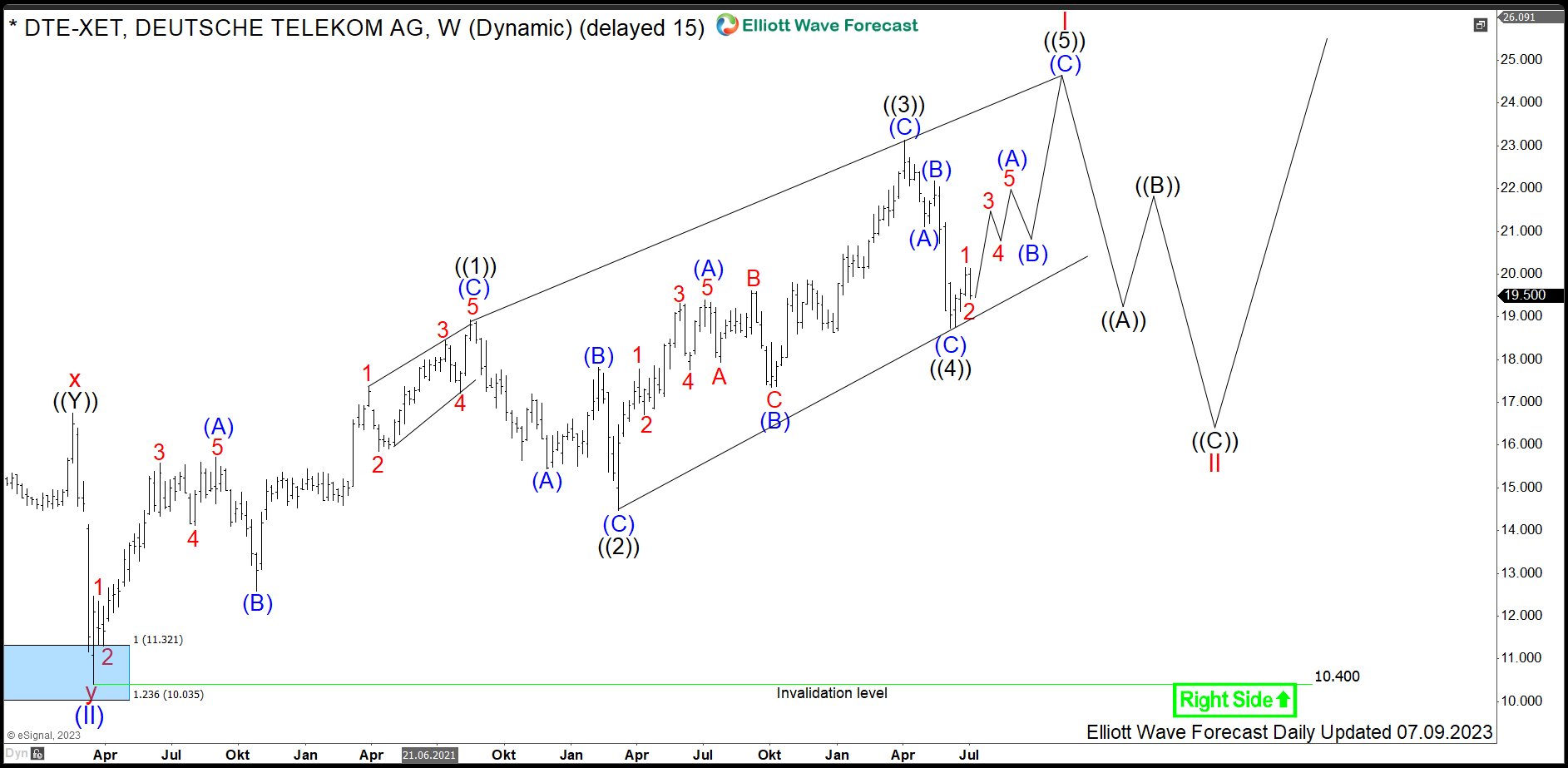

$DTE : Telecommunications Stock Deutsche Telekom Remains Supported

Read MoreDeutsche Telekom AG is a German telecommunications company and by revenue the largest telecommunications provider in Europe. Formed in 1995 and headquartered in Bonn, Germany, the company operates several subsidiaries worldwide. Deutsche Telekom is a part of both DAX40 and of SX5E indices. Even though the stock is highly appreciated by investors, the stock price […]

-

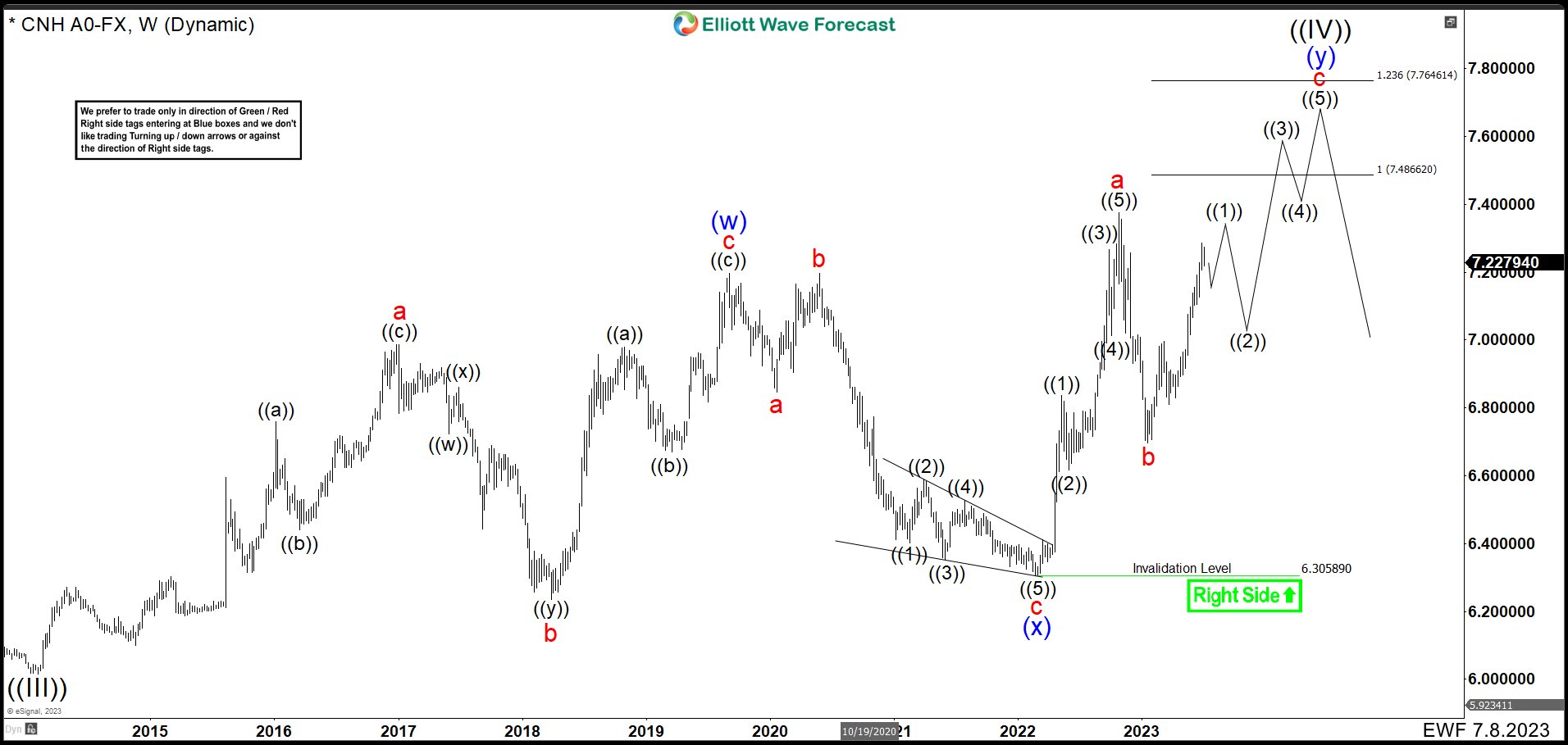

Renminbi (USDCNH) Broke The High And Entered In A Double Correction

Read MoreIn the last years, the renminbi made a pause in his attempt to get stronger against USD dollar. In February 2014, renminbi found support at 6.0153 and from there it made a perfect zig – zag correction structure to equal legs at 7.1964 in June 2020. After that, the USDCNH continue with the downtrend. Renminbi […]

-

S&P 500 (SPX) Looking for Short Term Pullback

Read MoreS&P 500 (SPX) shows an impulsive rally from 3.13.2023 low favoring more upside. This article and video look at the Elliott Wave path.