The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

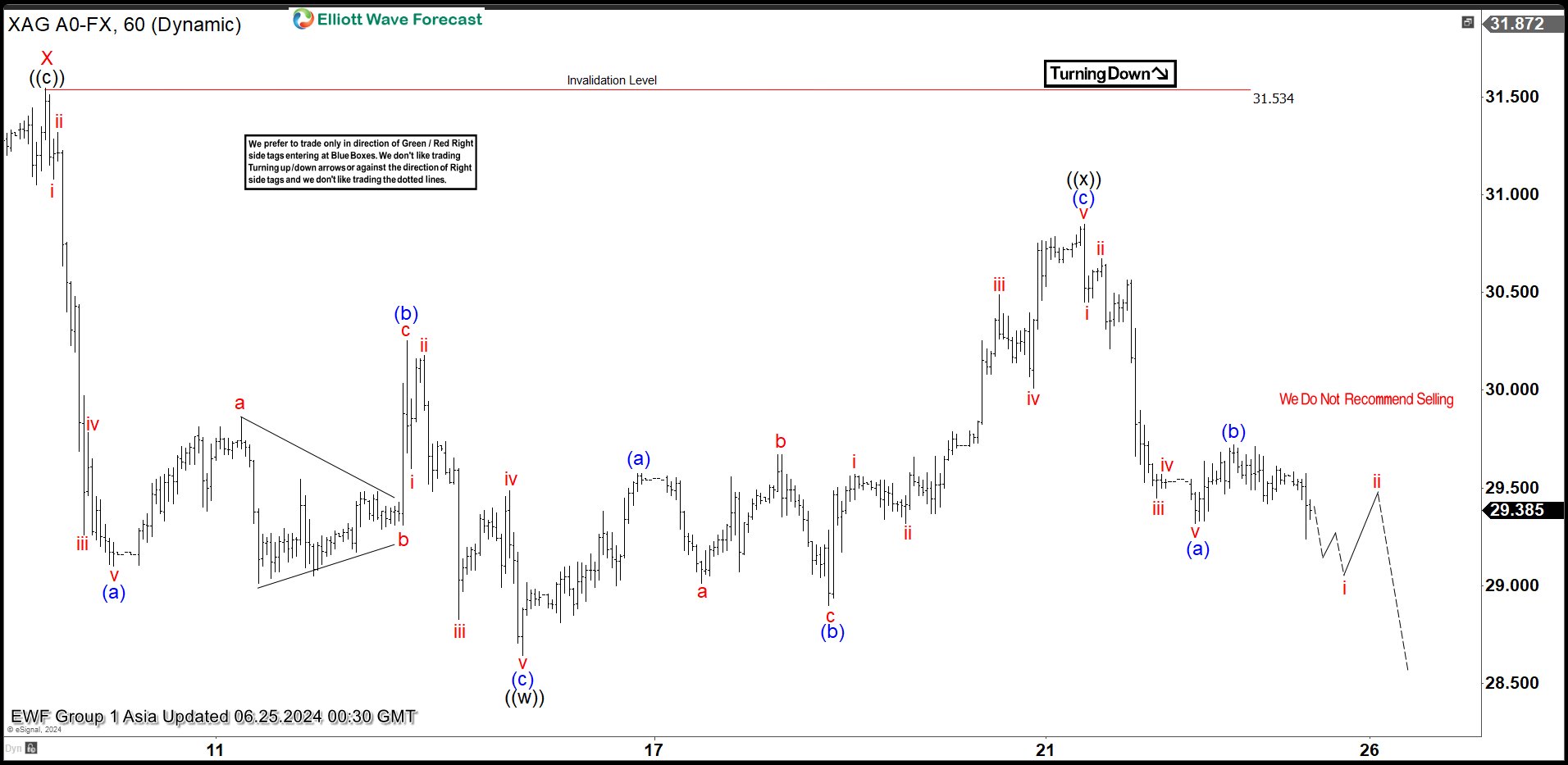

Elliott Wave Analysis on Silver (XAGUSD) Expects Further Correction Lower

Read MoreSilver (XAGUSD) is looking to correct as a double three from 5.20.2024 high. This article and video look at the Elliott Wave path of the metal.

-

Microsoft ($MSFT) Made New Highs From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of Microsoft charts. In which, the stock made new highs from the blue box area.

-

SPDR Industrial ETF ( $XLI) Found Buyers At The Blue Box Area As Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of SPDR Industrial ETF ($XLI). The rally from 1.17.2024 low at $109.90 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure […]

-

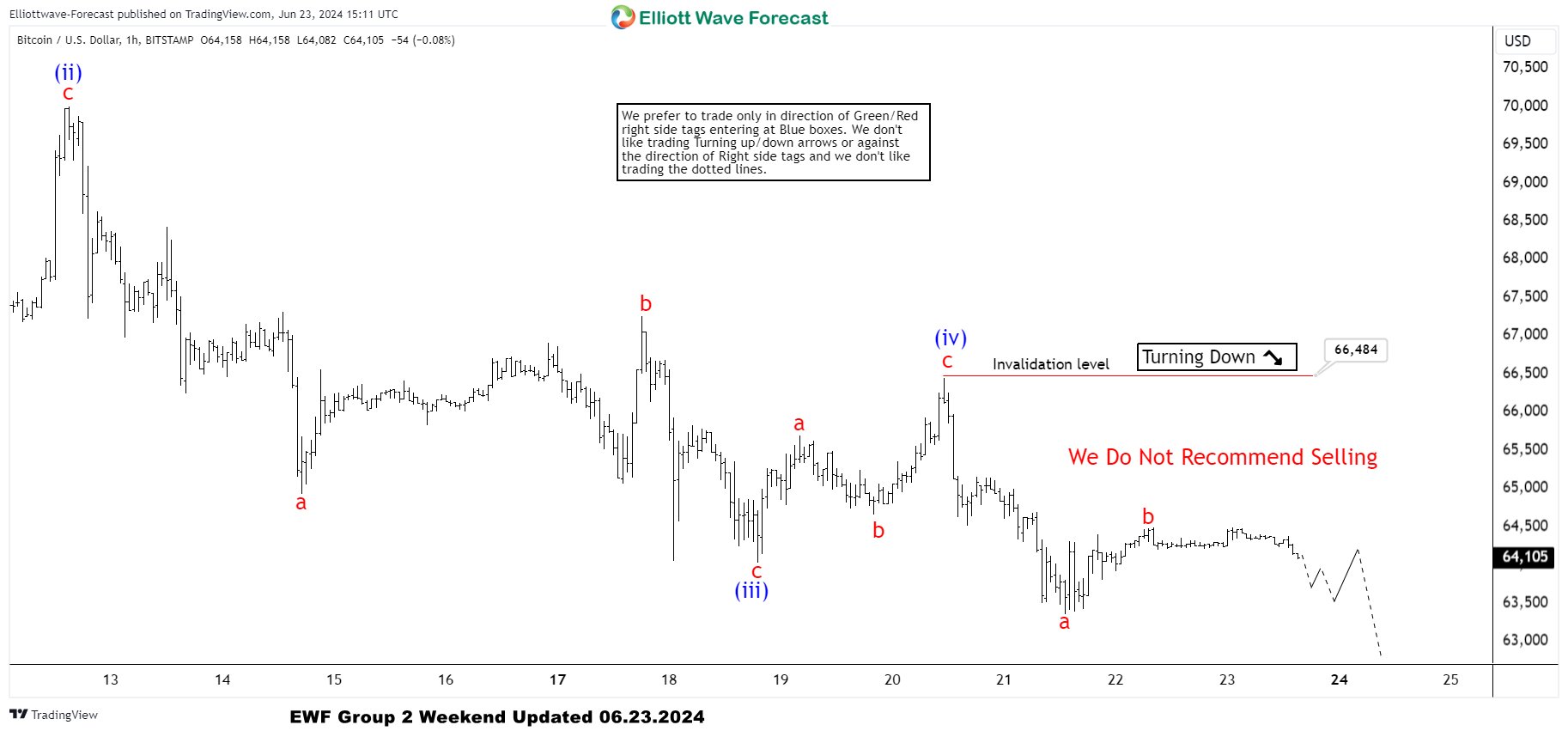

BTCUSD Elliott Wave : Forecasting the Decline Toward New Lows

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of Bitcoin BTCUSD , published in members area of the website. As our members know, Bitcoin is doing a correction against the 56510 low, which is unfolding as a Flat pattern. Now, the crypto is showing impulsive sequences in […]