The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Dollar Index ( DXY ) Elliott Wave Calling the Decline After 3 Waves Bounce

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of Dollar Index DXY , published in members area of the website. As our members know, Dollar has given us recovery against the 105.21 peak. It found sellers after 3 waves pattern and made the decline toward new lows […]

-

Platinum (PL) Looking to Extend Higher

Read MorePlatinum (PL) is still looking to resume the next bullish cycle. The metal still needs to break above 1348.2 to confirm that the next leg higher has started. Below we updated the Monthly and Daily Elliott Wave chart for the metal. Platinum (PL) Monthly Elliott Wave Chart Monthly chart of Platinum above shows Grand Cycle […]

-

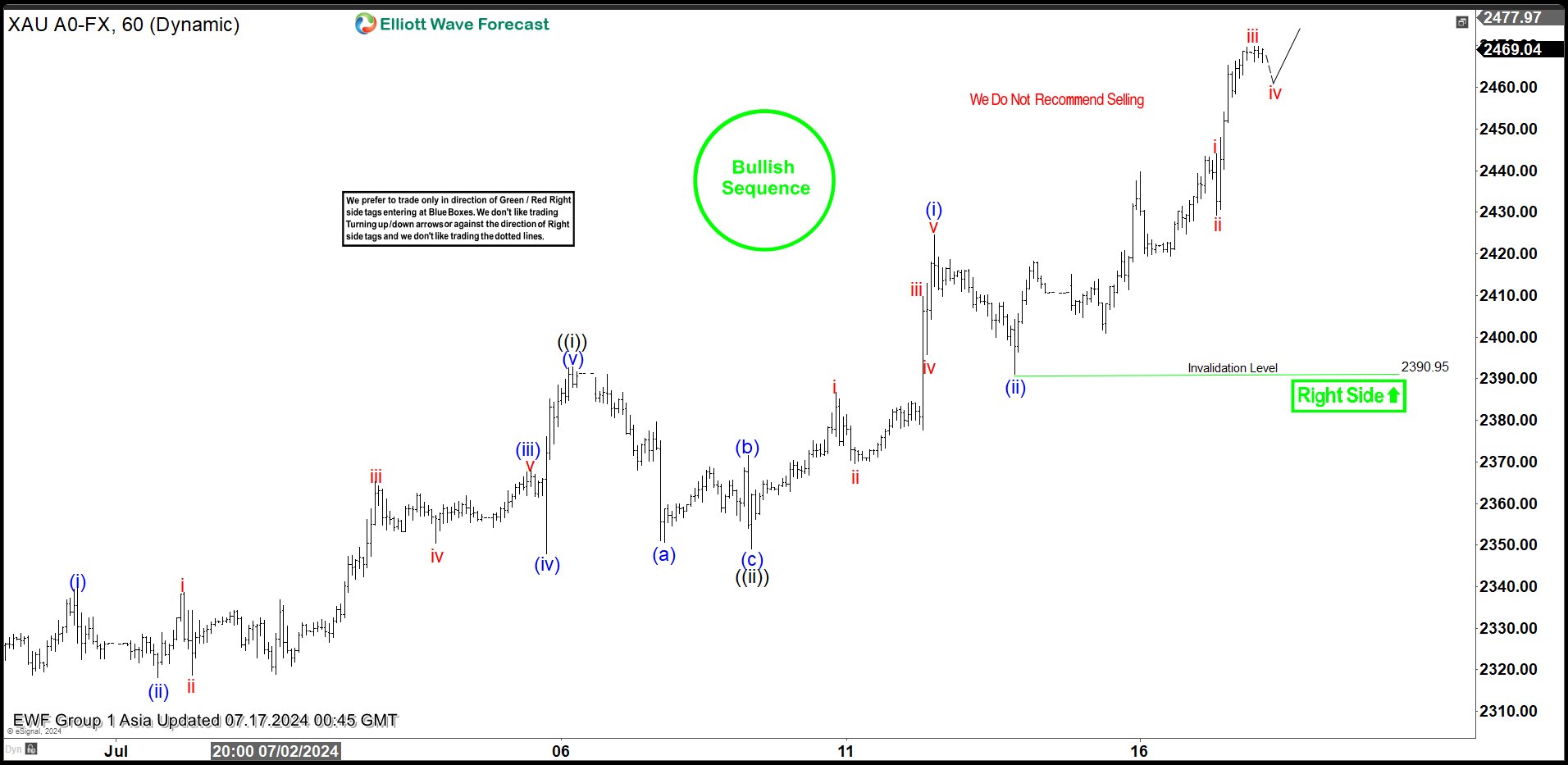

Elliott Wave Intraday: Gold (XAUUSD) Breaks to New All-Time High

Read MoreGold (XAUUSD) has made a new all-time high favoring further upside. This article and video look at the Elliott Wave path for the metal.

-

Elliott Wave Suggests Right Side in Dow Futures (YM) Firmly Bullish

Read MoreDow Futures (YM) shows incomplete bullish sequence from 4.19.2024 low favoring further upside. This article and video look at the Elliott Wave path.