The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Invesco Commodity Index Fund ( $DBC) Elliott Wave Structure Favors More Downside.

Read MoreHello Traders! In this technical blog we are going to take a look at the Elliott Wave path in Invesco Commodity Index Fund ($DBC) and explain why the ETF should see more downside in a ZigZag ABC correction towards a Blue Box area. The fund pursues its investment objective by investing in a portfolio of […]

-

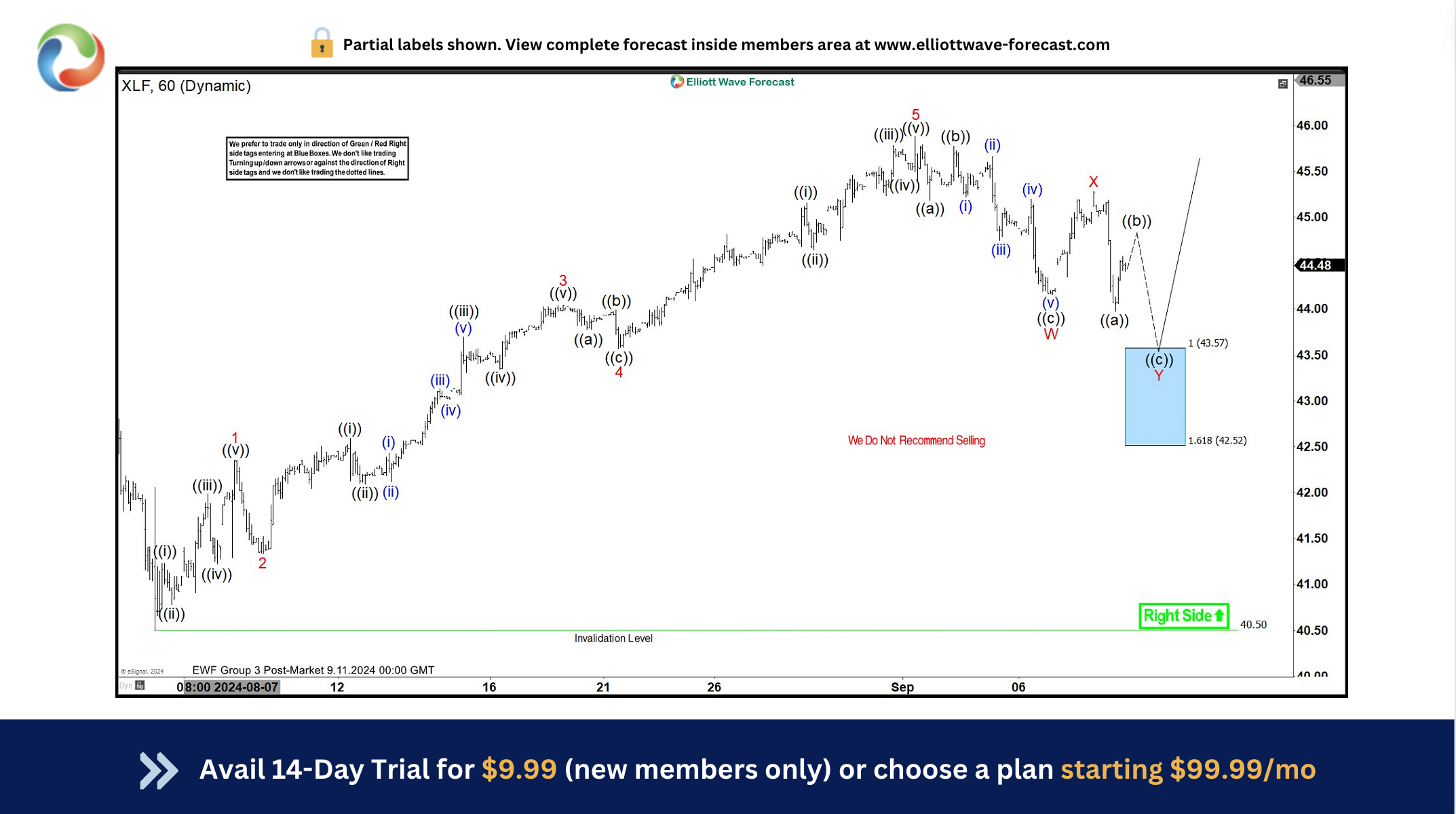

XLF Reaction Before & After Reaching The Blue Box Area

Read MoreIn this technical blog, we are going to take a look at the past performance of 1 hour Elliott Wave Charts of XLF a Financial ETF, which we presented to members at elliottwave-forecast.com. In which, the rally from 05 August 2024 lows, showed the higher high sequence in higher time frame charts favored more strength. Also, the right side tag […]

-

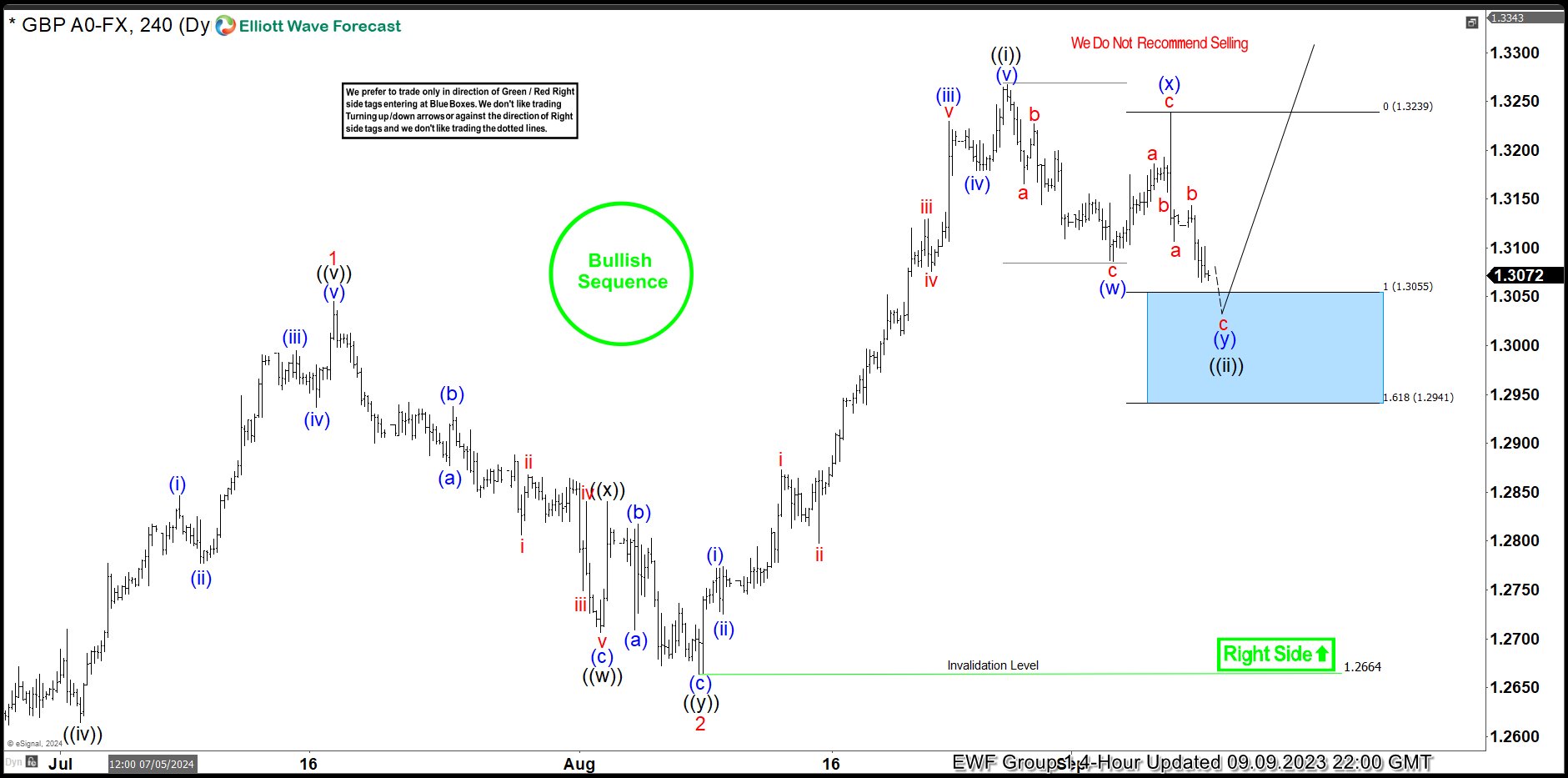

GBPUSD Elliott Wave: Buying the Dips at the Blue Box Area

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of GBPUSD Forex Pair , published in members area of the website. As our members know, GBPUSD has recently given us correction against the 1.2664 low. The pair reached our target zone and completed correction right at the Equal […]

-

Will Berkshire Hathaway (BRK.B) Continue Rally Or Correcting Soon?

Read MoreBerkshire Hathaway Inc., (BRK.B) is an American multinational conglomerate holding company headquartered in Omaha, Nebraska, United States. It operates as Insurance as major operations along with subsidiaries operate in diverse sectors such as confectionery, retail, railroads, home furnishings, machinery, jewelry, apparel, electrical power & natural gas distribution. It trades as “BRK.B” ticker at NYSE & […]