The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

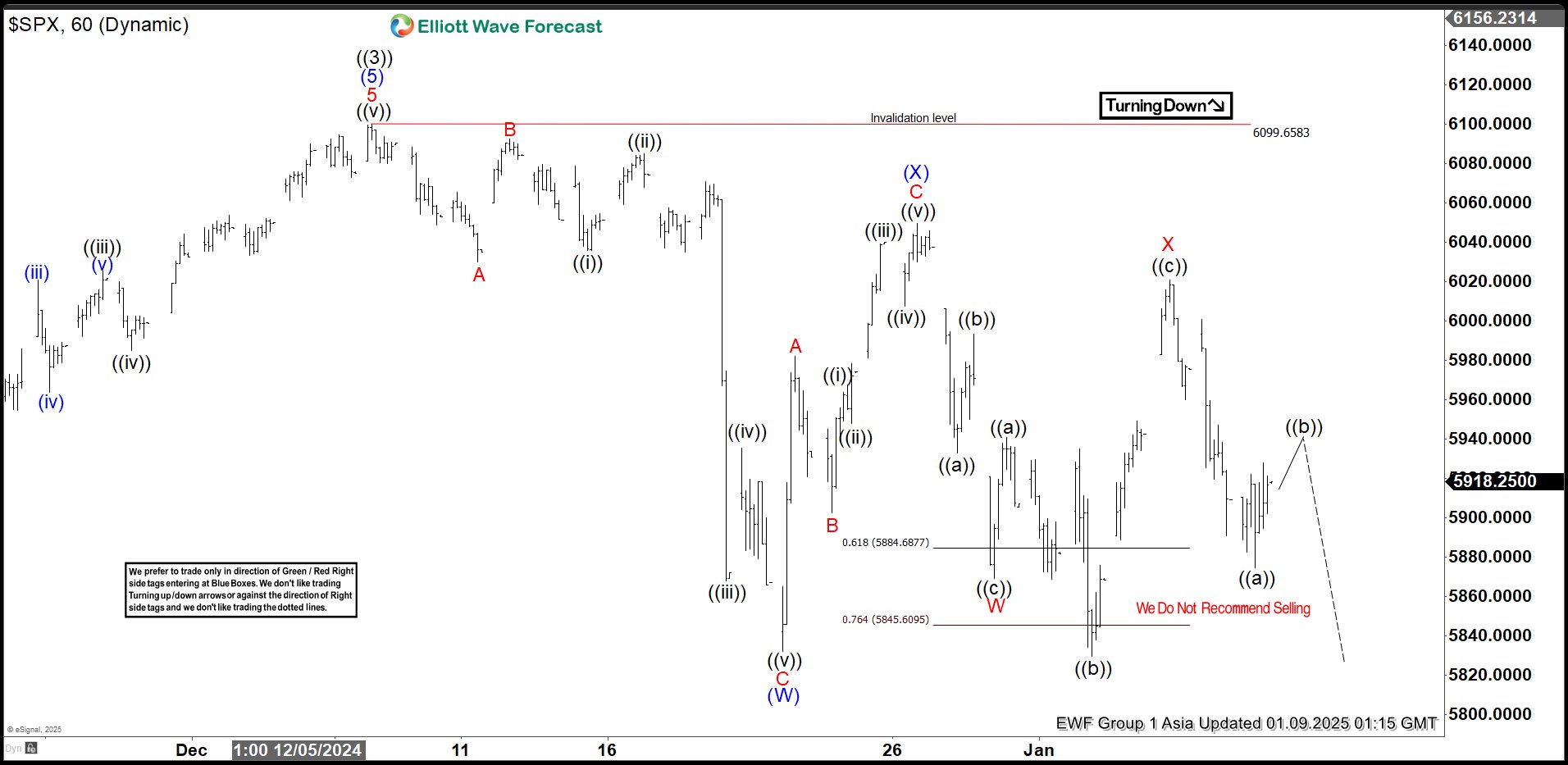

Elliott Wave View: S&P 500 (SPX) Looking for a Double Correction

Read MoreS&P 500 (SPX) is looking to correct as a double three Elliott Wave structure. This article and video look at the Elliott Wave path.

-

Rigetti Computing RGTI Ended a Cycle Looking for Support

Read MoreIn the last two days, RGTI has had a strong fall, losing more than 50% of its value. The stock ended a cycle and began a correction. Now we are going to see what could happen to the Quantum technology company, from where it can rebound and the pivots that will tell us if the […]

-

AMD Bearish Setup From Blue Box Turns Risk-Free for Sellers

Read MoreHello traders. Welcome to another ‘blue box’ blog post where we discuss trade ideas that Elliottwave-Forecast members took. In this one, we will discuss a recent AMD sell setup from the blue box. Looking at the big picture, we saw that $AMD completed a long-term bullish cycle. This cycle began in July 2015 and ended […]

-

Gold (XAUUSD): Elliott Wave Analysis Predicts the Decline from Extreme Zone

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of GOLD commodity ( XAUUSD ) , published in members area of the website. As our members are aware, XAUUSD recently completed a 3-wave recovery against the 2726.1 peak. The commodity found sellers right at the equal legs zone. […]