The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

EURGBP Trading Plan from 5.6.2015

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join Dan there for more insight into these proven methods of trading. […]

-

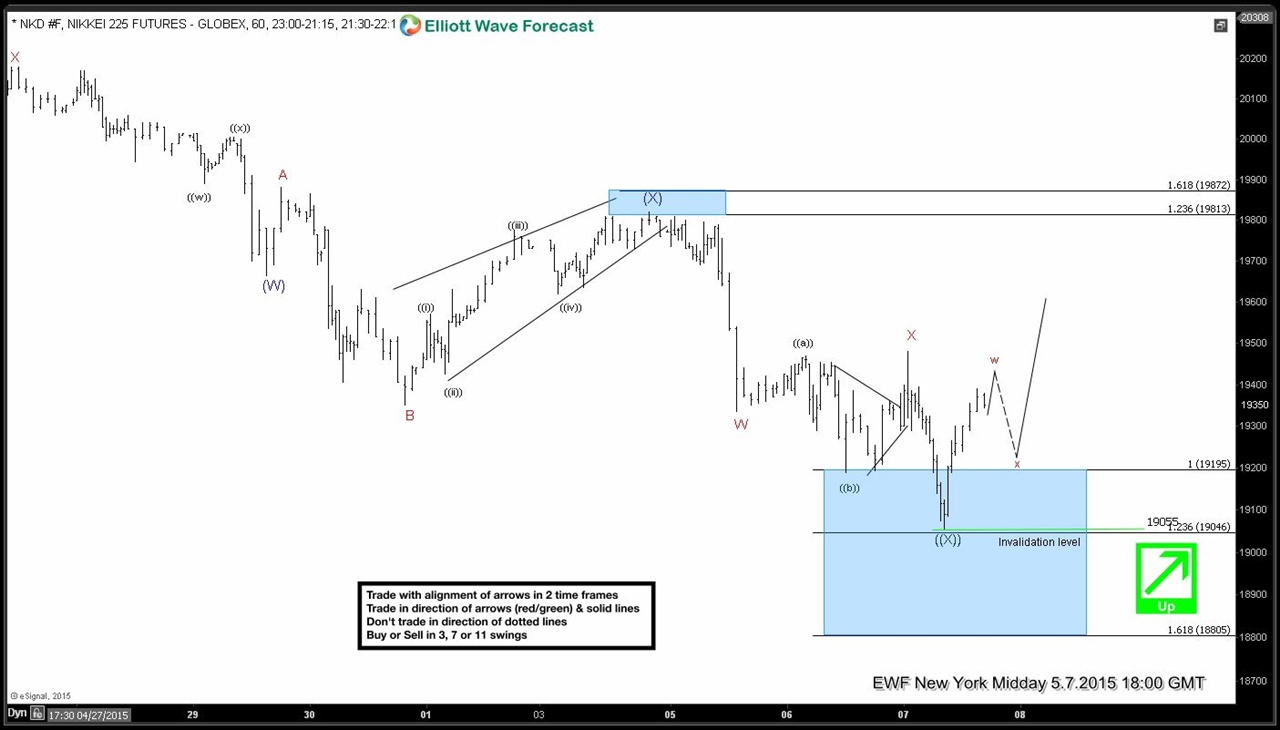

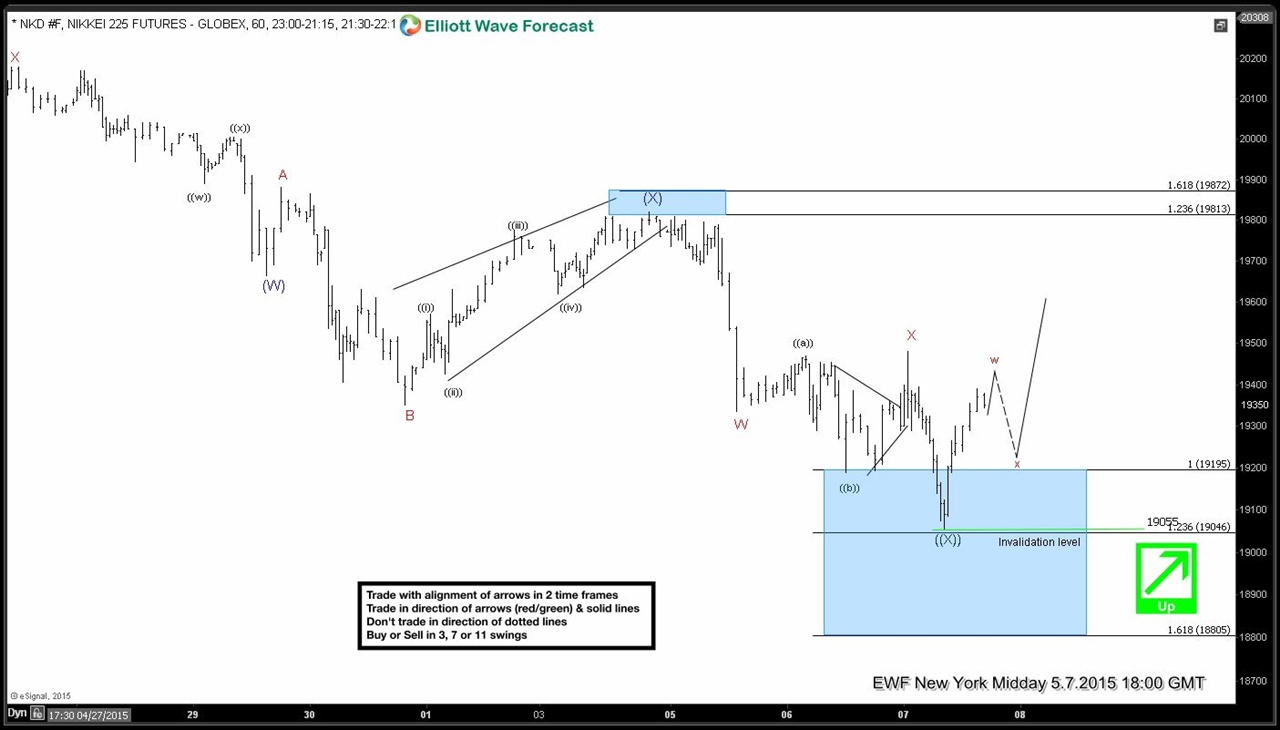

Nikkei (NI225) Short Term Elliott Wave Update 5.7.2015

Read MorePreferred Elliott Wave view suggests wave ((X)) pullback took the form of a double three (W)-(X)-(Y) structure. Wave (W) ended at 19665. Wave (X) took the form of a FLAT (3-3-5 structure) and completed at 19820. In our last Chart of the Day update, we said wave Y of ((X)) can still make one more low and test 18805 – 19045 […]

-

AAPL (Apple) Elliott Wave (V) in progress

Read MoreFrom wave ((x)) low in May 2012, Apple moved in 5 impulsive waves. Wave I ended at 82.16 and is subdivided into 5 waves. Wave II ended at 70.51 and unfolded in 3 waves. Wave III unfolded in 5 waves and ended just beyond 1.618 ext of wave I-II ending at 119.75. and is subdivided into […]

-

Nikkei (NI225) Short Term Elliott Wave Update 5.6.2015

Read MoreWave ((X)) pullback is in progress and is taking the form of a double three i.e. (W)-(X)-(Y) Elliott wave structure. Wave (W) ended at 19665, wave (X) took the form of a FLAT (3-3-5 structure) and completed at 19820. Wave (Y) is now in progress and is expected to end at 18805 – 19045 area to complete wave ((X)). […]