The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

AUDCAD Elliottwave Analysis 8.11.2015

Read MoreThis is an Elliott Wave Analysis video update on $AUD/CAD. This pair is not part of the 42 instrument we cover. If you are interested to learn more about Elliott Wave or how we can help you, click to join FREE 14 days trial.

-

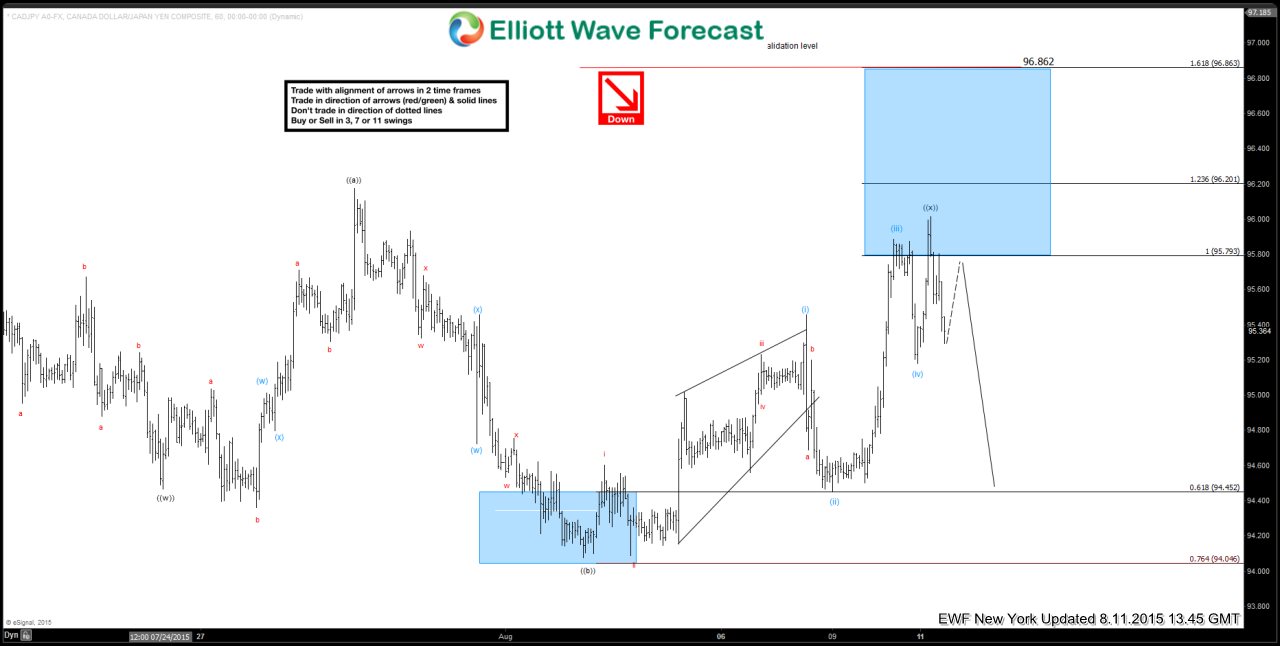

$CAD/JPY Short Term Elliott Wave Update 8.11.2015

Read MoreShort term Elliott Wave view suggests decline to 94.47 ended wave ((w)). Wave ((x)) bounce unfolded in the form of a FLAT structure where wave ((a)) ended at 96.17, wave ((b)) ended at 94.08, and wave ((c)) of ((x)) is proposed complete in 5 waves at 96.02. As far as price stays below 96.02, and more […]

-

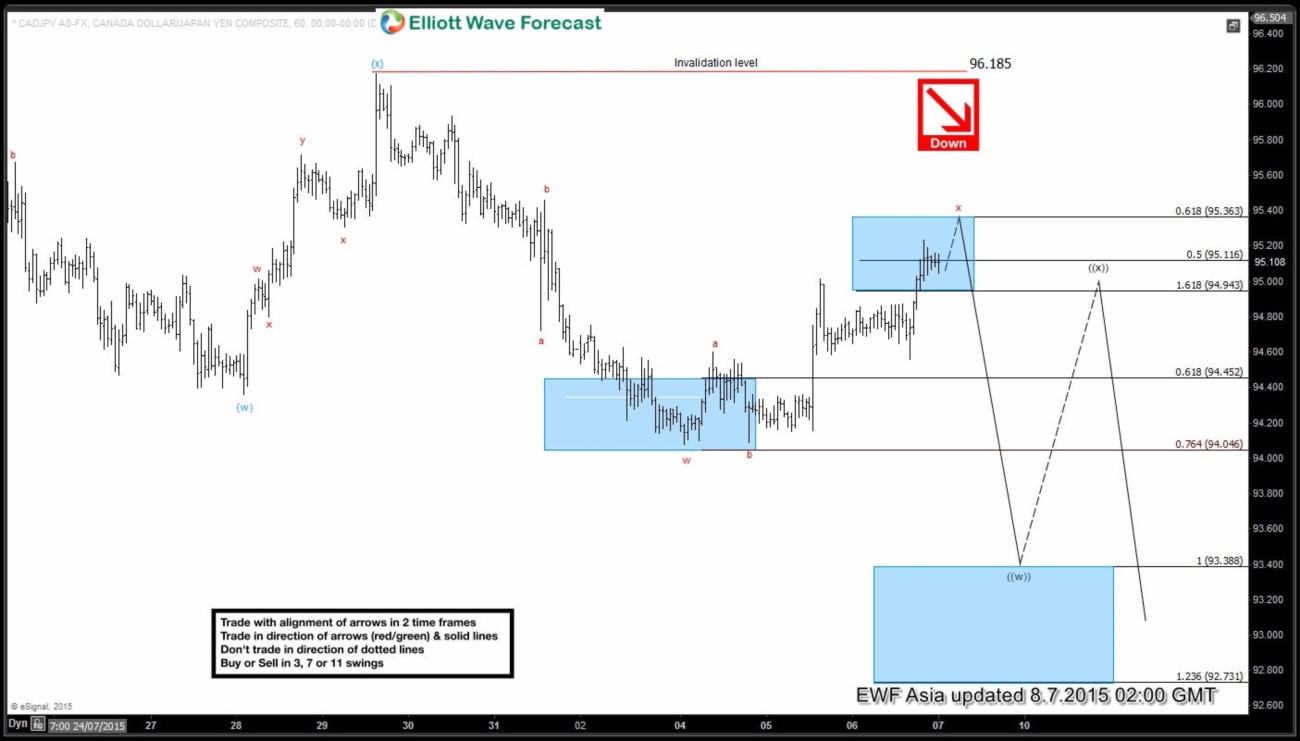

$CAD/JPY Short Term Elliott Wave Update 8.7.2015

Read MoreShort term Elliott Wave view suggests wave ((w) decline from 96.18 is in progress and taking the form of a double three wxy where wave w ended at 94.09. Wave x bounce is currently in progress as a FLAT, and there’s enough swing to call it complete, but a marginal high still can’t be ruled out towards 95.37. Once wave x […]

-

$CAD/JPY Short Term Elliott Wave Update 8.6.2015

Read MoreShort term Elliott Wave view suggests wave ((w) decline from 96.16 is in progress and taking the form of a double three wxy where wave w ended at 94.09, wave x bounce is in progress and expected to complete at 94.94 – 95.37 as a FLAT, then it should turn lower one more leg in wave y towards 92.74 […]