The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$AUDJPY:EWF forecasting the decline and selling the rallies

Read MoreDuring the summer of 2015. EWF members knew that AUDJPY was in bearish cycle from the 97.255 high, that was looking for further decline toward our target area : 83.814-80.642. AUDJPY has had one of the clearest structures during that period. Let’s take a quick look at Elliott Wave charts from the 27.July 2015. to […]

-

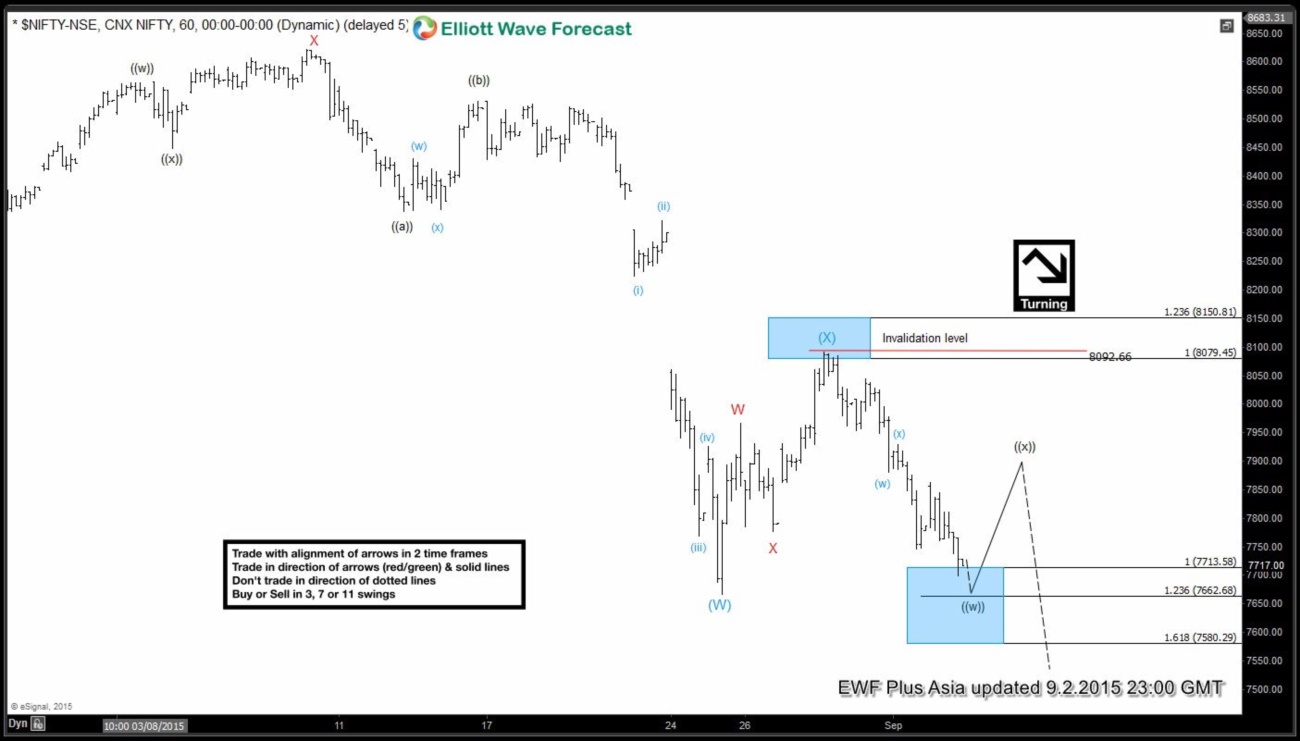

Nifty Short Term Elliott Wave Update 9.3.2015

Read MoreDecline from wave ((X)) at 8653.13 ended at 7667 as wave (W). From this level, wave (X) bounce unfolded as a double corrective structure WXY, where wave W ended at 7907.4, wave X ended at 7777.1, and wave Y of (X) ended at 8092.66. From this level, wave ((w)) is proposed complete at 7699.25, and wave ((x)) is in progress towards 7896.01 […]

-

Nifty Short Term Elliott Wave Analysis 9.2.2015

Read MoreDecline from wave ((X)) at 8653.13 ended at 7667 as wave (W). From this level, wave (X) bounce unfolded as a double corrective structure WXY, where wave W ended at 7907.4, wave X ended at 7777.1, and wave Y of (X) ended at 8092.66. The index has since resumed lower, and short term, wave ((w)) is expected to complete at 7662.68 […]

-

AUDNZD Medium Term Elliottwave Analysis 9.2.2015

Read MoreThis is a medium term Elliott Wave Analysis video update on $AUD/NZD. Medium term, we like to see more upside in the pair after the pullback is complete. We currently cover 42 instrument ranging from forex, indices, and commodities in 4 different time frames. Welcome to check our service and see if we can add value to […]