The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

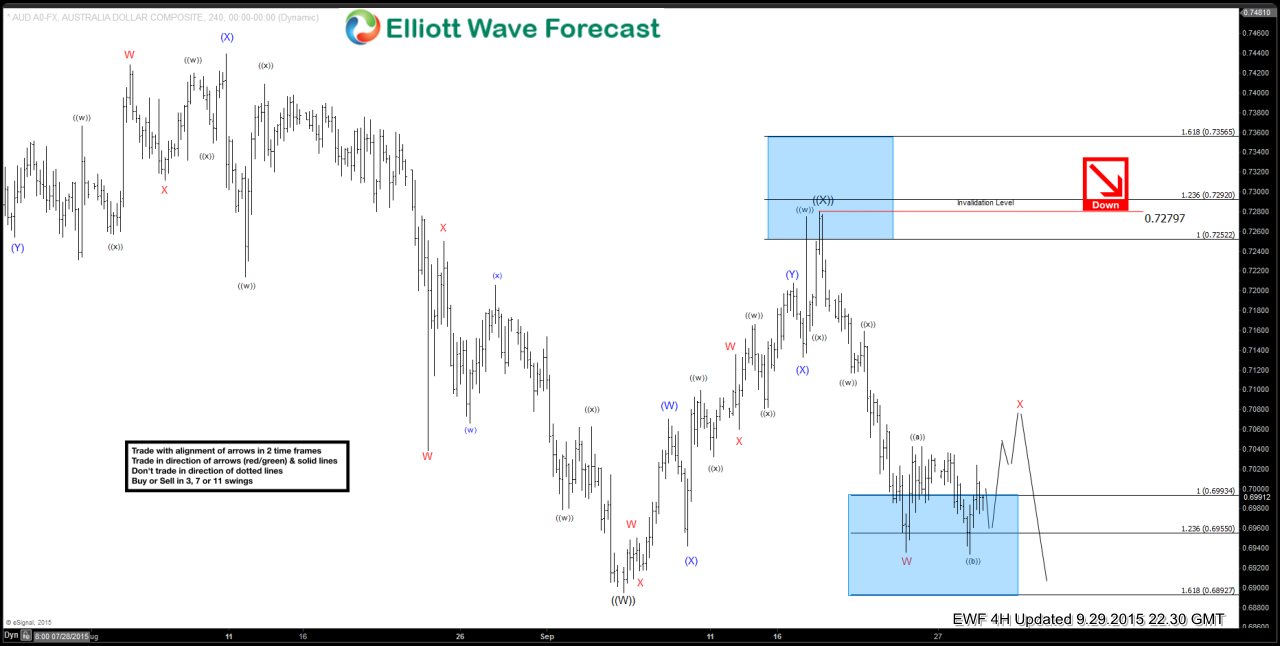

$AUDUSD Trading Plan Recap

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. AUD/USD Live […]

-

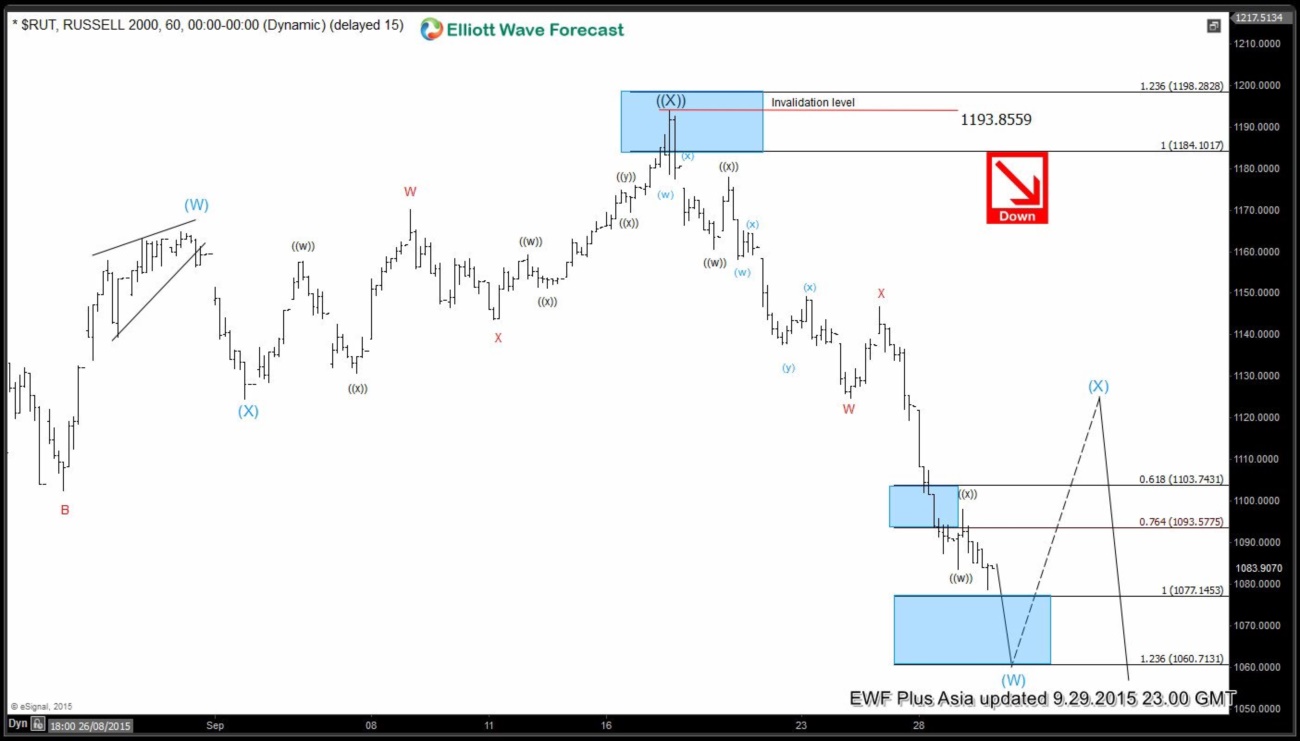

Russel 2000 Short Term Elliott Wave Update 9.30.2015

Read MoreBest reading of the cycle suggests that the decline to 1105.9 ended wave ((W)). From this level, the index bounced and ended wave ((X)) at 1193.85. The index has since resumed the decline lower, unfolding in a double corrective structure WXY where wave W ended at 1124.75, wave X ended at 1146.72, and wave Y […]

-

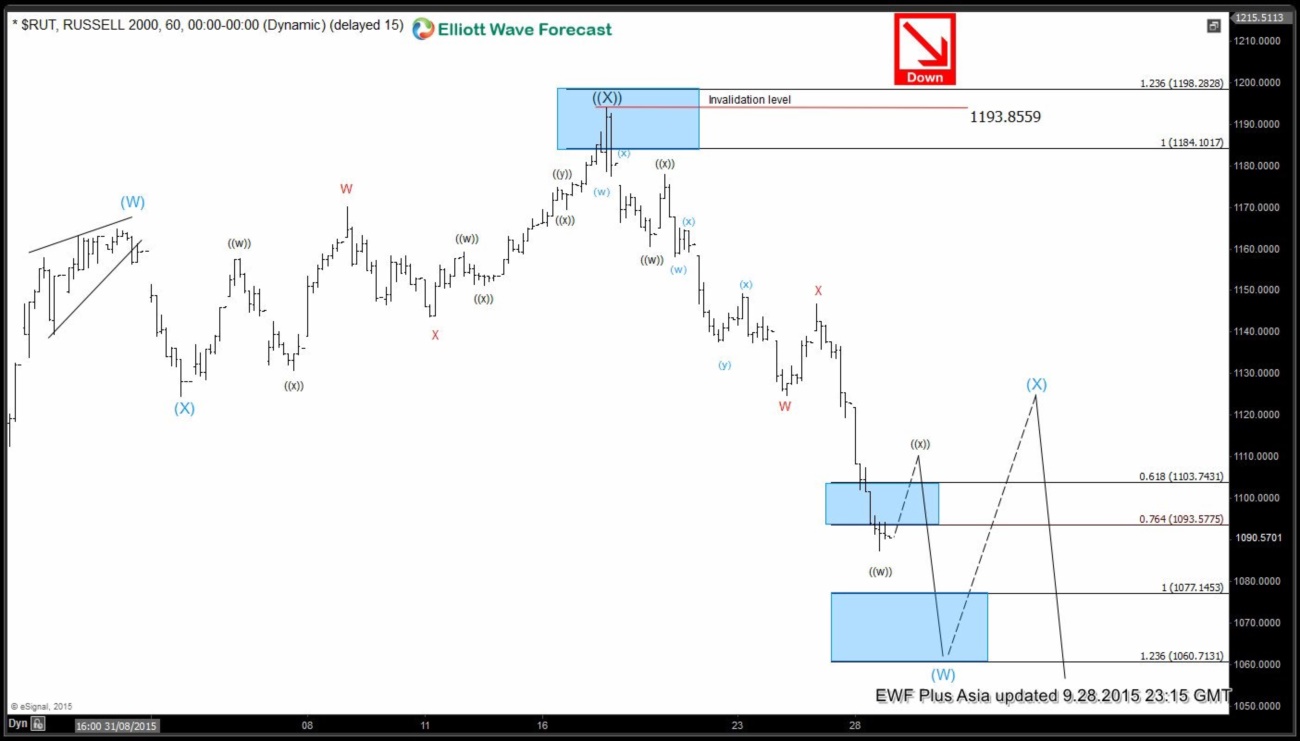

Russel 2000 Short Term Elliott Wave Analysis 9.29.2015

Read MoreBest reading of the cycle suggests that the decline to 1105.9 ended wave ((W)). From this level, the index bounced and ended wave ((X)) at 1193.85. The index has since resumed the decline lower, which is unfolding in a double corrective structure WXY where wave W ended at 1124.75, wave X ended at 1146.72, and wave […]

-

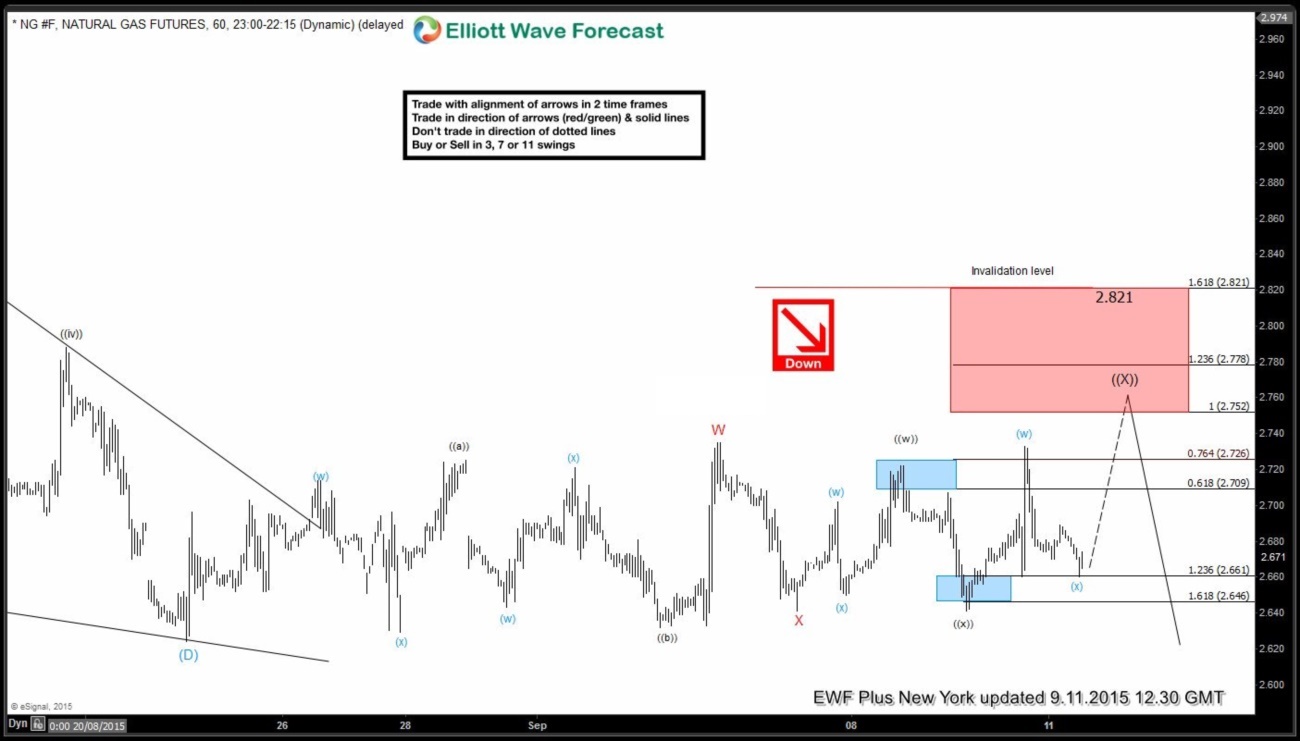

NG #F Elliott Waves Forecasting the decline

Read MoreAt EWF we are not just a market forecasting service, we also try to guide our clients to trade on the right side of the markets. And if our 24 hour chatroom, technical videos, live analysis sessions, live trading room, educational videos and market reports are not enough to help traders succeed, we also added Green […]