The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

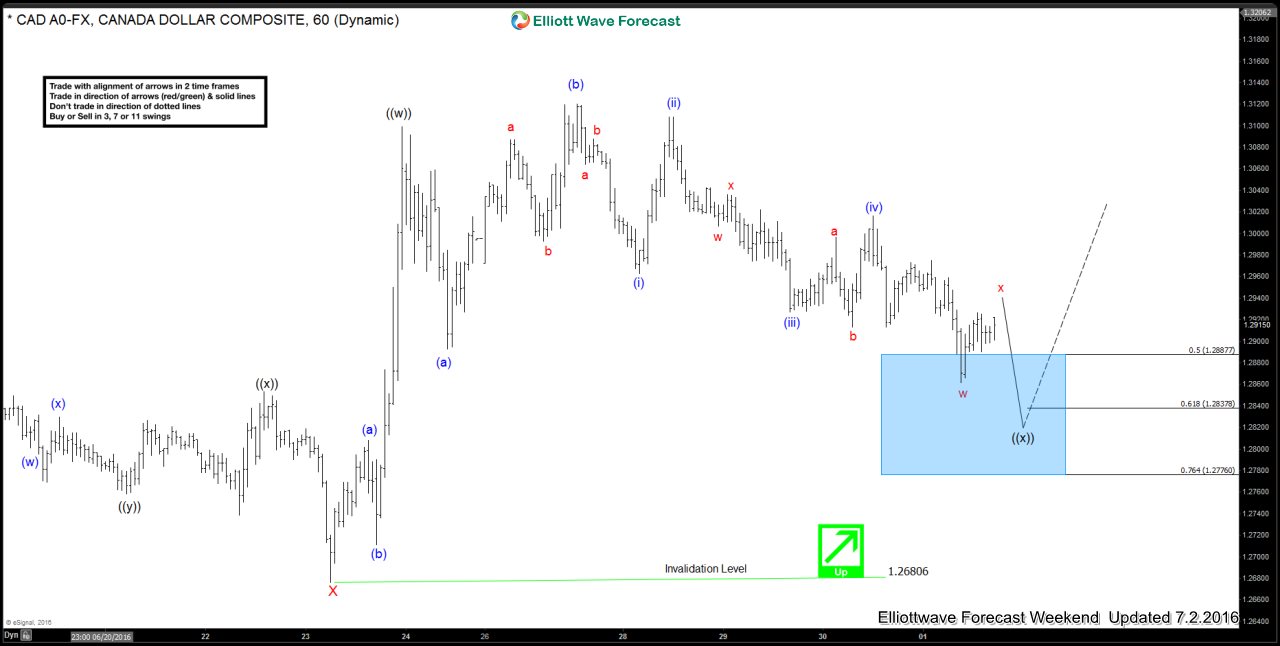

Expanded Flat forecasting the rally in $USDCAD

Read MoreExpanded Flat is a 3 wave corrective pattern which could often be seen in the market nowadays. Inner subdivision is labeled as A,B,C , with inner 3,3,5 structure. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Third wave C is always 5 waves structure, either motive […]

-

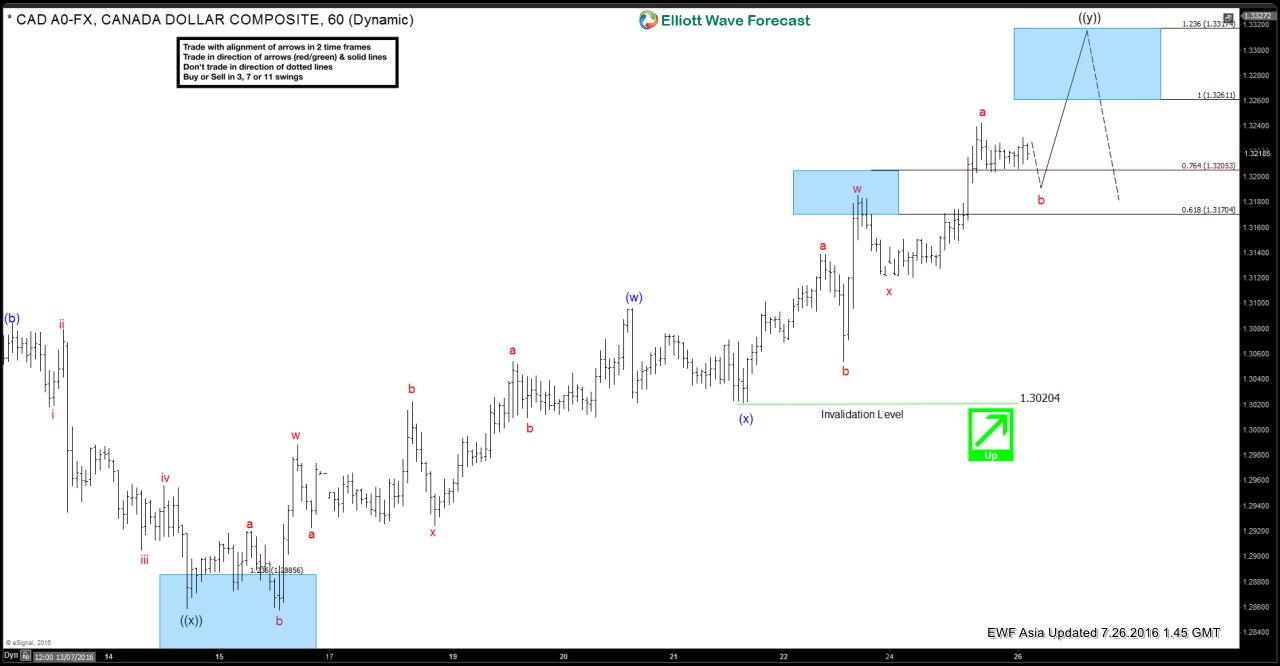

USDCAD Short-term Elliott Wave Analysis 7.26.2016

Read MorePreferred Elliott wave count suggests that move up from 1.2828 low is proposed to be unfolding as a triple three structure. 1.2828 where wave ((w)) ended at 1.3139, wave ((x)) ended at 1.28579 and wave ((y)) higher is now in progress towards 1.3261 – 1.3317 area before pair pulls back lower in 2nd wave ((x)) to […]

-

$GBPAUD Short-term Elliott Wave Analysis 7.22.2016

Read MoreShort term Elliottwave structure suggests rally from 7/11 low is unfolding as a double correction where wave W ended at 1.763 and wave X pullback ended at 1.731. From there, pair resumes rally where wave ((w)) ended at 1.777 and while pair stays below there in the near term, pair has scope to do another leg lower in (y) […]

-

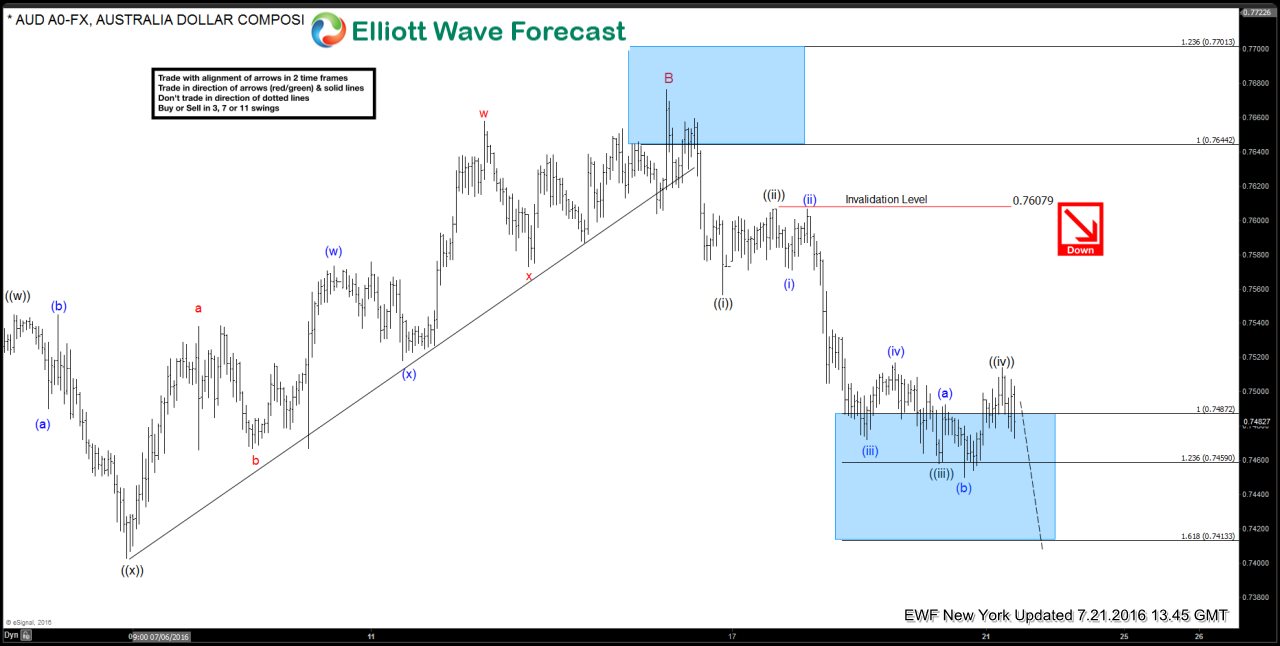

$AUDUSD – Extended Shorts in a Continuation Setup Part 2

Read MoreHere is a quick video blog post from one of our resident traders Dan Hussey on a recent AUD/USD setup he tweeted about! Follow Dan on twitter @DanielHusseyJr to hear more great ideas and get his trading ideas first hand. This setup was a short term example of a continuation setup that utilizes a truly […]