The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Oil $CL_F Live Trading Room Setup from 8/10

Read MoreHere is a short clip from our Live Trading Room on August 10. Take a look at how we manage the trade and risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily for 1 hour starting at 7:00 AM EST , join us there for more insight into these proven […]

-

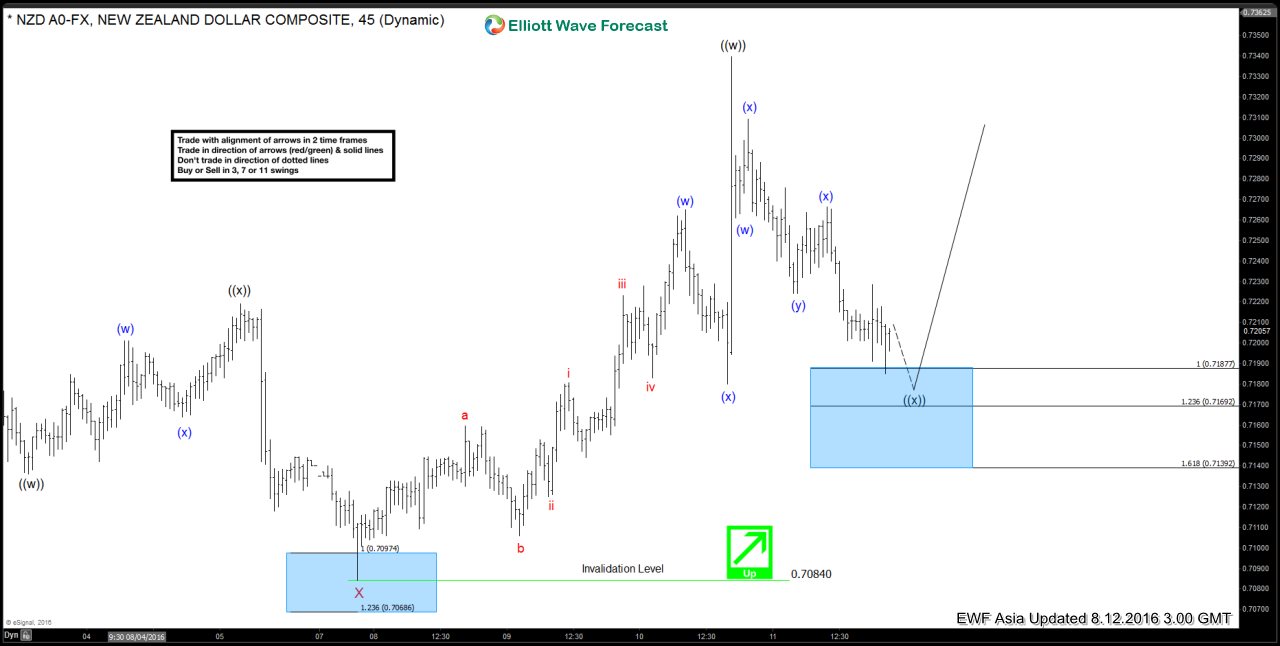

$NZDUSD Short-term Elliott Wave Analysis 8.12.2016

Read MoreRevised Elliott wave view suggests that cycle from 8/8 low (0.7084) ended with wave ((w)) at 0.734 and pair is in wave ((x)) pullback to correct the rally from 0.7084. Wave ((x)) pullback is proposed to be unfolding as a triple three where wave (w) ended at 0.7261, wave (x) ended at 0.7309, wave (y) ended […]

-

$GBPNZD Live Trading Room Setup from 8/5

Read MoreHere is a short clip from our Live Trading Room on August 5. Take a look at how we manage the trade and risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 7:00 AM EST , join us there for more insight into these proven methods of trading. Click […]

-

Nikkei Short-term Elliott Wave Analysis 8.10.2016

Read MorePreferred Elliott wave count suggests that dips to 15926 ended wave (X) and Index has started rally higher in the form of a zigzag structure where wave (v) of ((a)) is in progress and can reach as high as 16911, then it should pullback in wave ((b)) in 3, 7, or 11 swing to correct rally from 15926 […]