The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

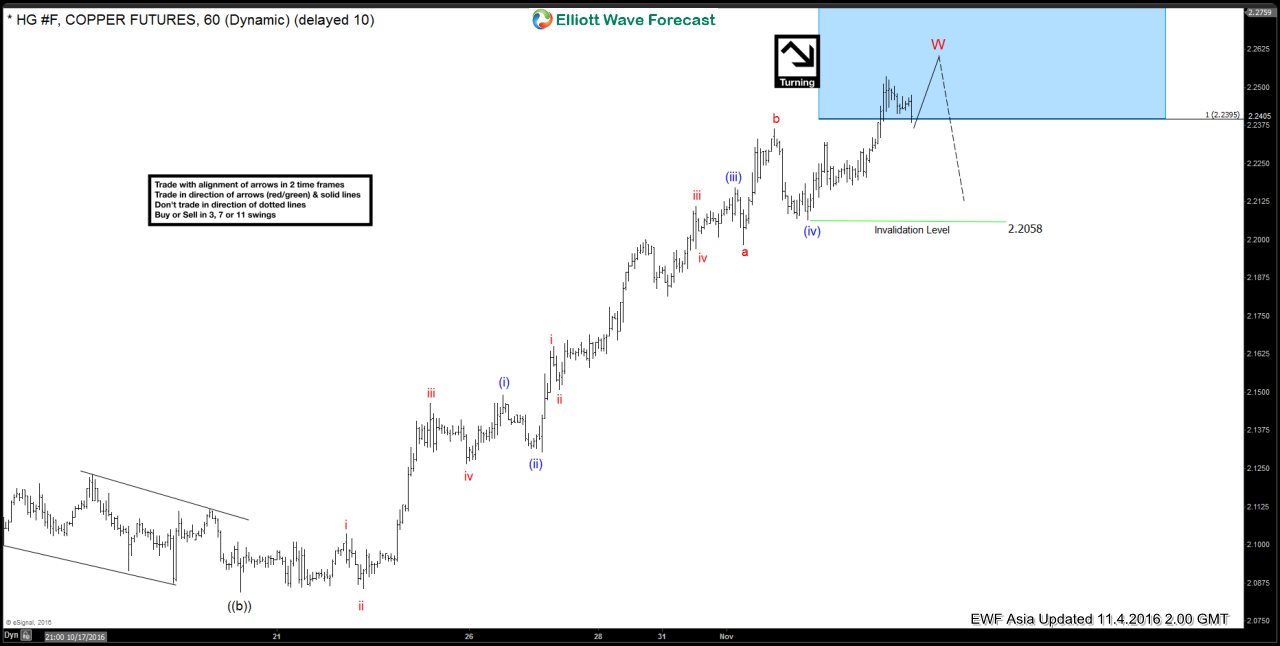

Copper Short-term Elliott Wave Analysis 11.4.2016

Read MoreBest reading of Elliott wave cycles suggests that cycle from 8/30 low is unfolding as a zigzag where wave ((a)) ended at 2.219 and wave ((b)) ended at 2.0845. Wave ((c)) is in progress as 5 waves and the metal has reached 100% of the ((a)) and ((b)) so minimum requirement is met to call wave […]

-

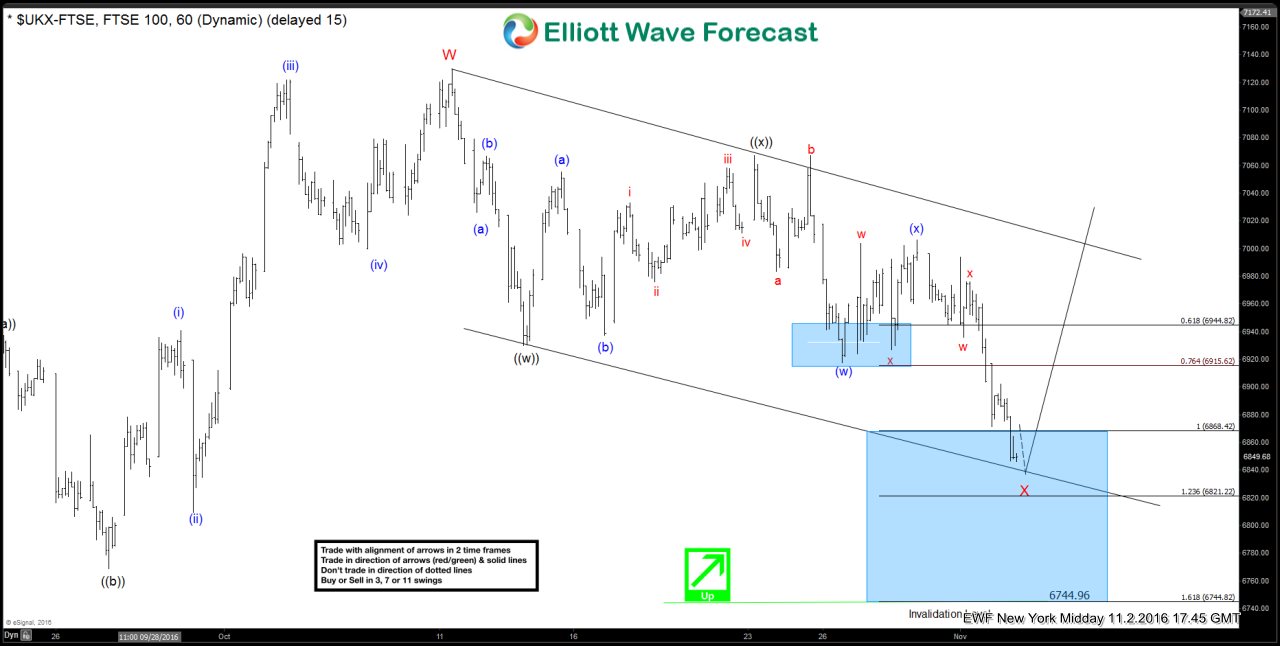

FTSE Short-term Elliott Wave Analysis 11.3.2016

Read MoreBest reading of Elliott wave cycles suggests rally to 7129.8 ended wave W. The Index is currently in wave X pullback as a double three where wave ((w)) ended at 6930 and wave ((x)) ended at 7067.34. The Index has reached 100% of the ((w))-((x)) and expected to end wave X somewhere between 6745 – 6868 […]

-

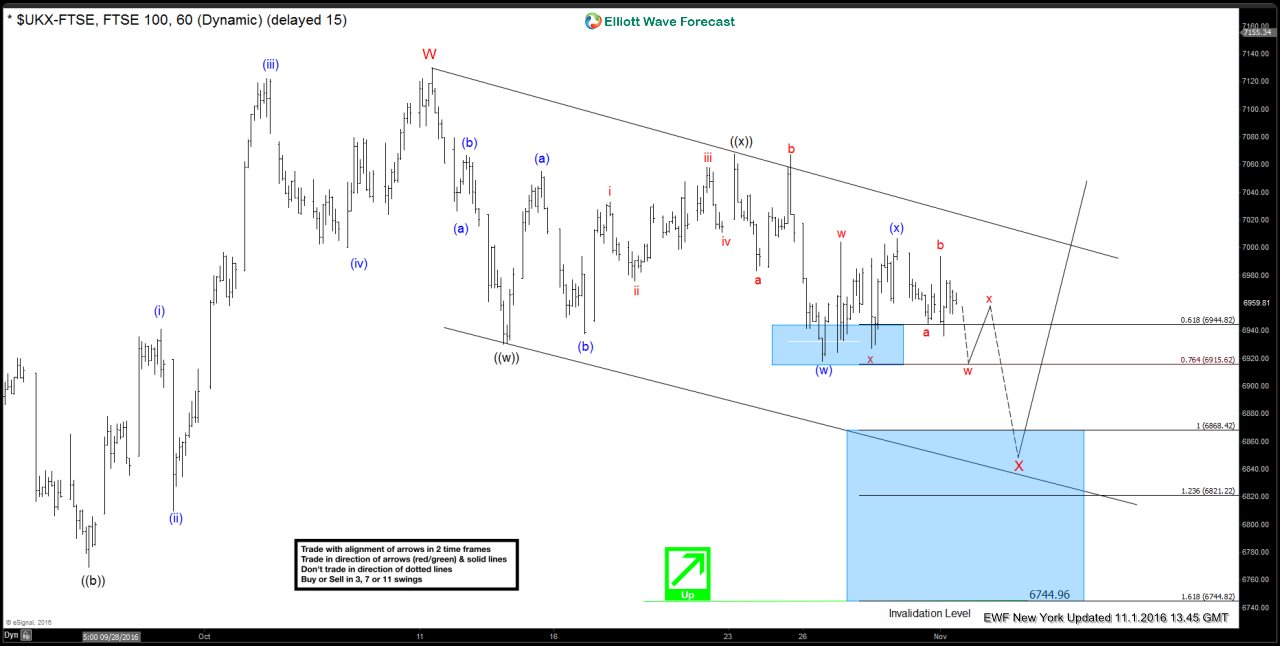

FTSE Short-term Elliott Wave Analysis 11.2.2016

Read MoreBest reading of Elliott wave cycles suggests rally to 7129.8 ended wave W. The Index is currently in wave X pullback as a double three where wave ((w)) ended at 6930 and wave ((x)) ended at 7067.34. While bounces stay below 7067.34, and more importantly below 7129.8, expect more downside in wave ((y)) of X towards 6821.1 […]

-

How could the US Election affect Global Market ?

Read MoreUS Election year always comes with uncertainty for the global market with Equities, futures and forex all interested in the relative strength of the United States dollar and ultimately that strength is based upon the US economic health which is still the one that sets the path for the rest of the world . As […]