The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$AUDUSD Elliottwaves forecasting the rally and buying the dips

Read MoreThe Video below is a short capture from the Live Trading Room held on September 13th by EWF Technical analyst Hendra Lau. In the first part, Hendra explained some basic rules of money management that every trader should be aware of, how to avoid overleveraging by spliting the position size within the instruments of the […]

-

$CADJPY Elliott Wave Zig Zag pattern

Read MoreHello fellow traders, in this technical blog we’re going to explain what Elliott Wave Zig Zag pattern looks like on real market example CADJPY price structure. Before we take a look at the $CADJPY chart, lets get through some basic EW theory and explain Zig Zag in a few words. Zig zag is the most […]

-

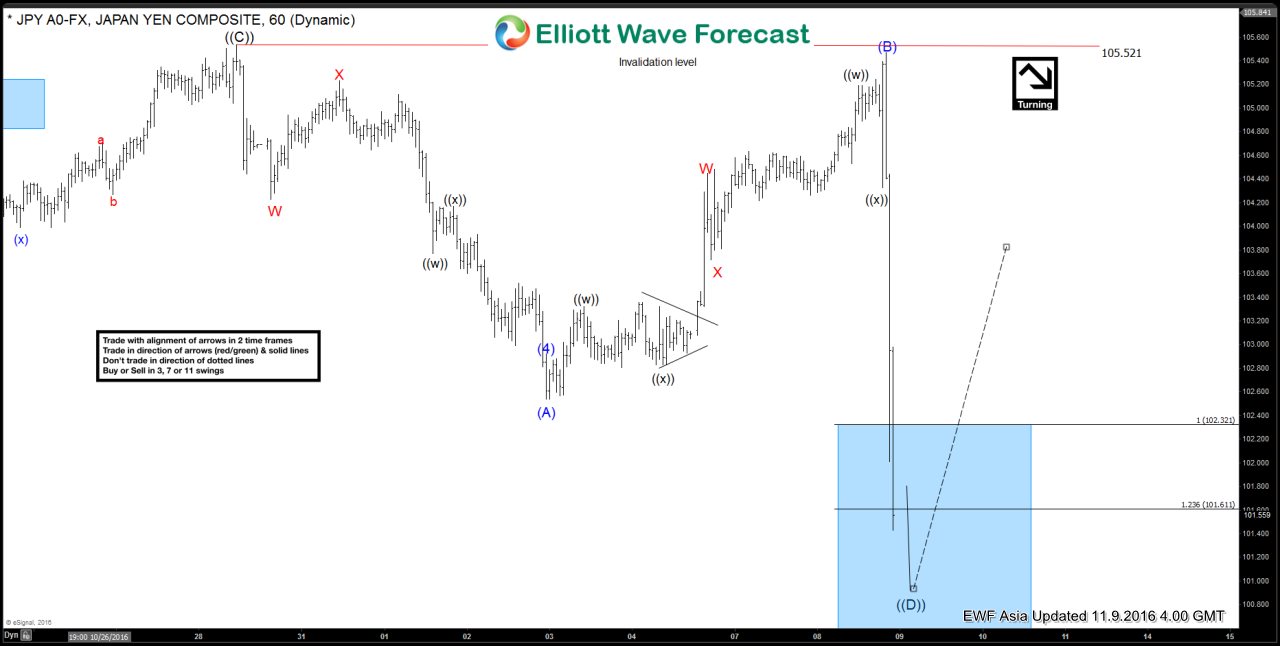

USDJPY Short-term Elliott Wave Analysis 11.9.2016

Read MoreRevised view of Elliott wave cycles suggests that cycle from 6/24 low is unfolding as a bearish triangle where wave ((A)) ended at 107.5, wave ((B)) ended at 99.51, and wave ((C)) ended at 105.5. Wave ((D)) has reached the minimum swing to end but can see marginal low towards 100.5 – 101 area before pair turns higher in […]

-

$SPX Elliott waves calling the decline & then the bounce

Read MoreIn this Technical blog we are going to take a look at $SPX 4 hour October 13th 2016 chart. In which instrument was showing 5 swings from August 15th peak, which is incomplete bearish sequence in New Elliott wave theory. So the idea was selling the bounces against September 22nd peak in sequence of 3, […]