The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Natural Gas ($NG_F) ready for winter rally?

Read MoreCold winters drive the demand for natural gas to power heating ovens or to generate electricity from natural gas to power heaters. The nymex natural gas prices reached a 17-year low of $ 1.64 on March 3, 2016, due to mild weather, weak demand, strong supplies and high inventories. As of December 1, prices rose […]

-

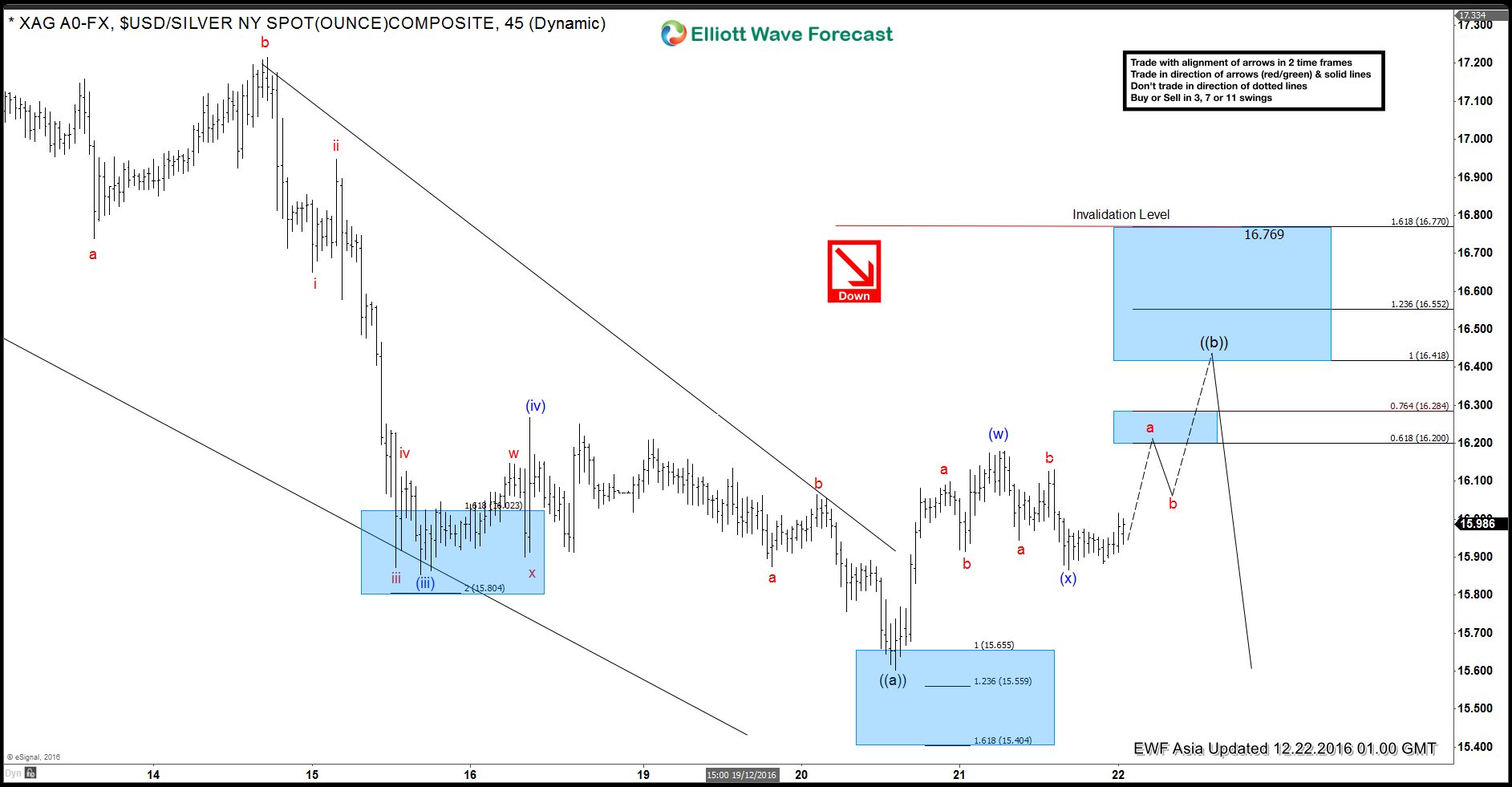

Silver 1H Elliott Wave Analysis 12.21.2016 – Elliott Wave Forecast

Read MoreSilver metal is showing an incomplete Elliott Wave sequence from 11.9.2016 peak. There are 5 swings down from 11.9.2016 peak which makes short-term sequence bearish against 12.7.2016 (17.25) peak. Decline from 18.99 – 16.14 was a 3 wave move labelled wave W followed by a 3 wave bounce to 17.25 that completed wave X. Cycle […]

-

Dow Jones (INDU) forecasting the rally & buying the dips

Read MoreHello fellow traders. Here’s a short capture from the Strategy of the Week video 10/16 2016 held by EWF Senior Analyst Daud Bhatti. Daud presented Elliott Wave count of Dow Jones Industrial Average and explained the swings structure. The Index was having incomplete bullish swings structure in the cycle from the January 21st low. Our […]

-

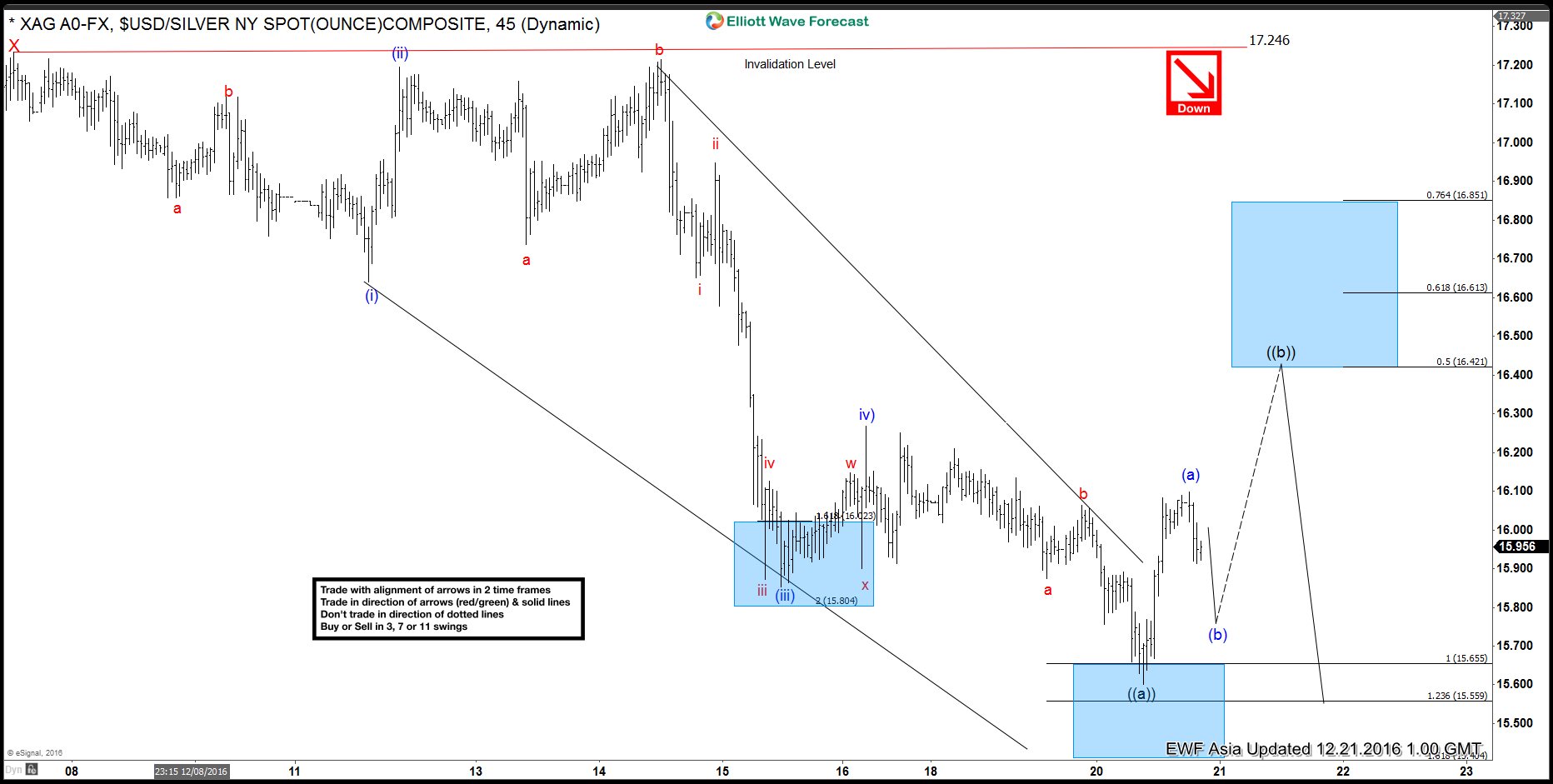

Silver Metal Elliott Wave Forecast 12.20.2016

Read MoreSilver metal is showing an incomplete Elliott Wave sequence from 11.9.2016 peak. There are 5 swings down from 11.9.2016 peak which makes short-term sequence bearish against 12.7.2016 (17.25) peak. Decline from 18.99 – 16.14 was a 3 wave move labelled wave W followed by a 3 wave bounce to 17.25 that completed wave X. Cycle […]