The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

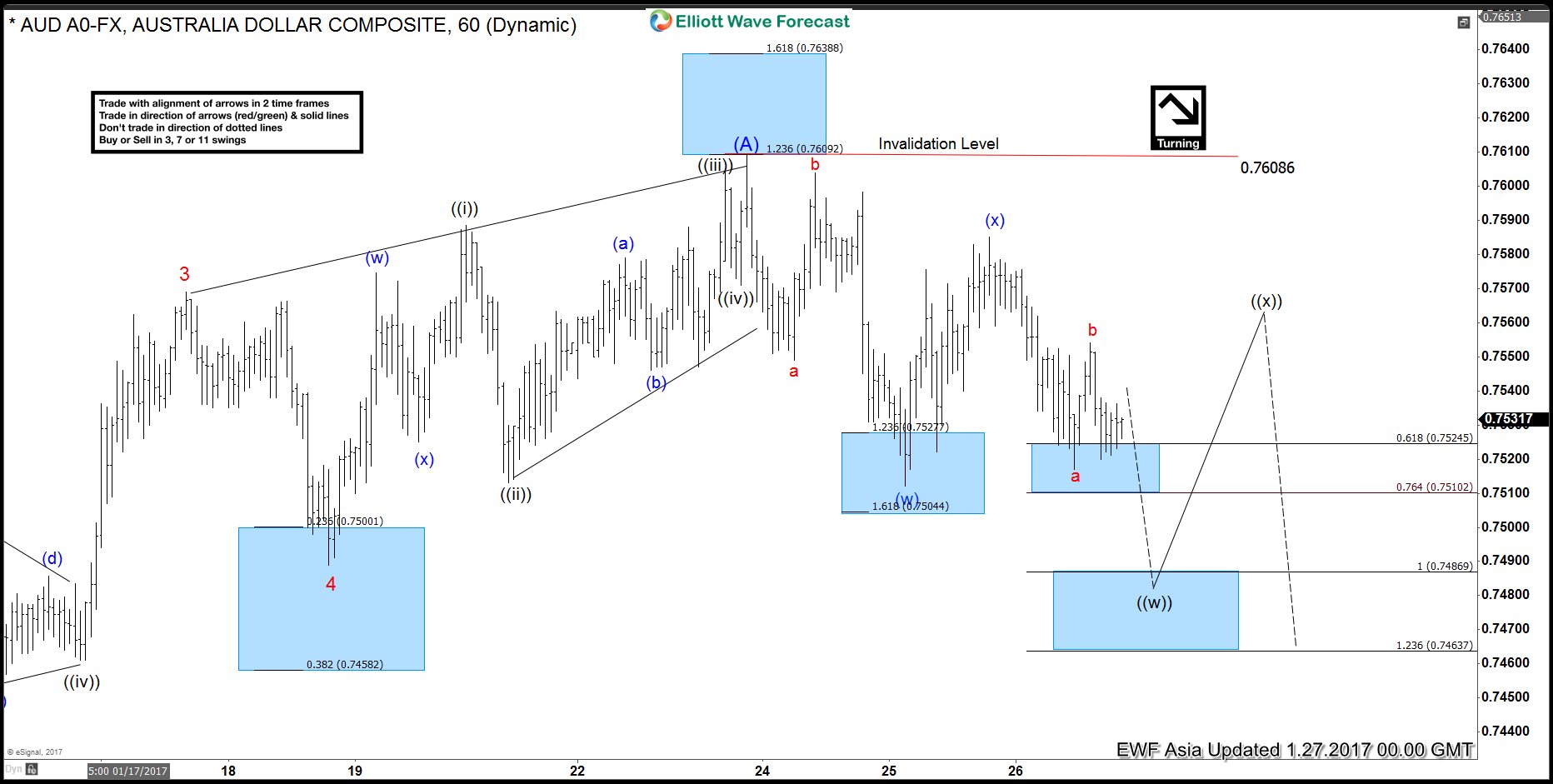

AUDUSD 5 wave cycle completed: Now turning lower

Read MoreAUDUSD 5 wave cycle from 12/23 low is proposed to be over at 0.7608 and pair is now turning lower. Yesterday, we mentioned that a break below 0.7511 would negate another high to complete wave (A) and suggest that 5 wave cycle from 12/23 low ended already at 0.7608. Today, pair failed to make a new […]

-

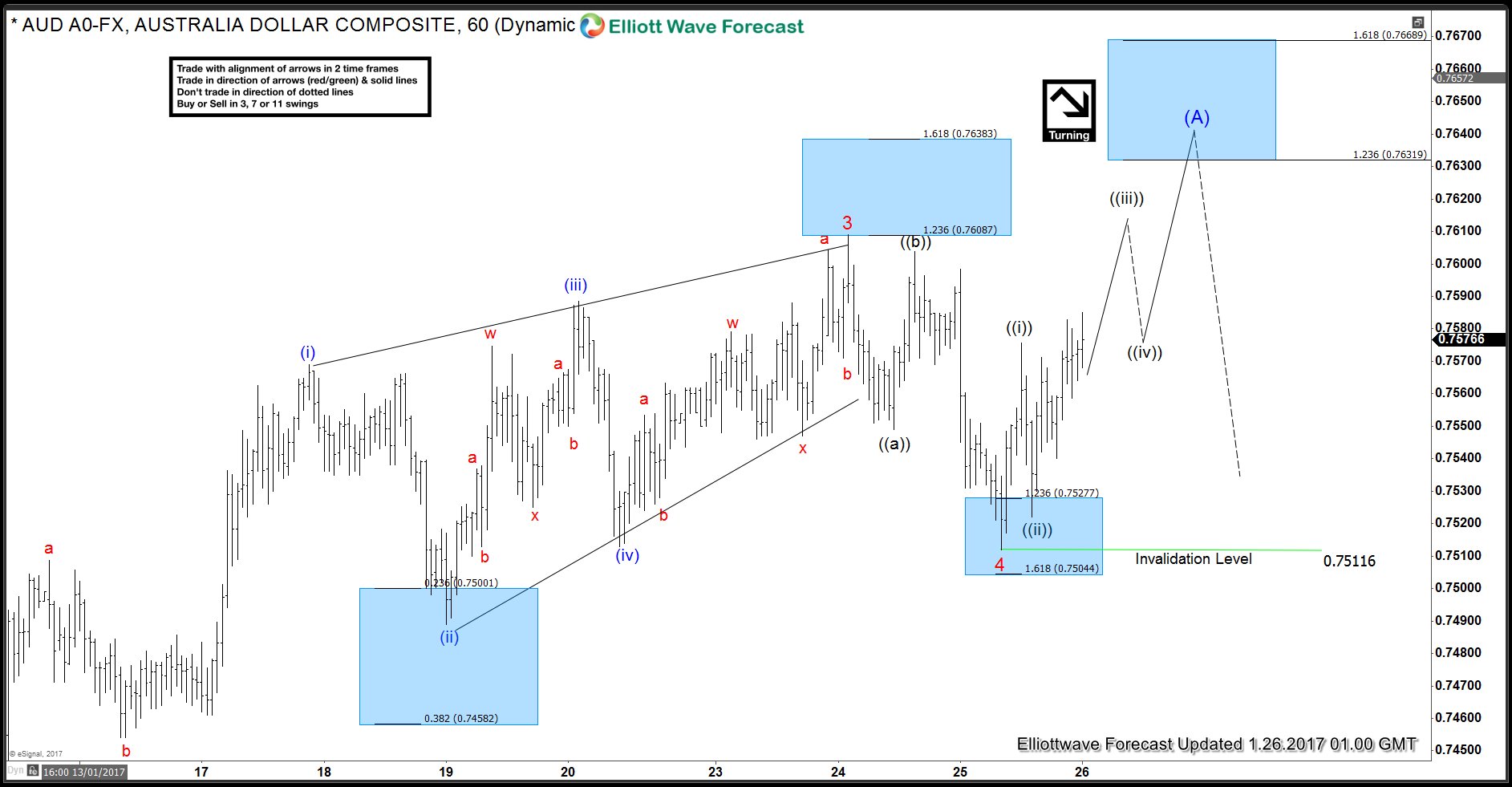

AUDUSD: 5 Wave move nearing completion

Read MoreAUDUSD 5 wave move up from 12/13 low can already be counted completed at 0.7609. However, while above 0.7511 low, another high to 0.7631 – 0.7699 area can’t be ruled out within this 5 wave move up from 12/23 low. As per the updated wave count, wave 3 is at 0.7609 and dip to 0.7511 was […]

-

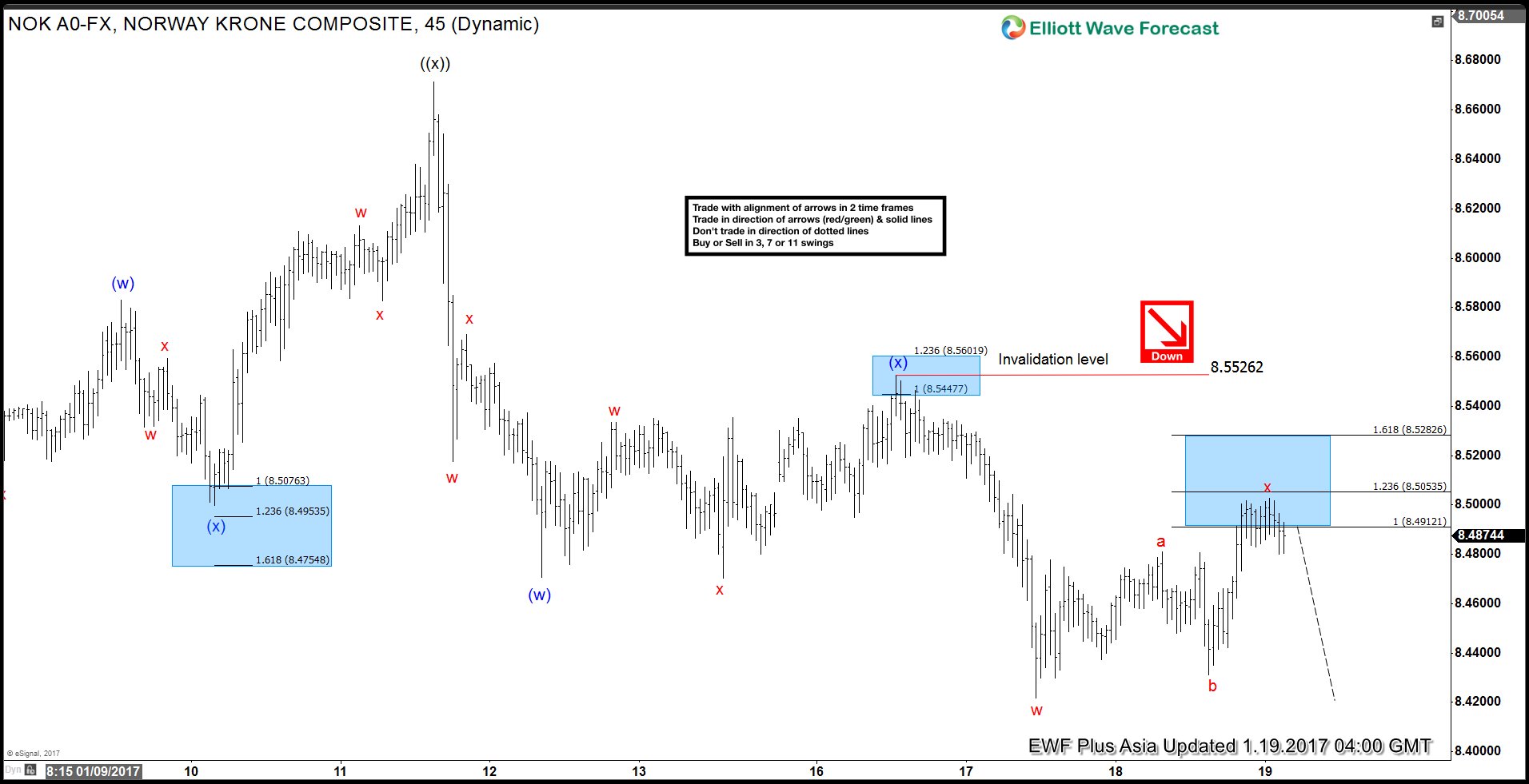

Elliott Wave forecast & market correlation example

Read MoreMarket Correlation Market correlation is one of the powerful techniques we use to forecast the market. Many traders, especially beginners, make mistake by trading and forecasting only one or a few instruments. E.g. the most popular are EURUSD, USDX, SPX, DAX, Gold. Although EURUSD is the most popular forex pair ever, it doesn’t always have […]

-

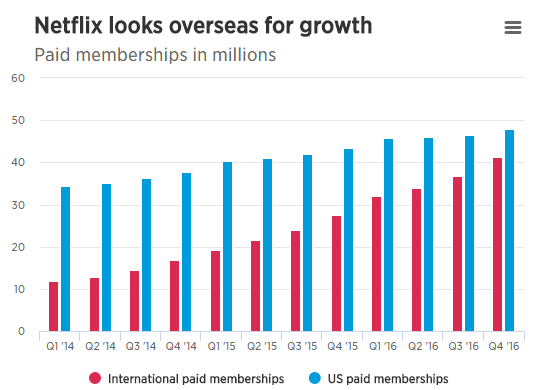

Do you need to worry about Netflix 5 waves move ?

Read MoreNetflix (NFLX) is an American multinational entertainment company that specializes in streaming media , film and television production , as well as online distribution and DVD by mail. Last week , the company posted its biggest-ever quarterly subscriber growth with 7.05 million new subscribers beating its own expectations of 5.2 million . As we can see in the chart below that Netflix international […]