The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

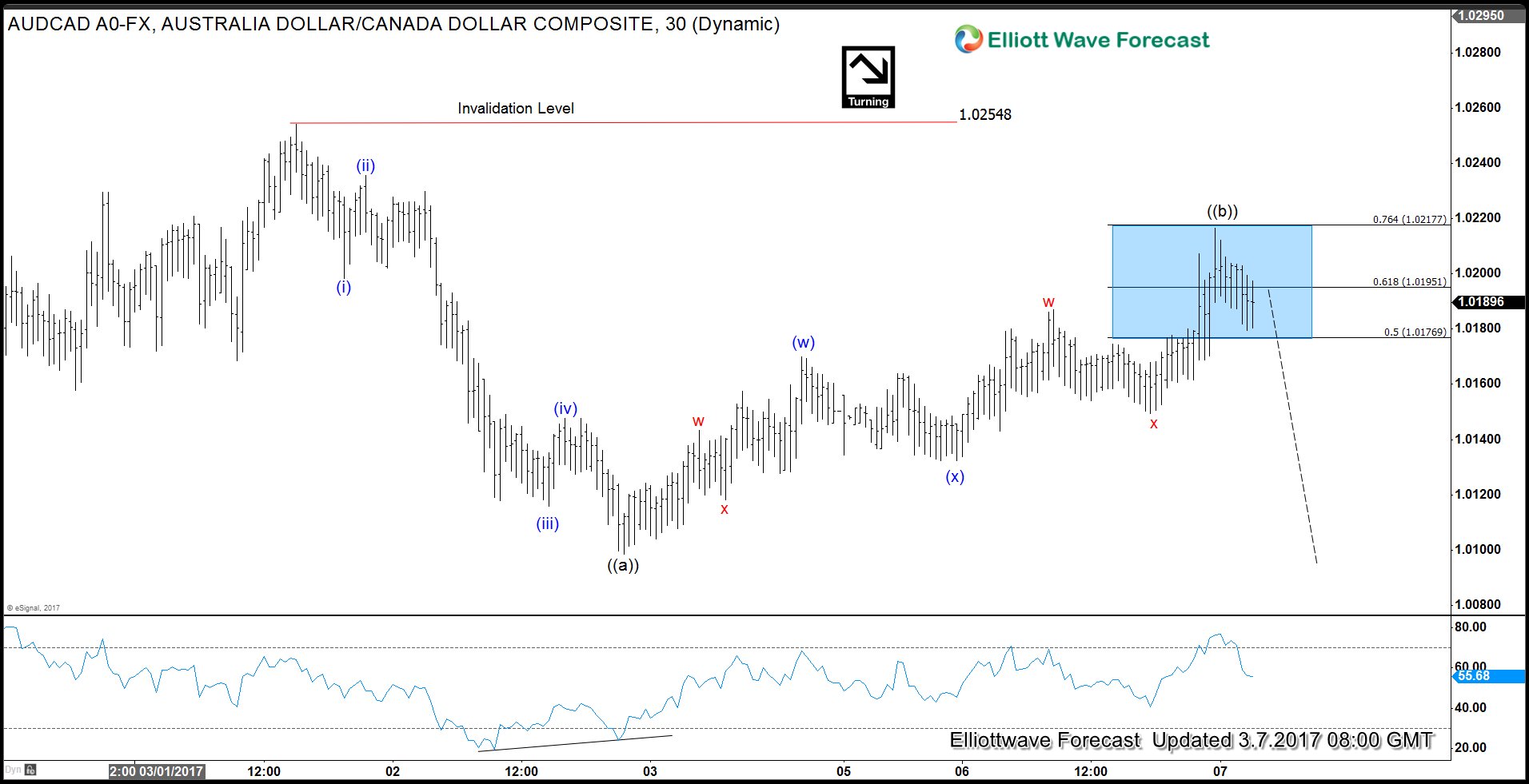

AUDCAD Elliottwave Intraday View

Read MoreShort term Elliottwave structure of AUDCAD from 3/1 peak (1.025) looks to be showing an impulse structure with a nice 5 waves subdivision where Minuette wave (i) ended at 1.0198, Minuette wave (ii) ended at 1.0235, Minuette wave (iii) ended at 1.0115, Minuette wave (iv) ended at 1.0147, and Minuette wave (v) ended at 1.0098. We […]

-

SPX Elliott wave view: Wave 4 started

Read MoreShort term Elliott wave view in SPX suggests that the rally from 1/23 low is unfolding as a 5 waves Elliott wave impulse structure where Minor wave 1 ended at 2301, Minor wave 2 ended at 2267, and Minor wave 3 ended at 2400.98. Internals of Minor wave 3 shows an extension and subdivided also as an […]

-

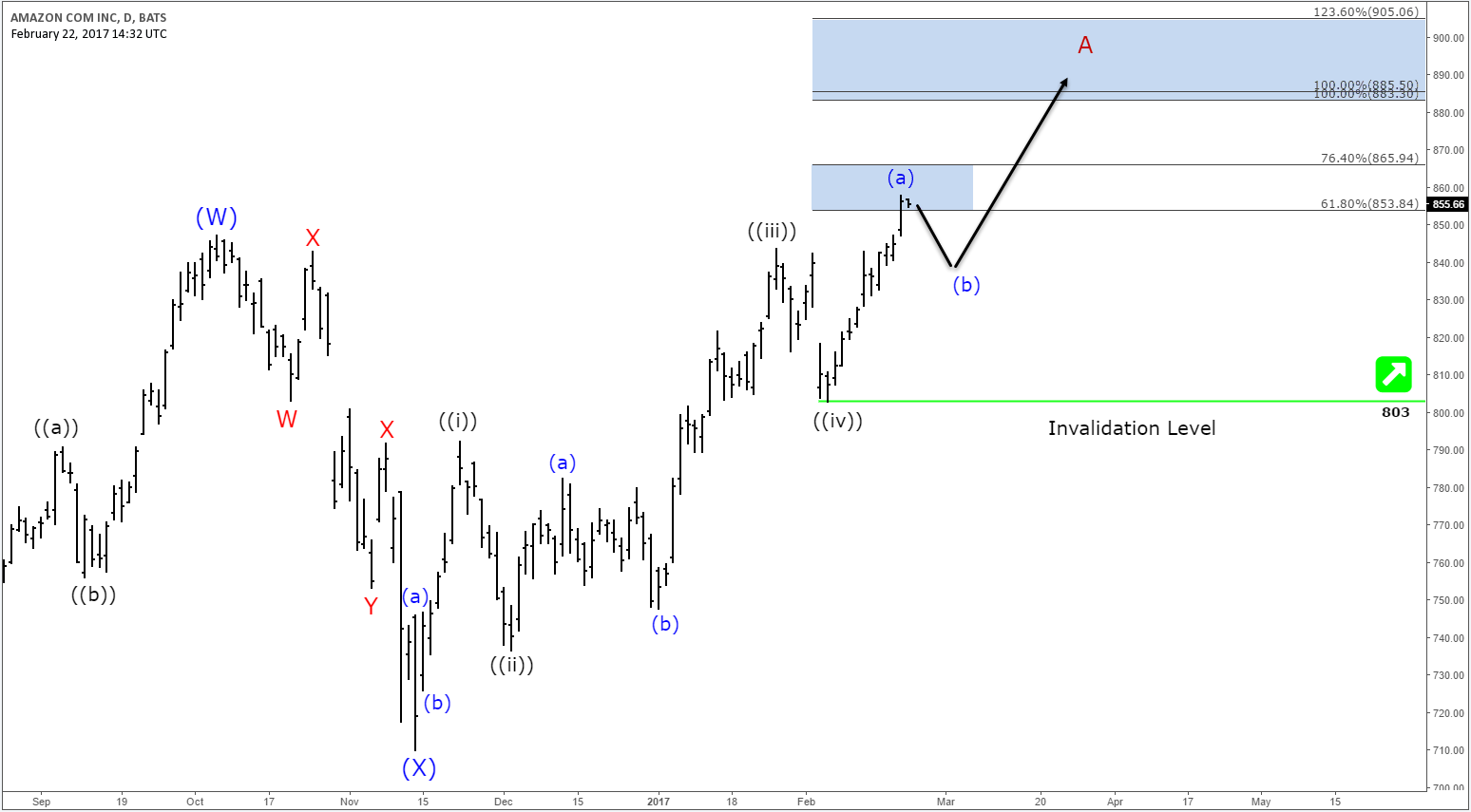

Amazon Elliott Wave Sequence Calling Higher

Read MoreAmazon Amazon (NASDAQ: AMZN) is one of the strongest companies providing positive returns to its investors in the recent decade . Last week AMZN managed to make new all time highs after breaking above October 2016 peak , this move opened an extension higher as the stock is now showing an incomplete bullish sequence from February 2016 low and […]

-

SPX Elliott Wave View: Ending wave 3 soon

Read MoreRevised short term Elliott wave view in SPX suggests that the rally from 1/23 low is unfolding as a 5 waves Elliott wave impulse structure where Minor wave 1 ended at 2301 and Minor wave 2 ended at 2267.2. The Index has erased momentum divergence at the peak suggesting it is likely still within Minor wave 3 […]