The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Nifty-NSE: Next Warning area for bulls

Read MoreIn June 2015, we mentioned that Nifty-NSE from India was in a warning area for the bulls and a larger correction was expected to take place. Over the next 12 months, Nifty lost 25% dropping from a high of 9119.20 on 3.4.2015 to a low of 6825 on 2.29.2016. However, as we keep mentioning World […]

-

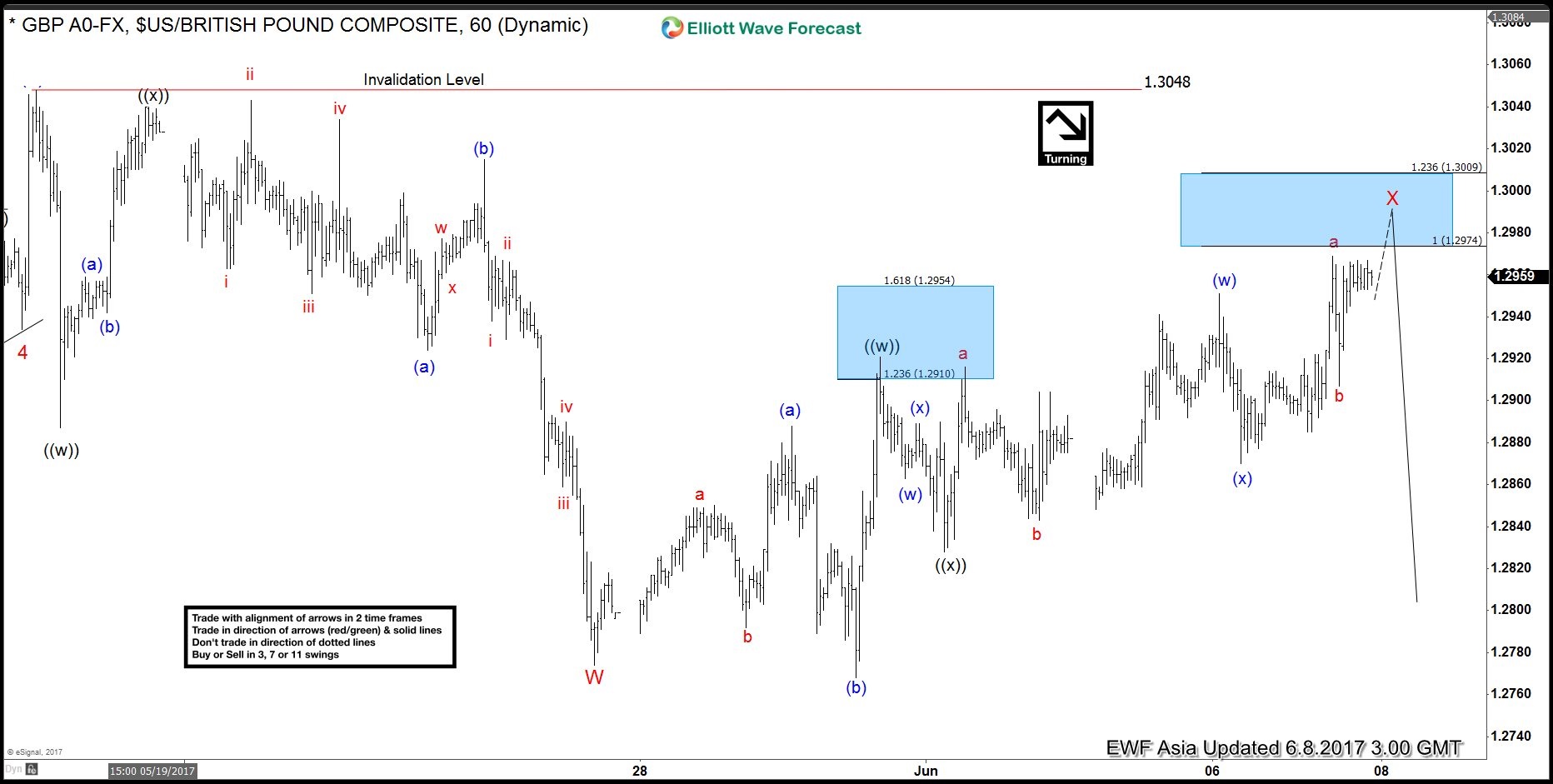

GBP reaction after UK Election (GE2017)

Read MoreThe pound sterling was headed for the biggest drop in a year after it emerged that the ruling Conservative Party has fallen short of a general majority after UK Election (GE 2017), just 10 days before the Brexit talks are scheduled to begin. The currency collapsed in front of all its main counterparts, since the supporters […]

-

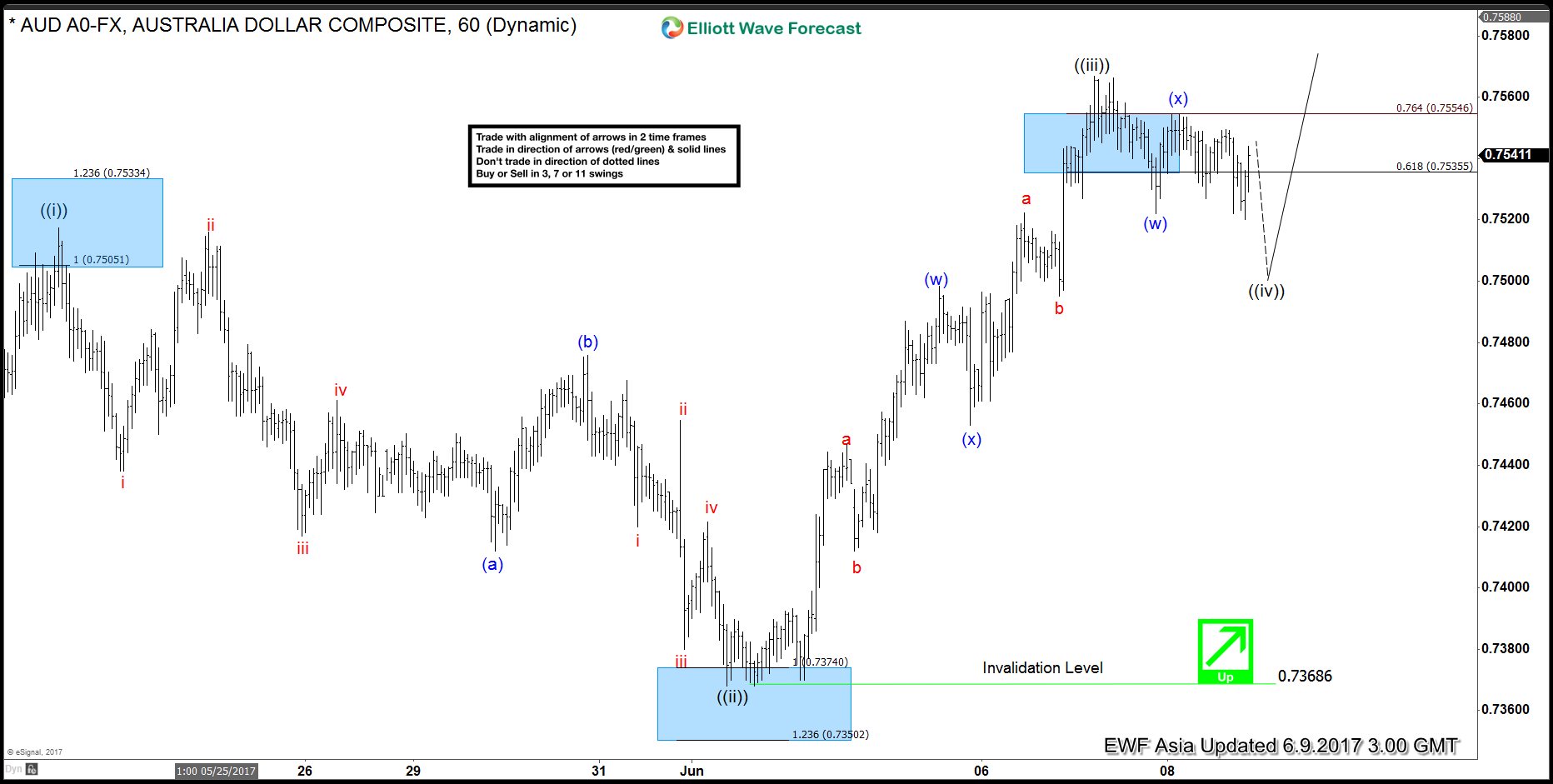

AUDUSD Elliott Wave Analysis 6.9.2017

Read MoreRevised short term AUDUSD Elliott Wave view suggests the rally from 5/9 low is unfolding as a leading diagonal Elliott Wave structure. Up from 5/9 (0.7325) low, Minute wave ((i)) ended at 0.7517, Minute wave ((ii)) ended at 0.7368, and Minute wave ((iii)) ended at 0.7566. Minute wave ((iv)) pullback is currently in progress to correct cycle from 6/1 […]

-

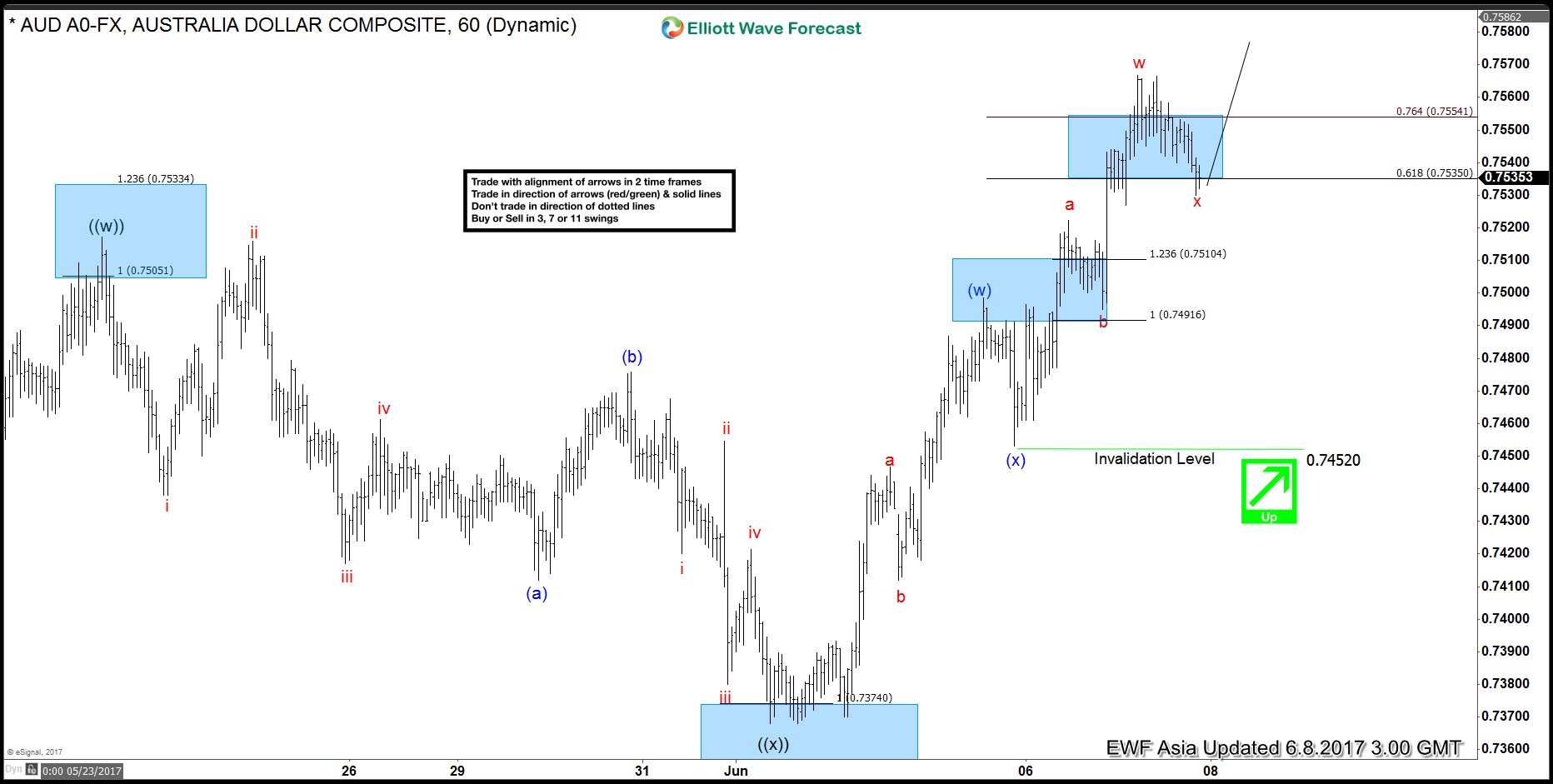

AUDUSD Elliott Wave View: Near Pullback

Read MoreShort Term AUDUSD Elliott Wave view suggests the rally from 5/9 low is unfolding as a double three Elliott Wave structure. Up from 5/9 (0.7325) low, Minute wave ((w)) ended at 0.7517 and Minute wave ((x)) ended at 0.7368. Pair has since broken above 0.7517, adding validity that the next leg higher has started. From 0.7368 low, the rally is […]