The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

YM (Dow Futures) Elliott Wave Analysis 6.16.2017

Read MoreShort term YM (Dow Futures) Elliott Wave view suggests the rally from 4/19 low is unfolding as a diagonal Elliott Wave structure where Minor wave 1 ended at 21010 (4/26), Minor wave 2 ended at 20474 (5/18), Minor wave 3 ended at 21270 (6/8), and Minor wave 4 ended at 21081 (6/8). Minor wave 5 is in progress and […]

-

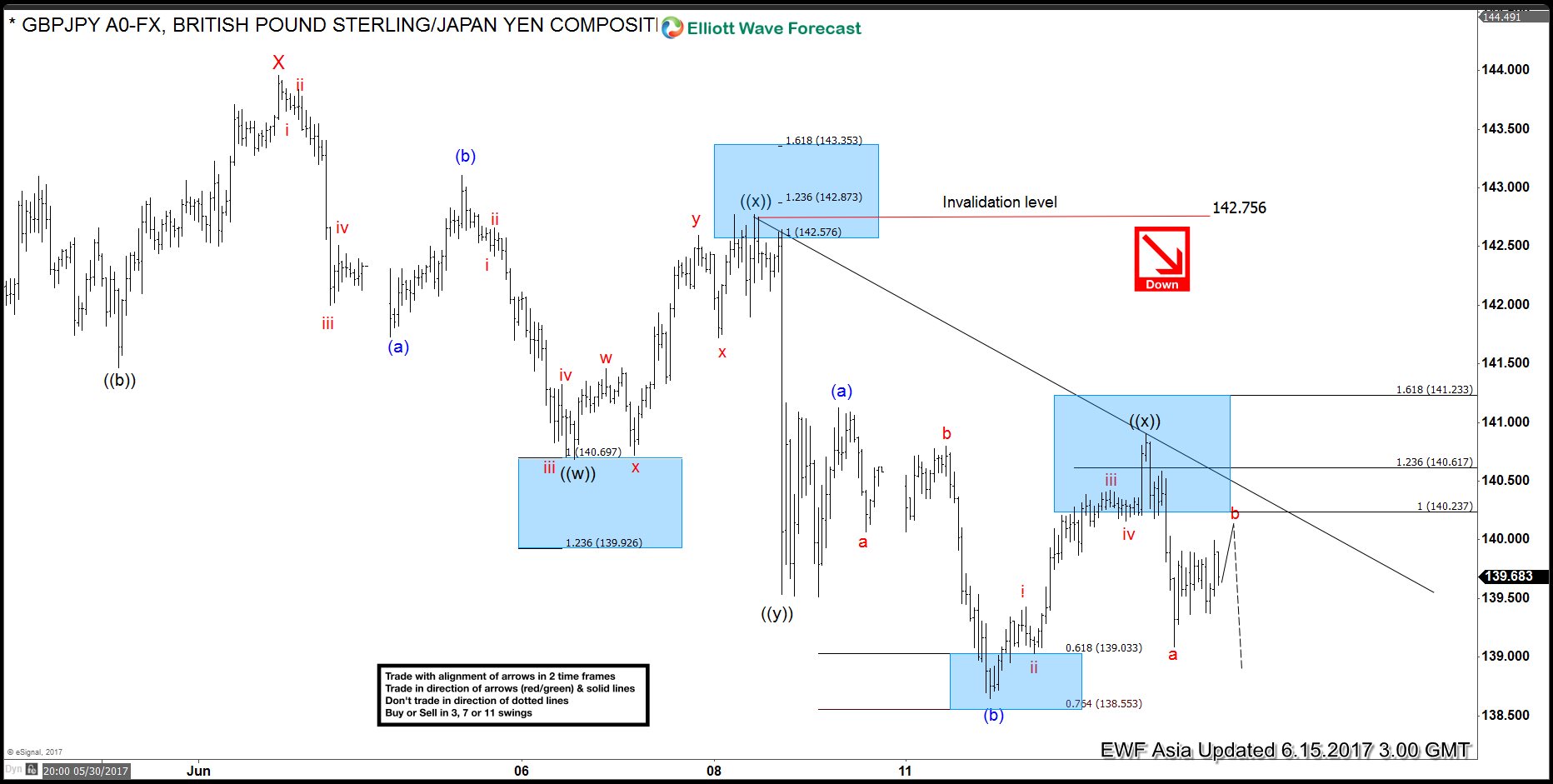

GBPJPY Elliott Wave Analysis: Resuming Lower

Read MoreShort term GBPJPY Elliott Wave view suggests the decline from 5/10 high shows a 5 swing sequence, thus favoring more downside. Decline from 5/10 high is unfolding as a double three Elliott Wave structure. Down from 5/10 peak (148.11), Minor wave W ended at 141.47 and Minor wave X ended at 143.96. Minor wave Y is currently in progress and has […]

-

GBPJPY Elliott Wave Analysis: Bearish Below 143.9

Read MoreShort term GBPJPY Elliott Wave view suggests the decline from 5/10 high shows a 5 swing sequence, thus favoring more downside. Decline from 5/10 high is unfolding as a double three Elliott Wave structure. Down from 5/10 peak (148.11), Minor wave W ended at 141.47 and Minor wave X ended at 143.96. Minor wave Y is currently in progress and has […]

-

How good are you at recognizing Elliott Wave Patterns ?

Read MoreHello fellow traders. Here is the chance to test your Elliott Wave knowledge again and eventually make some improvements. You probably know that we do a lot of free educational blogs, presenting various Elliott Wave Patterns through real Market examples. We also constantly teach our members through our services like Live Sessions and 24h Chat […]