The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

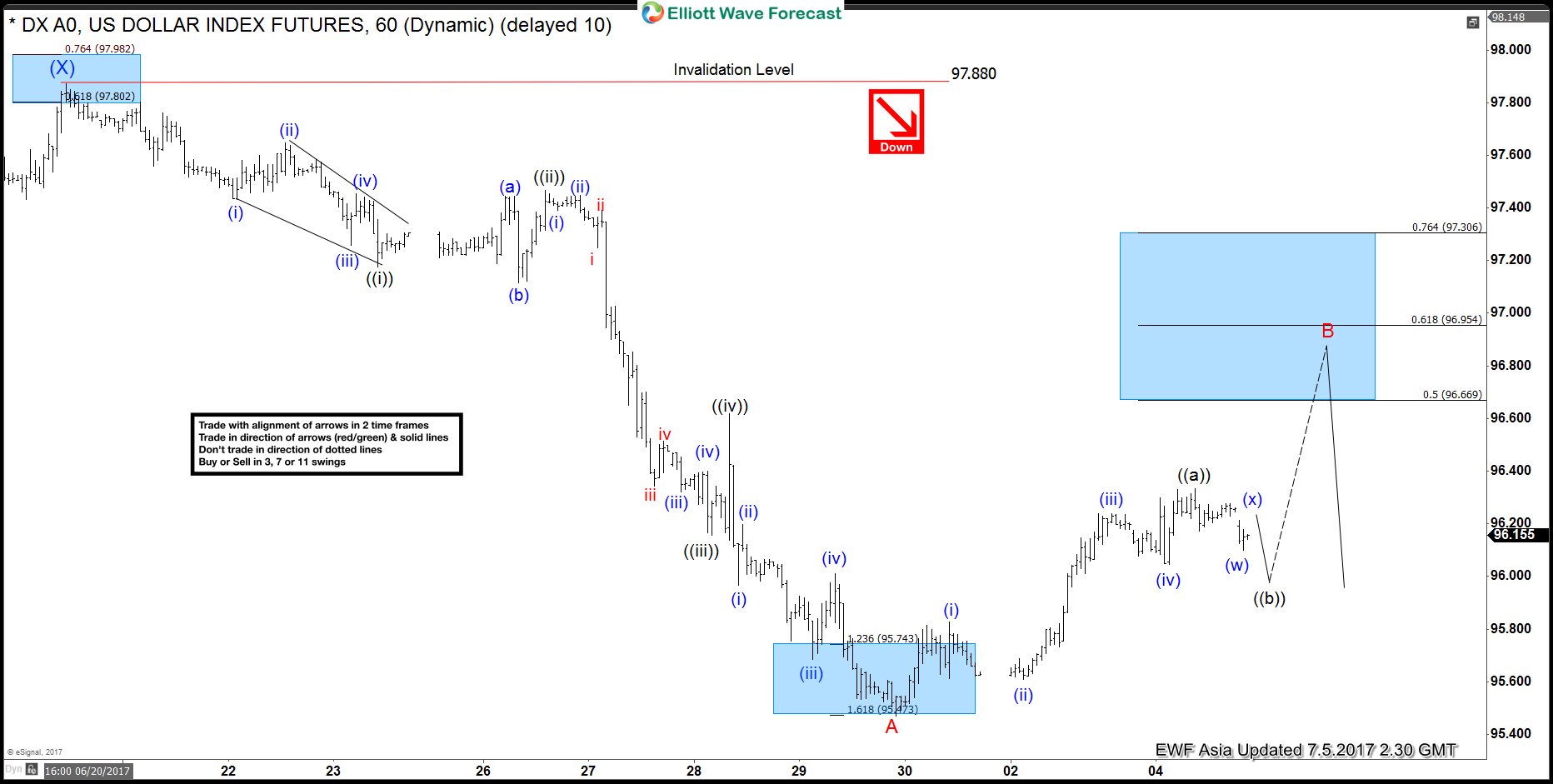

USDX Elliott Wave View: Correction in progress

Read MoreShort term USDX (USD Index) Elliott Wave view suggests the rally to 97.88 high on 6/20 ended Intermediate wave (X). Decline from there is unfolding as an impulse Elliott Wave structure with extension and ended at 95.47 low on 6/29. This 5 wave move could be Minor wave A of an Elliott wave zigzag structure structure, where Minute wave ((i)) ended at 97.17 and Minute wave […]

-

Next Elliott Wave Target for Ethereum ETHUSD

Read MoreThere has been a lot of headlines lately as the world’s new favorite cryptocurrency Ethereum (ETHUSD) soared +5,000% in value before the price dropped and it’s currently still up over 3,500%. Ethereum was only developed two years ago while bitcoin’s been around for almost eight years , many investors are expecting the ether token to take over in the coming months as […]

-

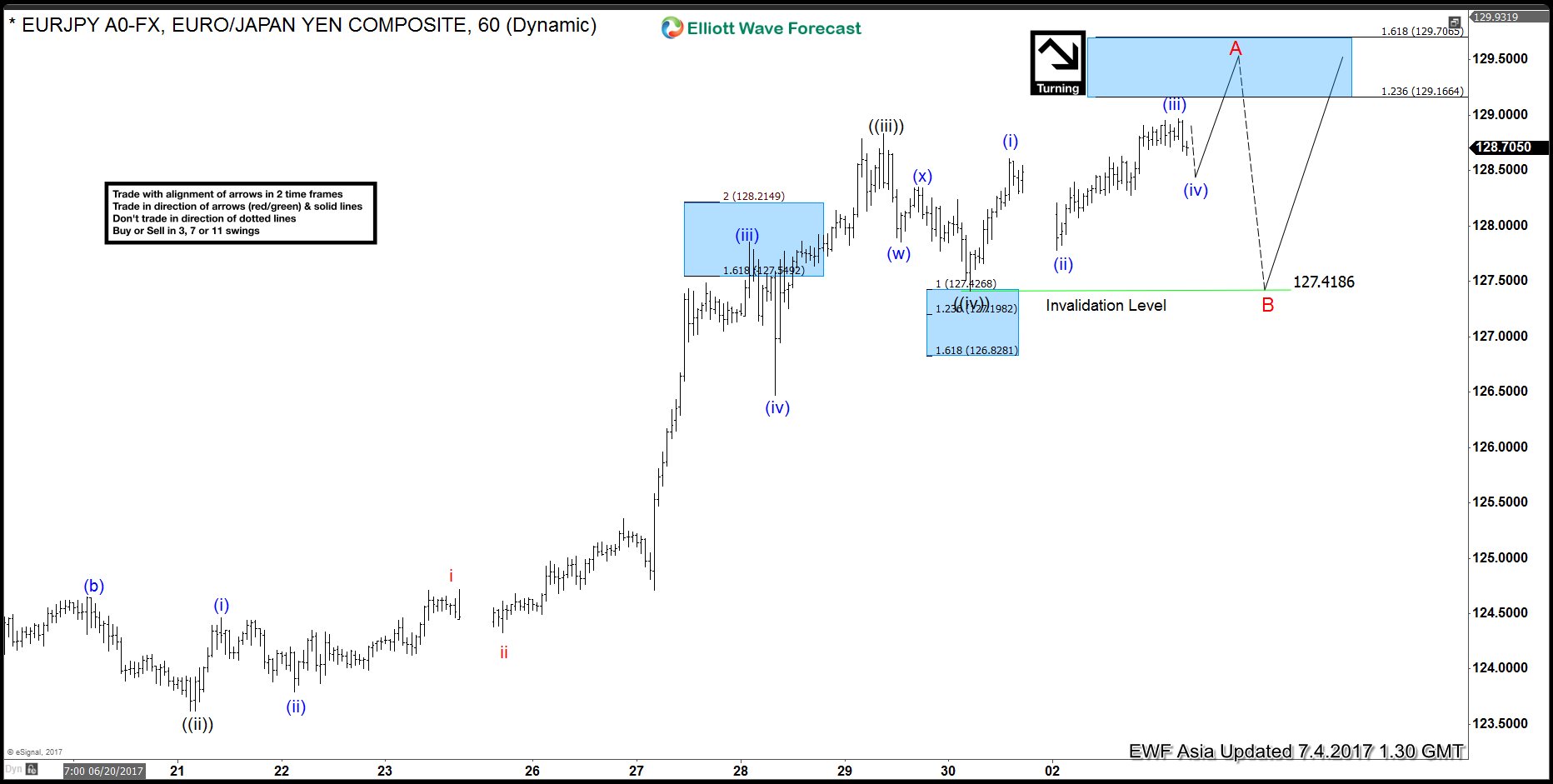

EURJPY Elliott Wave View: Ending Impulse

Read MoreShort term EURJPY Elliott Wave view suggests the decline to 122.35 on 6/15 low ended Intermediate wave (X). Rally from there is unfolding as an impulse Elliott Wave structure with extension. This 5 wave move could be Minor wave A of an Elliott wave zigzag structure structure, where Minute wave ((i)) ended at 124.46 and Minute wave ((ii)) ended at 123.62. […]

-

Next Elliott Wave Target for Bitcoin BTCUSD

Read MoreBitcoin is still considered as the currency of the Dark Web, despite the fact that it was the world’s best performing currency in 2015 & 2016 and currently 1 Bitcoin (BTCUSD) is worth 2 Ounces Of Gold which is significantly important in the financial world. The digital currency continued it’s outstanding performance during this year with +200% but Ethereum […]