The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

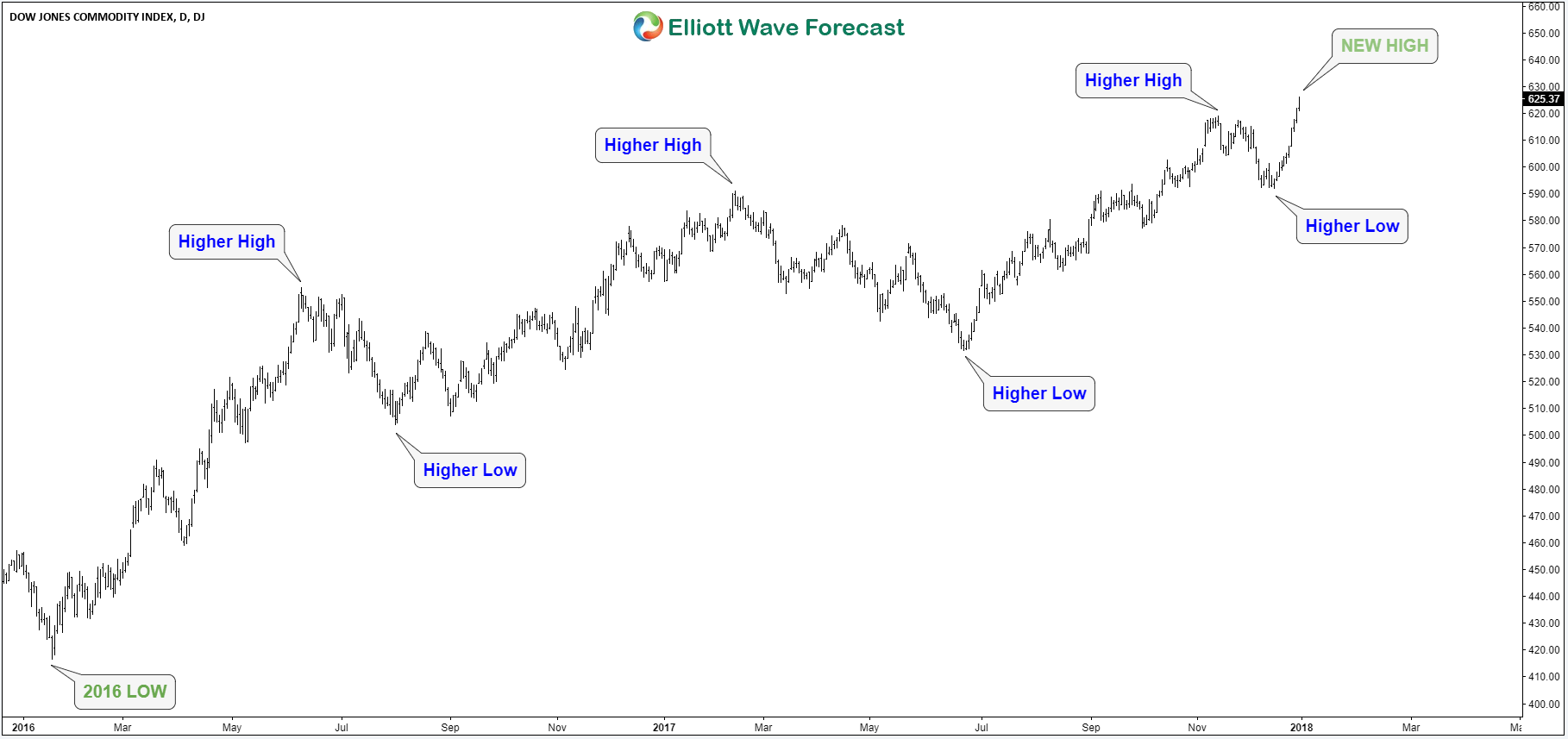

Gold is Ready for New Rally

Read MoreGold closed above $1,300 per ounce for the first time in 5 years as the U.S. dollar saw it’s worst decline over the past 14 years. Despite a strong start in 2017, XAUUSD spent most of the year in a sideways range around $1250 area before the final bounce came by year end to allow the precious metal to […]

-

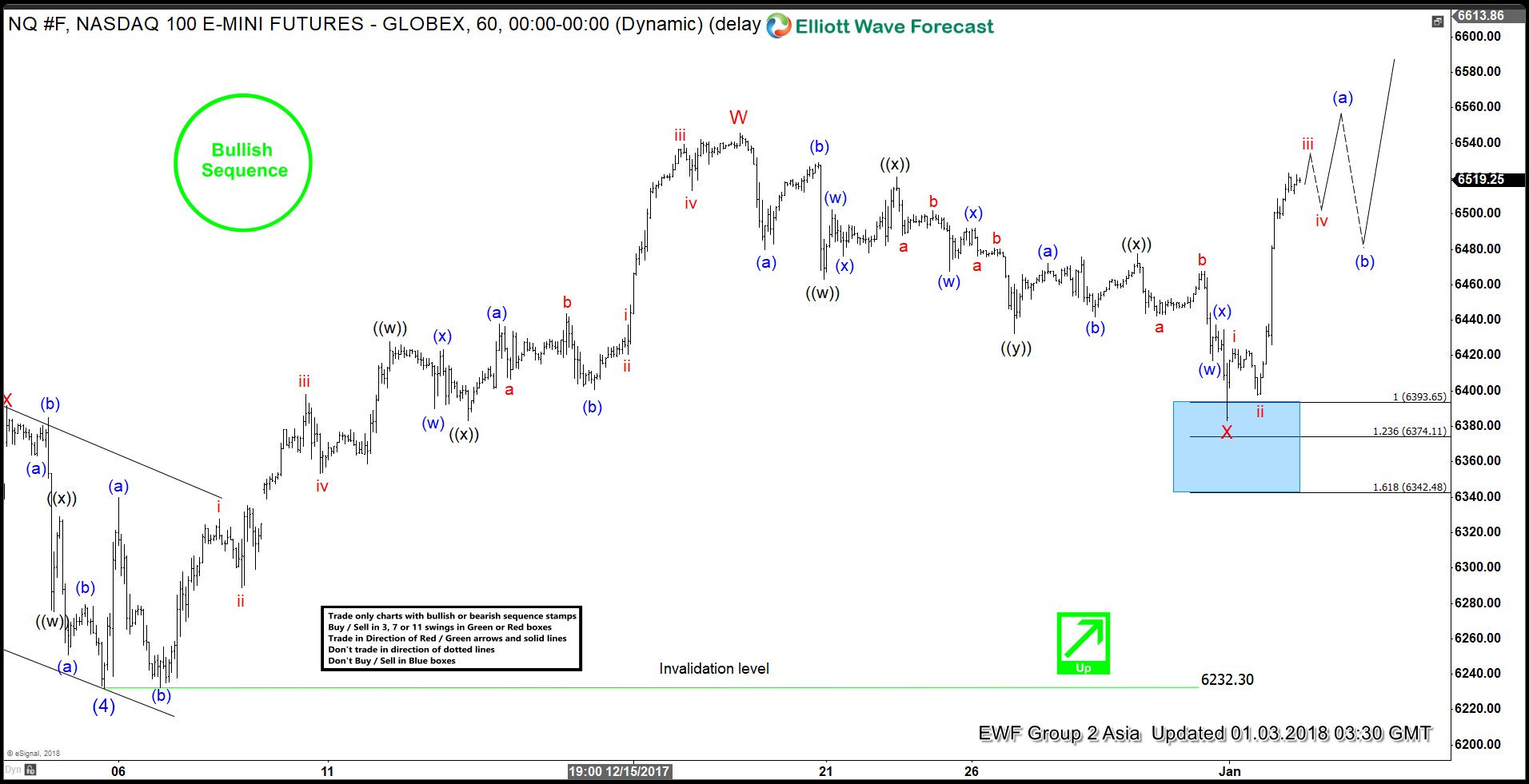

Elliott Wave Analysis: Nasdaq Ended Correction

Read MoreElliott Wave view for Nasdaq suggests that the Index has ended the correction to the cycle from 12/5 low at 6383.25 and from there it it has started the next leg higher. Up from Intermediate wave (4) low on 12/5, the rally unfolded as a double three Elliott Wave structure where Minor wave W ended at 6545.75 and Minor wave X […]

-

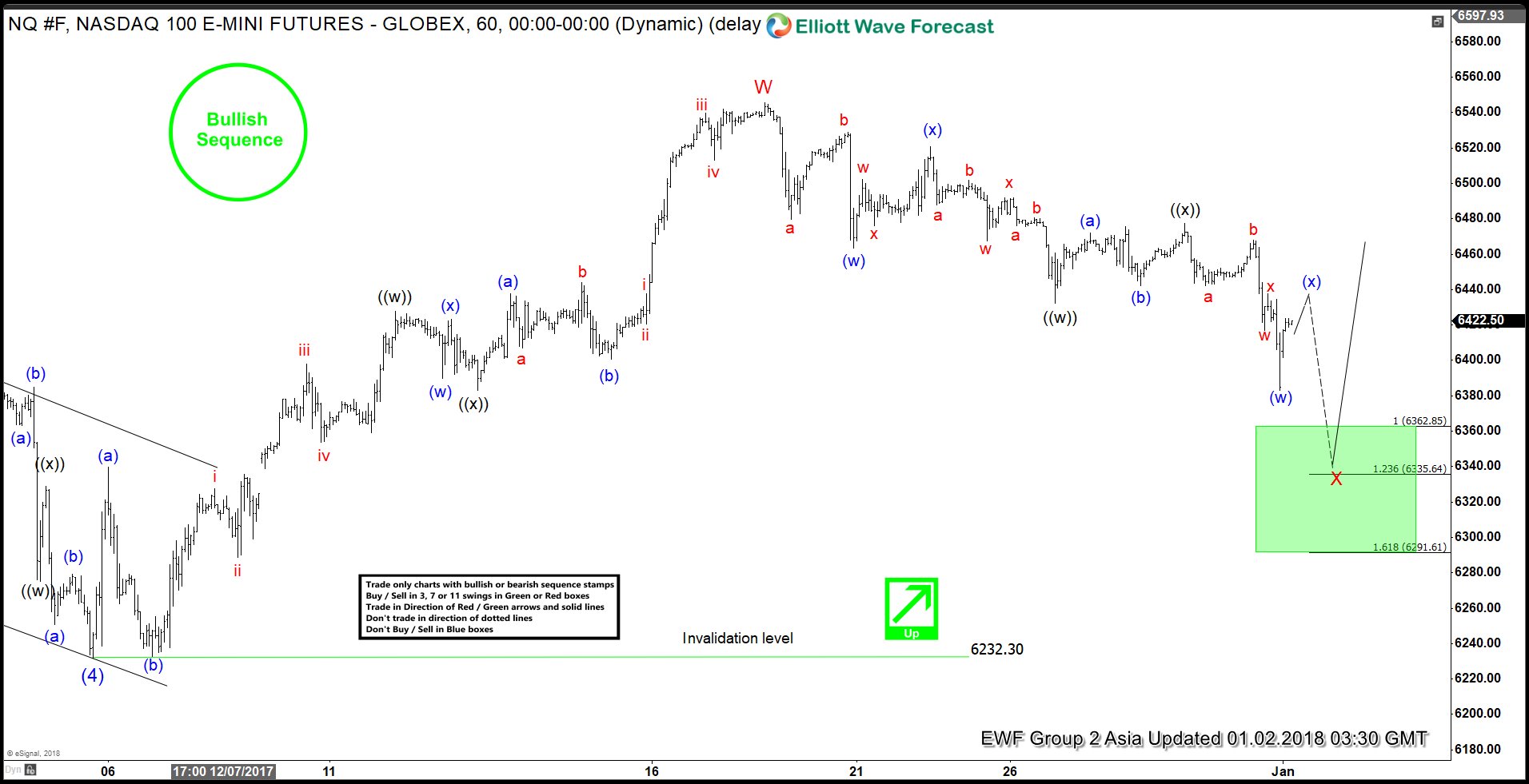

Elliott Wave Analysis: Nasdaq Correcting cycle from 6232.3 low

Read MoreNasdaq Short Term Elliott Wave view suggests that the Index is correcting the rally from 12/5 low (6232.3). While dips remain above Intermediate wave (4) at 6232.3, expect Index to extend higher. Rally from Intermediate wave (4) low unfolded as a double three Elliott Wave structure where Minor wave W ended at 6545.75 and Minor wave X is in progress […]

-

Bitcoin: Technical and Psychological Perspective

Read MoreHello fellow traders, in this blog post, we will discuss the most hyped cryptocurrency Bitcoin in a technical as well as psychological perspective. From the zero line, we are calling bitcoin completed in the super cycle blue wave (a) at 17/12/17 top. From that high, the market completed the first leg of 3 of a double correction. […]