The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

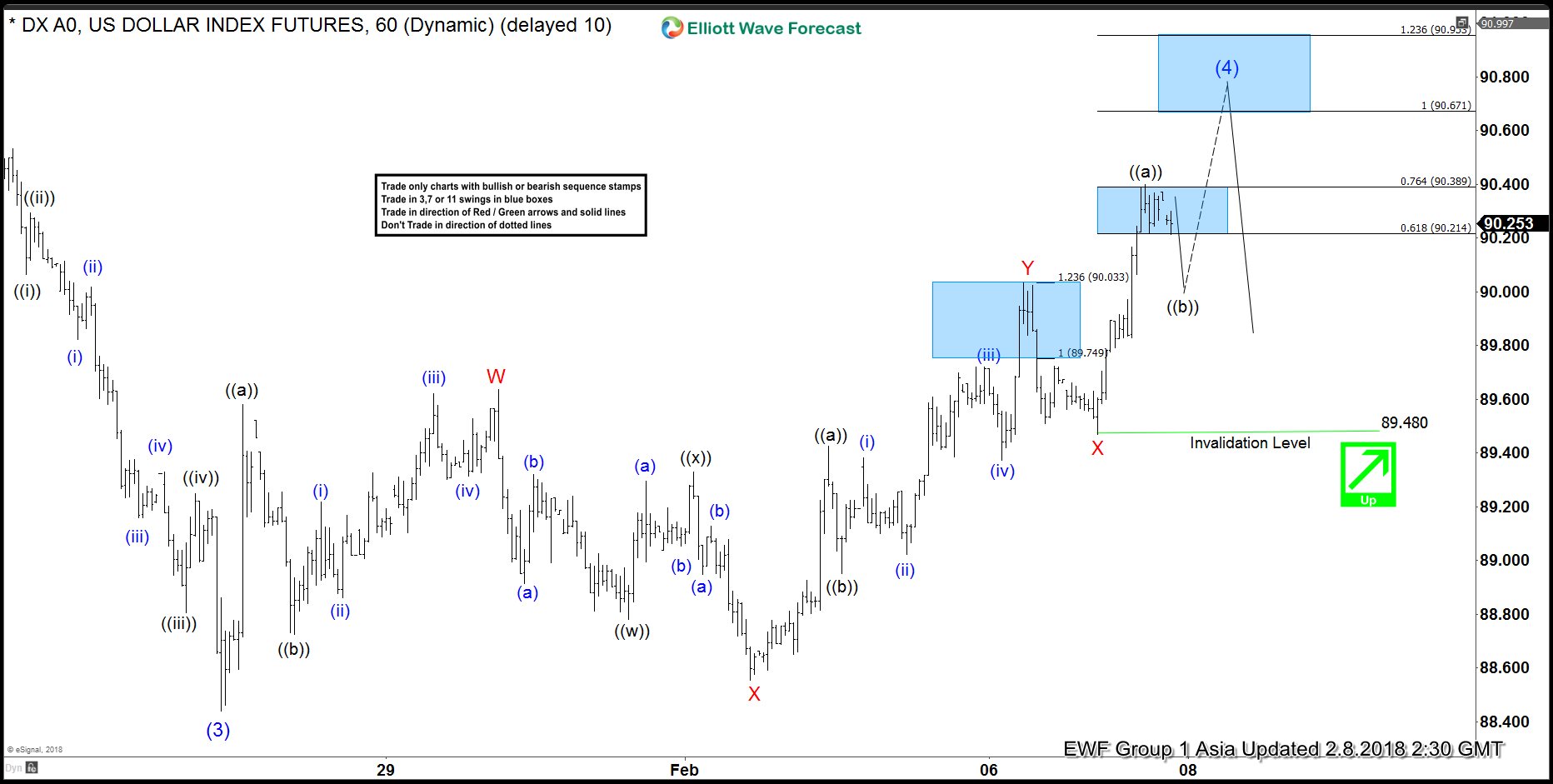

Elliott Wave Analysis: DXY extended correction as triple three

Read MoreDXY Short Term Elliott Wave view suggests that the decline to 88.44 ended Intermediate wave (3). Up from there, correction in Intermediate wave (4) is in progress as a triple three Elliott Wave structure. Rally to 89.64 ended Minor wave W, decline to 88.55 ended Minor wave X, Minor wave Y ended at 90.03 and Minor […]

-

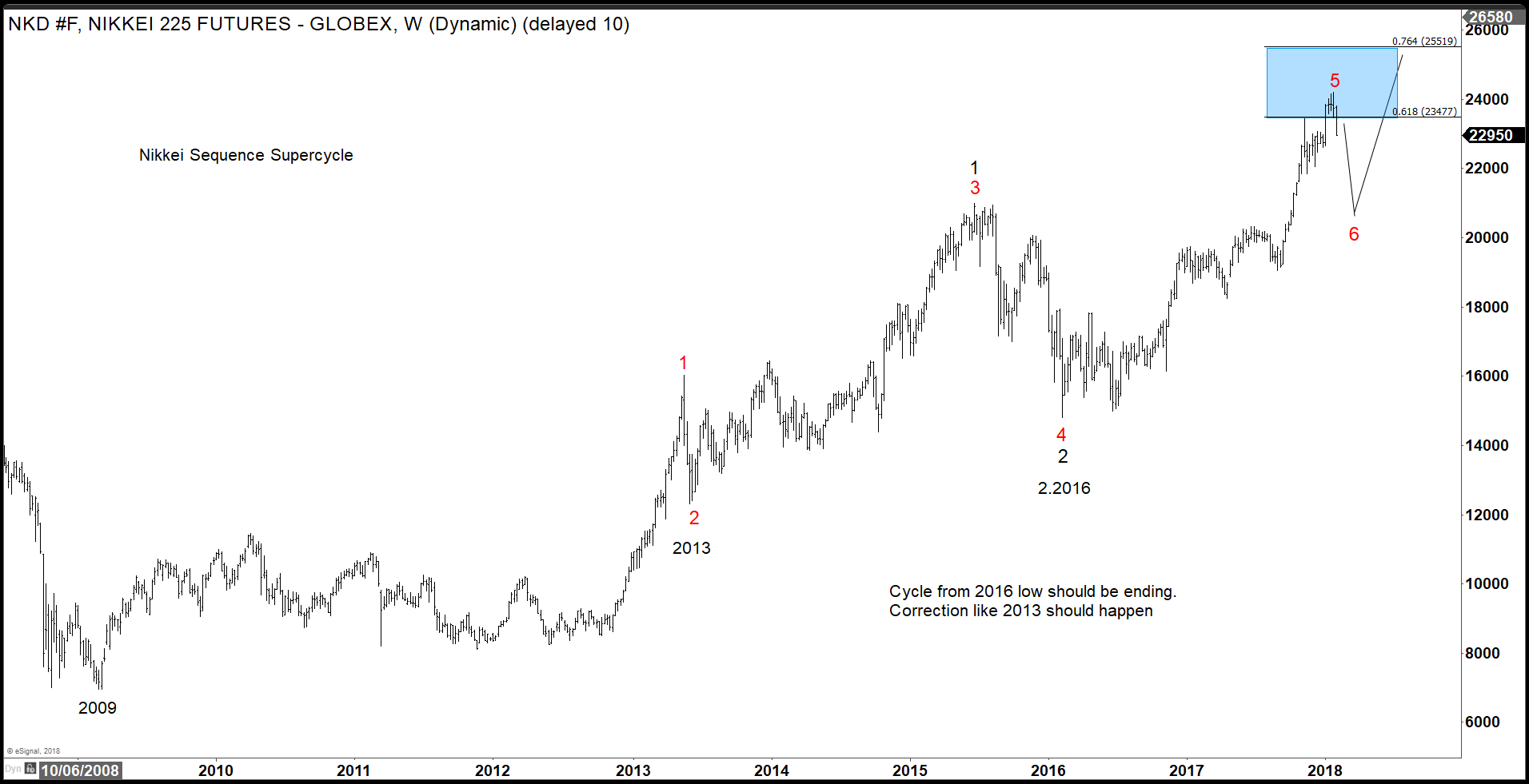

Why the NIKKEI Index still has more upside

Read MoreIn this blog, I want to discuss with you why NIKKEI Index has still more upside. In the chart below you can see our NIKKEI Indexweekly chart. You can see that the NIKKEI is in the area of 61.8-76.4% Extension from 2009 lows. Showing an incomplete bullish sequence against that low. We do understand that […]

-

CORN (ZC #F) Futures Impulsive Elliott Wave Rally

Read MoreHello fellow traders, another trade setup we have advised to members recently is Corn Futures.In this technical blog we’re going to take a quick look at the past Elliott Wave charts of ZC #F published in members area of www.elliottwave-forecast.com , explain the forecast and trading setup. As our members know, Corn have had incomplete bullish […]

-

Wells Fargo WFC Remains Bullish

Read MoreWells Fargo (NYSE: WFC) is the world’s second-largest bank by market capitalization and the third largest bank in the U.S. by assets. Last week, the Bank was fined $185M by the FED for ‘widespread illegal practices’ because of the recent fake accounts scandal and it was banned from growing until it convinces authorities it’s addressing shortcomings. It’s […]