The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

United States Steel Corporation $X Daily Elliott Wave View

Read MoreUnited States Steel Corporation (NYSE: X) is the second largest steel domestic producer behind Nucor Corporation (NYSE: NUE) and also the world’s 24th largest steel producer. Last year, Steel price surged higher reaching new all time high of 4772 in December gaining +60% before a correction took place. The price is expected keep rising in the coming years […]

-

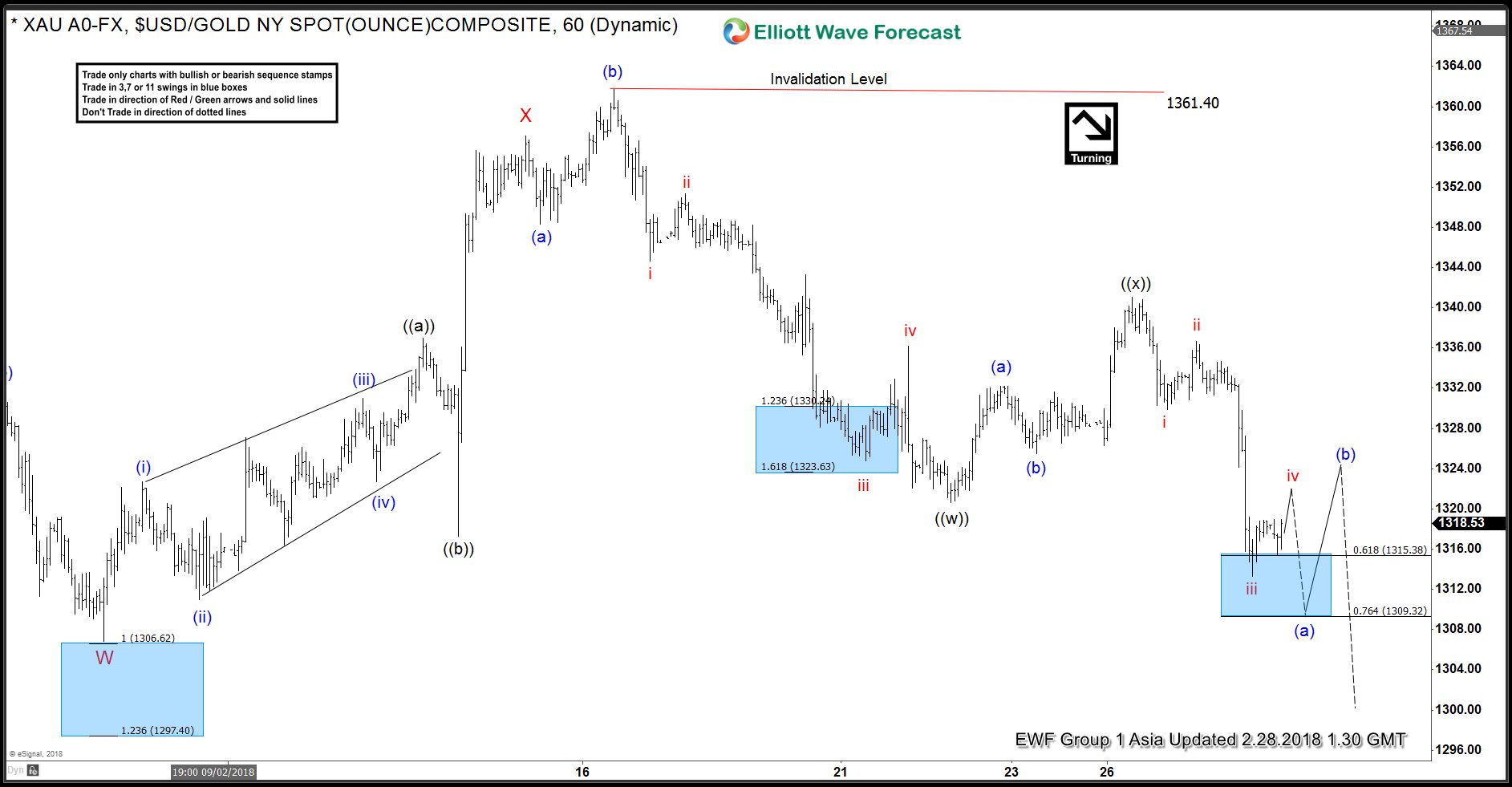

Elliott Wave Analysis: Gold in Double Correction

Read MoreRevised Short Term Elliott Wave view in Gold suggests that the yellow metal is still correcting cycle from 12/13/2017 low ($1236.3) as a double three Elliott Wave structure. Up from 12/13/2017 low, Intermediate wave (W) ended at $1366.06 and Intermediate wave (X) pullback remains in progress as a double three. Down from $1366.06, Wave W of […]

-

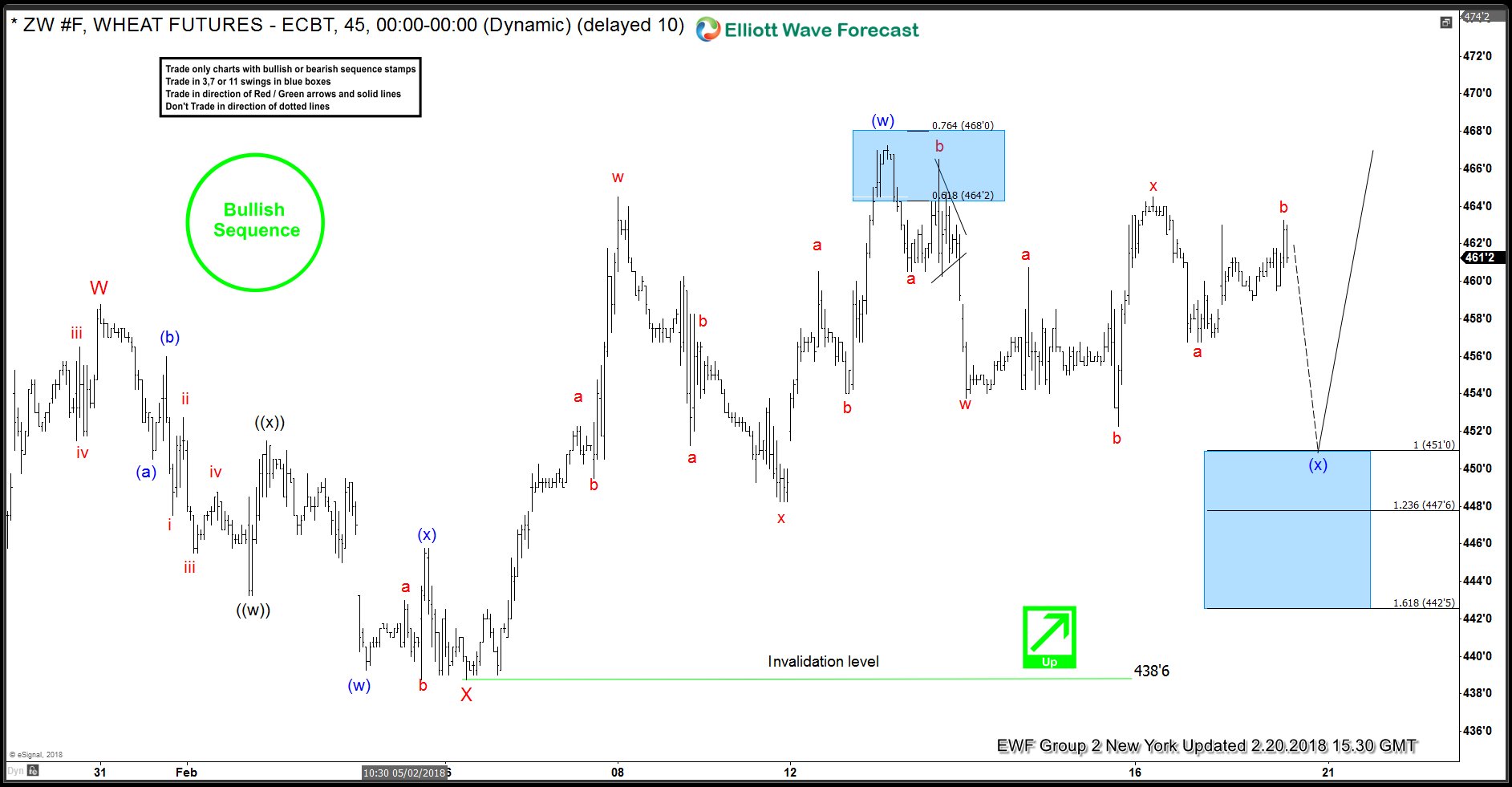

WHEAT (ZW #F) Forecasting Rally & Buying Dips

Read MoreHello fellow traders. Another trade setup we have advised to members recently is WHEAT (ZW #F). In this technical blog we’re going to take a quick look at the past Elliott Wave charts of ZW #F published in members area of www.elliottwave-forecast.com, explain the forecast and trading setup. As our members know, WHEAT have incomplete and […]

-

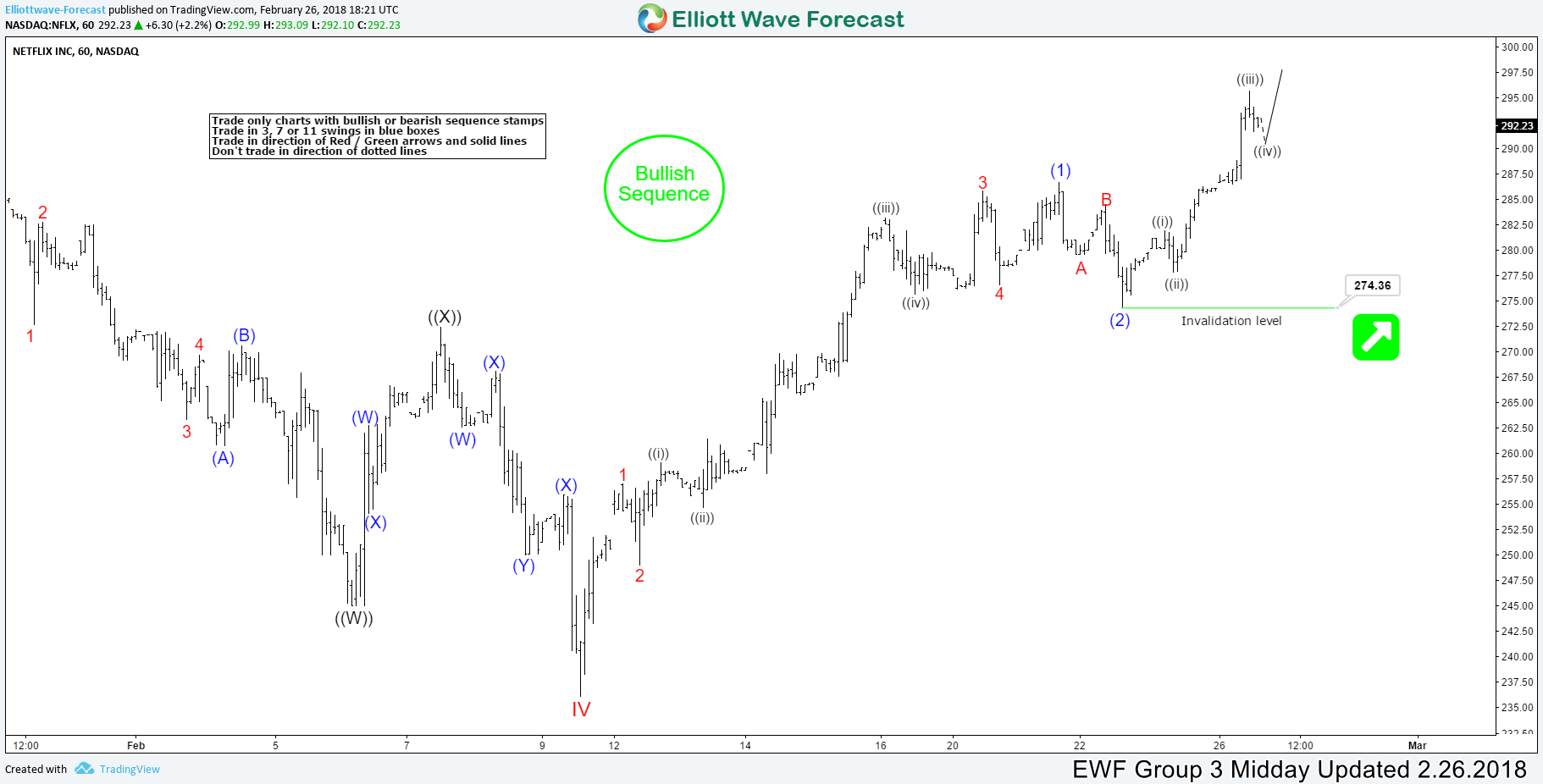

NFLX (Netflix) Elliott Wave: Showing incomplete Impulse sequence

Read MoreNetflix stock symbol: (NFLX ) Short Term Elliott Wave view suggests that the decline from January 29.2018 peak 286.70 to decline to 236.16 low on February 09.2018 low ended Cycle degree wave IV. Above from there, the rally has resumed higher by a break above 286.70 high in Cycle degree wave V looking for more upside extension. Also, it’s […]