The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

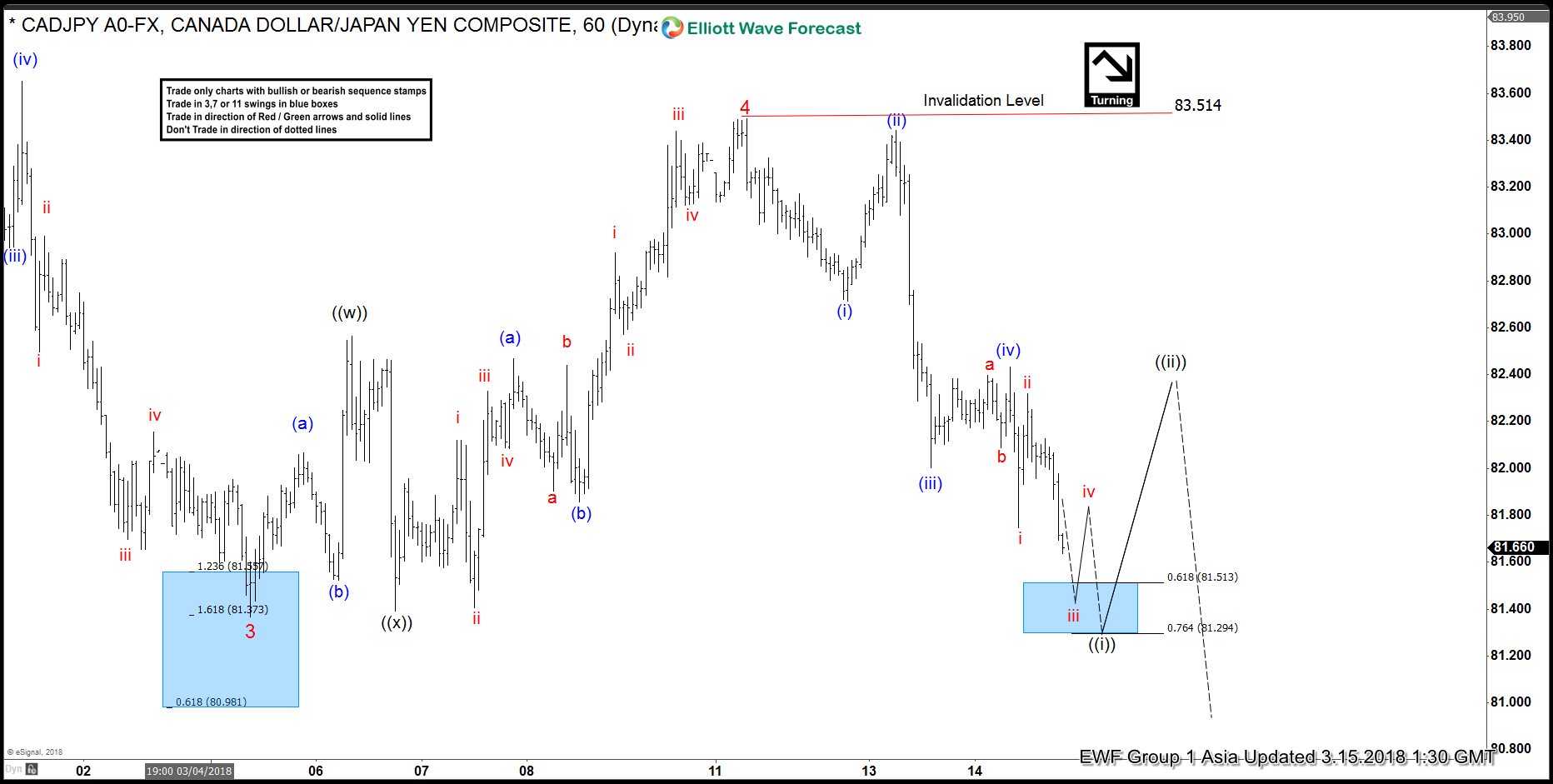

$CADJPY Elliott Wave Analysis: Further Downside to End Wave 5

Read More$CADJPY Elliott Wave view suggests that the decline from 1.5.2018 high (91.58) is unfolding as a 5 waves impulse Elliott Wave structure. Minor wave 3 of this impulsive move ended at 81.36 on 3.5.2018 and Minor wave 4 ended at 83.51 on 3.12.2018. While bounces stay below 83.51, pair now has scope to extend lower to […]

-

CADJPY Elliott Wave View: What Do We Make Of This Week’s Drop

Read MoreIn this blog, we will take a look at CADJPY Elliott Wave View in the short-term. Rally from 81.36 (3/5/2018) to 83.51 (3/11/2018) was a double zig-zag Elliott wave structure where wave ((w))was sub-divided as (a)-(b)-(c) and ended at 82.56, wave ((x)) ended at 81.39 and wave ((y)) was also sub-divided as (a)-(b)-(c) and completed […]

-

USDCAD Elliott Wave Analysis: Potential Upside to 1.324

Read MoreUSDCAD Short Term Elliott Wave view suggests the rally from 1/31 low (1.2247) remains in progress as a triple three Elliott Wave Structure. A triple three is labelled as WXYZ and each leg in this structure is corrective, so we have 3-3-3-3-3 structure. Up from 1.2247, Intermediate wave (W) ended at 1.2689, Intermediate wave (X) […]

-

Elliott Wave Analysis: Calling more Upside In JPM

Read MoreIn this blog, we will have a look at a past Elliott wave short-term structures of the JP Morgan Chase (JPM) Stock. In the chart below, you can see the 1-hour chart presented to members in our Live Session Webinar on the 03/02/18. We said to members that the JPM stock made a marginal new […]