The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave Analysis: Gold Short-term View

Read MoreGold short term Elliott Wave view suggests that the yellow metal is in a sideways move, typical characteristic of a triangle Elliott Wave structure. A triangle is a sideways range structure with ABCDE label. In the case of Gold, decline from 1/25/2018 peak ($1366.06) ended in Minor wave A at $1302.6. Minor wave B bounce […]

-

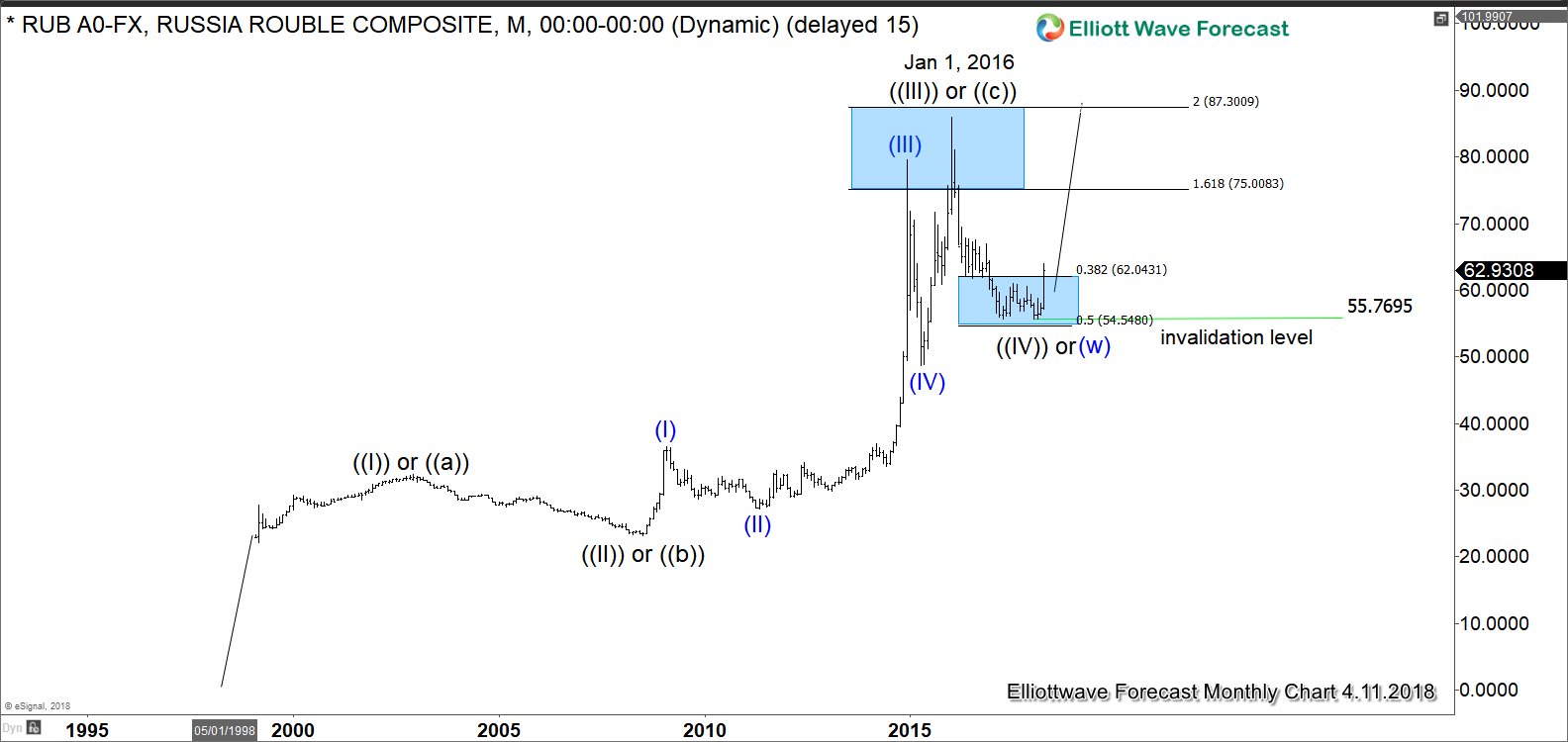

Ruble Falls Following US Sanctions Against Russia

Read MoreNew U.S. Sanctions Hurt Russia’s Ruble and Benchmark Index Last Friday, as part of the U.S. effort to punish Moscow for “malign activity around the globe”, the U.S Treasury Department targeted numerous Russian oligarchs, officials, and companies by freezing their assets under U.S. jurisdiction. In addition, the U.S. also prohibits U.S. citizens or entities from […]

-

Gold Elliott Wave View: Bullish Triangle Consolidation

Read MoreGold has been trading in a sideways range between $1366 and $1302 for nearly 3 months now and has not yet managed to break the consolidation on either side. This consolidation is increasingly looking like a Bullish Triangle Consolidation and once completed, should result in a thrust out of the triangle. We will also present […]

-

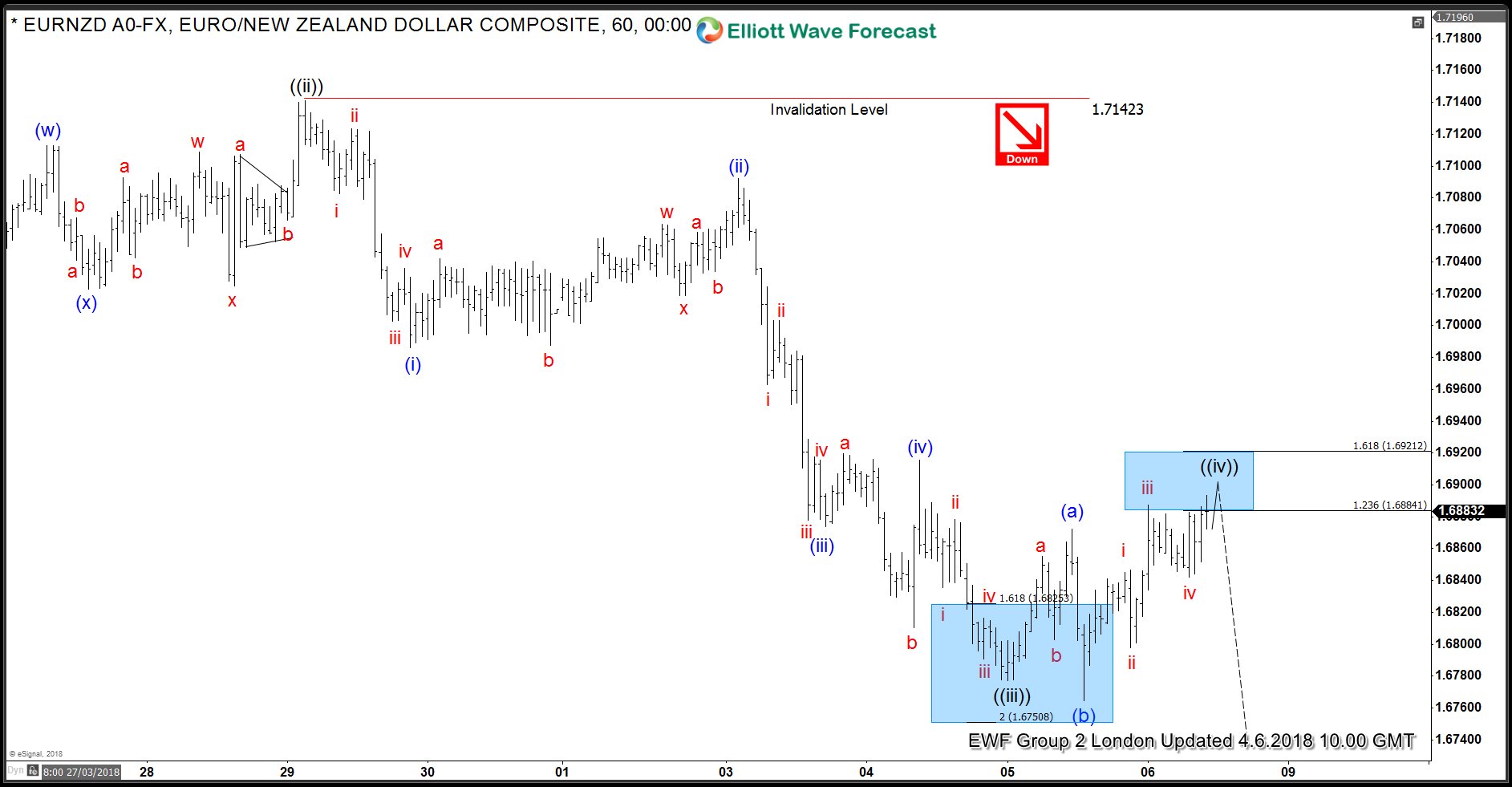

EURNZD Forecasting The Decline after Elliott Wave Flat

Read MoreHello Fellow Traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURNZD published in members area of the website. We’re going to explain the forecast and Elliott Wave Pattern. Before we take a look at the real market expample of Expanded Flat, let’s explain it in […]