The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

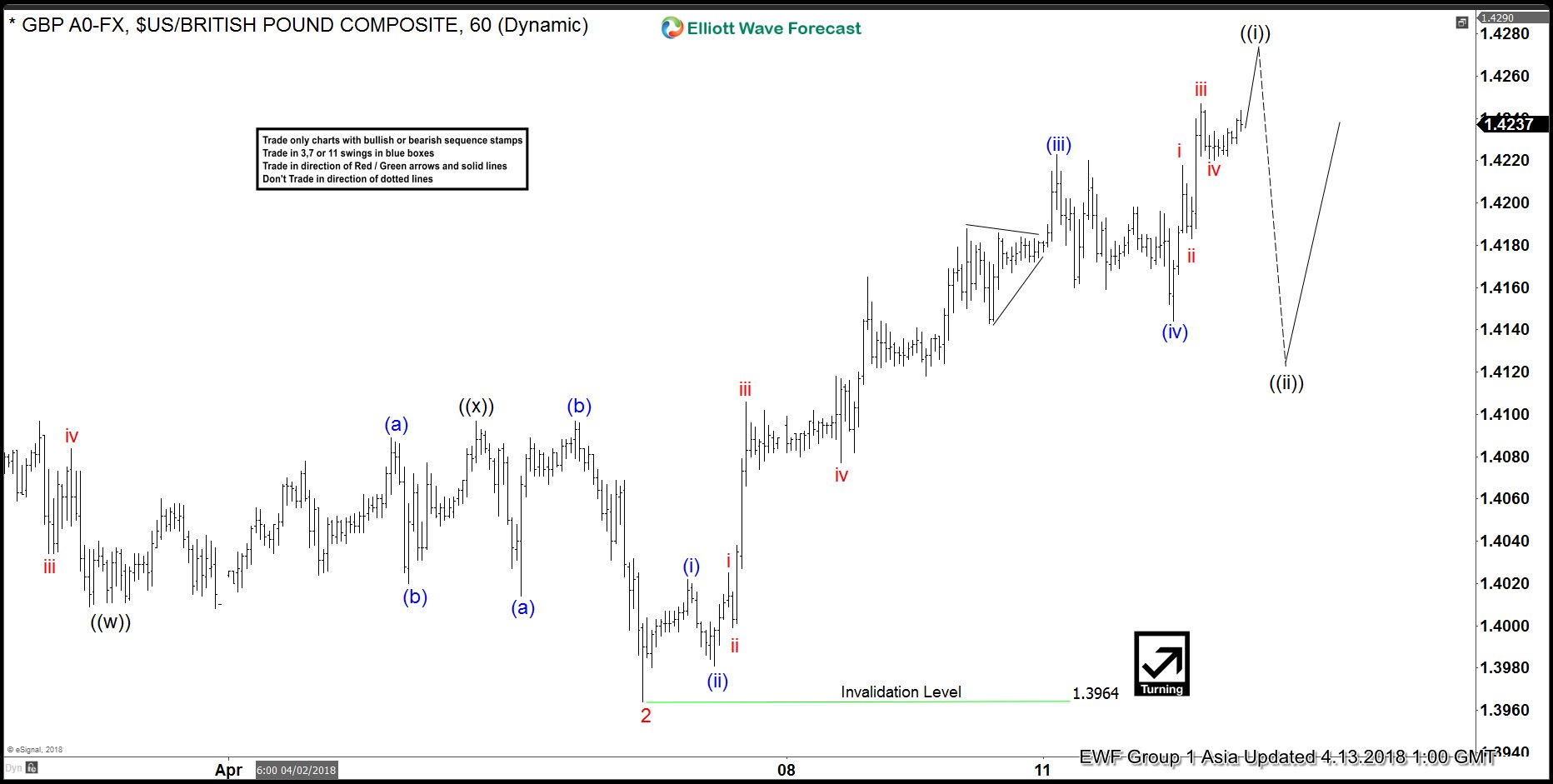

Elliott Wave Analysis: GBPUSD Strength Expected

Read MoreGBPUSD Short Term Elliott Wave view suggests that the rally from 3.1.2018 low (1.371) is unfolding as a 5 waves impulse Elliott Wave Structure. Up from 3.1.2018 low, Minor wave 1 ended at 1.4245 and Minor wave 2 ended at 1.3964. Pair has since broken above Minor wave 1 at 1.4245, suggesting that the sequence from […]

-

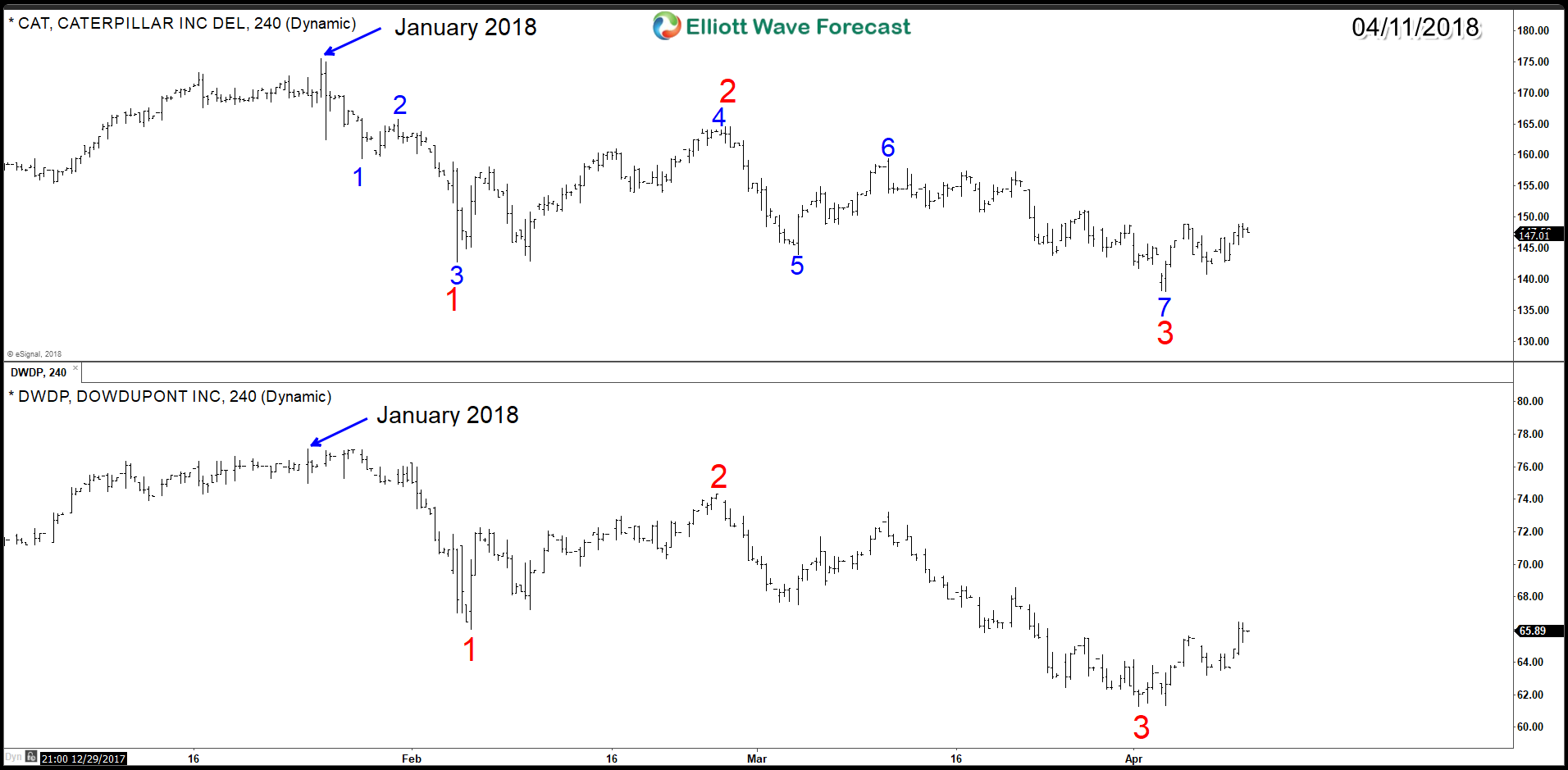

Stocks Short Term Elliott Wave Bounce is Purely Technical

Read MoreStocks and ETFs follow the same code in the market same as the rest of financial instruments like Forex. Every 5 waves impulsive structure is followed by a technical corrective sequences which come in 3-7-11. At the end of the corrective sequence, usually the instrument will resume the move within the main trend or at least correct […]

-

Elliott Wave Analysis: USDCAD Moving in Impulsive Structure

Read MoreUSDCAD Elliott Wave view suggests that the decline from 3/19 high (1.313) is unfolding as a 5 waves impulse Elliott Wave structure. Minor wave 1 ended at 1.2819, Minor wave 2 ended at 1.2943, and Minor wave 3 is in progress. Internal of Minor wave 3 also unfolded as an Elliott Wave impulse structure in […]

-

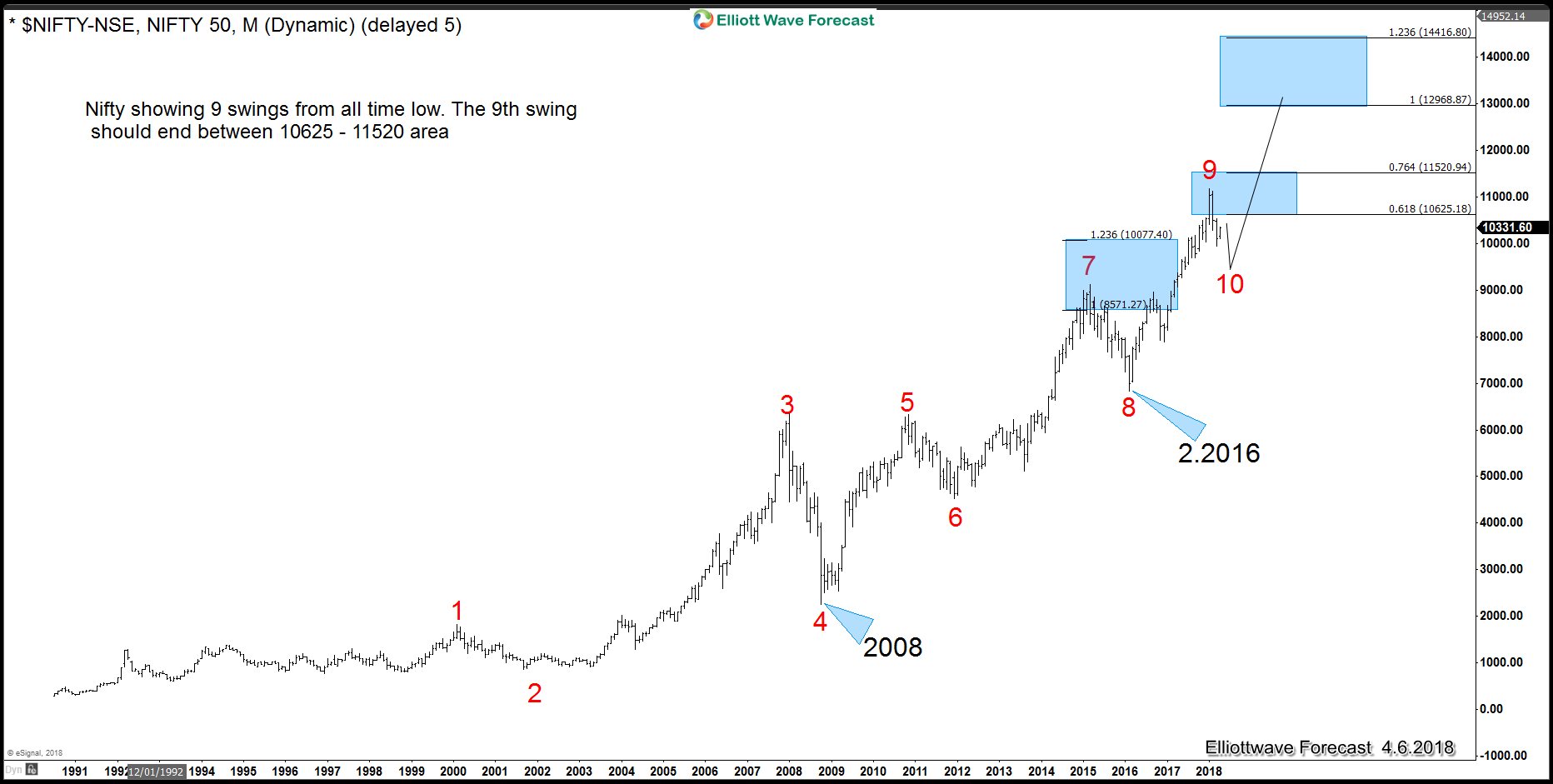

Nifty 50 Index Bullish Sequence to the All Time Highs

Read MoreThe Nifty 50 Index has a bullish sequence from the lows to the all time highs. The index currently shows nine swings up from the all time lows into the 2018 highs. It is now correcting the cycle higher from the February 2016 lows. This is noted on the chart with the red 8 label. In […]