The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Straits Times Index STI Supporting Stock Market Bulls

Read MoreStraits Times Index (STI) is regarded as the benchmark index for the Singapore stock market. It tracks the performance of the top 30 companies listed on the Singapore Exchange. It is jointly calculated by Singapore Exchange (SGX), Singapore Press Holdings (SPH) and FTSE Group (FTSE). Applying the One Market concept , we know that major world […]

-

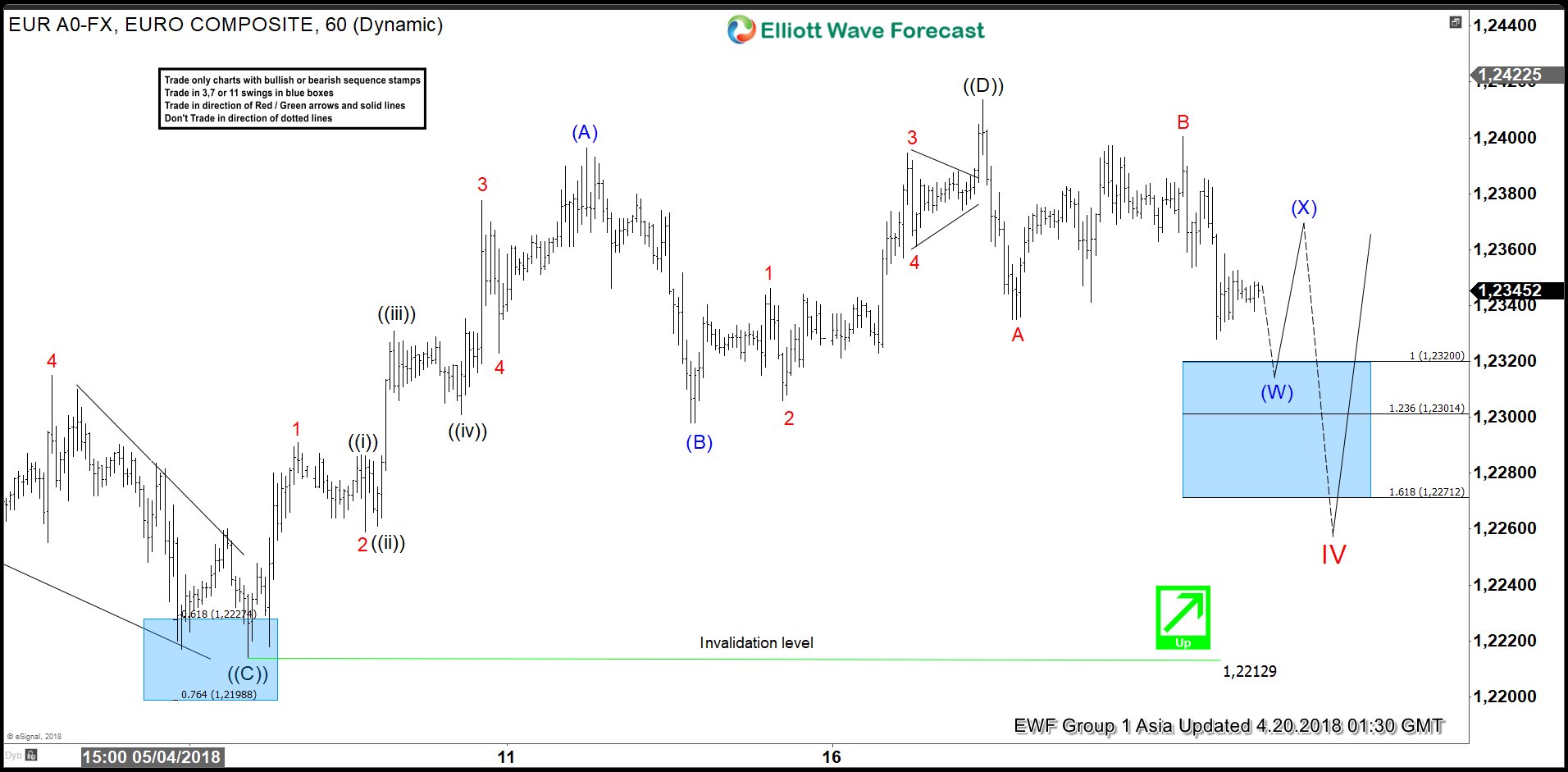

EURUSD Elliott Wave View: Still Trading Sideways

Read MoreShort-term EURUSD Elliott Wave view suggests that the pair remains in a sideways triangle range between 1.2554 and 1.2153 levels as mentioned in the previous post here. Until we break out of the range, we look for the sideways price action to continue. Triangle doesn’t have any particular trend, but it is generally a continuation […]

-

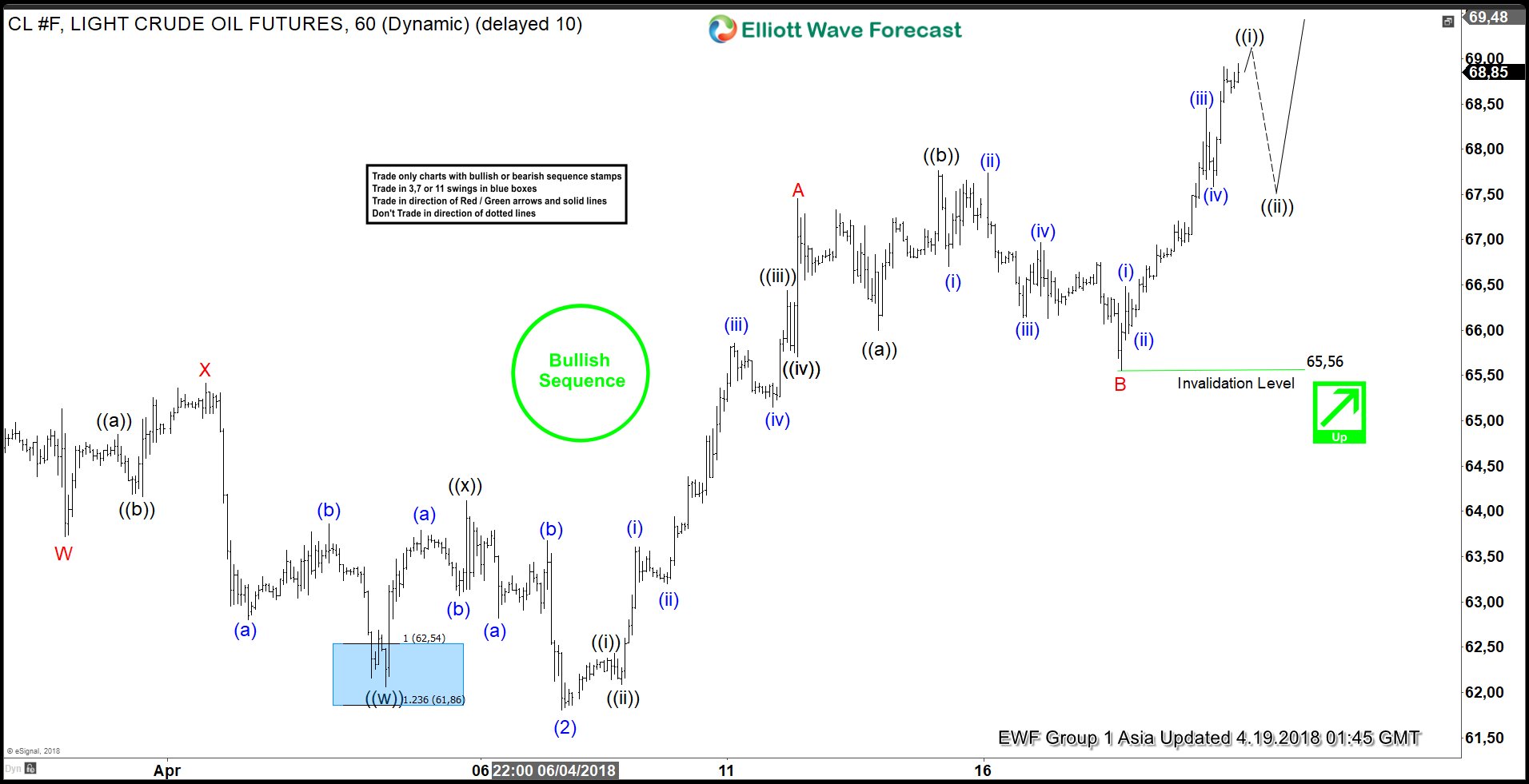

CL_F Elliott Wave View: Calling More Strength

Read MoreCL_F Elliott Wave short-term view suggests that the decline to 61.80 on 4/06/2018 low ended Intermediate wave (2). Above from there, Intermediate wave (3) remains in progress as Zigzag Elliott Wave structure. Looking to extend higher towards 70.43-72.47 area at a minimum. Up from 61.80 low, the instrument made a strong rally higher. And ended […]

-

Soybeans (ZS_F) Forecasting The Elliott Wave Pullback

Read MoreIn this technical blog, we are going to take a quick look at the past performance of Soybeans (ZS_F) Charts presented in members area. Last month instrument made a strong reaction lower from March 02. 2018 peak (1083.2) and ended the cycle from June 2017 low cycle. Thus suggested that we should be correcting that cycle […]