The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave Analysis: Amazon Showing Impulse Rally

Read MoreAmazon ticker symbol: $AMZN short-term Elliott wave analysis suggests that the cycle from 6/25/2018 low ($1646.31) is rallying higher in an impulse structure. This suggests that the internal sub-division of each leg higher is unfolding as 5 waves structure of lesser degree i.e Minute wave ((i)), ((iii)) & ((v)), whereas Minute wave ((ii)) & ((iv)) […]

-

EURJPY Forecasting the Path & Buying the Dips

Read MoreHello Fellow Traders. Another instruments we have traded lately is EURJPY. As our members know, EURJPY has been correcting the cycle from the June 2016 low ( 109.187). We knew that price will find buyers as soon as it reaches extremes per Elliott Wave hedging strategy. We recommended members to wait for extremes to be […]

-

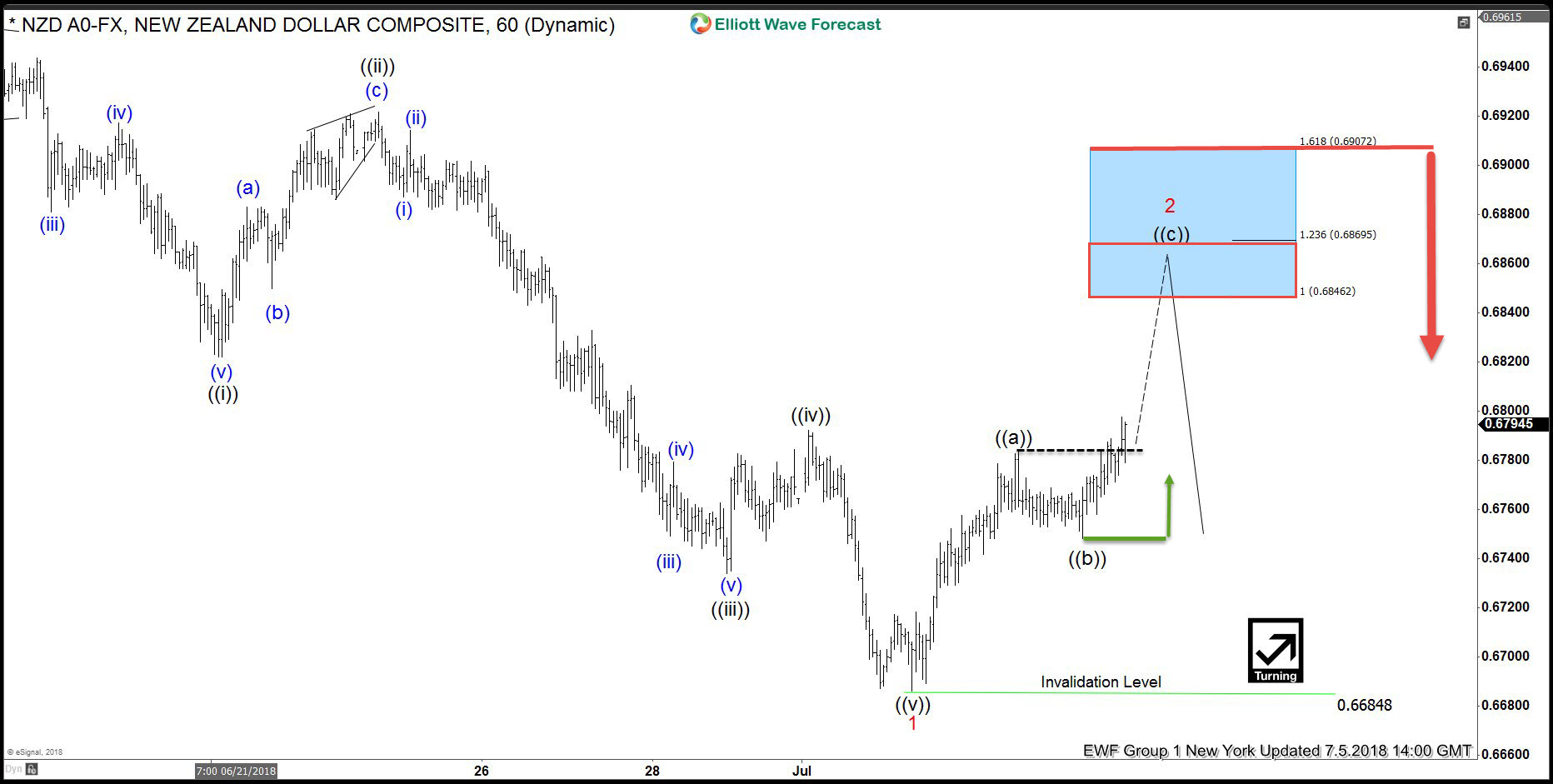

NZDUSD forecasting the path & selling the rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of NZDUSD . In further text we’re going to explain the Elliott Wave structure, forecast and trading strategy. As our members know, we were keep saying that NZDUSD has had incomplete bearish sequences in cycle from the July […]

-

Facebook Elliott Wave Analysis: Correction Taking Place

Read MoreFacebook ticker symbol: $FB short-term Elliott Wave analysis suggests that the decline to $192.22 low ended cycle degree wave II as double three structure. Up from there, the stock is rallying higher and making new all-time highs within cycle degree wave III. Up from $192.22 low, the rally to $208.2 high ended primary wave ((1)). […]