The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Trading Elliott Wave Charts with the Right Side Tag and Blue Boxes

Read MoreSimplifying Elliott Wave Analysis for Traders One of our goals at Elliottwave-Forecast is to figure out the best way to present Elliott Wave charts in such a way that non-technical traders can easily understand our view and know what they need to do. To this end, we implement the Right Side Tag and Blue Boxes […]

-

OIL Elliott Wave Analysis: Extending to the Downside

Read MoreOil ticker symbol: CL_F short-term Elliott wave analysis suggests that the bounce to $70.44 high ended intermediate wave (2). The internals of that bounce took place as Elliott wave double correction where Minor wave W ended in 3 swings at $69.92. From there, the pullback to $68.26 completed the Minor wave X in 3 swings. […]

-

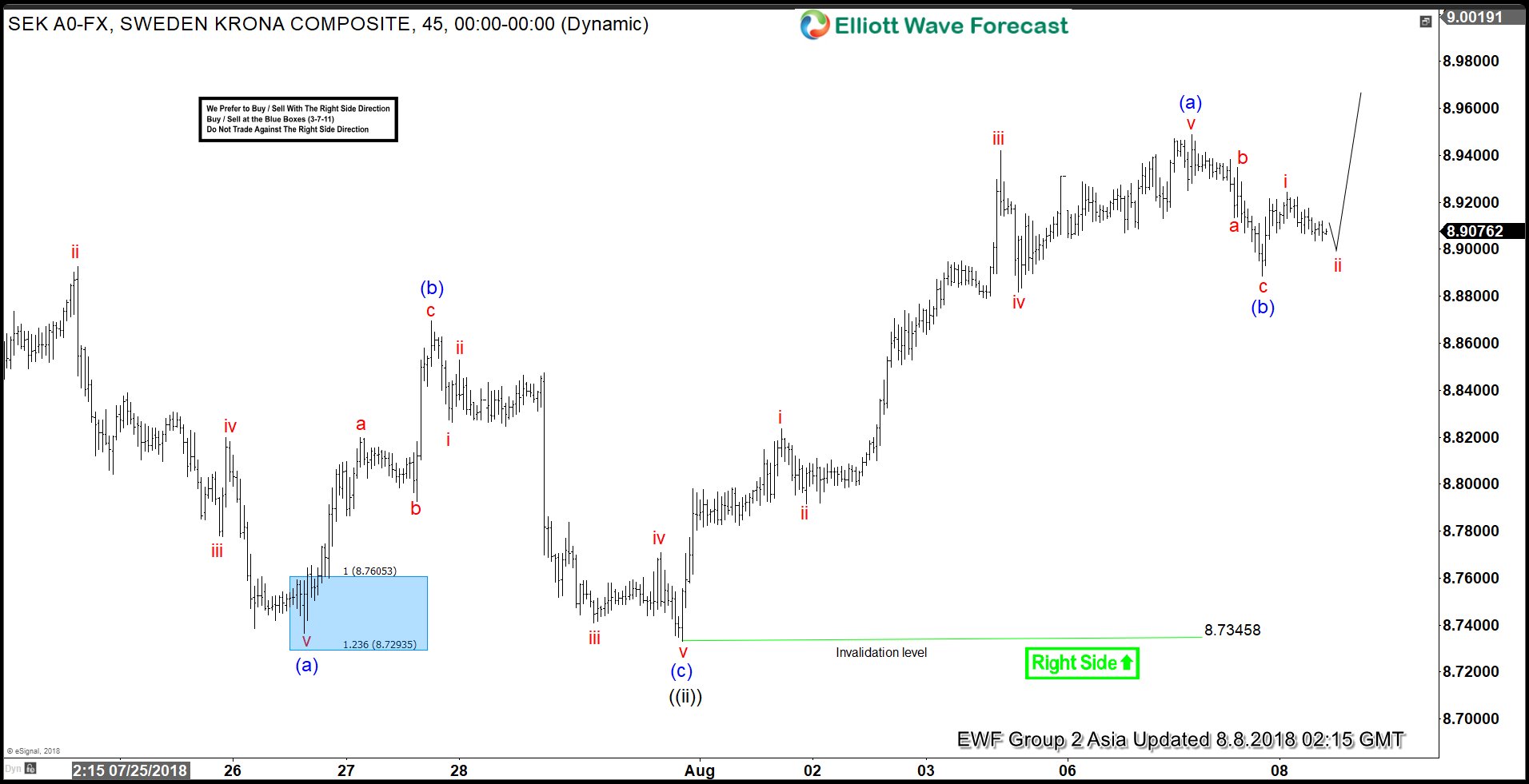

USDSEK Elliott Wave View: Starting C Leg Higher?

Read MoreUSDSEK short-term Elliott Wave view suggests that the decline to 8.7345 low ended Minute wave ((ii)) pullback. The internals of that pullback unfolded as Elliott wave Zigzag correction where Minutte wave (a) ended in 5 waves structure at 8.7377 low. Then the bounce to 8.8687 high ended Minutte wave (b) bounce in swings. The decline […]

-

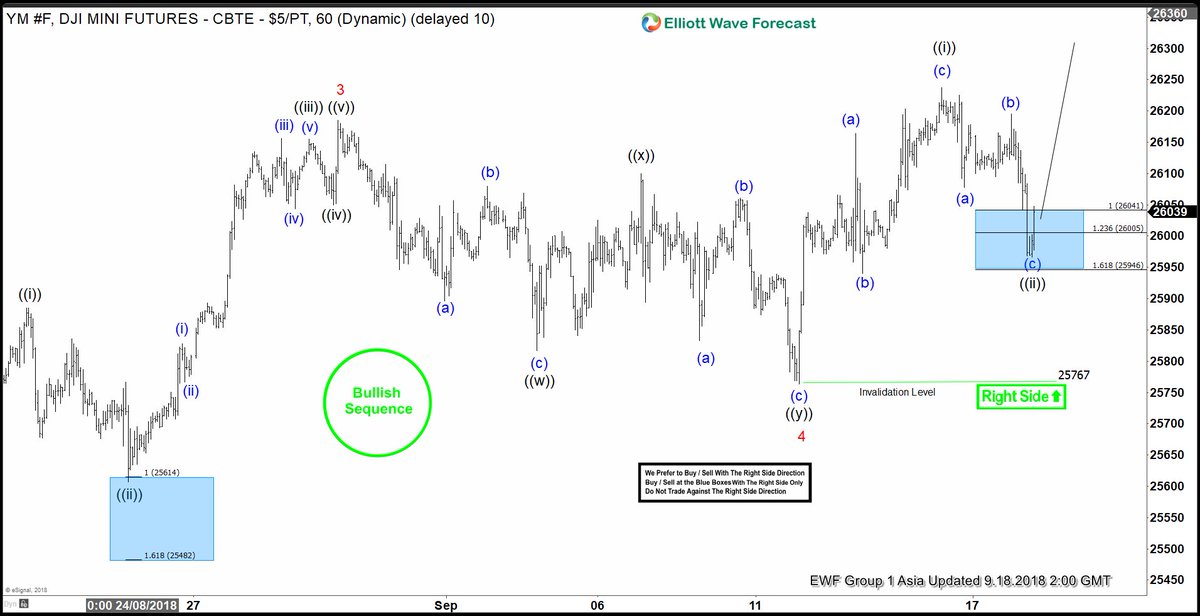

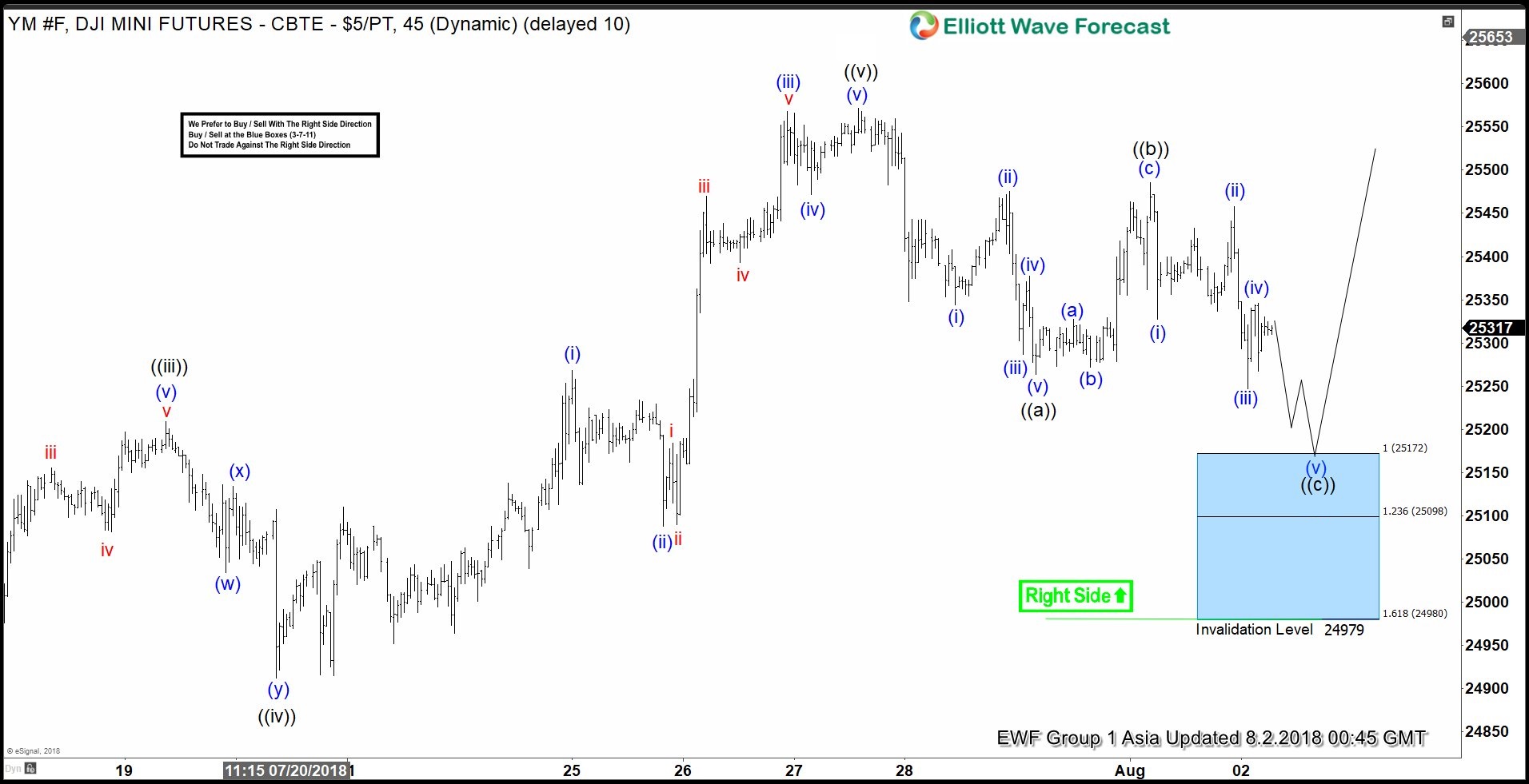

Dow Jones Elliott Wave Analysis: Inflection Area Called The Bounce

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of the Dow Jones Industrial which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 08/02/18 indicating that Dow Jones ended the cycle from 07/27 low in red wave 1. As Dow Jones ended the […]