The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

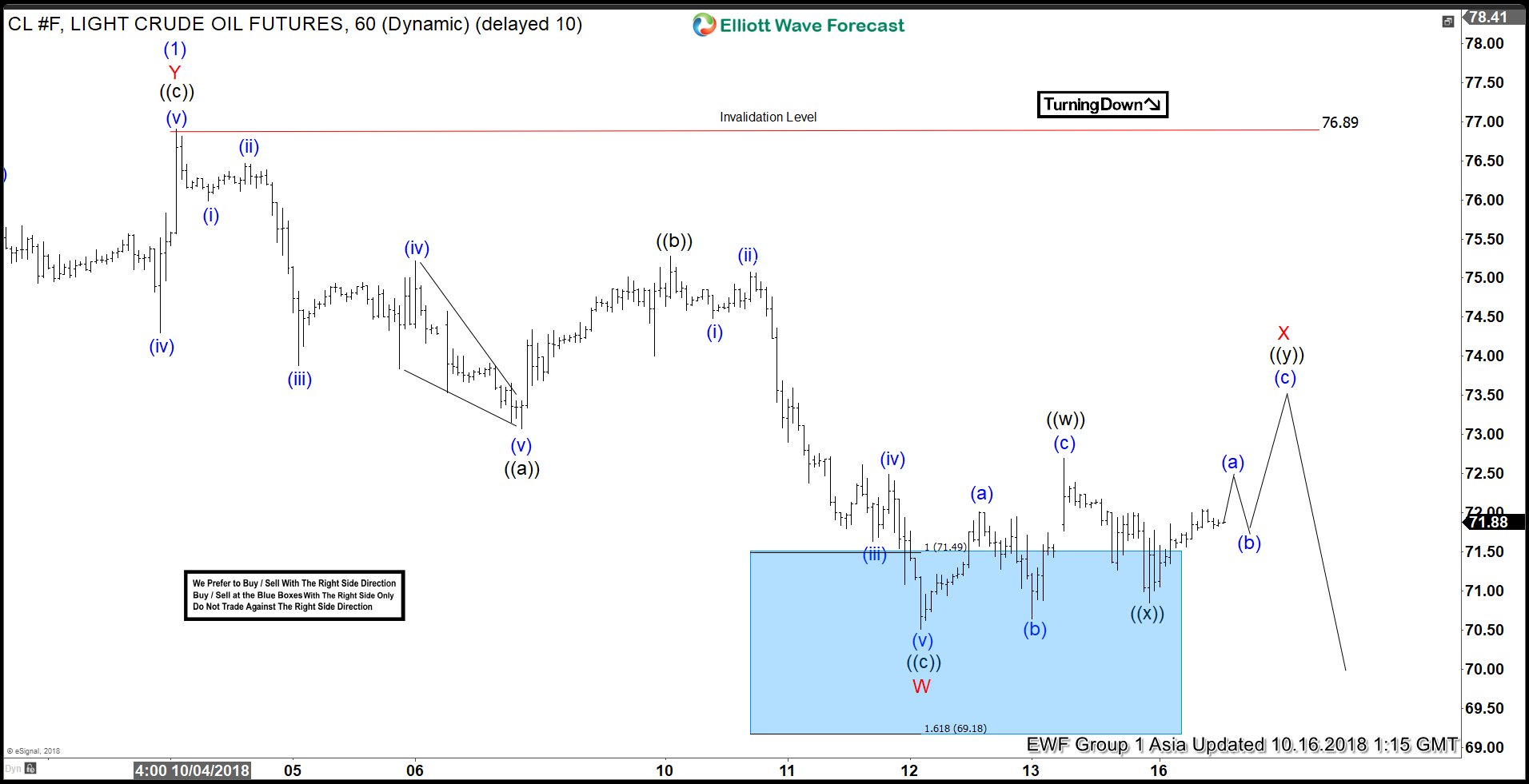

Another Leg Lower Can Enter OIL Into Buying Area?

Read MoreOIL ticker symbol $CL_F short-term Elliott wave view suggests that a rally to 76.89 high ended the cycle from 8/15/2018 low in intermediate wave (1). The internals of that rally higher unfolded in a corrective structure thus suggests the instrument can be doing ending diagonal structure in primary wave ((5)) higher. Down from there, intermediate […]

-

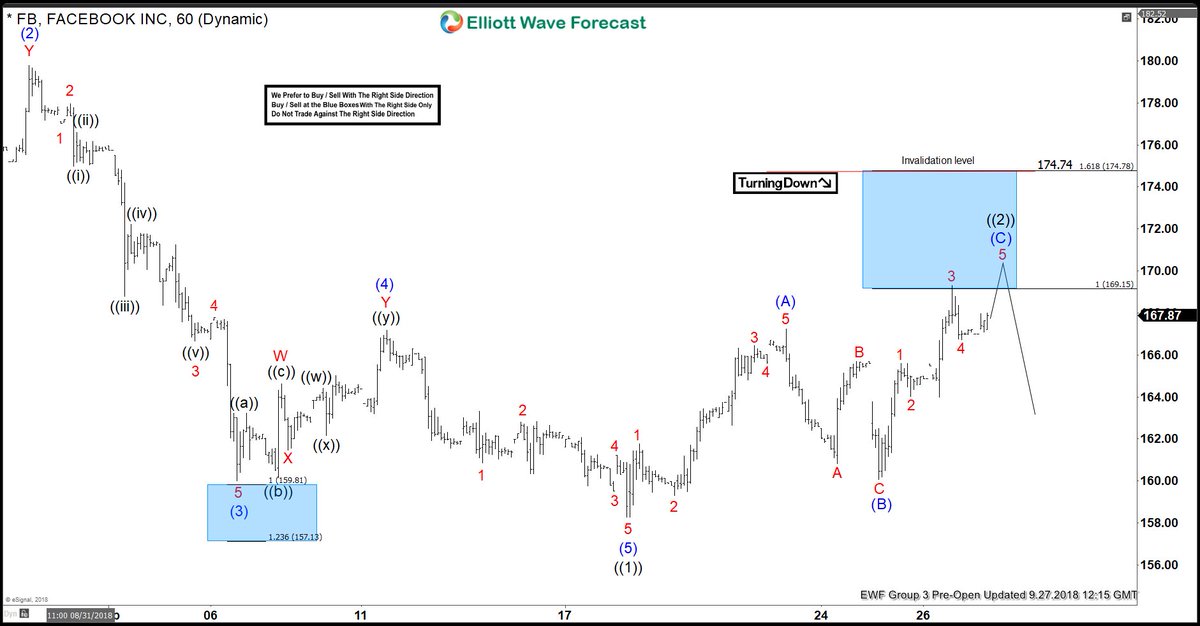

Facebook Elliott Wave View: Found Sellers in Blue Box Area

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of the Facebook stock which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 09/27/18 indicating that FB ended the cycle from 8/07/2018 peak low in black wave ((1)). The internals of that move […]

-

SPX Another Selling Can Enter Index Into Buying Area?

Read MoreSPX short-term Elliott wave view suggests that a rally to $2941.42 high ended primary wave ((2)) bounce. Down from there, primary wave ((C)) remain in progress as impulse structure. Where initial decline to $2912.63 low ended Minute wave ((i)). A bounce to $2939.86 high ended Minute wave ((ii)). A decline to $2883.92 low ended Minute […]

-

DAX Bearish Sequence Calling For More Downside

Read MoreDAX short-term Elliott wave view suggests that the decline to 11865.47 low ended intermediate wave (W). Up from there, the bounce to 12460.67 high ended intermediate wave (X). The internals of that bounce unfolded as a zigzag structure where Minor wave A ended at 12184.41 high in lesser degree 5 waves. A pullback to 12064.41 […]