The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

AAPL Elliott Wave View: Ready For Next Leg Lower

Read MoreAAPL short-term Elliott wave view suggests that a rally to $233.53 high ended supercycle degree wave (III) as an impulse. Down from there, supercycle degree wave (IV) remains in progress as double three structure. Where the initial decline to $212 low ended cycle degree wave w. The internals of that leg lower unfolded as a Zigzag […]

-

IBEX Elliott Wave Calling Rally To Fail For Further Downside

Read MoreIBEX short-term Elliott wave view suggests that a rally to 9668.31 high ended intermediate wave (X) bounce. Down from there, the index made a declined in 5 waves impulse structure. And ended Minor wave A of a zigzag structure at 8850.20 low. Where the lesser degree Minute wave ((i)) ended at 9471.20 low. Up from […]

-

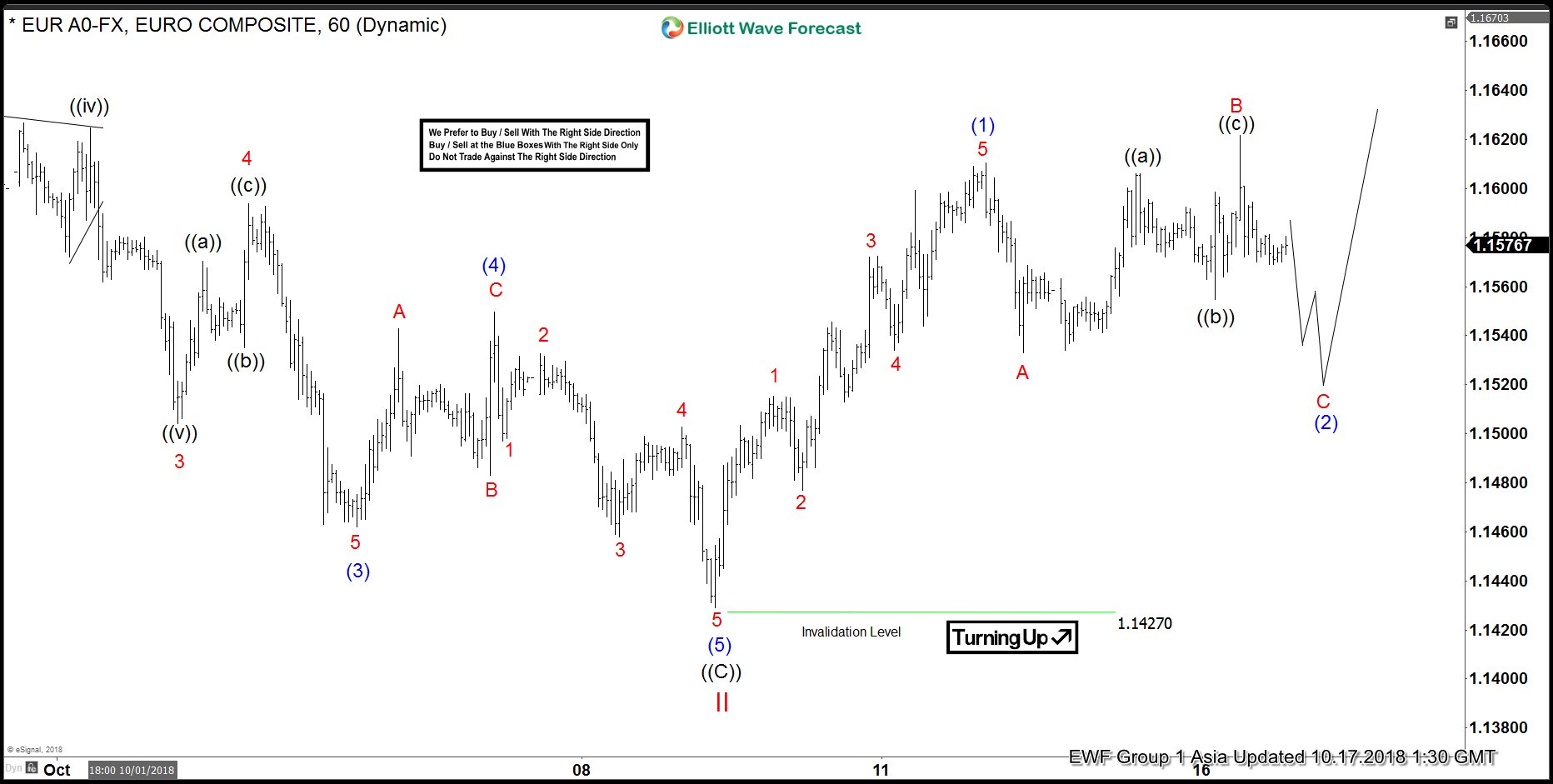

EURUSD Elliott Wave: Ready For Next Leg Higher

Read MoreEURUSD short-term Elliott wave view suggests that the decline to 1.1427 low ended cycle degree wave II pullback. The internals of that pullback unfolded as a Flat structure which ended the correction against 8/15/2018 low. Up from 1.1427 low, the pair is expected to resume the next leg higher in cycle degree wave III. The […]

-

AUDUSD: Bearish Sequence Called The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDUSD published in members area of the website. As our members know, AUDUSD has incomplete bearish sequences in the cycle from the January 2018 peak. Price structure suggests that the pair is targeting 0.6938 area as […]