The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Being Down $45 Billion in AMZN Stock No Big Deal

Read More“What goes up must come down.” – Sir Isaac Newton It was widely reported this week that Amazon (AMZN) founder, Jeff Bezos, lost roughly $45 Billion dollars in net worth during the October stock market selloff as shares of AMZN cratered from all-time highs set on 9/4/2018 at $2,050.50/share to the most recent low of […]

-

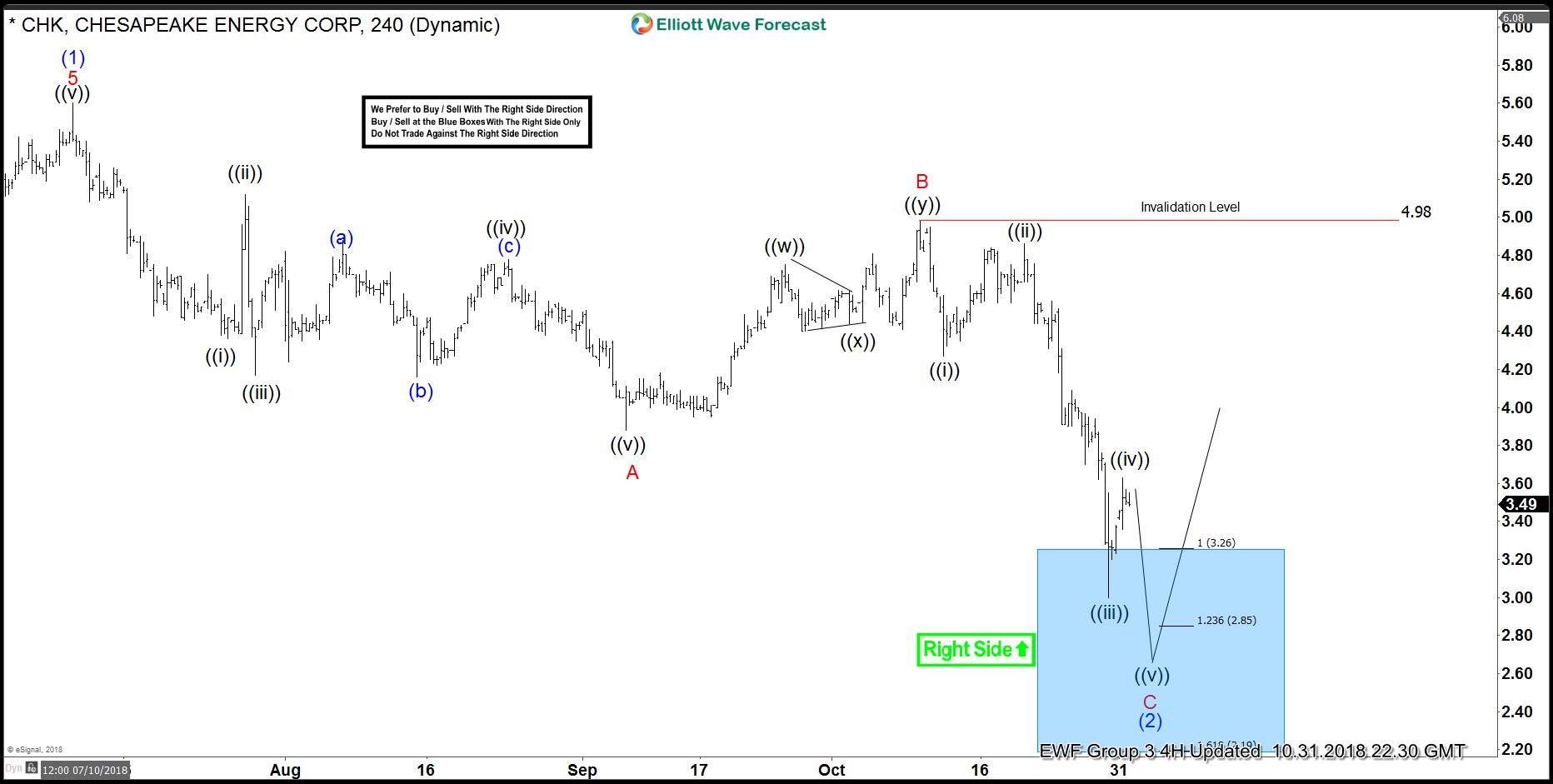

Why We Are Buying CHK Again

Read MoreAfter just getting stopped out in CHK for no loss, why are we buying again? I am of the firm belief that if you only traded based on the media drive-by observations of any particular stock you would be hard pressed to know what to do most of the time. For example, how many times […]

-

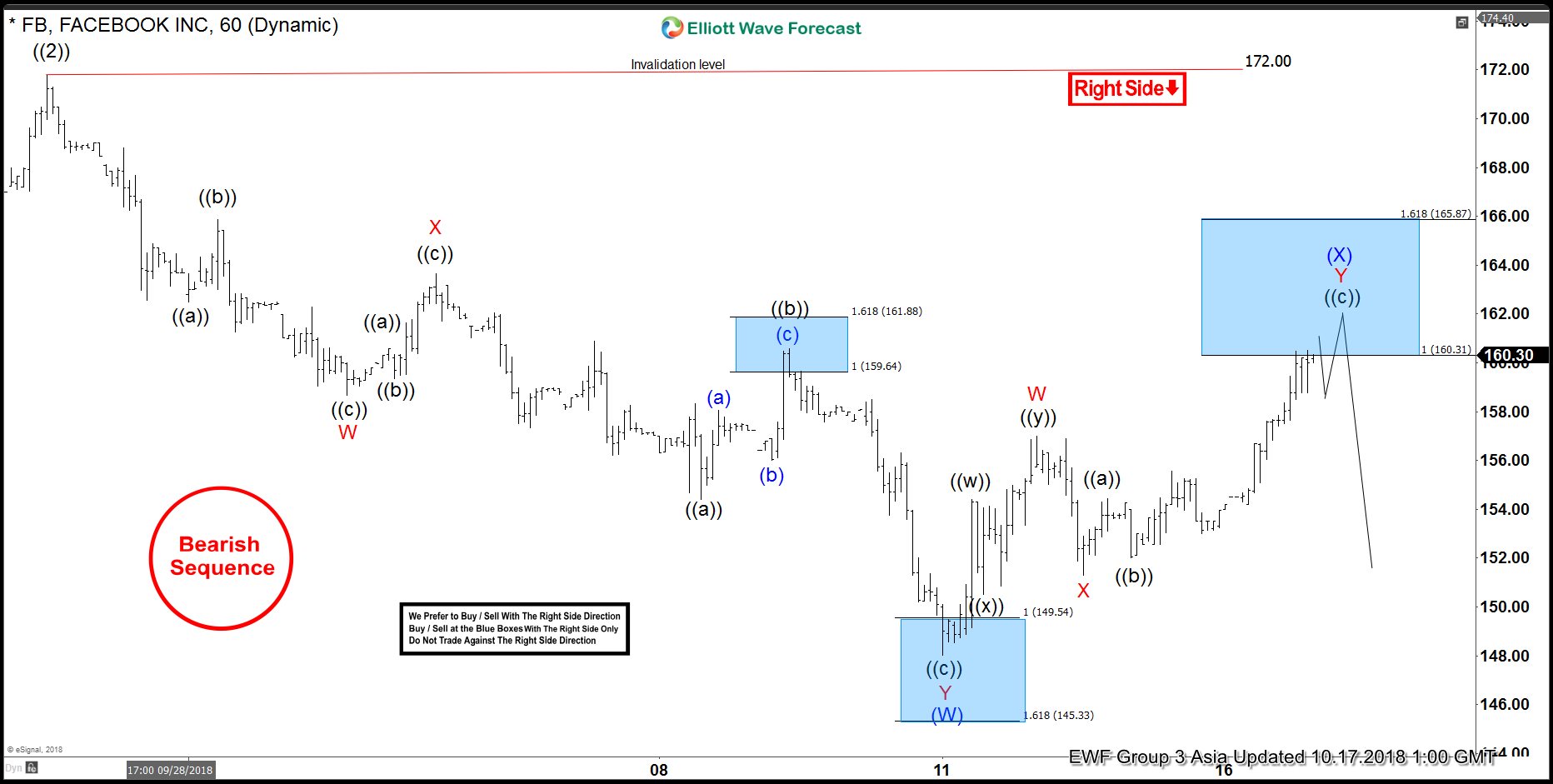

Facebook Forecasting The Decline & Selling The Rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of Facebook. As our members know, early in October, Facebook has incomplete sequences in the cycle from the July 2018 peak. The Stock was still missing another swing down to complete proposed pattern. Consequently , we expected Facebook […]

-

Dow Jones Elliott Wave View: Correction Completed

Read MoreDow futures ticker symbol: YM short-term Elliott wave view suggests that a bounce to 25845 high ended cycle degree wave “b”. Down from there, cycle degree wave “c” unfolded as ending diagonal structure i.e lesser degree cycles within primary wave ((1)), ((3)) & ((5)) also unfolded in 3 swings structure. Where primary wave ((1)) ended […]