The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

OIL Elliott Wave Analysis: Calling For More Weakness

Read MoreOIL Elliott wave analysis suggests that a decline from October 3, 2018 peak ($76.9) is unfolding as impulse Elliott wave structure. Down from $76.9 peak, the primary wave ((1)) ended at $68.47 low. A primary wave ((2)) bounce ended at $69.65 high. Then a decline to $54.75 low ended primary wave ((3)). Primary wave ((4)) […]

-

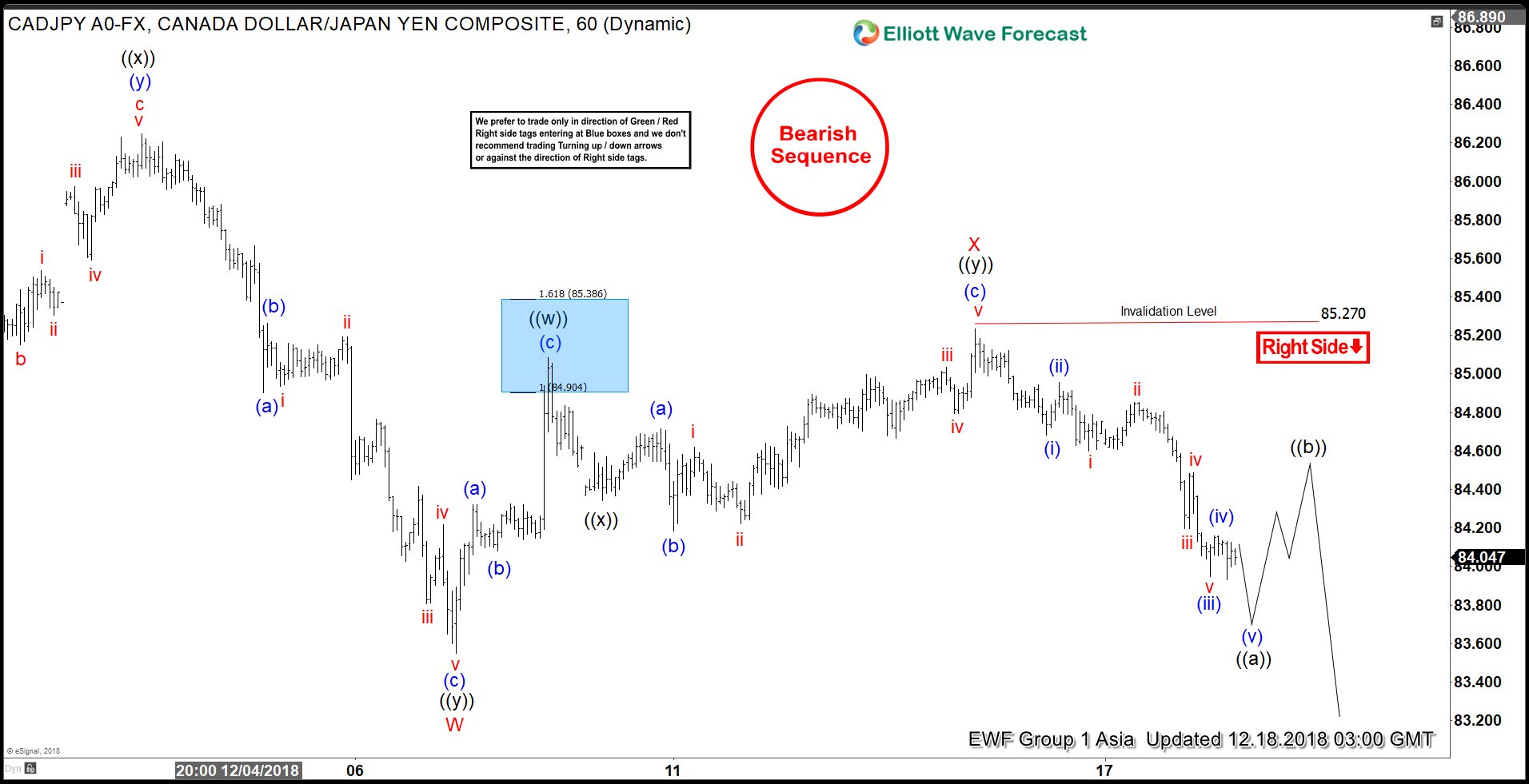

Elliott Wave View: CADJPY Selloff To Resume

Read MoreShort Term Elliott Wave view suggests that cycle from 11.8.2018 high (87) ended at 83.55 in Minor wave W and bounce to 85.27 ended Minor wave X. Pair has resumed lower in Minor wave Y, but it needs to break below Minor wave W at 83.55 for confirmation and to avoid double correction in Minor wave […]

-

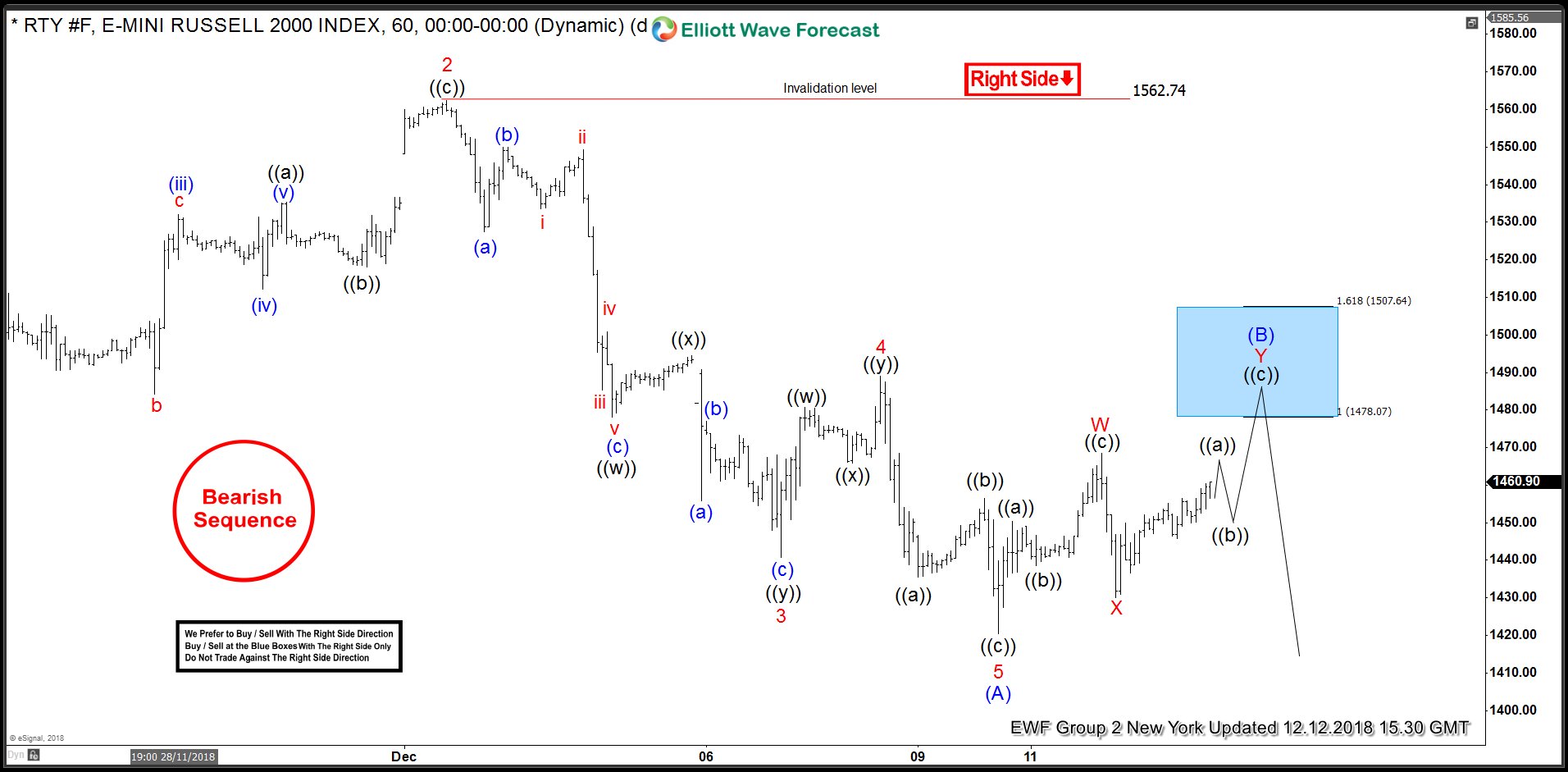

RUSSELL Incomplete Bearish Sequences Calling The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of RUSSELL published in members area of the website. As our members know, RUSSELL has incomplete sequences in the cycle from the August 31th 2018 peak. Break of October 24th low, has made 31th August cycle incomplete to […]

-

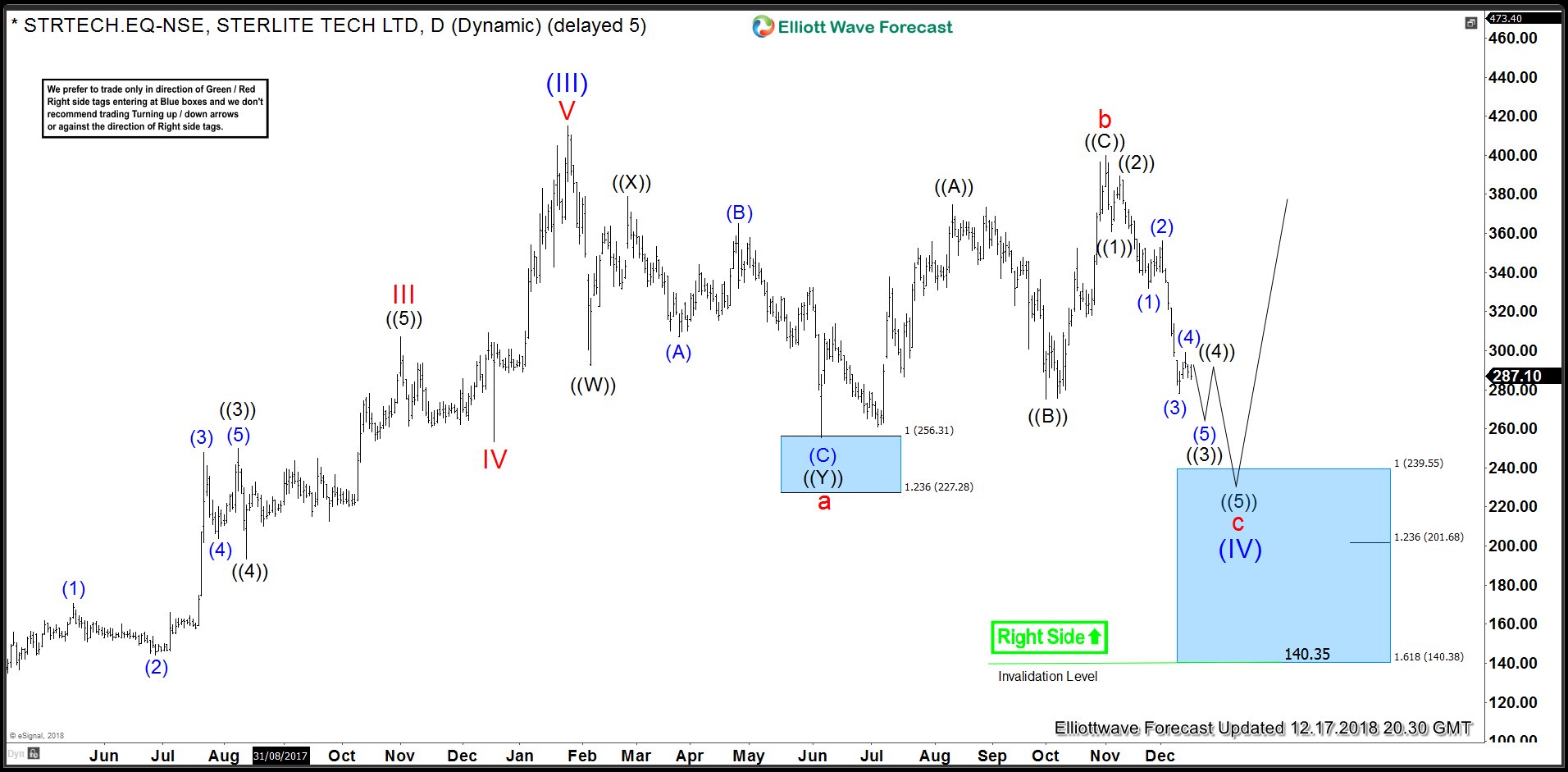

STRTECH (Sterlite Technologies): Elliott Wave FLAT Structure

Read MoreSterlite Technologies Ltd. (STRTECH) Sterlite Technologies Limited designs, builds and manages “smarter networks” Sterlite Tech develops & delivers optical communication products, network & system integration services and software solutions for telecoms globally. The company is listed on the Bombay Stock Exchange and the National Stock Exchange of India. The company changed its name to Technologies Limited’ from Dec.2006. It is India’s only integrated […]