The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

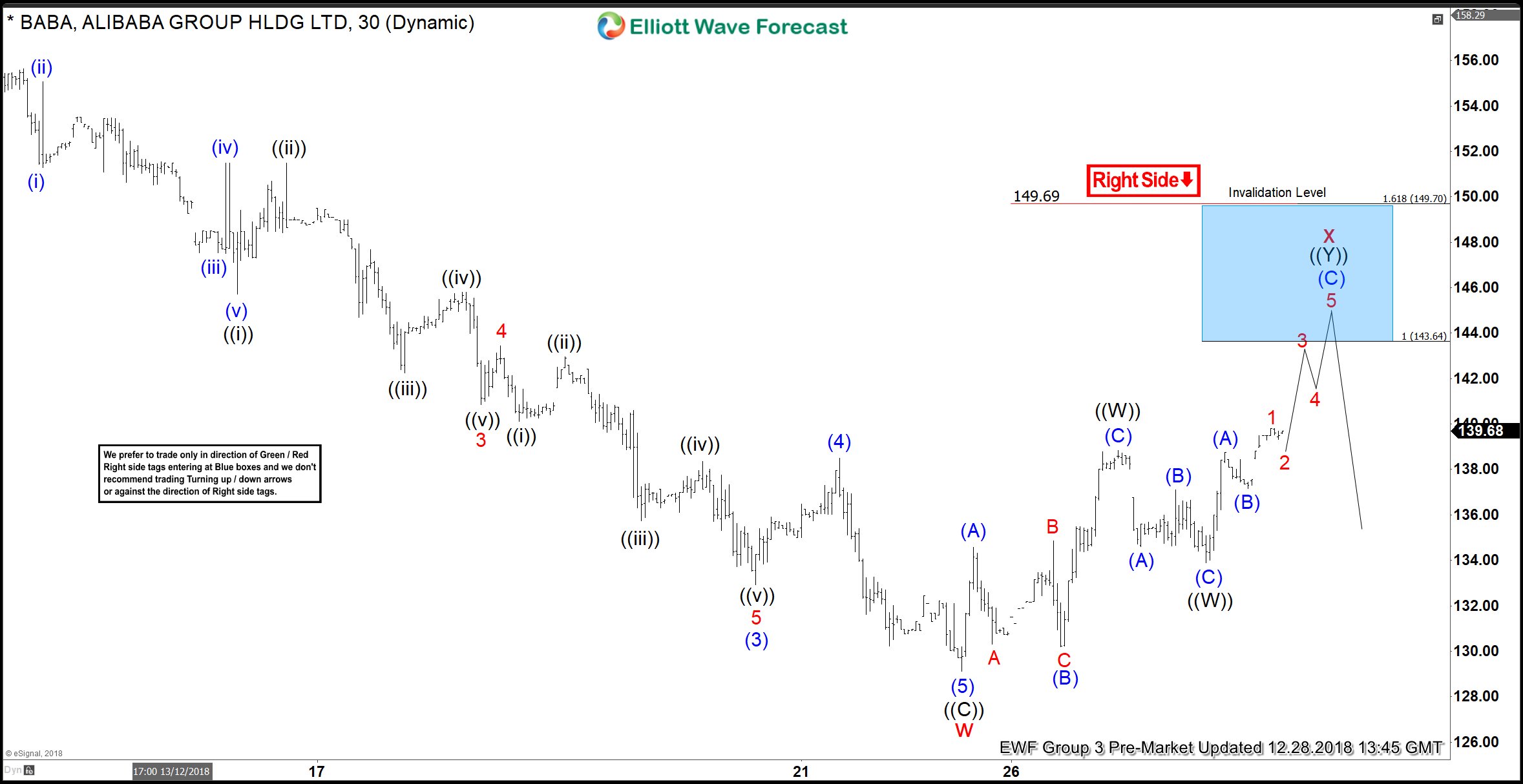

Alibaba Elliott Wave Structure Looking for Rally to Fail

Read MoreElliott Wave view in Alibaba (BABA) shows that the stock has an incomplete bearish sequence from 6.5.2018 high ($211.7). The 100% target in 7 swing comes at $88.3 and this view remains valid as far as the stock stays below 12.3.2018 high ($168.8). Near term, decline from 12.3.2018 high ended with Cycle degree wave w […]

-

Will Yen Continue to Outperform in 2019?

Read MoreCare to guess what is the best performing major currency in 2018? Chances are you will say that it’s the US Dollar. Although US Dollar is doing pretty well this year, the best performing currency is in fact the Japanese Yen. You can see in the table below that despite the Dollar Index rallying 4.9% […]

-

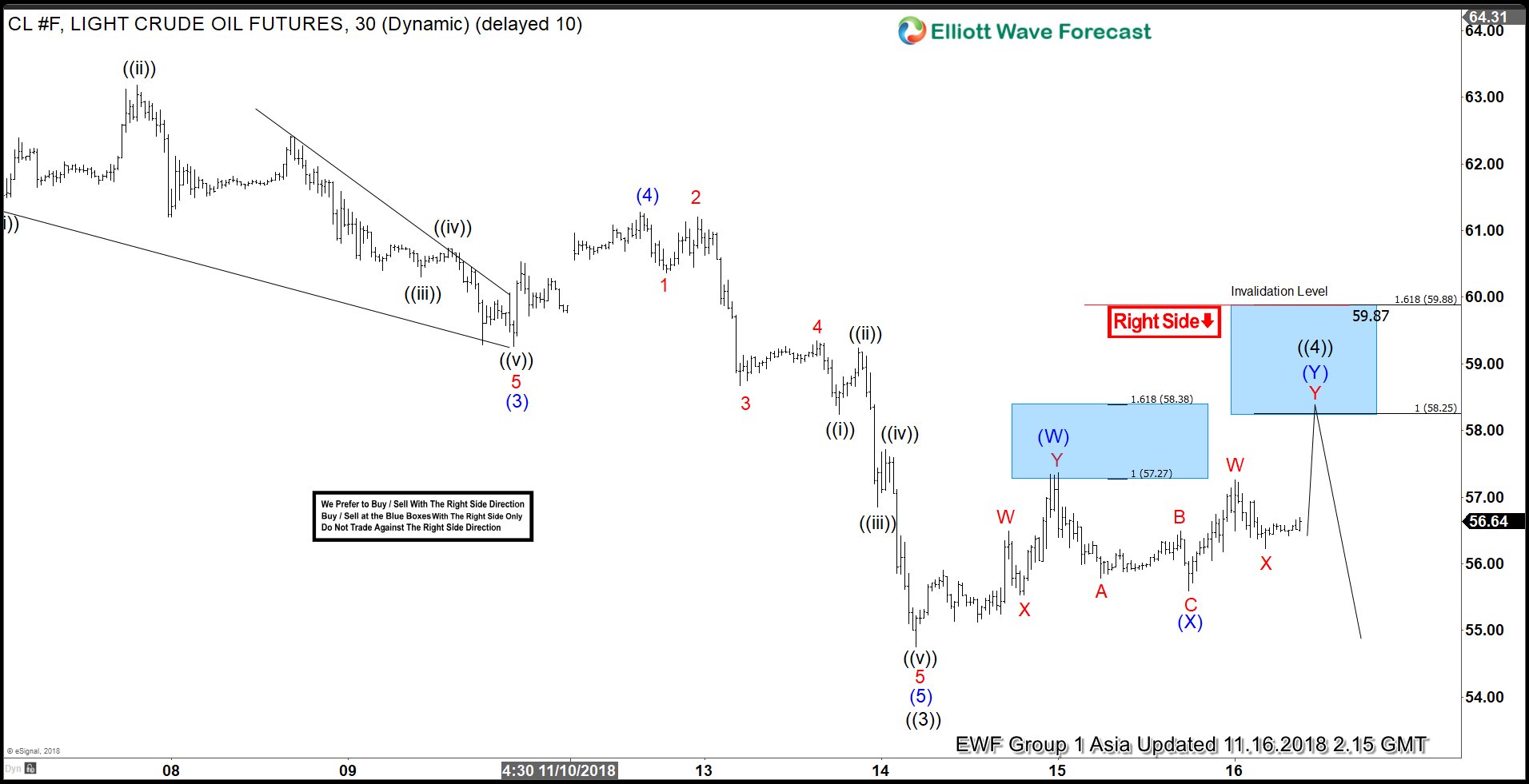

OIL Elliott Wave Forecasting The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of OIL published in members area of the website. As our members know, we were calling for decline in OIL from November 2018. As of right now the commodity is correcting the cycle from the 26.18 low. Proposed […]

-

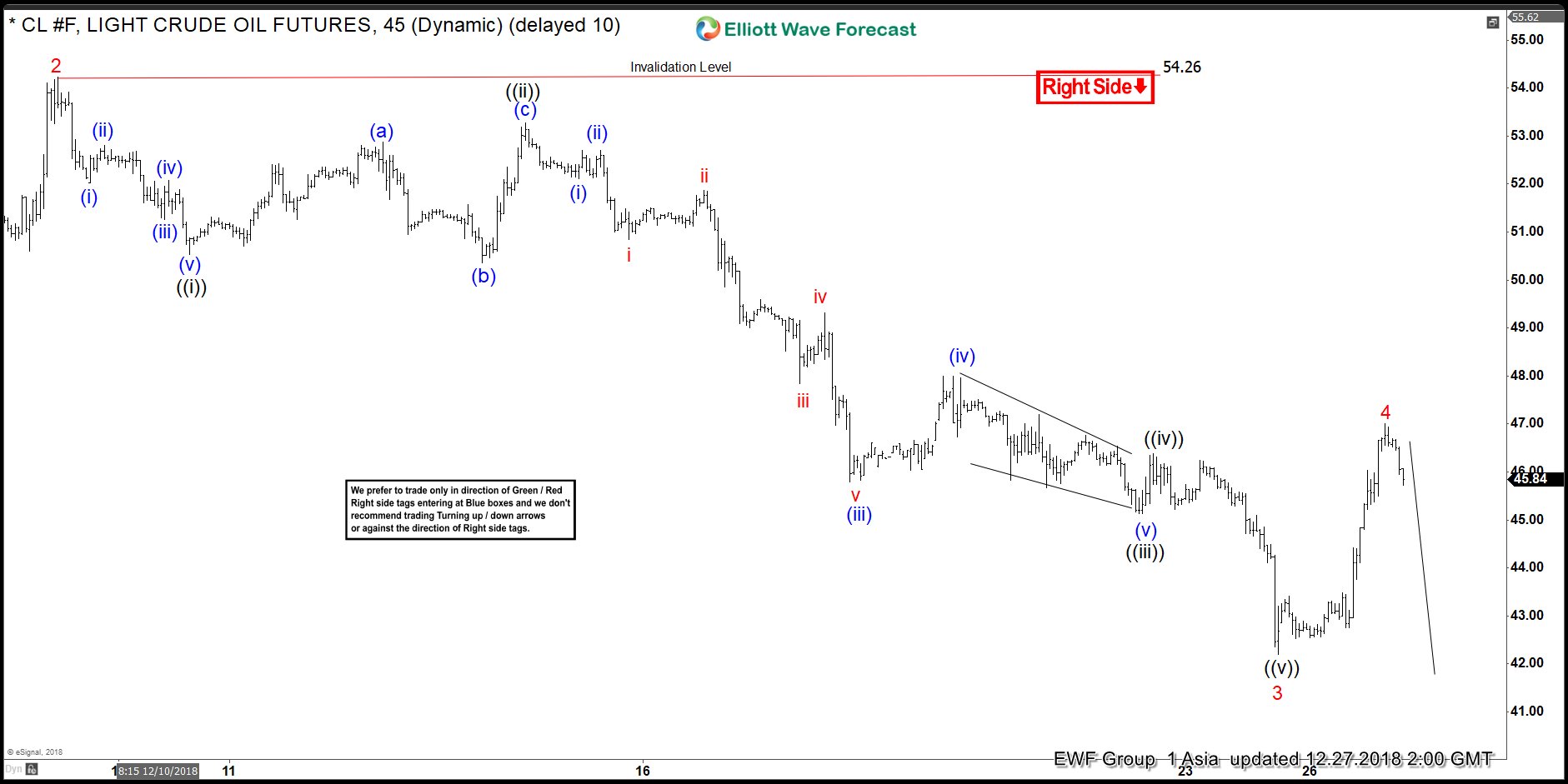

Oil: Impulsive Elliott Wave Structure In Play

Read MoreElliott Wave outlook in Oil (CL_F) suggests that the move lower from 10/3 high ($76.9) remains in progress as a 5 waves impulsive Elliott Wave structure. Down from $76.9, Primary wave ((1)) ended at $65.74, Primary wave ((2)) ended at $67.95, and Primary wave ((3)) remains in play. Internal of Primary wave ((3)) also unfolded […]