-

Hang Seng: Incomplete Elliott Wave Sequence

Read MoreHello fellow traders. In this technical blog we’re going to present the past Elliott Wave charts of Hang Seng ( $HSI-HKG ) published in members area of www.elliottwave-forecast.com . As our members know, we were pointing out that Hang Seng is having incomplete bullish swings sequences in the cycles from the February 12th and December […]

-

How good are you at recognizing Elliott Wave Patterns ?

Read MoreHello fellow traders. Here is the chance to test your Elliott Wave knowledge again and eventually make some improvements. You probably know that we do a lot of free educational blogs, presenting various Elliott Wave Patterns through real Market examples. We also constantly teach our members through our services like Live Sessions and 24h Chat […]

-

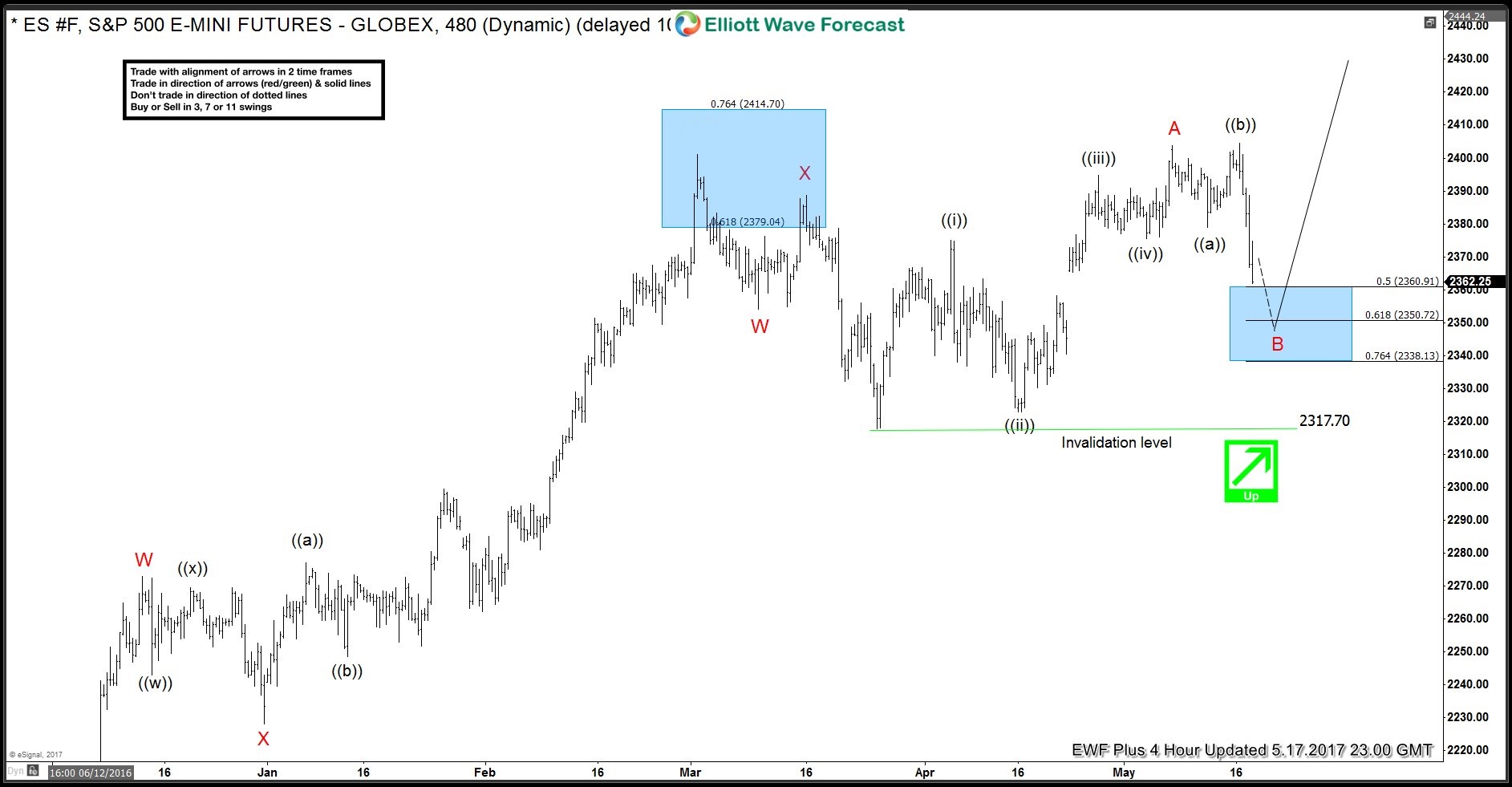

ES_F (S&P 500) made new all time high after Flat correction

Read MoreIn this technical blog we’re going to take a look at the past Elliott Wave charts of $ES_F (S&P 500) published in members area of www.elliottwave-forecast.com and explain Elliott Wave Flat structure. As our members know, we were pointing out that $ES_F (S&P 500) is within bullish trend. Price structure has been calling for more strength once […]

-

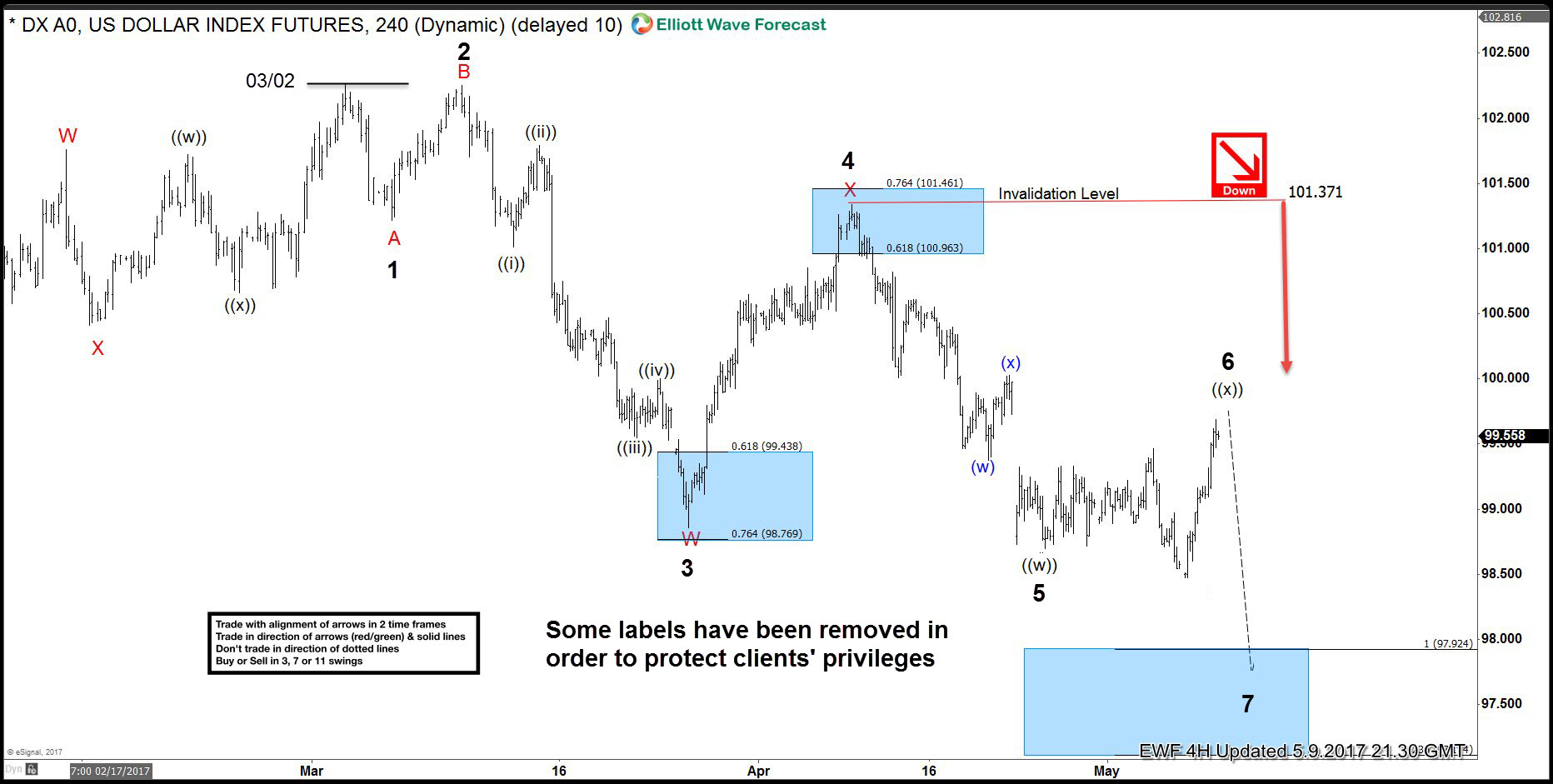

USDX forecasting the decline after Flat

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of Dollar Index published in members area of www.elliottwave-forecast.com. We’re going to take a look at the price structures of USDX , count the swings and explain the forecast. USDX 4 hour update 05.09.2017 As our […]

-

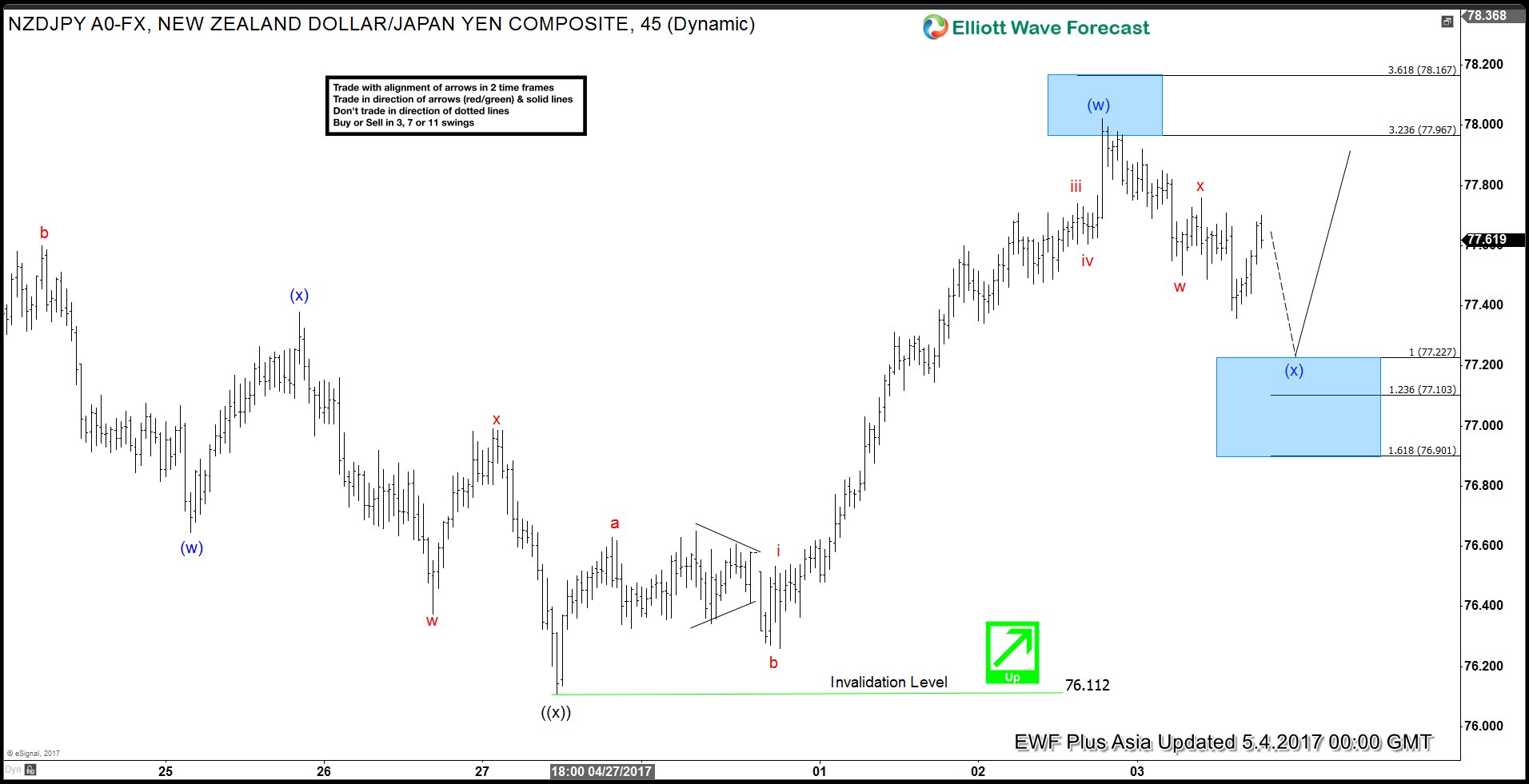

NZD JPY Elliott wave sequence forecasts the rally

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of NZD JPY published in members area of www.elliottwave-forecast.com. We’re going to take a look at the structures, count the swings and explain the trading setup. The chart below is NZD JPY 4 hour update from 05.04.2017. As our […]

-

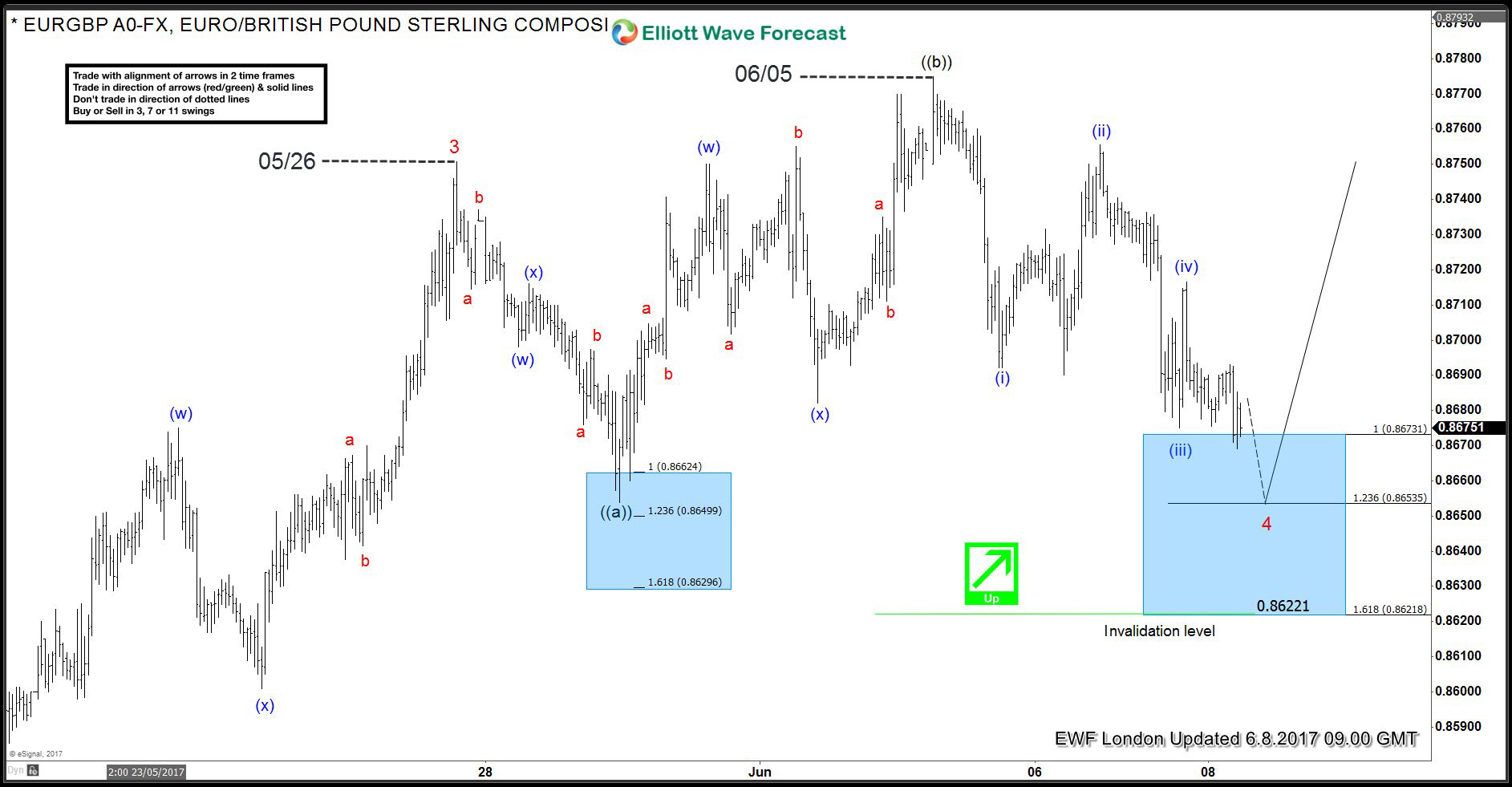

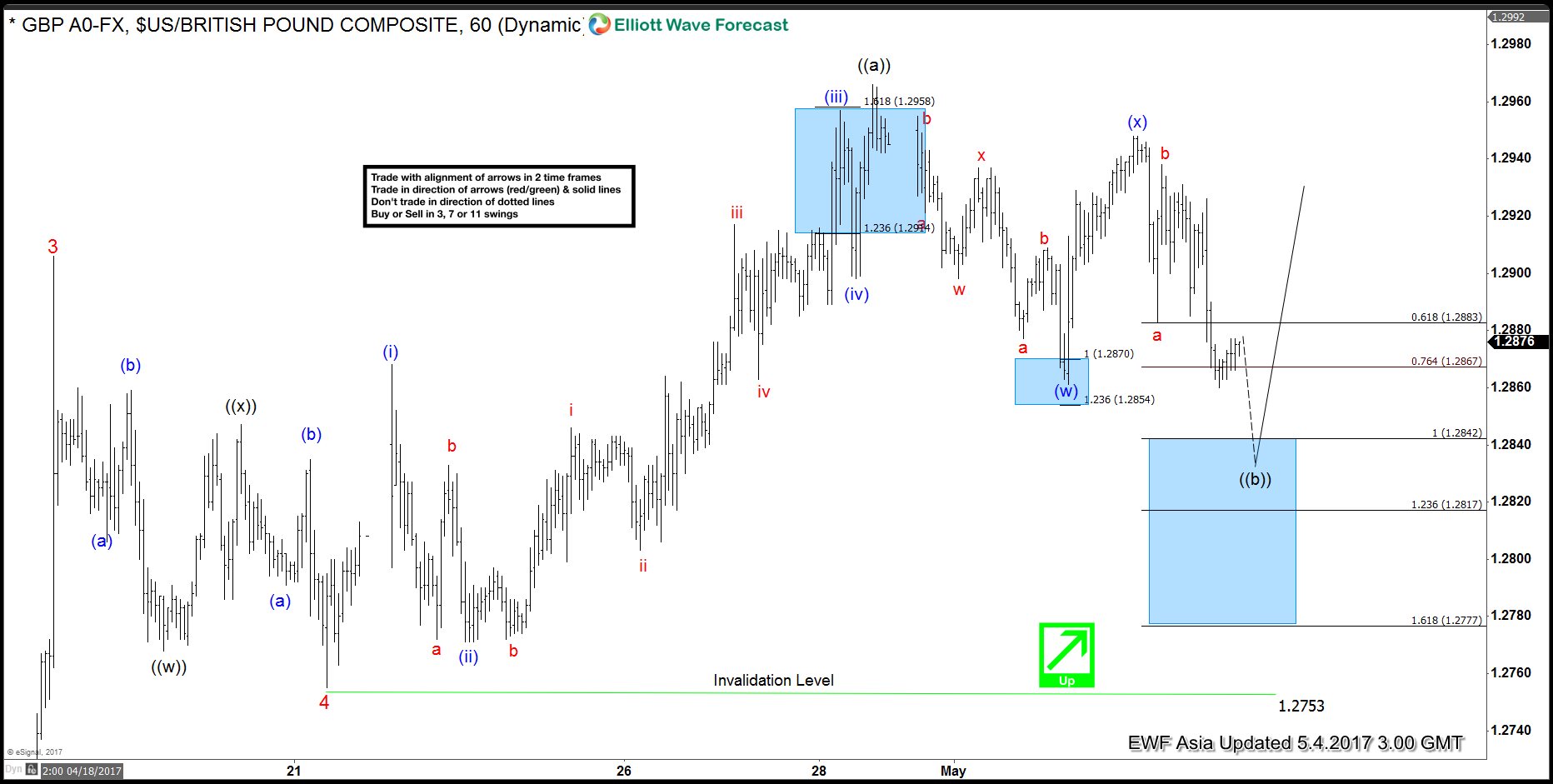

GBP USD made new high after Double Three correction

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave chart of GBP USD published in members area of www.elliottwave-forecast.com. In further text we’re going to take a look at the structures,count the swings and explain the reasons why we called for the extension to the upside. […]