-

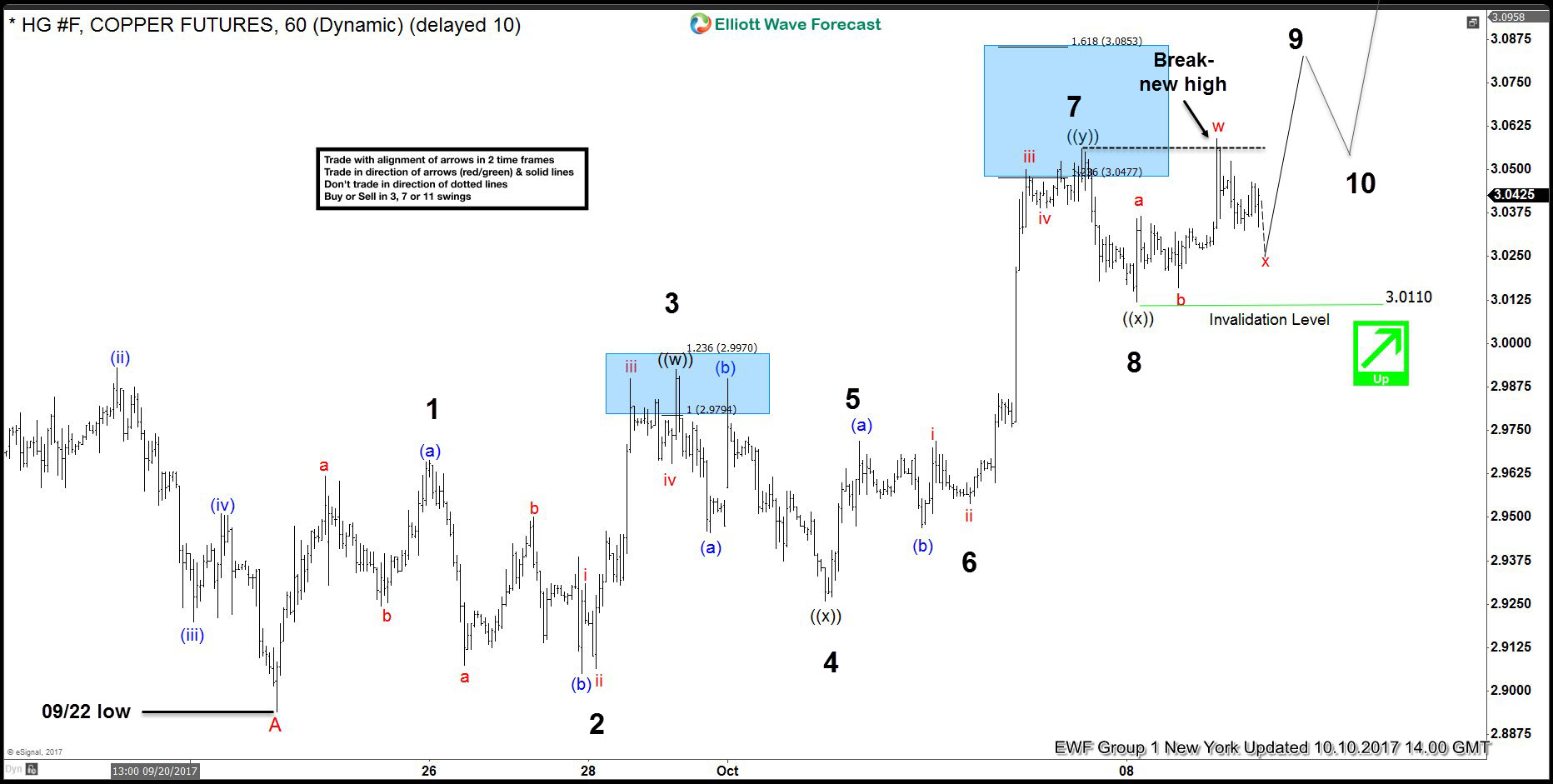

Copper swings sequences calling the rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of Copper published in members area of www.elliottwave-forecast.com. In further text we’re going to count the swings, explain the short term Elliott Wave view. Copper Elliott Wave 1 Hour Chart 10.10.2017 As our members know, Copper […]

-

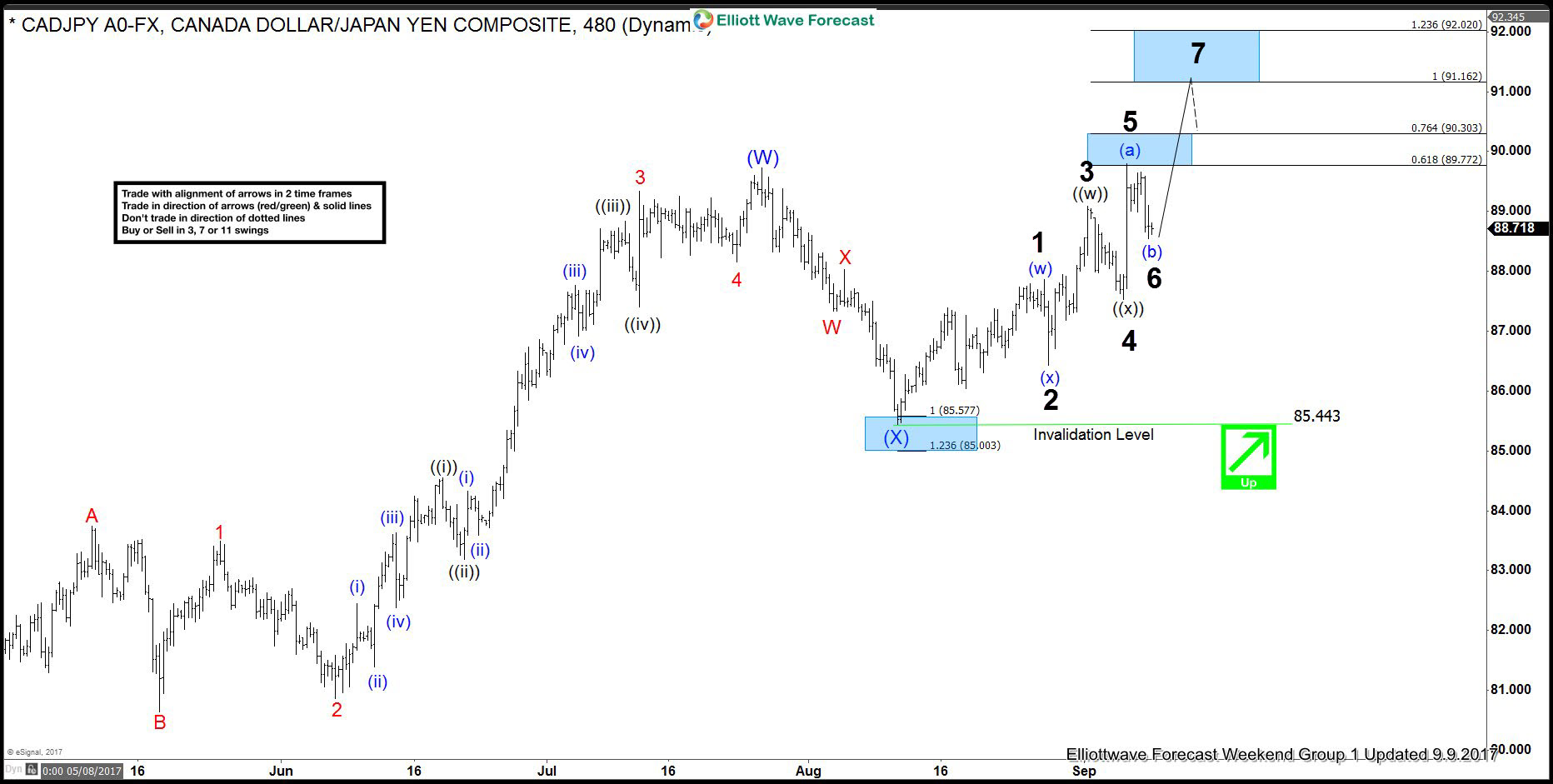

CADJPY Forecasting the Rally using Swings Sequences

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of CADJPY published in members area of www.elliottwave-forecast.com. In further text we’re going to count the swings, explain the Elliott Wave view and trading strategy. Let’s start with 4 hour update. CADJPY Elliott Wave 4 Hour […]

-

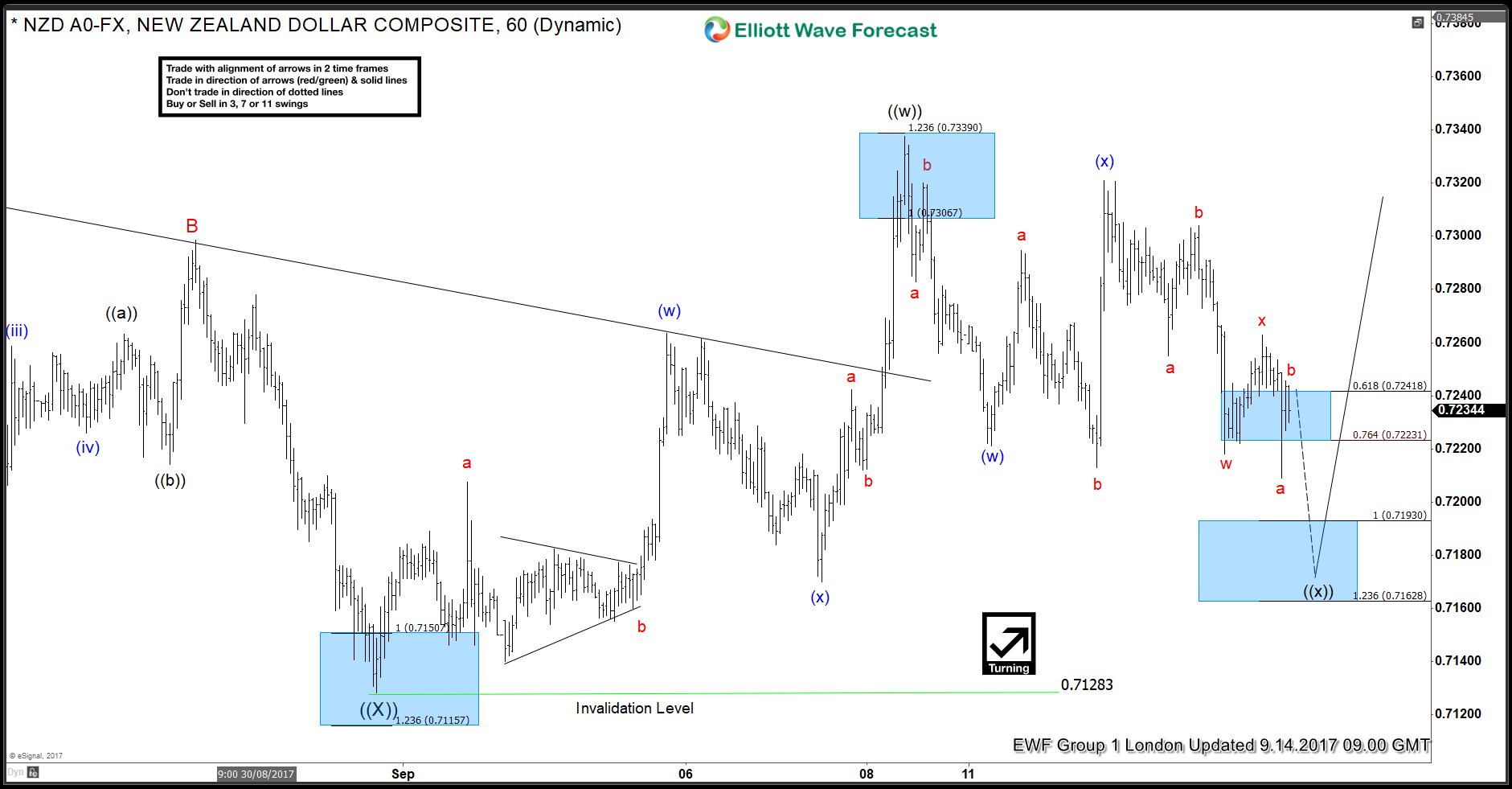

NZDUSD forecasting the path and buying short term dips

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of NZDUSD published in members area of www.elliottwave-forecast.com. In further text we’re going to count the swings, explain the Elliott Wave view and trading strategy. NZDUSD Elliott Wave 1 Hour Chart 09.14.2017 Back then we were […]

-

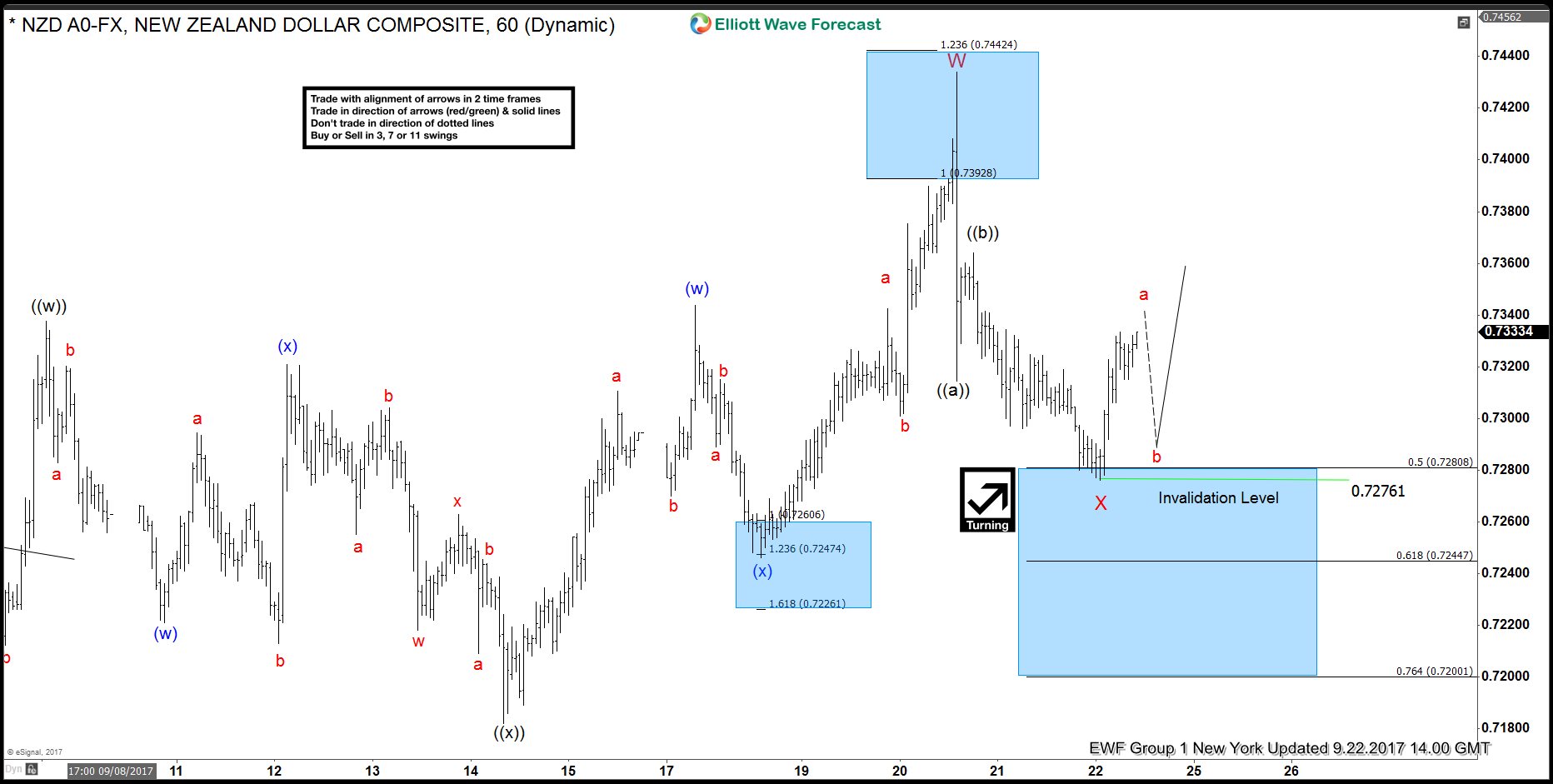

NZDUSD Elliott Wave View: Resuming Higher

Read MoreNZDUSD Short Term Elliott Wave view suggests the rally from 8/31 low unfolded as a double three Elliott Wave structure and ended with Minor wave W at 0.7434. Up from 8/31 low (0.7127), Minute wave ((w)) ended at 0.7337, Minute wave ((x)) ended at 0.7182, and Minute wave ((y)) of W ended at 0.7434. Minor […]

-

Natural Gas (NG #F) buying the dips

Read MoreThe video below is a capture from the London Live Session group 2 held on September 8th by Daud Bhatti. Daud presented Elliott Wave count of Natural Gas, counted the swings and explained our trading strategy. Natural Gas (NG #F) trading strategy Currently the price is showing 5 swings from the 08/4 low (2.753 low) […]

-

GBPCAD selling the rallies

Read MoreThe video below is a capture from the London Live Session group 2 held on August 30th. Daud presented Elliott Wave count of GBPCAD ,explaining our forecast and trading strategy. GBPCAD trading strategy Current price structure of GBPCAD suggests the pair is doing wave 2 recovery. It’s labelled as double three structure ((w))((x))(y)) when it […]