-

Forecasting the path of $GBPNZD

Read MoreThe video below is a short capture from NY Live Analysis session held on 05/16 by EWF Senior Analyst Daud Bhatti. Daud was presenting Elliott Wave count of $GBPNZD, forecasting the rally from precisely determined technical area: 2.11462-2.0965. Back then, $GBPNZD was showing incomplete swings sequences calling for at least another leg up toward equal legs-1.236 fib extension @ 2.1799-2.2033 , area where […]

-

Elliott Waves calling the rally in $USDCAD

Read MoreThe video below is a short clip captured from London Live Analysis Session held on May 5 /2016 where EWF Analyst Hendra Lau is showing Elliott Wave count of $USDCAD forecasting the rally from precisely determined technical area: 1.2806-1.2723. The pair has already given nice results, proposed (X) pull back ended as double three structure at […]

-

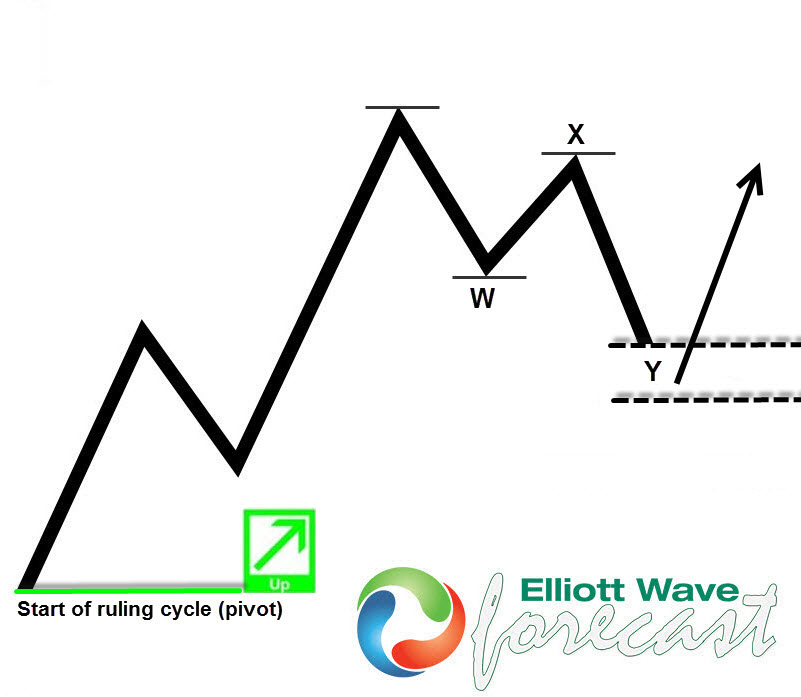

New to Elliott Wave? This is the first thing you should learn

Read MoreHello fellow traders, welcome to Elliott Wave Forecast. In this technical blog we’re going to get through some basic stuff of Elliott Wave Theory in order to help you get started with it. Many of you probably already know that Elliott Wave is the most powerful form of Technical Analysis used to forecast financial market […]

-

Elliott Wave forecasting the rally in $Silver and $Gold

Read MoreSilver and Gold had been little bit tricky in short term structures but the overall view was very clear. We kept our members on the right side of the market, calling the commodities bullish. We suggested buying them in the dips in 3-7-11 swings. The video below is a capture from London Live Analysis session […]

-

Elliott Waves calling the crash in USDX

Read MoreThe video below is a short clip captured from NY Live Analysis Session held on 2/24 where EWF Founder & Chief Currency Strategist, Eric Morera is showing 4 Hour Elliott Wave count of USDX index, forecasting the decline from precisely determined technical area: 98.364-98.799. Besides forecast Eric is listing the techniques we follow while analyzing the market […]

-

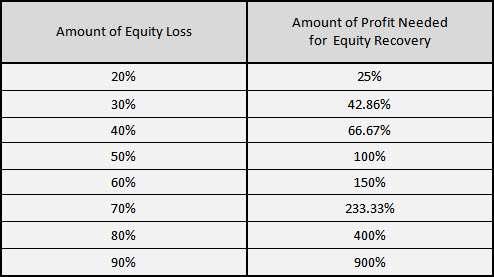

An Important Lesson on Money Management

Read MoreThere are 3 major key factors in Trading that every professional trader should have: 1. Ability to forecast the market 2. Good Money management 3. Good Psychology. It’s crucial for all three factors to be included in order to succeed. If just one of these 3 mentioned factors is missing, the trader will fail. In […]