-

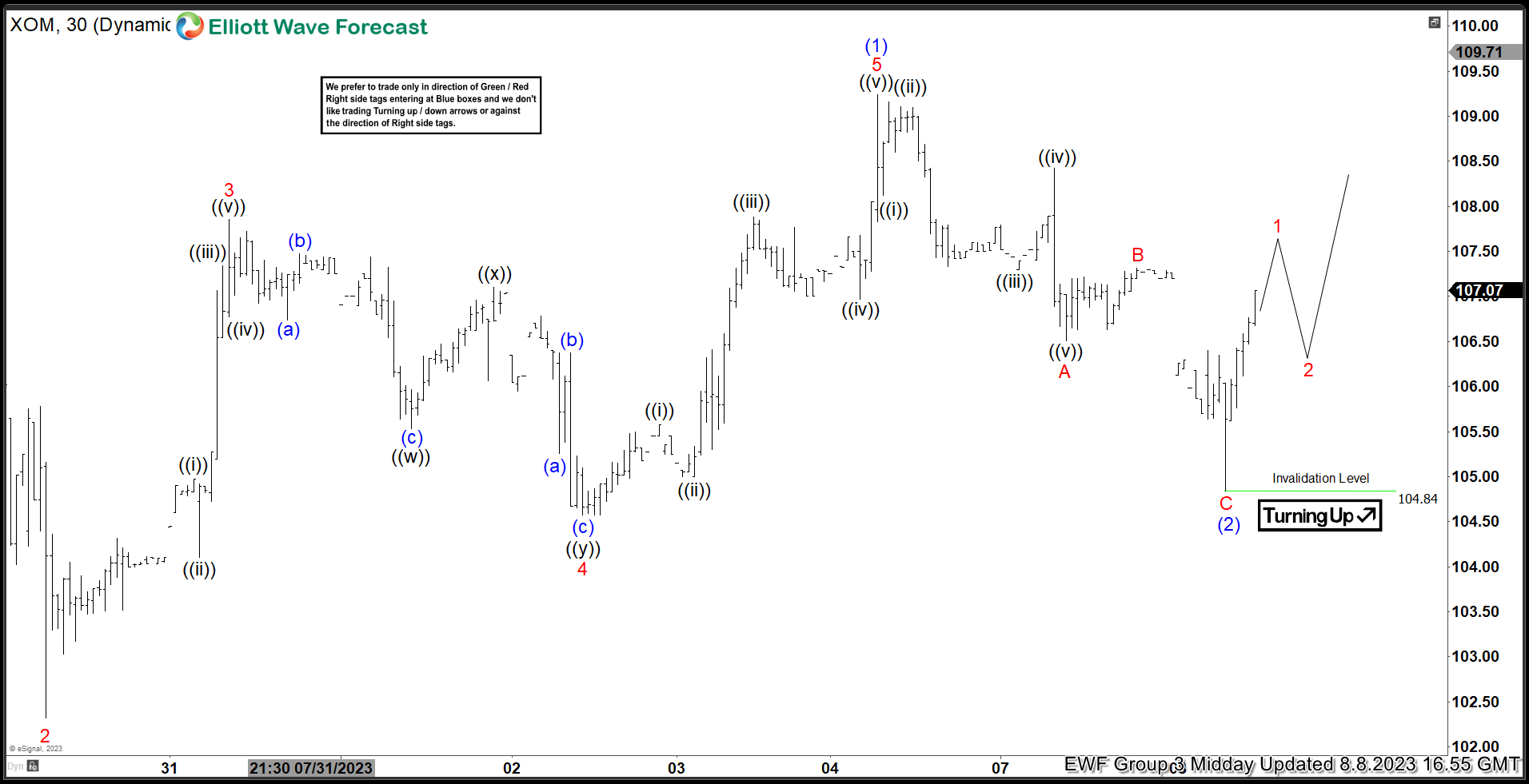

Exxon Mobil Corp ($XOM) Found Buyers After a Corrective Pull Back.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Exxon Mobil Corp ($XOM). The rally from 7.17.2022 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure & […]

-

VanEck Gold Miners ETF ($GDX) Reacts Lower From The Blue Box Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of VanEck Gold Miners ETF ($GDX). The pullback from 7.18.2023 high unfolded as a 5 wave impulse with an incomplete bearish sequence from 5.04.2023 high. So, we advised members to sell the bounce in 3 swings […]

-

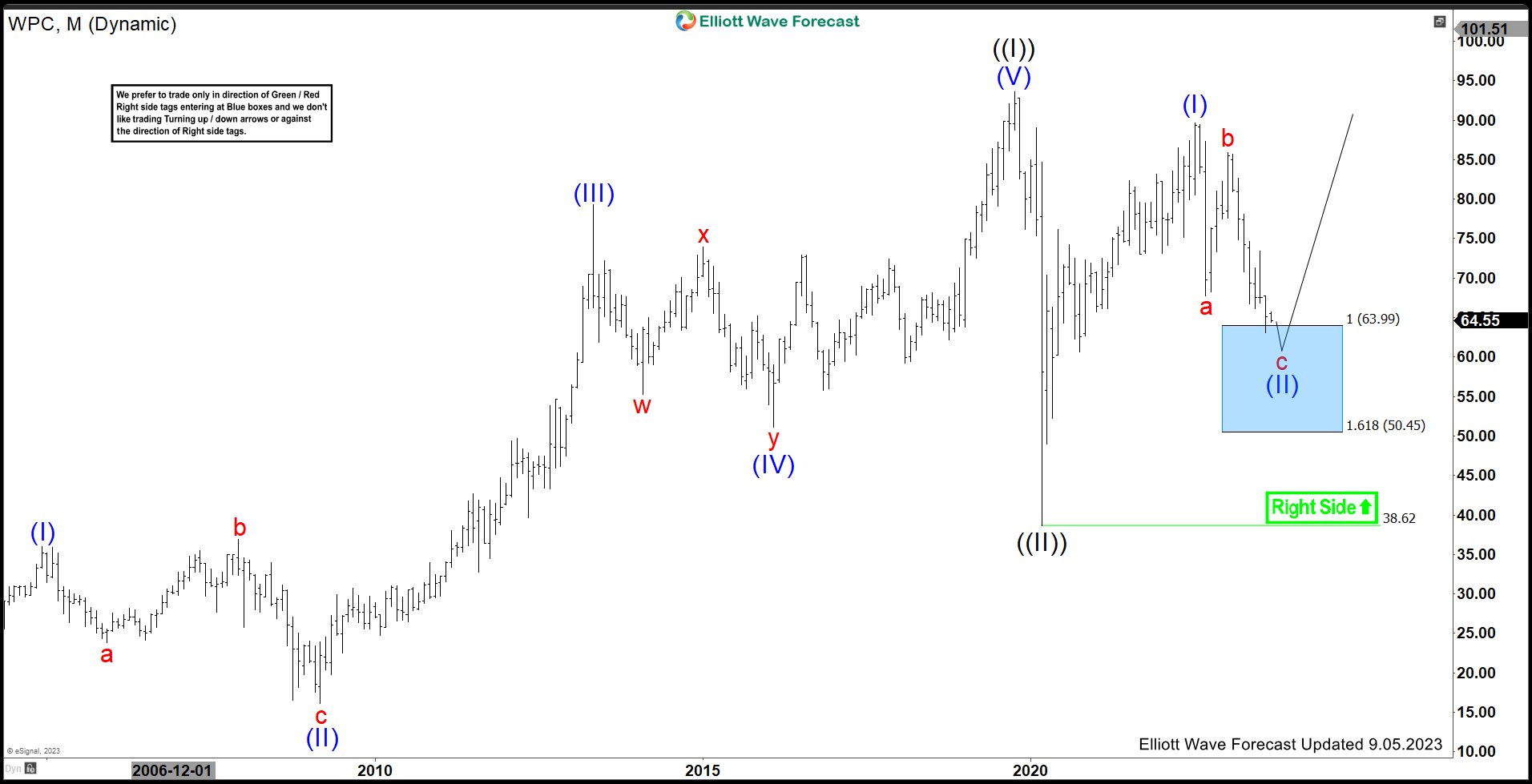

W. P. Carey Inc. ($WPC) Is Poised To Rally Soon From a Blue Box Area.

Read MoreHello Traders! Today, we will look at the Grand Super Cycle of W. P. Carey Inc. ($WPC) and explain why the stock is at a Generational low and a Multi Year Rally should happen soon. W. P. Carey Inc. is a real estate investment trust that invests in properties leased to single tenants via NNN leases. The company is organized […]

-

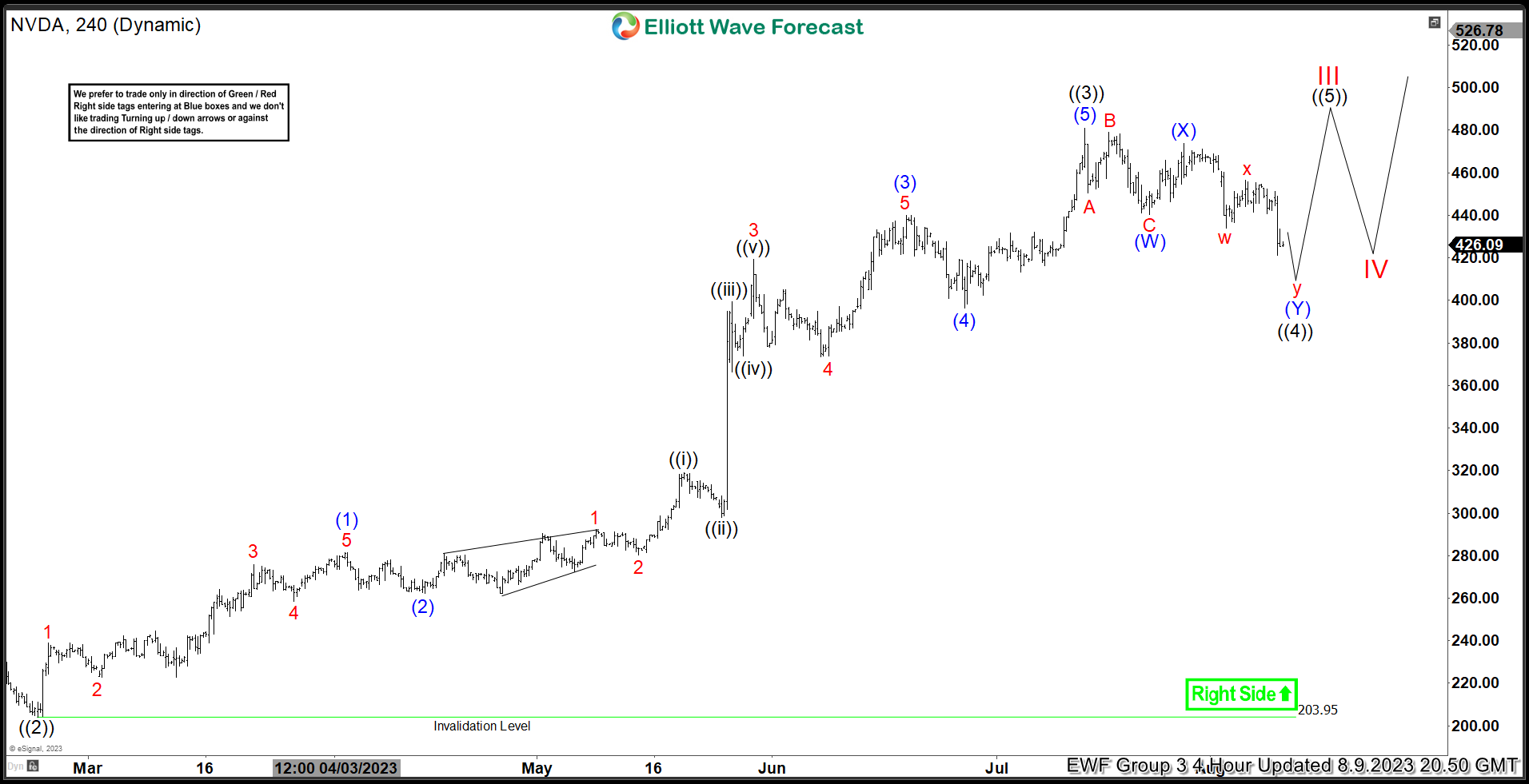

NVIDIA Corp. ($NVDA) Found Buyers After a Corrective Pull Back.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4 Hour Elliott Wave chart of NVIDIA Corp. ($NVDA) The rally from 10.13.2022 low unfolded as a 5 wave impulse breaking to new all time highs with an incomplete bullish sequence from 2.28.2023 low. So, we expected the pullback to unfold […]

-

General Electric Co. ($GE) Reacts Higher From The Blue Box Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of General Electric Co. ($GE) The rally from 6.23.2023 low unfolded as a 5 wave impulse with an incomplete bullish sequence from 7.19.2023 low. So, we advised members to buy the pullback in 7 swings at […]

-

Enbridge Inc. ($ENB) Is Poised To Rally Soon From a Blue Box Area.

Read MoreHello Traders! Today, we will look at the Monthly and Weekly Elliott Wave structure of Enbridge Inc. ($ENB) and explain why the stock is at a Generational low and a Multi Year Rally should happen soon. Enbridge Inc. is a multinational pipeline and energy company headquartered in Calgary, Alberta, Canada. Enbridge owns and operates pipelines throughout Canada and the United […]