-

General Electric Co. ($GE) Blue Box Area Wins Again. What’s Next?

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of General Electric Co. ($GE). The rally from 10.23.2023 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure & […]

-

Uber Technologies Inc. ($UBER) Bullish Structure Calling for More Upside

Read MoreHello Traders. In today’s article, we are going to follow up on Uber Technologies Inc. ($UBER) forecast posted back in August 2022 and take a look at the latest count. You can find the article here. $UBER Daily Elliott Wave View Aug 2022: Third Wave Extension Different Types of Wave Extensions The overall structure looks […]

-

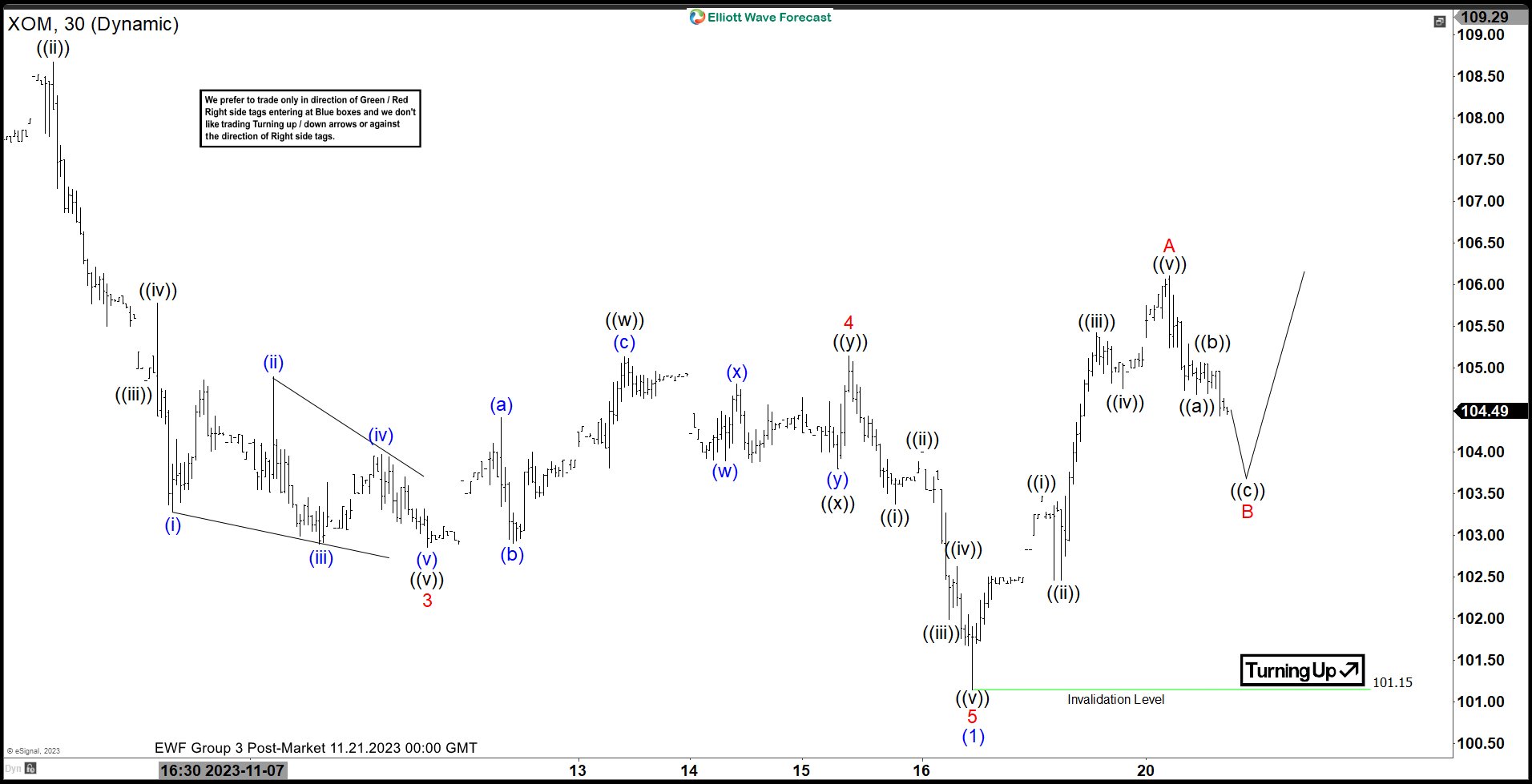

Exxon Mobil Corp ($XOM) Calling the Zigzag Higher.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of Exxon Mobil Corp ($XOM). The rally from 11.16.2023 low at $101.15 unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the […]

-

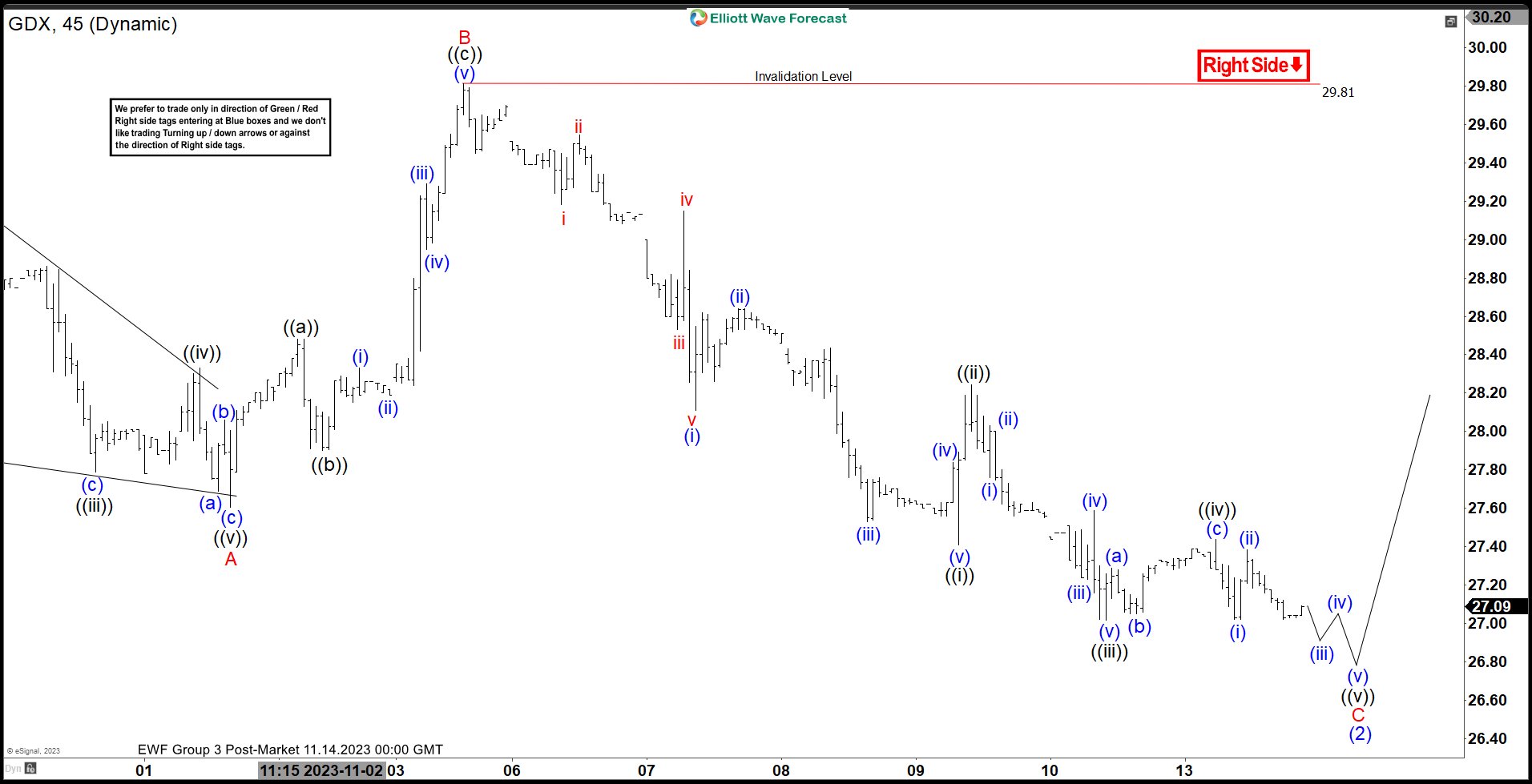

VanEck Gold Miners ETF ($GDX) Keeps Finding Buyers at Extreme Areas.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of VanEck Gold Miners ETF ($GDX). The rally from 10.04.2023 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure […]

-

Tesla Inc. ($TSLA) Reacting Higher From Another Extreme Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of Tesla Inc. ($TSLA). The rally from 10.31.2023 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 3 swings (ABC) and find buyers again. We will explain the structure & […]

-

Australian Securities Exchange Ltd (ASX) Correction Remains in Progress.

Read MoreHello Traders! Today, we will look at the Elliott Wave structure of Australian Securities Exchange Ltd (ASX) and explain why more downside can happen before higher soon. Australian Securities Exchange Ltd (ASX) is an Australian public company that operates Australia’s primary securities exchange. The ASX was formed on 1 April 1987, through incorporation under legislation of the Australian Parliament […]