-

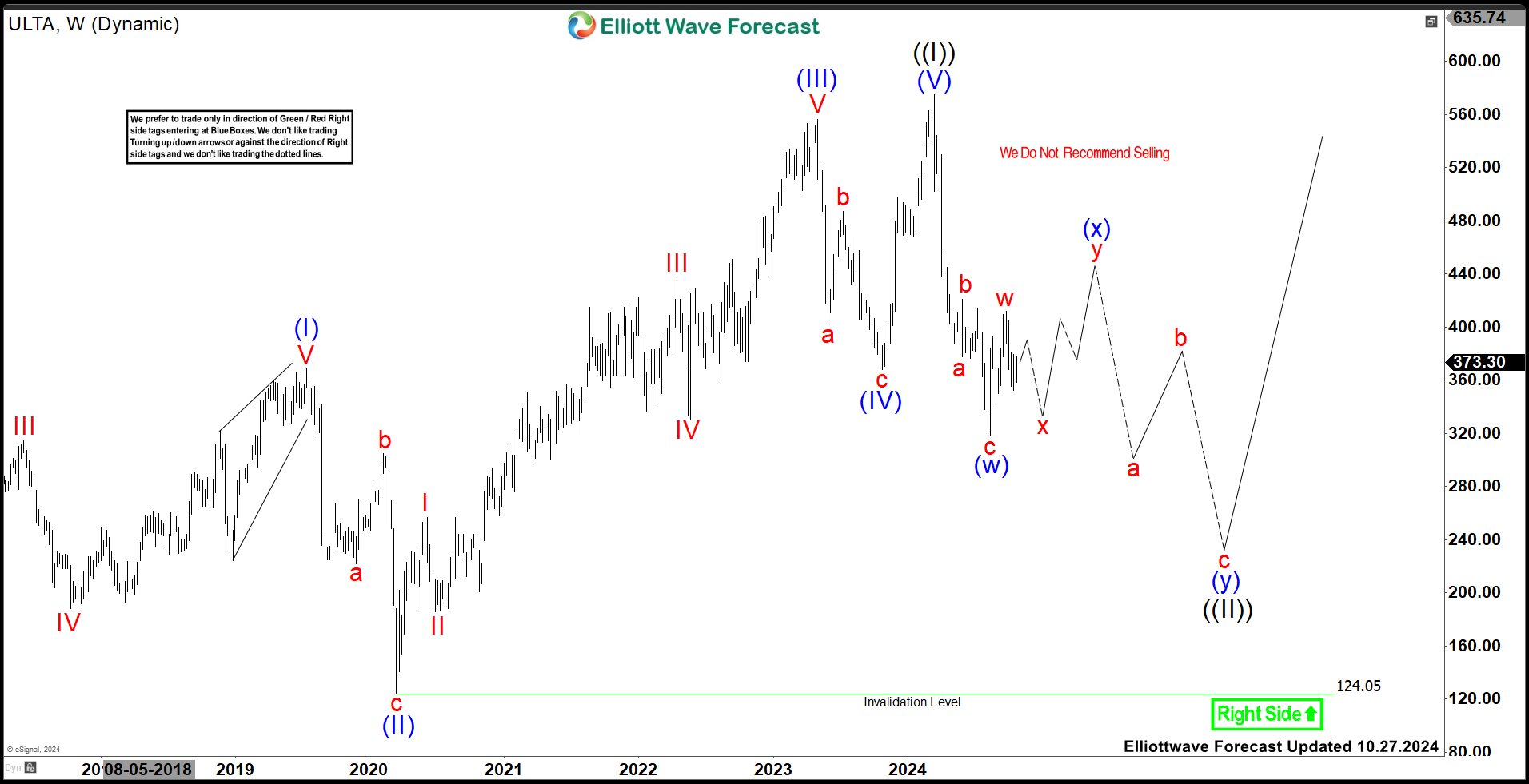

ULTA Beauty (ULTA) Should Remain Sideways

Read MoreULTA Beauty, Inc., (ULTA) operates as specialty beauty retailer in the United States. It offers branded & private label beauty products, including cosmetics, fragrance, haircare, skincare, bath & body products, professional hair products, salon styling tools through stores, shop-in-shops, e-commerce websites & mobile applications. It is based in Bolingbrook, IL, comes under Consumer Cyclical sector […]

-

SoFi Technologies (SOFI) Should Continue Short-term Rally

Read MoreSoFi Technologies, Inc., (SOFI) provides various financial services in the US, Latin America & Canada. It operates through three segments; Lending, Technology Platform & Financial services. It is based in San Francisco, CA, comes under Financial Services sector & trades as “SOFI” ticker at Nasdaq. SOFI ended larger weekly correction at $4.24 low in December-2022 […]

-

Is Solana (SOL) Ready To Continue Next Rally?

Read MoreSolana (SOL) is highly functional project that banks on Blockchain technology’s permission less nature to provide the decentralized finance (DeFi) solutions. It was officially launched in March-2020 with the headquarters in Geneva, Switzerland. Since April-2020 low, SOL:Binance made all time high of $267.52 in November-2021 as (I) impulse sequence. Currently, it favors upside in ((3)) […]

-

Will NextEra Energy (NEE) Continue Bullish Trend or Correcting Lower?

Read MoreNextEra Energy, Inc., (NEE) is an American Energy company through its subsidiaries generates, transmits, distributes & sells electric power to retail & wholesale customers in North America. The company generates electricity, through wind, solar, nuclear, natural gas & other clean energy. It is based in June Beach, Florida, comes under Utility sector & trades as […]

-

Elliott Wave View on GDX Favors Pullback Before Rally

Read MoreShort Term Elliott Wave View in GDX suggests the zigzag correction should find support towards extreme areas before resume higher to finish the impulse sequence from 5-August, 2024 low. It is showing higher high sequence in daily from September-2022 low and expect short term rally to continue against August-2024 low. Since 5-August, 2024 low, it […]

-

Mastercard (MA) Should Pullback Soon To Provide Next Opportunity

Read MoreMastercard Incorporated (MA), provides transaction processing & other payment-related products & services in the United states & internationally. The company offers payment related products to integrated products & value-added services for account holders, merchants, financial institutions, digital partners, businesses, governments & other organizations. It is headquartered in New York, comes under Financial Services sector & […]