-

ASML Holding (ASML) Favors Rally Towards 1457.74

Read MoreASML Holding N.V., (ASML) provides lithography solutions for the development, production, marketing, sales, upgrading & servicing semiconductor equipment systems. It also offers hardware, software & services to chipmakers to produce the patterns of integrated circuits. It comes under Technology sector & trades as ‘ASML’ ticker at Nasdaq. ASML trading at ATH, broke the price channel […]

-

Liquidia (LQDA): Buy The Breakout Or Wait For Pullback?

Read MoreLiquidia Corporation, (LQDA) is a biopharmaceutical company. It develops, manufactures & commercializes various products for unmet patient needs in the United States. It comes under Healthcare sector in Biotechnology Industry & trades as “LQDA” ticker at Nasdaq. As discussed in last article, it extends rally in impulse I from June-2025 low. It should extend into […]

-

SoFi Technologies (SOFI) Favors Rally Between $34.95 – $38.49

Read MoreSoFi Technologies, Inc., ( SOFI ) provides various financial services in the US, Latin America, Canada & Hong Kong. It operates through three segments; Lending, Technology Platform & Financial services. It comes under Financial Services sector & trades as “SOFI” ticker at Nasdaq. SOFI favors rally in bullish sequence from December-2022 low in weekly. It […]

-

RY (Royal Bank of Canada) Favors Rally To 187.25 or Higher

Read MoreRoyal Bank of Canada., (RY) operates as diversified financial service company worldwide. It operates through personal finance, commercial banking, wealth management & Insurance segments. It comes under Financial services sector & trades as “RY” ticker at NYSE. RY extends rally from April-2025 low as nesting as it managed to erase the momentum divergence. It favors […]

-

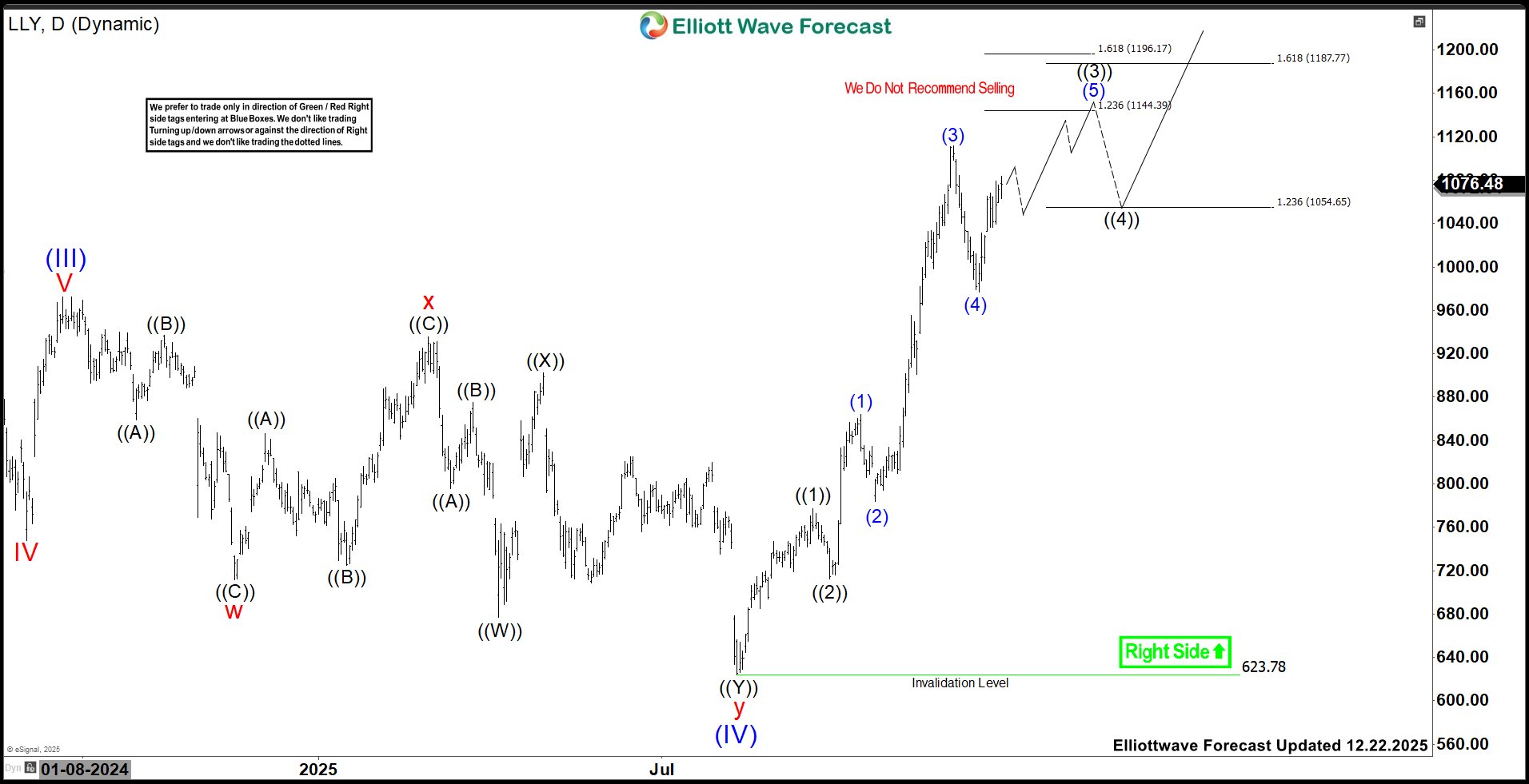

Eli Lilly & Company (LLY): Buyers Looking For Rally Between $1144.4 – $1196.17

Read MoreEli Lilly & Company (LLY) discovers, develops & markets human pharmaceuticals worldwide. It comes under Healthcare sector & trades as “LLY” ticket at NYSE. As discussed in last article, LLY favors rally in ((3)) of impulse I within August-2025 rally. It favors upside between $1144.39 – $1196.17 area, while above 12.10.2025 low to finish ((3)). […]

-

Vistra Corp (VST): Trading The ((2)) Pullback For Next Big Rally

Read MoreVistra Corp., (VST) operates as an integrated retail electricity & power generation company in the United States. It operates through five segments like Retail, Texas, East, West & Asset Closure. It comes under Utilities sector & trades as “VST” ticker at NYSE. In daily, VST ended April rally in ((1)) at $219.82 high & favors […]