-

Nikkei (NKD) Looking to Complete Wave 5 of Elliott Wave Impulse

Read MoreNikkei (NKD) rallying in wave 5 of an impulsive structure. This article and video look at the Elliott Wave path of the pair.

-

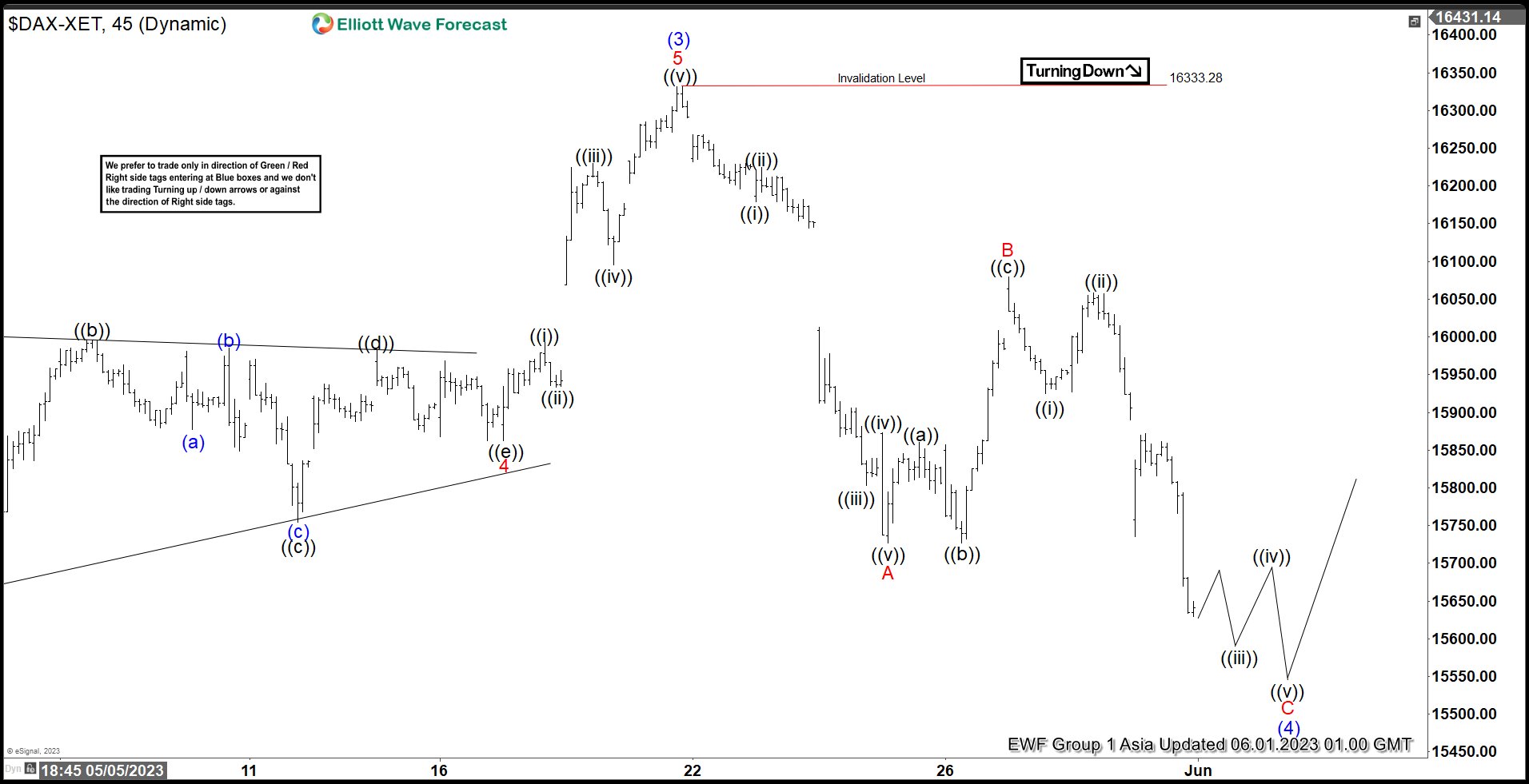

Elliott Wave View: DAX Pullback in Progress

Read MoreDAX is correcting in a zigzag Elliott Wave structure and should continue lower. This article and video look at the Elliott Wave path.

-

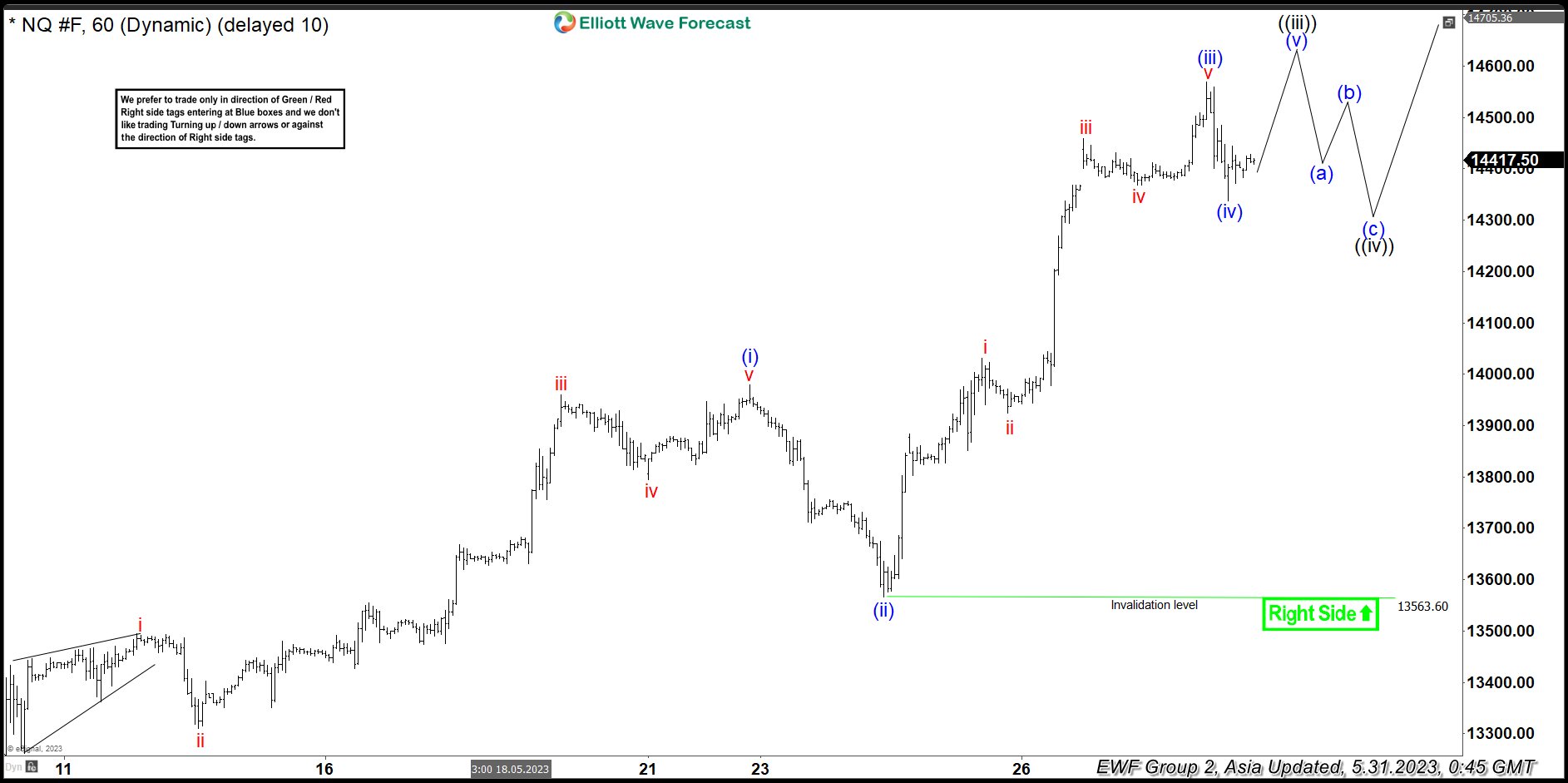

Elliott Wave Forecasts Nasdaq (NQ) to Continue Higher

Read MoreNasdaq (NQ) rally from 4.26.2023 low as impulse and look for further upside. This article and video look at the Elliott Wave path.

-

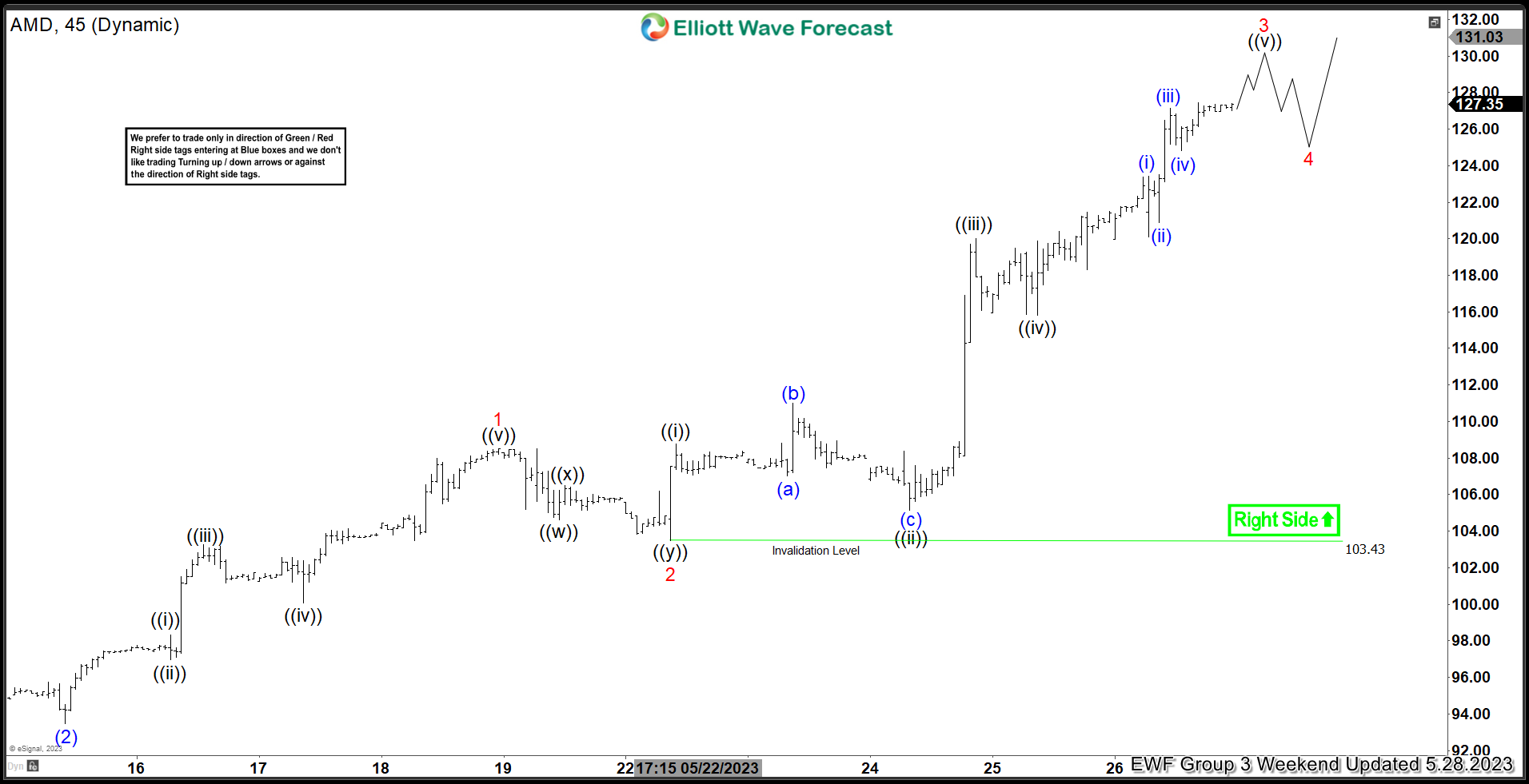

AMD Bullish View with Strong Elliott Wave Impulse Rally

Read MoreAMD rally from 5.4.2023 low is in progress as an impulse structure, looking for further upside. This article and video look at the Elliott Wave path.

-

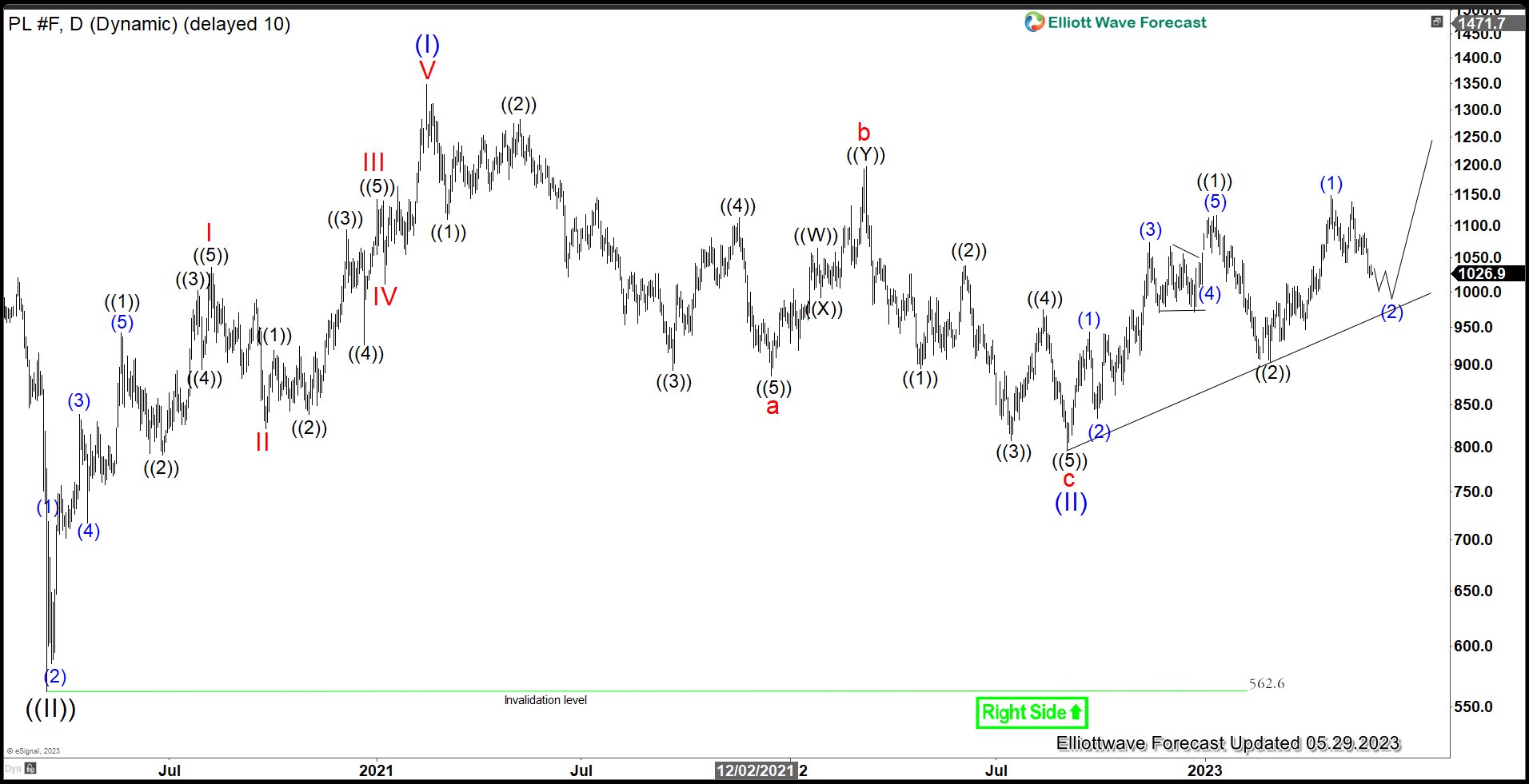

Platinum (PL) Correction in Progress

Read MorePlatinum (PL) shows a higher high (bullish sequence) from 9.1.2022 low favoring further upside. Since forming the intermediate top at 1148.9 on April 21, the metal has corrected cycle from 2.27.2023 low at 903.9. The correction can still extend lower in the near term but it should end above 903.9 before the next leg higher […]

-

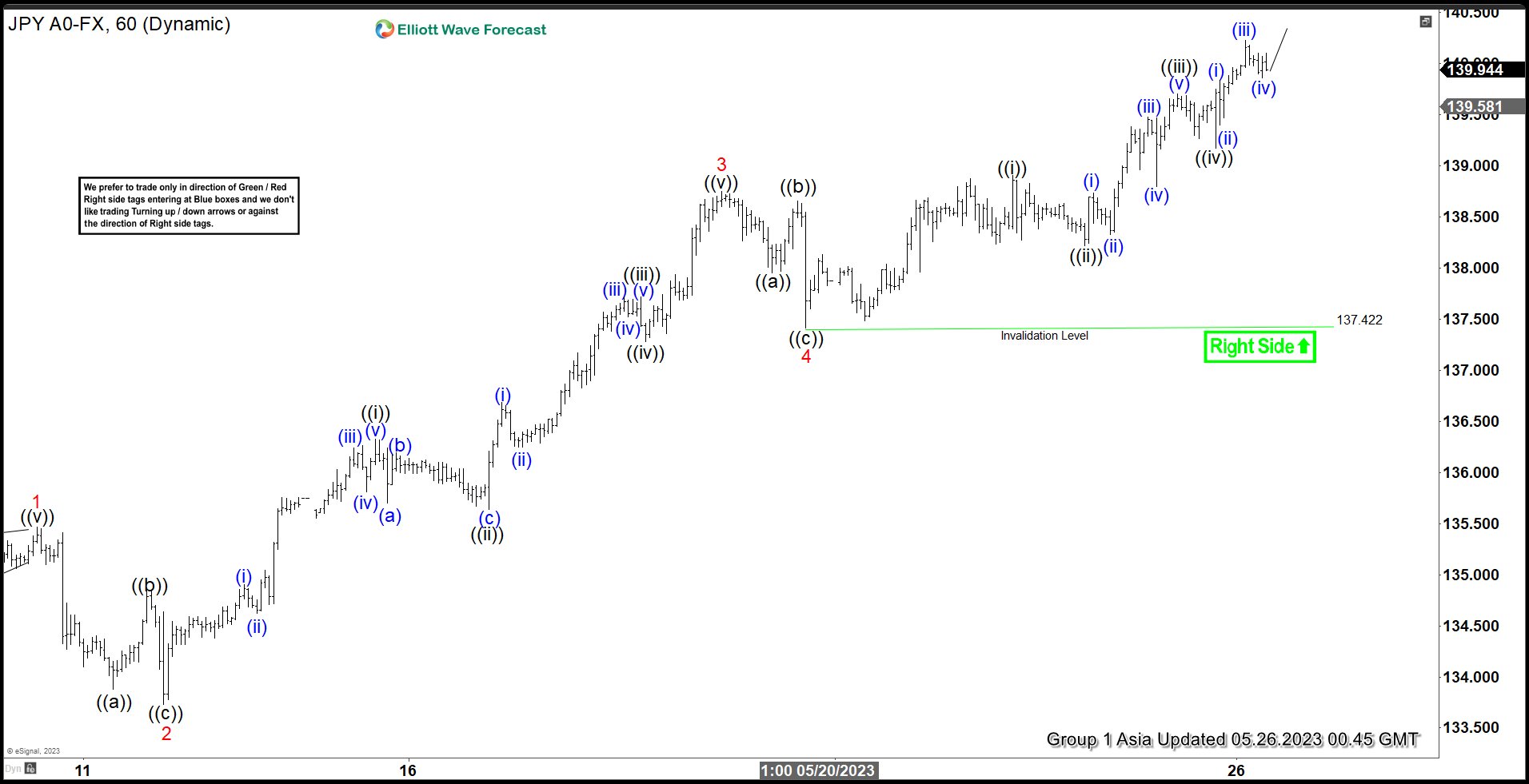

Elliott Wave View: USDJPY Approaching Turning Area

Read MoreUSDJPY rally from 5.4.2023 low takes the form of an impulsive structure. This article and video look at the Elliott Wave path.