-

Long Term Outlook of S&P 500 (SPX) A Path To 10000, A Nesting On The Making.

Read MoreOn March 4, 1957, the Standard & Poor’s 500 < SPX> was introduced. The S&P 500 index has became synonymous with the term “U.S. stock market.” It is one of the leading benchmarks for the market, even though others, including the Russell and Wilshire indexes, are broader measures of the market. In this video, we […]

-

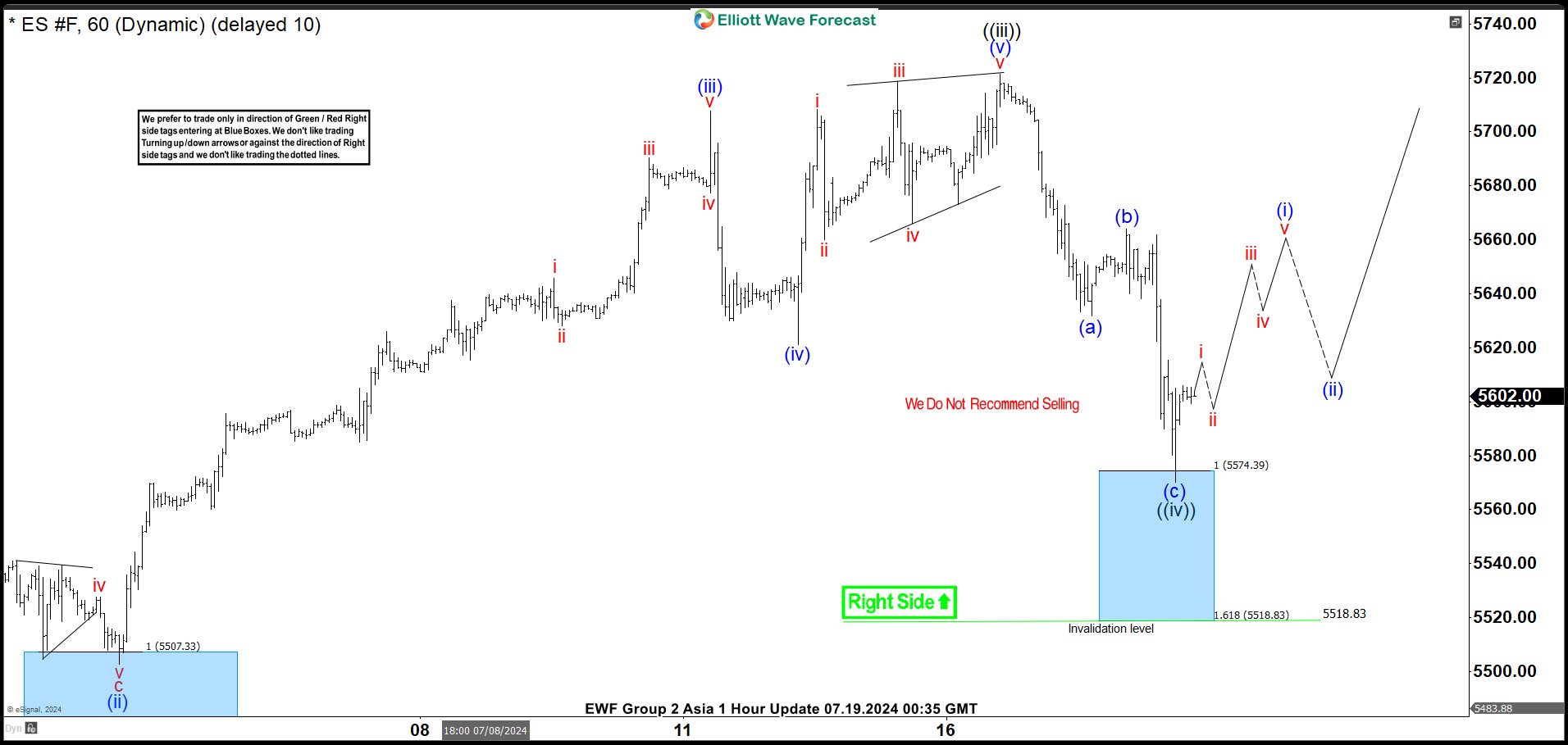

Elliott Wave Expects S&P 500 E-Mini Futures (ES) to Continue Higher

Read MoreS&P 500 E-Mini Futures (ES) rallies in impulsive structure and should see more upside. This article and video look at the Elliott Wave path.

-

Elliott Wave Intraday: Rally in Bitcoin (BTCUSD) Looking Impulsive

Read MoreBitcoin (BTCUSD) rally from 7.5.2024 low looks impulsive favoring higher. This article and video look at the Elliott Wave path.

-

Platinum (PL) Looking to Extend Higher

Read MorePlatinum (PL) is still looking to resume the next bullish cycle. The metal still needs to break above 1348.2 to confirm that the next leg higher has started. Below we updated the Monthly and Daily Elliott Wave chart for the metal. Platinum (PL) Monthly Elliott Wave Chart Monthly chart of Platinum above shows Grand Cycle […]

-

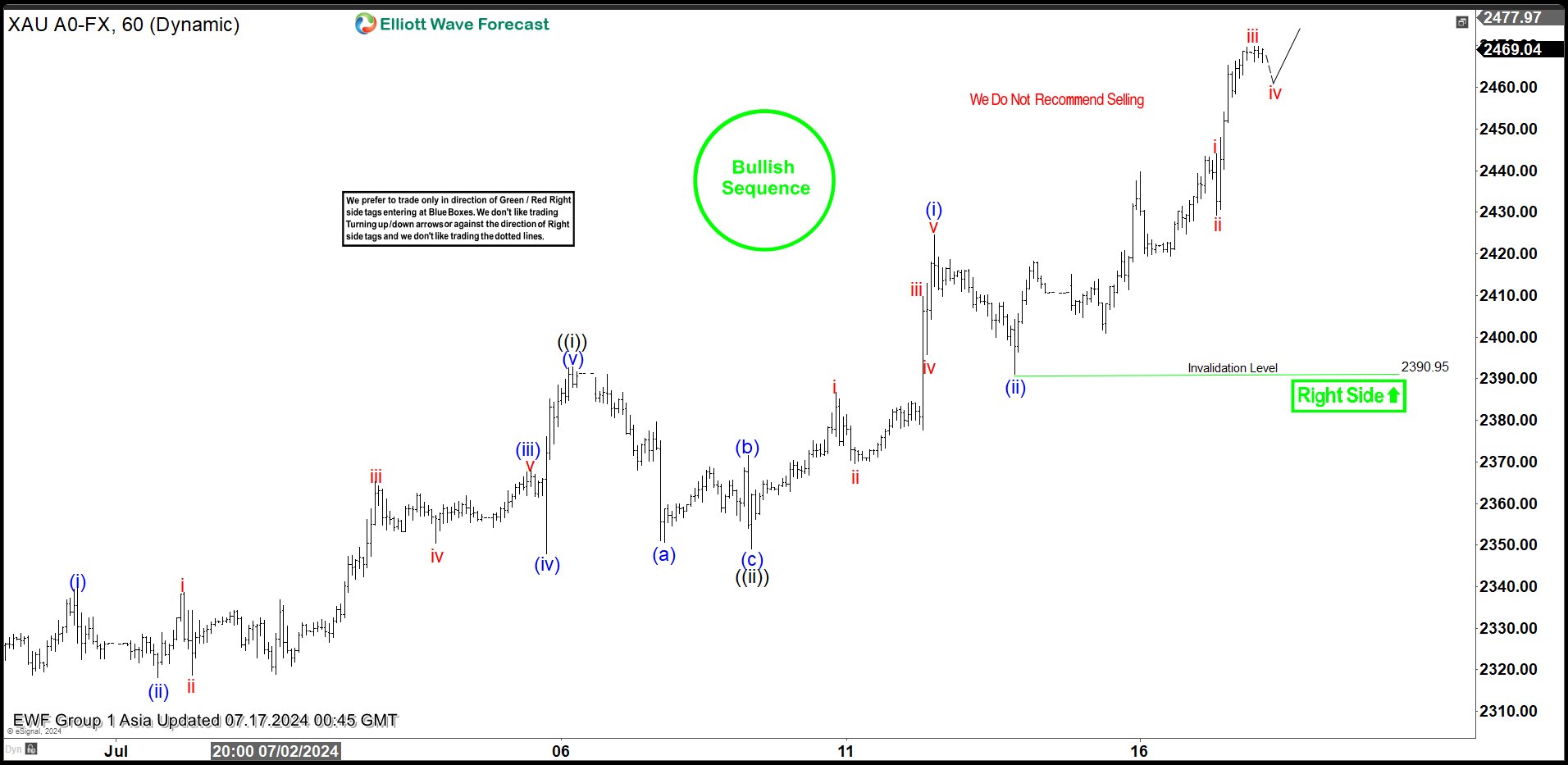

Elliott Wave Intraday: Gold (XAUUSD) Breaks to New All-Time High

Read MoreGold (XAUUSD) has made a new all-time high favoring further upside. This article and video look at the Elliott Wave path for the metal.

-

Elliott Wave Suggests Right Side in Dow Futures (YM) Firmly Bullish

Read MoreDow Futures (YM) shows incomplete bullish sequence from 4.19.2024 low favoring further upside. This article and video look at the Elliott Wave path.