-

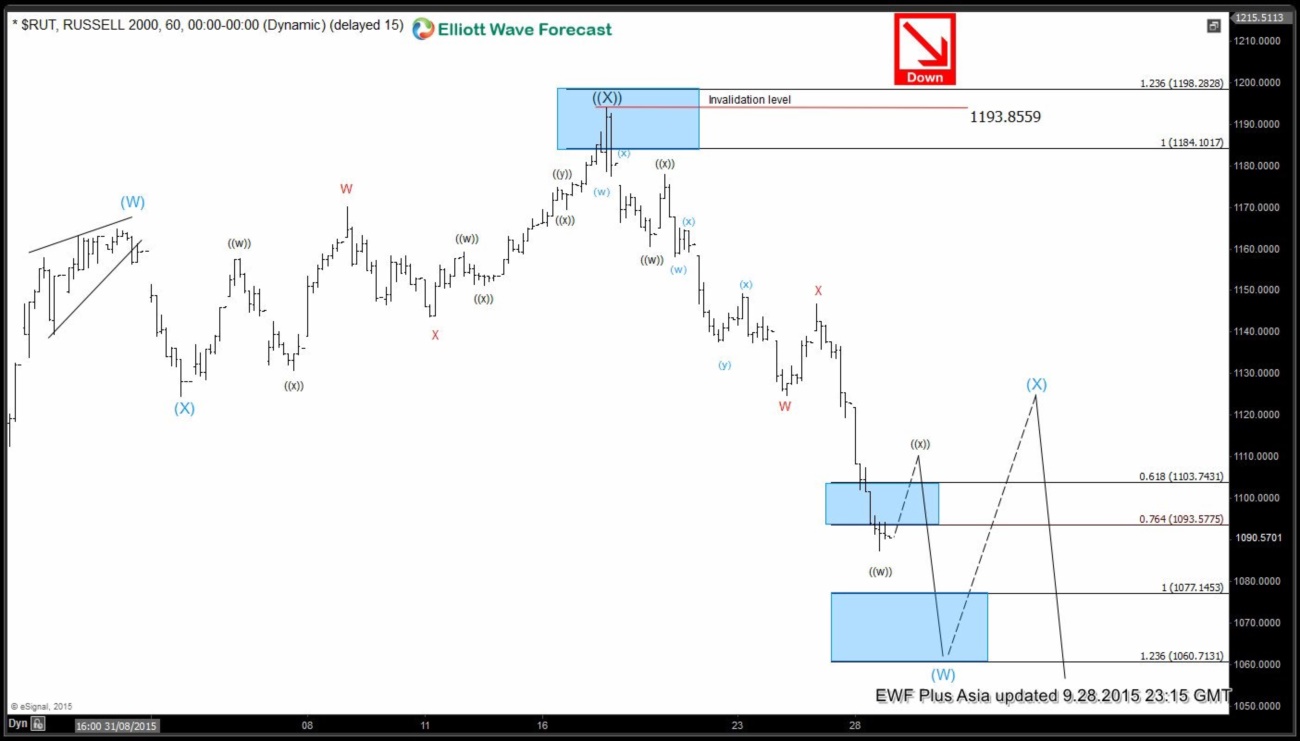

Russel 2000 Short Term Elliott Wave Update 10.1.2015

Read MoreBest reading of the cycle suggests that the decline to 1105.9 ended wave ((W)). From this level, the index bounced and ended wave ((X)) at 1193.85. The index has since resumed the decline lower, unfolding in a double corrective structure WXY where wave W ended at 1124.75, wave X ended at 1146.72, and wave Y […]

-

Russel 2000 Short Term Elliott Wave Update 9.30.2015

Read MoreBest reading of the cycle suggests that the decline to 1105.9 ended wave ((W)). From this level, the index bounced and ended wave ((X)) at 1193.85. The index has since resumed the decline lower, unfolding in a double corrective structure WXY where wave W ended at 1124.75, wave X ended at 1146.72, and wave Y […]

-

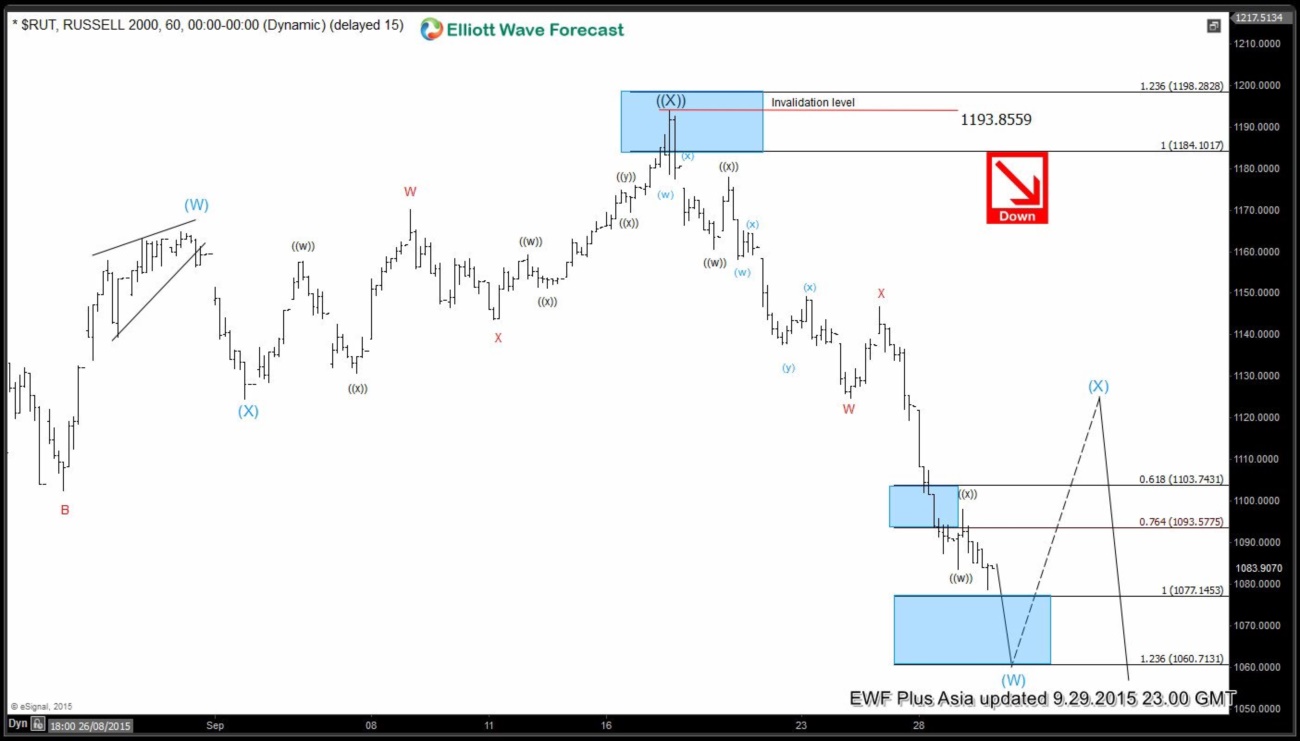

Russel 2000 Short Term Elliott Wave Analysis 9.29.2015

Read MoreBest reading of the cycle suggests that the decline to 1105.9 ended wave ((W)). From this level, the index bounced and ended wave ((X)) at 1193.85. The index has since resumed the decline lower, which is unfolding in a double corrective structure WXY where wave W ended at 1124.75, wave X ended at 1146.72, and wave […]

-

$AUDCAD Medium Term Elliottwave Analysis 9.29.2015

Read MoreThis is a medium term Elliottwave Analysis video on $AUDCAD. Wave (X) bounce is likely still in progress to correct the decline from 1.0345, and more downside is likely after wave (X) bounce is complete. As more downside is still expected at a later stage, we don’t like buying the proposed wave (X) bounce. EWF currently covers […]

-

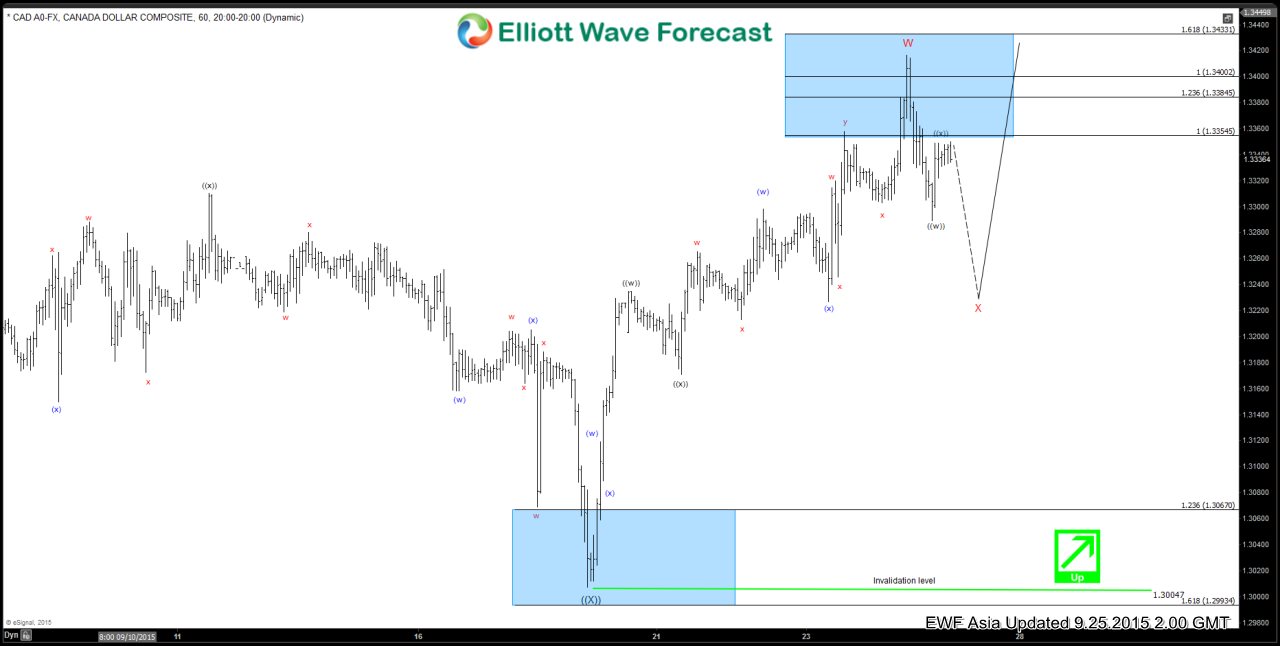

USDCAD Short Term Elliott Wave Update 9.25.2015

Read MoreBest reading of the Elliottwave cycle suggests wave ((W)) ended at 1.3353. Decline from this level ended at 1.3 as wave ((X)). The rally higher from 1.3 unfolded as a double three structure ((w))-((x))-((y)) where wave ((w)) ended at 1.33, wave ((x)) ended at 1.317, and wave ((y)) of W ended at 1.341. Wave X pullback […]

-

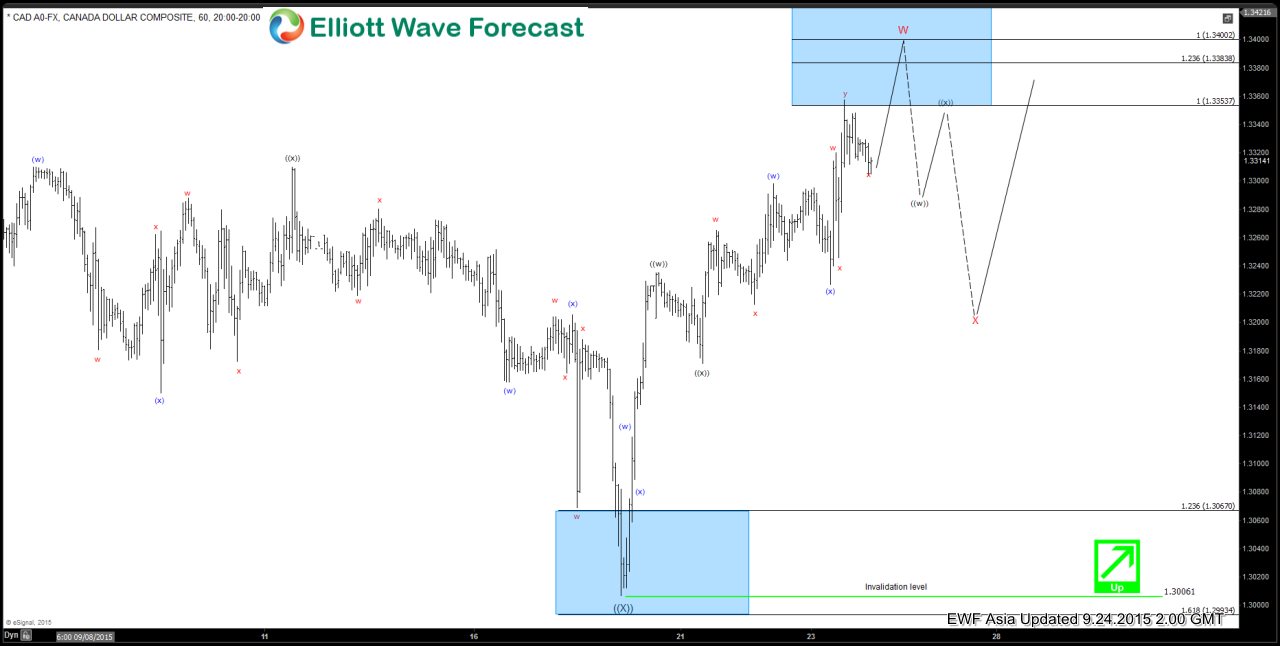

USDCAD Short Term Elliott Wave Analysis 9.24.2015

Read MoreCurrent best reading of the Elliottwave cycle suggests wave ((W)) ended at 1.3353. Decline from this level ended at 1.3 as wave ((X)). The rally higher from 1.3 is unfolding as a double three structure ((w))-((x))-((y)) where wave ((w)) ended at 1.33, wave ((x)) ended at 1.317, and wave ((y)) is in progress towards 1.338 […]