-

Oil $CL_F Short-term Elliott Wave Analysis 9.30.2016

Read MoreShort term Elliott wave count suggests that pullback to 42.55 at 9/20 ended wave X. The rally from there is unfolding as a zigzag where wave (a) ended at 46.52, wave (b) ended at 44.2, and wave (c) of ((w)) is proposed complete at 48.32. While bounces stay below there, expect the instrument to pullback in 3, 7, or […]

-

NZDCAD Elliott Wave Trade Setup 9.29.2016

Read MoreThe Elliott wave trading setup below comes from Sept 28 Live Trading Room session. $NZDCAD is showing a 5 swing sequence from 4/27 (0.8597) low and more upside is favored. Near term, pair is correcting cycle from 7/21 (0.9085) low towards 0.935 – 0.941 area before the rally resumes. We want to buy the pullback in 3, […]

-

Oil $CL_F Short-term Elliott Wave Analysis 9.29.2016

Read MoreShort term Elliott wave count suggests that pullback to 42.74 at 9/16 ended wave X. The rally from there is unfolding as a double three where wave (w) FLAT ended at 46.52, wave (x) ended at 44.22 and wave (y) is in progress as a flat towards 48.1 – 48.9 area to complete wave ((w)) and […]

-

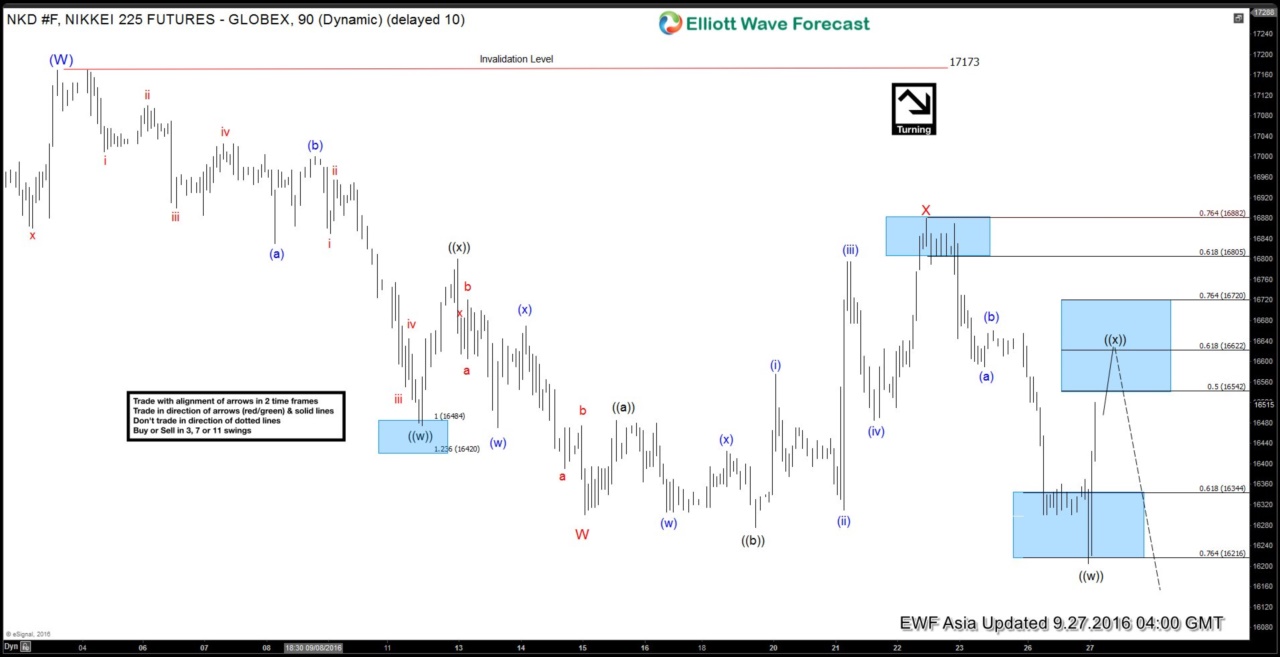

Nikkei $NKD Short-term Elliott Wave Analysis 9.28.2016

Read MoreShort term Elliott wave count suggests that rally to 17173 ended wave (W). Decline from there is unfolding as a double three where wave W ended at 16300 and wave X bounce ended at 16883. Near term, while Index stays below wave ((x)) at 16605 and more importantly as far as pivot at 9/22 (16883) high stays intact, expect Index […]

-

Nikkei $NKD Short-term Elliott Wave Analysis 9.27.2016

Read MoreShort term Elliott wave count suggests that rally to 17173 ended wave (W). Decline from there is unfolding as a double three where wave W ended at 16300 and wave X bounce ended at 16880. Near term, Index is correcting cycle from 9/22 (16880) with potential target of 16542 – 16720 area, then as far as pivot at 16880 stays intact, expect […]

-

USDPLN Elliott wave Analysis 9.23.2016

Read More$USDPLN Weekly Elliott wave chart below suggests that cycle from 5.3.2011 low (2.64) has ended and the pair is in the process of pullback to correct this cycle in 3, 7, or 11 swing with potential target as low as 3.216 – 3.396 area before the rally resumes. Looking at the Daily Elliott wave chart […]